- Core CPI increased by more than expected

- The market reaction was dirtied by simultaneous ECB headlines...

- ...as Treasuries cheapened, before returning to focus on liquidity..

- ...while the dollar retained post-release appreciation

- 70% of the y/y rise in CPI and core CPI is not due to base effects

- There was high breadth to the acceleration…

- ...but autos and housing played the largest roles

- The Fed needs to sound less certain about transitory factors…

- ...and consider both transitory upside and downside pressures

US headline CPI, y/y % change // m/m % change SA, May :

Actual: 5.0 / 0.6

Scotia: 4.5 / 0.4

Consensus: 4.7 / 0.5

Prior: 4.2 / 0.8

US core CPI ex-food and energy, y/y % change // m/m % change SA, May:

Actual: 3.8 / 0.7

Scotia: 3.3 / 0.2

Consensus: 3.5 / 0.5

Prior: 3.0 / 0.9

Base effects? Oh please. Transitory? We’ll see, but it’s not obvious that price pressures will prove to be fully fleeting. For now, we have yet another upside surprise to core CPI inflation to evaluate and markets didn’t take it so well. See the tables above for the prints as both headline and core inflation came in higher than expected.

Markets

The US 10 year Treasury yield’s reaction was a bit dirtied by the fact that the ECB press conference was unfolding around a similar time frame to markets taking down the inflation figures, but the cheapening tendency before the data that drove the 10 year yield up by about 3bps this morning got an added instant boost with about another 3bps rise immediately following the release. That has since all been reined in likely due to a return to the liquidity pressures that have been driving yields lower over recent weeks (see the morning Daily Points). The USD appreciated a touch post-release and has remained firmer since then.

The Fed Connection

Before turning to the individual drivers, it’s worth considering a few points on how this may affect Fed-thinking. In short, the Fed's base effect argument is getting overwhelmed by data. Had we only been dealing with shifting base effects over the past couple of months, then year-over-year headline CPI would have risen from 2.6% in March before factoring in the m/m acceleration in prices through April and May to 3.3% y/y now. Instead we're at 5% y/y.

As for core, if we were only dealing with shifting base effects over the past couple of months, then core CPI would have risen from 1.6% y/y in March to 2.2% now and instead we're at 3.8%. Base effects are indeed playing a role, but only about 30% of the acceleration in headline and core year-over-year inflation rates since March can be explained by base effects with the other 70% of the rise explained by month-over-month changes.

It remains uncertain how durable these gains may prove to be. That in itself is a point against strident insistence that this is all transitory. It's too difficult to wean out potentially (but not certainly) transitory supply chain issues from reopening effects from stimulus effects. I still don't think we hold at numbers like these, but there is a good case for more persistence than the Fed is letting on. To be frank, the Fed's conviction to date sounds more like a macro hedge fund talking its position rather than a central bank focused upon risks.

The Numbers

The broad takeaway to what follows is that there is high breadth to US inflationary pressures when the numbers are decomposed. This observation is buttressed by the following points.

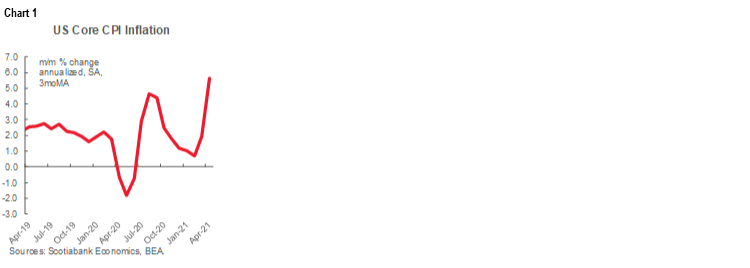

Chart 1 (front page) takes the month-over-month seasonally adjusted change in core CPI and annualizes that change to show price pressures free of year-over-year base effects. It applies a smoothed 3 month moving average to the volatile data. Without smoothing, annualized month-over-month core inflation was 8.3% in May after 5.6% in April.

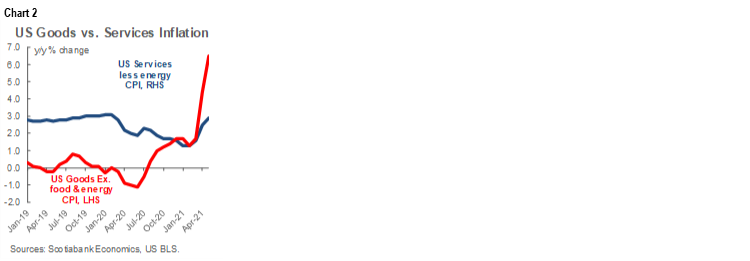

Chart 2 (front page) shows that core goods price inflation is running off the charts and at a pace that cannot be explained by weakness a year ago. Goods price inflation is running at 6.5% y/y now after hitting a low of -1.1% last June. The chart also shows that services price inflation is accelerating and this area is likely to have greater upside as pandemic effects on less socially distanced services gradually ease. If some transitory factors that may be boosting goods price inflation at least partially abate this effect may coincide with an acceleration in services inflation.

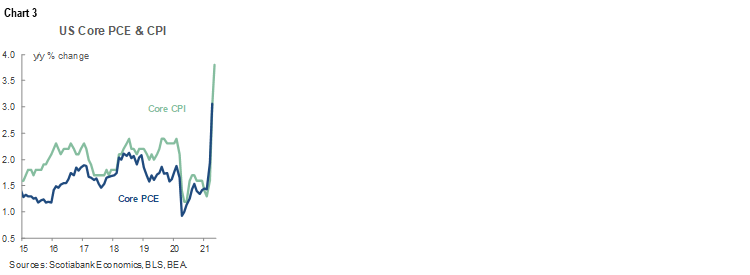

Chart 3 (front page) shows the acceleration in core CPI as a guide to where core PCE is likely to go on June 25th. Core PCE is likely to land around 3 ½% y/y.

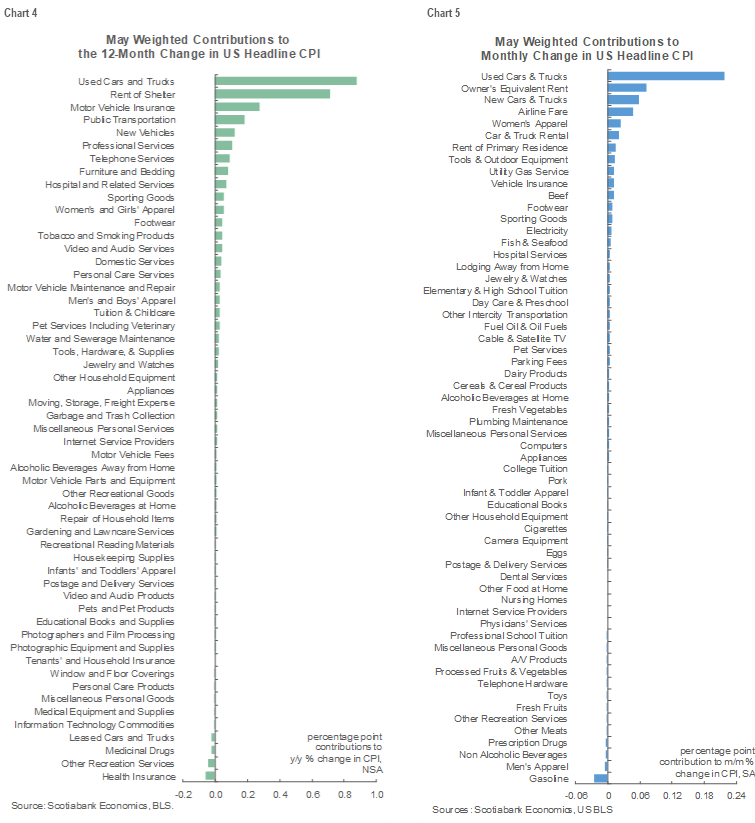

Chart 4 (next page) shows the weighted contributions to the year-over-year change in CPI by category. Vehicles—used and new — and related insurance premiums along with housing are the hottest drivers. Chart 5 does the same thing for the month-over-month weighted contributions to changes in CPI with a similar conclusion.

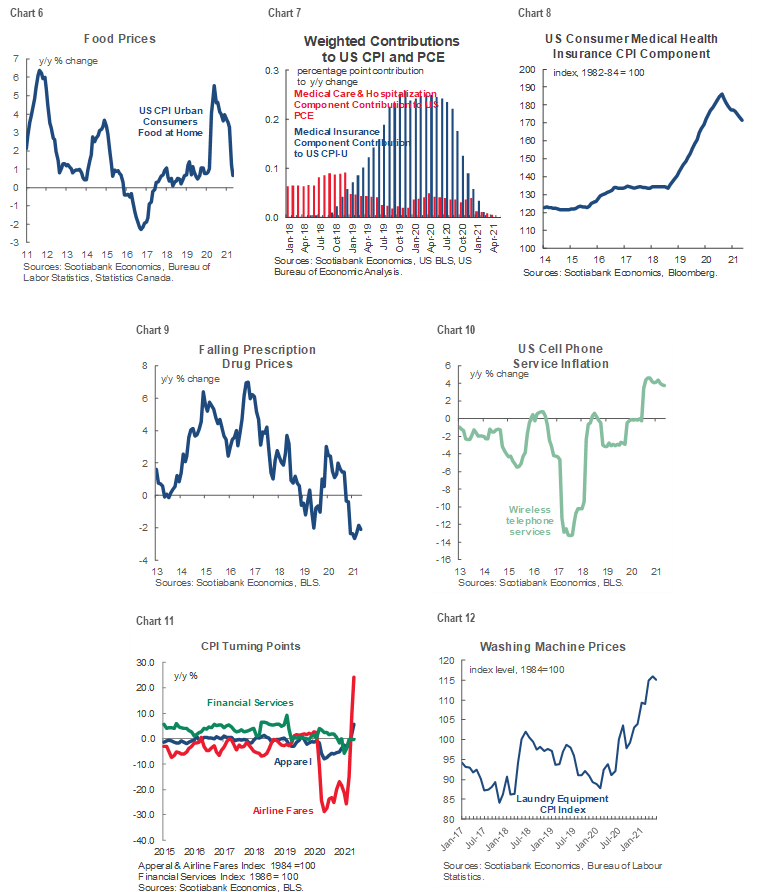

Charts 6–12 (page 4) show patterns across some individual contributions. One takeaway is that the earlier acceleration in food prices (at home, 7.7% weight) and medical care (~8% total weight) have fully subsided now. Prescription drug price inflation remains weak. Airfare, cellphone services, apparel and appliances are under upward inflationary pressure. Financial services price inflation has firmed compared to earlier weakness.

A point to these last slides is that when we talk of transitory drivers that may come off from present rates, we should also speak to what may be transitory weakness in other areas like the base effects operating against food price inflation that is unlikely to go away, or medical care price inflation that is unlikely to go away etc. Transitory doesn’t just mean looking at the presently hot prices and dismissing them.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.