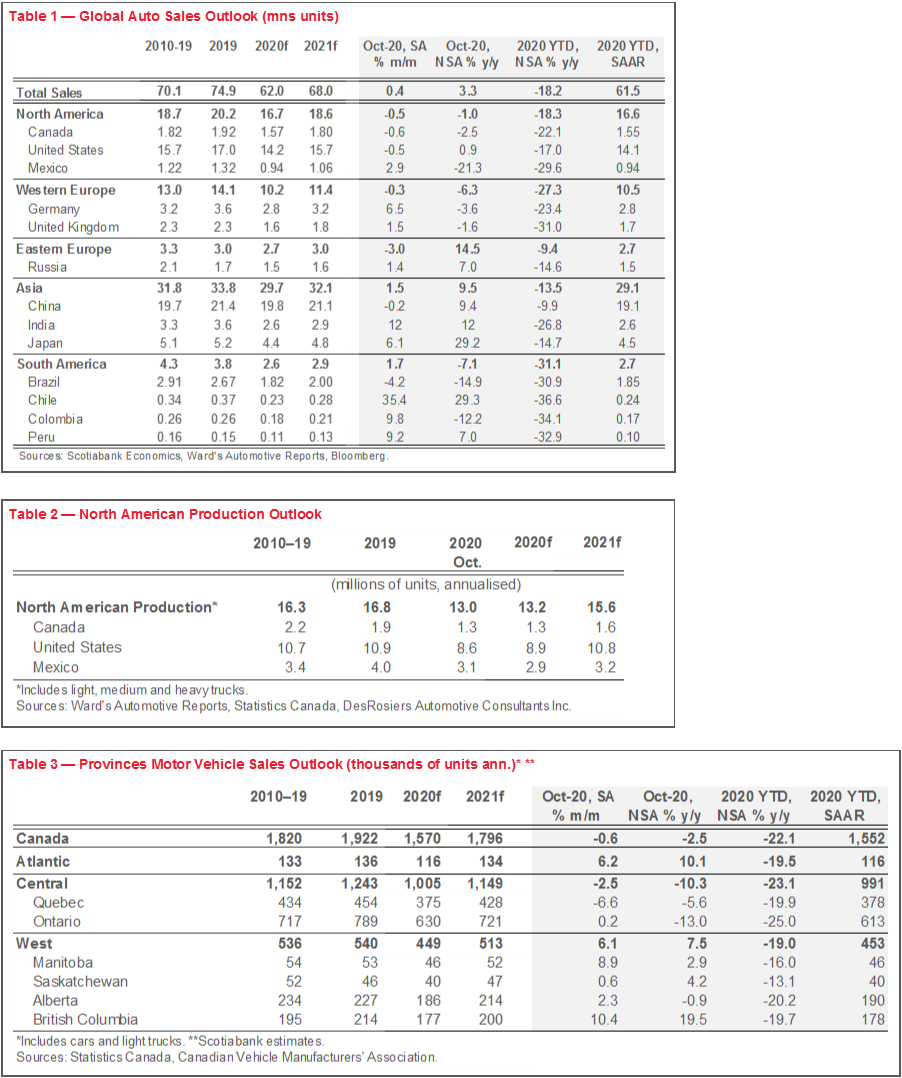

Global auto sales continued to stabilize in October with another 0.4% m/m (sa) pick-up in purchases. On a year-over-year basis, sales were in positive territory (3.3%) for a second consecutive month since the pandemic struck. Sales are still down by -18.2% y/y year-to-date, but are trending in the right direction.

While China continues to drive the global numbers, all regions are showing stabilization—if not modest improvements—relative to the retrenchments in auto sales under first waves of COVID-19, broad-based lockdowns, and subsequent rebounds.

Even as most major economies face second waves, auto sales are expected to fade, but not disappear. Restrictions have generally been more targeted, while dealerships have adapted—to varying degrees—to new ways of transacting sales.

Lessons from the first waves suggest that sales may be deferred into the new year as opposed to being lost, particularly in economies where substantial government supports remain in place. More balanced supply dynamics in the new year would underpin this.

Some downside risks to the outlook have also been removed (or at least reduced) including US election outcomes and vaccine developments and this bodes well for trending improvements in the economic and auto sales outlook over time, albeit with potential volatility in the near term.

OUR WATCH LIST

It is an understatement to say that this downturn is anything but usual. Given the inordinate volatility in monthly auto sales over the course of the pandemic, we continue to attempt to look through the noise to assess where trends are going. We briefly pick up on some questions posed at the end of the summer here—and add some new ones—with two more months of data before touring October’s auto sales around the globe.

Second waves will likely dampen auto sales, but not destroy them. First waves demonstrated that both mandatory and voluntary restrictions on the part of the consumer have an impact on growth, and retail sales more specifically. But first waves also illustrated the potential strength of pent-up demand that could be expected. A big part of the rebound effect has been government supports, and, at least in most advanced economies, this is still playing a bridging role through second waves. Furthermore, dealerships and consumers have increased capacity and receptiveness to carrying out more of the purchasing process virtually.

The policy environment—and fiscal supports in particular—are expected to cushion second waves. There had already been greater certainty in this regard in Canada as the federal government had announced additional income support measures (and other program extensions) well into 2021 by the end of the summer. However, up until weeks ago, a key concern from a global auto market perspective was whether the US would provide additional fiscal supports as pre-election negotiations stalled. With incoming President Biden, the prospects of near-term stimulus have grown substantially even if the amounts may be more muted in the context of a potentially Republican-controlled Congress. This, along with positive economic developments in the US economy, should have spillovers for major trading partners such as Canada and Mexico where auto exports have been accelerating on the back of higher auto demand in the US.

Supply constraints that have impacted new vehicle inventories are likely to extend into the early new year. October production figures from Wards Automotive indicate production has come in under earlier estimates, likely owing to a variety of factors including efficiency knocks from new safety measures as well as potential supply chain disruptions related to COVID-19 outbreaks at facilities. This will push out the supply-demand rebalancing further into the new year as production catches up to the exceptionally strong Q3 rebound in new vehicle sales. Persistent inventory challenges are broad-based across dealerships in Canada with an earlier survey by the Ontario Motor Vehicle Industry Council indicating four in five dealerships reported difficulty obtaining new or used vehicles. US inventories as a ratio of sales are also running at the lean end of the past decade (chart 2).

A transition to used vehicle sales appears to be taking hold. New and used vehicle sales tend to operate counter-cyclically. While both tend to be dampened in economic downturns, a greater share of buyers shift to used vehicle markets when the economy is weak. Softer pricing in used vehicle sales tends to partly underpin this trend as a result of reduced overall demand as well as an increase in supply. In this downturn, prices have been surprisingly strong (after a brief dip during the shutdown). Retail sales of used vehicles in Canada (by value) surged into positive territory relative to pre-pandemic levels over the summer, while new vehicle sales are approximately level. Strong pricing no doubt has supported this, but with used vehicle pricing starting to weaken as expected by the Canadian Black Book, this should support higher volume sales, underpinning this transition towards stronger used vehicle sales over the course of the recovery.

These supply and pricing dynamics have supported margins for the most part. Dealers and manufacturers have relied less on incentives and other promotions to close sales. J.D. Power is reporting that average new vehicle transaction price hit another all-time high in the US in October.

The electric vehicle movement is gaining momentum on almost all continents recently. Concerns that low gas prices may reverse global markets for new electric vehicles is likely short-sighted. We reported earlier on a McKinsey assessment concluding that the pandemic should have modestly positive impacts on global EV sales, driven by Chinese and European markets. This is starting to play out in data with the share of Chinese EV sales in October surpassing earlier levels (from about 5% to 6% of total sales) on the back of policy supports. Similar policy supports (and a more stringent regulatory environment) in Europe are expected to drive this trend in this market as well when data is available.

Meanwhile, a Biden Presidency will likely accelerate (albeit slowly) changes in the US market, with California driving up new standards, along with its ban on the sale of gas-powered cars by 2035. Closer to home, Quebec has announced a similar ban by 2035. And with two auto manufacturers now planning EV production in Canada, along with a looming federal EV sales target in 2025 (10% of new sales from 3% in 2019), the federal government can be expected to provide more supports to accelerate this shift. Subsidies may not be required as long as anticipated, with analysis from Carnegie Melon researchers suggesting advancements in battery technologies could put EVs in price parity with gas-fueled vehicles by 2025.

Finally, as bad as second waves are (or have been) for major economies around the world, there have also been some offsetting developments in recent weeks. In particular, the announcement of effective vaccines in the pipeline and reduced US political uncertainty are two key drivers of broader economic optimism that have been feeding through financial markets as well as commodity markets. This provides some offset to otherwise more restrictive measures that have been introduced in some parts of the economy to counter second waves.

CHINA DRIVES GLOBAL AUTO SALES IMPROVEMENTS IN OCTOBER

Momentum in global auto sales continues to be driven largely by China. October Chinese purchases retreated only modestly (-0.2% m/m), but posted a hefty 9.4% y/y improvement. Reportedly, 6% of October sales were electric vehicles as the country aggressively strives to meet a 25% EV sales target by 2025. As the pandemic remains at bay, Chinese auto sales are expected to continue to improve over the remainder of the year.

Japanese auto sales posted a strong sales month in October with a 6.1% m/m improvement as the country was enjoying a brief lull in COVID-19 cases. Massive year-over-year improvements (29.2% y/y) speak more to the substantial sales declines last October when the sales tax was increased by 2 ppts. With cases escalating rapidly towards the end of the month, sales will likely be weaker for the remainder of the year, albeit with some offsets from base effects from last fall’s tax.

South Korea—though a smaller market—is on track to be the least-impacted auto sales market amidst the pandemic with year-to-date sales currently only -2% y/y. October sales pulled back by -15.5% m/m, but are still modestly positive on a year-over-year basis (0.3% y/y).

Rounding out the rest of the region, divergences in auto sales largely continue to track COVID-19 outbreaks. Australia posted another month of strongly accelerating sales (20.9% m/m; -1.5% y/y) as it has so far avoided major second waves. India experienced a further improvement in sales in October (11.7% m/m; 12.3% y/y) as a persistent first wave is largely under control, while Indonesian sales continue to contract (-10.7% m/m; -47.1% y/y) against rising COVID-19 cases.

NORTH AMERICAN SALES CONTINUE TO STABILIZE BUT WITH HEADWINDS

US auto sales continued to normalize in October with a modest pullback of -0.5% m/m (0.9% y/y). October’s selling rate of 16.2 mn units is less than 5% below last year’s annual sales, while a broad range of economic indicators similarly continues to hold up against second (or third) waves of the pandemic. With some deterioration in auto purchase sentiment noted by the Conference Board, sales may be dampened over the remainder of the year, but reduced election uncertainty and the possibility of some form of fiscal support in the near term will likely put a floor under auto sales activity.

Canadian auto sales similarly continued to stabilize in October with a modest -0.6% m/m (sa) deceleration, sitting 2.5% down year-over-year. October’s selling rate at 1.85 mn saar units is only 5% below 2019 annual sales, mirroring the broader economic recovery where gains are largely moderating following impressive rebounds in the immediate aftermath of lockdowns. See the most recent Auto News Flash for more details on Canadian and US October auto sales.

Second waves across Canada will likely moderate auto sales heading into the end of the year. In fact, preliminary figures for Ontario and, to a lesser extent Quebec, already showed slowing auto sales in October as those economies entered second waves earlier than other parts of the country. But these are not expected to destroy demand as much as dampen demand in the near term with some deferral in sales into the new year.

Mexican auto sales modestly improved again in October (by 2.9% m/m) but still sit steeply in negative territory relative to last October (-21.3%). Trend improvements are expected, albeit at a slower pace in line with a softer recovery in private consumption and economic output more generally, along with more limited fiscal capacity to accelerate the recovery.

EUROPEAN AUTO SALES FACE A STEEP CLIMB BACK

European auto sales continued to trend in the right direction in October but with considerable volatility and variability across markets, largely a function of outbreaks. Western European sales, for example, slowed by -6.3% m/m for the month but this masked a 6.5% m/m improvement in Germany against a -4.5% m/m retrenchment in French auto sales, mirroring a difference in the path of the pandemic. Italy and Spain similarly saw October sales pull back modestly, while UK sales picked up modestly (1% m/m) despite escalating cases in October.

With COVID-19 cases decreasing in November (or at least plateauing), auto sales in the region should continue to normalize over the remainder of the year.

SOUTH AMERICAN AUTO SALES HEADING IN THE RIGHT DIRECTION (MOSTLY)

South American auto sales showed signs of further recovery in October with an overall 2% m/m increase in activity. This is the second month of solid rebounds across most of the region as it emerged from prolonged first waves that extended through the summer for the most part.

Brazil continues to underperform, driving headline numbers as the largest auto market, with sales retreating by -4% m/m (-15% y/y). Chile, followed by Peru, showed tremendous rebounds of 35% m/m (29% y/y) and 9% m/m (7% y/y), respectively. With political turmoil erupting in November, this could introduce further volatility in the trend recovery for Peruvian auto sales. Colombian auto sales improved by 9% m/m, but were still down relative to last year (-12% y/y).

*All numbers reported on y/y basis as not seasonally adjusted, whereas m/m are seasonally adjusted.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.