- Jobs and wages signal push beyond full employment…

- ...while omicron could add to wage and price pressures

- The BoC should be seriously considering hiking now

CDN jobs, m/m 000s // UR (%), December, SA:

Actual: 54.7 / 5.9

Scotia: 20 / 6.0

Consensus: 25 / 6.0

Prior: 153.7 / 6.0

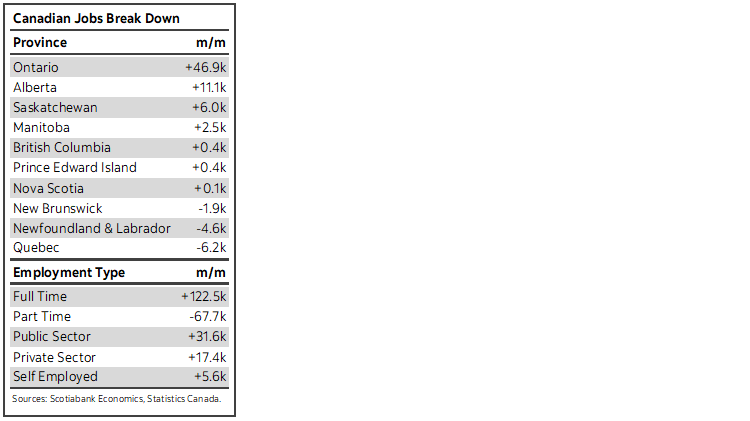

I’ll take 55k jobs that beat expectations, even though the gain still landed well within the 95% confidence bands around the sample estimate for StatsCan’s Labour Force Survey which limits one’s ability to say the beat was anything more than statistical noise. What is more interesting is yet another month of rapid wage gains that by now has established a firm trend. Some details are shown in the accompanying table.

Wages were up another 6.3% m/m at a seasonally adjusted and annualized rate. That now makes it six consecutive months of annualized month-over-month gains between 6–9% (chart 1). It’s unclear that we will get renewed softening in this measure into 2022 as COVID-19 restrictions take hold given that we’re at a very different point in terms of labour market tightness.

Also recall that unit labour costs (productivity-adjusted employment costs) continue to soar in Canada and an upward slope shift was evident since before the pandemic (chart 2). We’ll probably see further upward pressure once we get 2021Q4 figures.

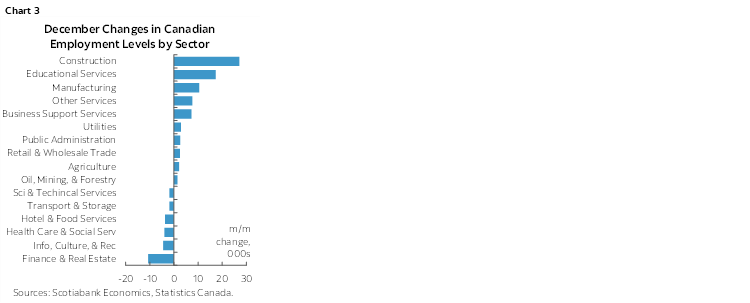

The details behind the 55k job gain were mixed. Public payrolls were up 32k with private payrolls up 17k. That wasn’t due to public administration jobs that were only up by 2.6k. There was a 17k rise in educational services that's one part public and one part private. Health care and social assistance lost 4k workers. Most of the overall job gain was in construction, manufacturing and education (chart 3).

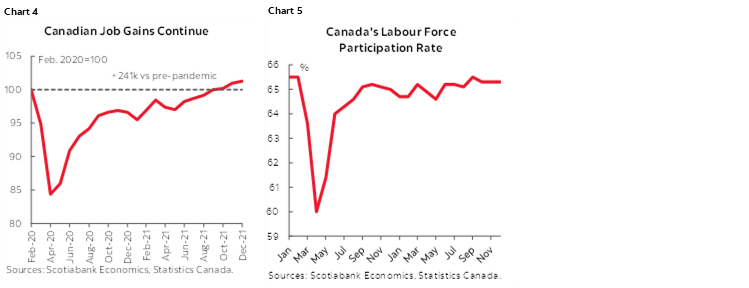

Overall Canadian employment is now 240,500 above where it was in February 2020 before the pandemic struck with full force (chart 4). The labour force participation rate has pretty much fully recovered (chart 5). This is therefore a different debate than in the US where employment is still below pre-pandemic levels, though so is willingness to supply labour. Canada has had an undeniably full employment recover and then some.

A rather large caveat here is that the figures don’t capture any omicron effects especially since StatsCan once again brought forward the reference week to the week of December 5th–11th sans explanation and instead of the normal week that includes the 15th. Since most of the omicron surge has occurred since then, the numbers may be about as fragrant as the deck of a St. John’s fishing trawler. Even if omicron imposes a step back, however, it’s still quite possible that Canada will remain at or very near full employment.

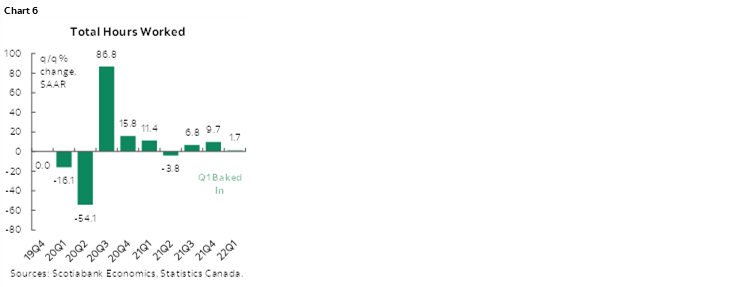

Hours worked were up 0.3% m/m in December and are tracking an explosive gain toward 10% q/q SAAR in 2021Q4 (chart 6). Even before any 2022Q1 data rolls in, we’re tracking a strong baked-in gain in hours worked of 1.7%.

So what does the Bank of Canada do? My view favours hiking now. Our official base case forecast is still for lift-off to occur in April and it may very well be that the BoC has not quite mustered the courage to hike later this month. I think it’s 50–50 pending further new information. A case for holding off is omicron uncertainty and uncertainty over the amount of slack in the economy. My views on these issues are as follows:

- Our estimates suggest the output gap won’t close until around mid-year or so, but there are enormous bands around this view. We don’t know what potential GDP is at the starting point. We don’t know at what rate potential GDP growth should be forecast and there are wide bands around those efforts. Further, 2021Q4 GDP growth may be materially higher than our estimates which could mean earlier closure of spare capacity, while there are wide brackets around our forecasts for actual GDP growth.

- omicron is likely to be a near-term negative shock to growth as the data rolls in, but probably a fairly mild one. I’m cautiously assuming that this shock is front-loaded in the year and conditions rebound thereafter. Monetary policy can do nothing about the current backdrop. That backdrop has been fundamentally altered with very different conditions for capacity and labour markets than during prior waves. Monetary policy should be looking 6–18 months ahead.

- Prices and wages may be more revealing of capacity constraints than output gaps. Even past BoC staff research has downplayed relying too heavily upon output gaps as an inflation driver (here) which seems mismatched to other BoC communications.

- omicron is another inflationary shock by imposing further damage upon supply chains and probably reducing willingness to supply labour.

- From a starting point of already strong wage and price pressures, another inflationary shock further raises the risk of expectations running away from the BoC’s control. That’s where the BoC’s household and business surveys will be important on January 17th.

- At the same time, real interest rates have dropped and inappropriately eased over time.

The BoC has already ended net GoC bond purchases. Reducing stimulus should consist of some combination of signalling an end to its reinvestment phase and hiking the policy rate. I don’t think it should wait. Doing so with as strong wage and price signals as we have at present would have to be accompanied by strong arguments behind how cautiously starting a process with gentle rate hikes would meaningfully impair growth relative to retaining optionality to not have to go as quickly later, and how COVID variants like omicron are expected to persist through much more of the monetary policy horizon than the front-loaded point above. Hiking now would nevertheless be a communications challenge to the BoC, but not an insurmountable one. Not hiking until some made-up measure of spare capacity shuts put policy into an inflexible straightjacket and has put the BoC well behind the curve. That is likely why Governor Macklem’s pre-holiday speech took a step toward distancing the central bank from this forward guidance (recap here). They won’t be repeated here, but review the section that recapped the Governor’s key quotes.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.