- BoC cut 25bps as expected

- The bias was on the hawkish side of neutral as expected

- Ottawa photobombed the BoC by adding to inflation risk

- Markets responded by reducing priced expectations for BoC cuts

- Full press conference transcript

The Bank of Canada met our expectations by cutting its policy rate by 25bps. Markets were already priced for this and all but two shops got the call right. What mattered, however, was the way in which they conveyed a neutral-hawkish policy bias going forward that leans a little more toward the hawkish side of things which was my expectation. They are saying their principal focus will be upon ensuring that inflation and inflation expectations are well anchored. The view on other parts of the street that the BoC would be unambiguously dovish in response to tariff wars was struck a blow.

MARKET REACTION

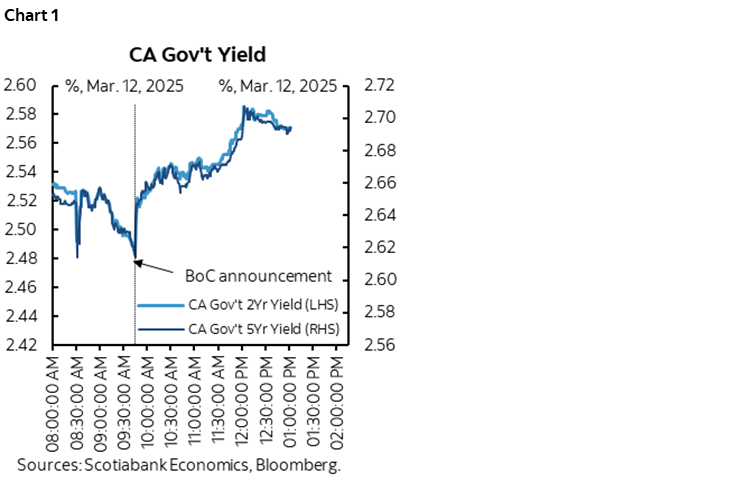

The Canadian government 2-year bond yield increased by about 9bps after all of the communications (chart 1). There was a similar rise in the five-year GoC bond yield. Pricing for the next decision on April 16th was reduced to less than half of a 25bps cut that is probably still too rich. Market pricing for the rest of the year now sees less than two cuts priced which is about 12bps less than priced going in and here too I find that to be rich. Canada’s negative rate spreads to US Treasury yields narrowed a touch which is consistent with my view that it may be too wide.

CANADIAN GOVERNMENT PHOTOBOMBED THE BOC WITH MORE TARIFFS

The Federal government unusually called a press conference right in the middle of the BoC’s communications to announce retaliatory tariffs. This caused some brief confusion around the start of the BoC’s press conference that nevertheless remained on track. Ottawa normally coordinates such communications.

What was announced was a 25% tariff rate against another $30 billion of imports from the US. This is in addition to the 25% rate against $30B of imports that has already been implemented. Today’s 25% on another $30B pulls forward a portion of the remaining $125B of targeted imports that had been postponed, leaving $95B of postponed targeted imports.

The effect is to modestly add to imported price pressures. I found that odd in terms of timing while the BoC was communicating its decision. Nevertheless, the strategy appears to be for Canada to coordinate with the Europeans disproportionate retaliation against the US imposition of tariffs on steel and aluminum. Canada exported about $35B of steel and aluminum to the US last year, and so the implementation of a 25% tariff against a sum total of $60B of imports from the US is almost double what the US has targeted to date.

Thus far, Trump has not responded despite speaking after the announcements. We’ll see how this strategy works, but for now, it tips the balance toward being more inflationary through import prices than disinflationary through the demand shock from the US tariffs. The overnight European retaliatory moves and now Canada’s make it clear to the US administration that its trade partners will not merely roll over in response to abusive US trade policies.

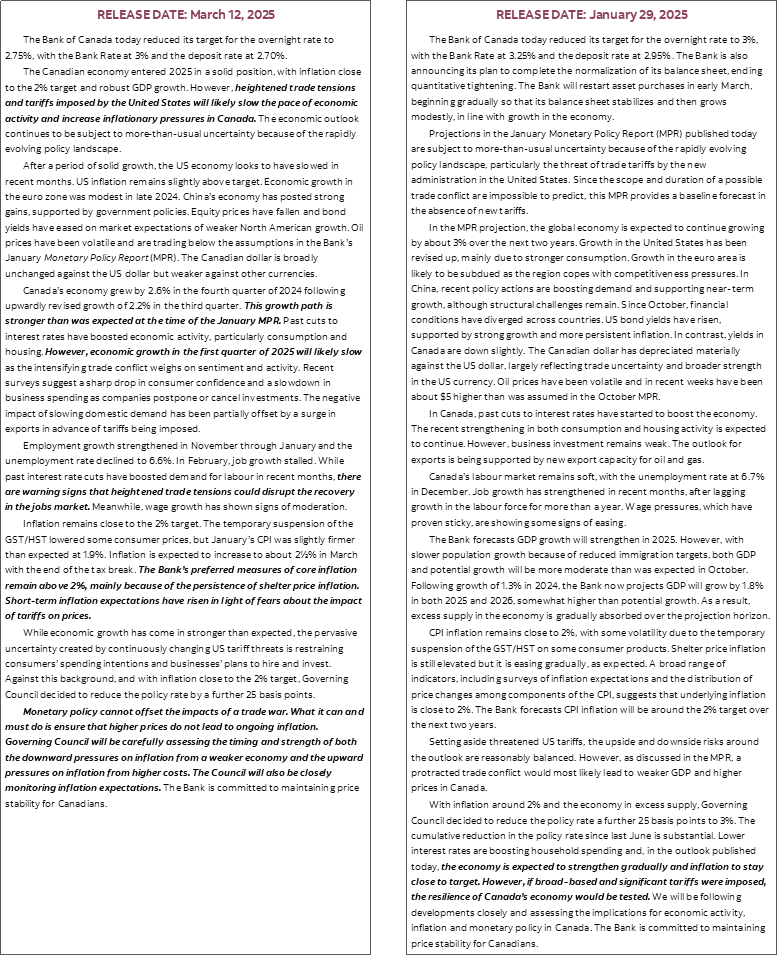

STATEMENT EMPHASIZES TARIFF EFFECTS ON INFLATION

A comparison of today’s statement with the previous one is attached. The money quote is in the final paragraph that ends with a neutral-hawkish spin on the statement:

“Monetary policy cannot offset the impacts of a trade war. What it can and must do is ensure that higher prices do not lead to ongoing inflation. Governing Council will be carefully assessing the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs. The Council will also be closely monitoring inflation expectations.”

In plain English, this is not committing to any path for the policy rate as they wish to see where the balance of risks ultimately lie in terms of their mandate to achieve 2% inflation over the medium-term. They are being very clear that this will be their focus.

Other keys include the second paragraph’s mention that “heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada.” That’s a clear nod to stagflation risk.

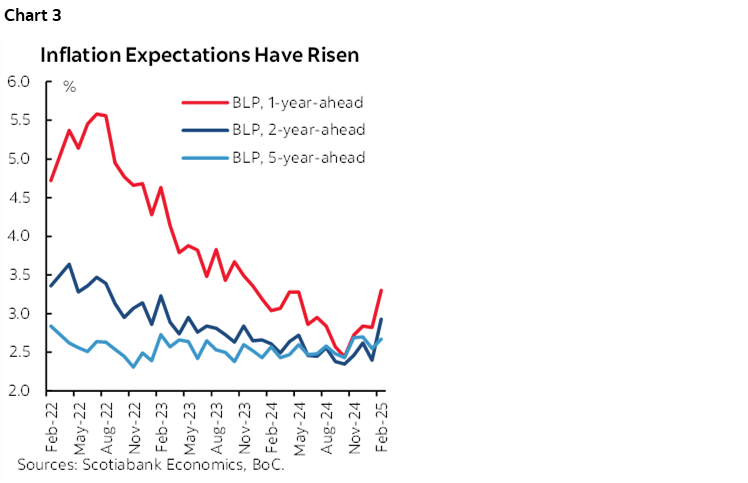

They backed that up by saying that “preferred measures of core inflation remain above 2% mainly because of the persistence of shelter price inflation” which is debatable, and that “short-term inflation expectations have risen” due to tariffs.

They also acknowledged that growth to date has been “stronger than expected at the time of the January MPR” when they last published a forecast, but that “economic growth in the first quarter of 2025 will likely slow.”

The fifth paragraph warned of warning signs in the job market, but did not elaborate. If they mean flat employment in February, then I still think that was a weather report distorted by fake seasonal adjustments (recap here).

OPENING REMARKS

Governor Macklem’s opening remarks to his press conference are here. They generally reinforced the statement’s core messages.

Macklem's comment on the end of the GST/HST tax break lifting inflation will happen sooner than the March reading despite his guidance. It will probably start next week. The GST/HST cut ended in mid-February, and so half of the downward effect on CPI from the cuts will reverse in Feb, the other half in March. That was the pattern on the way down for CPI in response to the tax cut within December and January CPI readings as it was spread over both months because the tax cut kicked in at mid-December.

SUPPLEMENTING WITH SURVEYS—BUSINESSES AND CONSUMERS EXPECT HIGH TARIFF PASS THROUGH

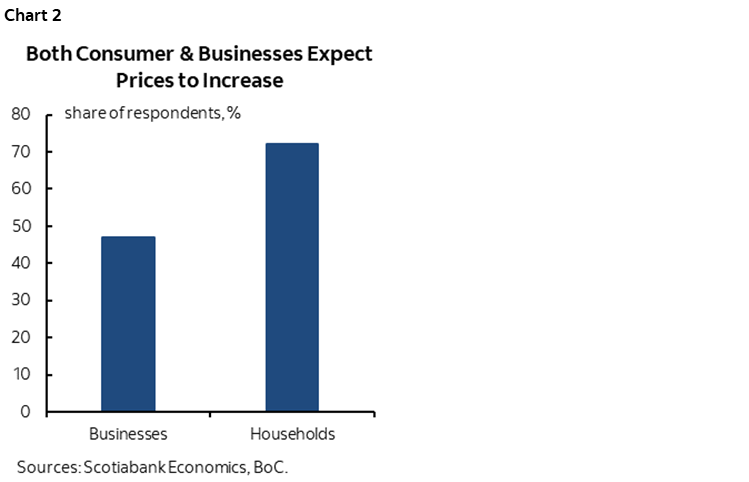

The press conference acknowledged that the BoC is in between forecast rounds and therefore offered survey-based soft data to help them assess the effects of tariffs. The survey results are here. What is key to the BoC are the price signals. Chart 2 shows that about half of all businesses expect to raise prices if tariffs are in place and their report showed that almost all of that half of businesses expect to pass through basically all of the higher tariffs into end prices. That’s very high, and likely overstated in an economy with slack, but it’s soft data.

This hasn’t escaped consumers. The BoC surveys show that 72% of consumers expect higher prices due to tariffs and trade tensions which is also shown in the same chart. Their business leaders’ pulse survey shows a jump in inflation expectations (chart 3).

PRESS CONFERENCE—FULL TRANSCRIPT

The press conference was insightful in terms of several key matters. What follows is an attempt at providing a full transcript subject to the limitations of my ability to type fast enough as it was unfolding! Answers are from Governor Macklem unless specifically noted to have been provided by Senior Deputy Governor Rogers. Any errors or omissions are my own, but I think this accurately captures the broad messages.

Q1. What kind of inflationary impact are we talking about from tariffs and is this a one-off jump in the price level or something that can feed through inflation?

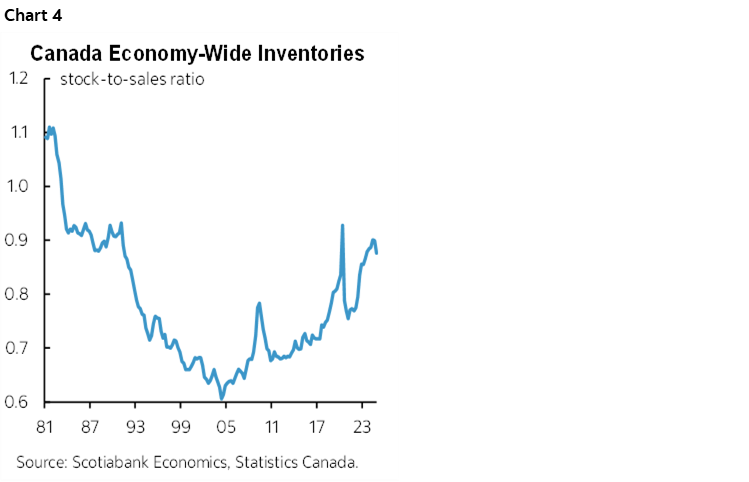

A1. I can't put a number on it. The scenario is changing literally every day. In terms of the channels, we're very clear in identifying a number of channels. CAD has depreciated and that means more expensive imports. Retaliatory tariffs puts an extra charge on goods coming into Canada. The uncertainty itself is adding costs, with businesses holding higher inventories (ed. see chart 4), looking for new suppliers and searching for new markets. There are a number of new costs that businesses are facing and ultimately they will get passed through. There is uncertainty around how much and how quickly that will happen. We have a lot of data we will be monitoring to be able to trace the effects. The reality is some prices are going to go up. We can't change that. We don't want to see knock-on effects with other prices going up and becoming generalized inflation. We cannot let that happen.

Q2. Is there the possibility of a hike in the future given your hawkish stance?

A2. There is a lot of uncertainty. We cannot provide that forward guidance. I can share how we are thinking about it. Monetary policy cannot offset the impact of a trade war. What we can do is ensure any rise in inflation is temporary. That means we're going to do as much as we can to help the economy adjust but that is limited by the need to control inflation. We are focused on two things. First is assessing the upward pressure on inflation coming from new costs and second is the downward pressure from weaker demand. It's going to take some time for that to work through. We are also going to focus upon inflation expectations. Well anchored inflation expectations will be critically important.

Q3. Can you explain why tariffs will be inflationary and explain why the US administration is arguing against this?

A3. We've been very clear tariffs will weaken the economy. Our exports to the US will be weaker. We're hearing from businesses that will weaken their investment and hiring intentions. It could well mean layoffs. Consumers are becoming more cautious in their spending. That will all put downward pressure on inflation. But, there are a number of higher costs that will add to inflation. We're focused upon weighing those downward pressures and upward pressures to maintain price stability.

Q4. What do you expect will happen to Canada's unemployment rate this year?

A4. I don't have a forecast for you. I would expect some rise in the unemployment rate. [ed. not so sure. immigration is also tightening.]

Q5. Is a recession imminent? How do you feel about a former Governor leading trade negotiations?

A5. Rogers answered this one. We don't have a forecast at this decision. We did supplement our views with the accompanying surveys. Macklem adding that it's going to depend a lot on what the US does with their trade policy. The BoC operates independently from the government and that is key.

Q6. Did you consider cutting by 50bps? Did you consider whether cutting more than 25bps could add to uncertainty and a loss of confidence?

A6. We did not seriously consider a cut of 50bps. Monetary policy needs to be forward looking. The hard data so far still looks good. The survey data makes it pretty clear that consumer and business confidence has been sharply affected and that will have an impact on the economy. That's why we decided to cut 25bps. There is a lot of uncertainty and lack of predictability. A trade war weakens growth but also prices and inflation. Against that background we did not want to get ahead of ourselves. We will proceed carefully with any further changes to our policy rate.

Q7. You mention the impact of the weaker C$ on prices. Will the BoC be more sensitive toward movements in the C$ in future rate decisions?

A7. To some extent the C$ is a shock absorber that helps to offset some of the impact. It also affects costs imported from the US. We're going to look at CAD in the context of everything else that is going on.

Q8. How much of a role will Canada's retaliatory tariffs play in the shock compared to the US actions?

A8. Rogers speaking. They add to uncertainty and prices. They are decisions made by the government. Governments need all the tools they need in a trade war.

Q9. Does CAD depreciation have a stronger impact on the economy than rate cuts?

A9. The fact that we have been lowering interest rates has had some effects on the C$ but they are more related to the trade actions and uncertainty created by the US government. [ed. he basically didn't answer the substitute question which they haven't in a long time].

Q10. Is the policy rate neutral or slightly stimulative?

A10. We do our best to estimate neutral. We'll do that again into our April meeting. Right now our neutral rate estimate is centered on the 2.75% mid point. We are in that neutral range. [ed. nothing new there, 2.25–3.25 is what they published last April when they raised the neutral rate range]

Q11. How is financial stability factoring into your thinking?

A11. Rogers answered this one. We'll have our financial stability report in May. Markets are starting to react to tariffs. They were underestimating effect but we're seeing markets respond. We haven't seen it have a destabilizing effect so far. [ed. In my view, a central bank cannot be vague on stability issues. They should have clearly stated that markets are functioning well, engaged in price discovery.]

Q13. Is it better to have a stronger or weaker C$ to keep import costs lower or do we also have to pay attention to the impact on exporter profits?

A13. We don't focus on or target the C$. What you are seeing in the dollar is reflecting what is going on.

Q14. How do tariffs pass through to consumer prices? In your January scenario most of the pass through happens in year 3 but your surveys show earlier. Why not sooner and are you prepared in terms of how to manage this?

A14. Rogers answering. The speed and magnitude of pass through are two key questions and uncertainties. A trade war is a supply shock. It affects production costs and capacity. In that sense it's similar to COVID. But what's different compared to COVID is that these supply restraints ran into surging demand. What we expect in a trade war is lower demand but with supply constraints. That would mean that we don't see the same speed or magnitude of pass through. Macklem kicked in that it depends on what you are buying; vegetables and fruit will likely see faster pass through than durable goods. It will take some time to come to an overall assessment.

Q15. Is there any validity to weighting short-term inflation expectations more than long-term given the uncertainty?

A15. The short answer is we look at them both. Monetary policy cannot stop some prices from going up. We want to make sure those first direct prices increases don't spill over into second round prices increases. One of the ways we focus on that is through long-term inflation expectations. And that would be a big warning sign to us.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.