- Canada added 22k jobs in August

- Wage growth far outpaces inflation and productivity, more lies ahead

- Youths are paying the price for excessive temps

- The BoC should continue to tread very carefully

- Canadian jobs m/m 000s / UR %, SA, August:

- Actual: 22.1 / 6.6

- Scotia: 30 / 6.5

- Consensus: 25 / 6.5

- Prior: -2.8 / 6.4

Sorry Canada-haters, but the country’s job market remains resilient! Focusing upon the key 25+ age category strengthens this observation as the youths category continues to struggle as nonpermanent residents have crowded them out. Wage growth continues to far outpace inflation and productivity which continues to add to inflation risk and competitiveness challenges. On balance, the overall tone of the report continues to send a cautious signal to the BoC’s policy easing efforts. Hence, there are positives and negatives in the interpretations of the numbers; if you want rates to go down sharply and quickly then you hated them, but if you like a resilient consumer then you welcomed it.

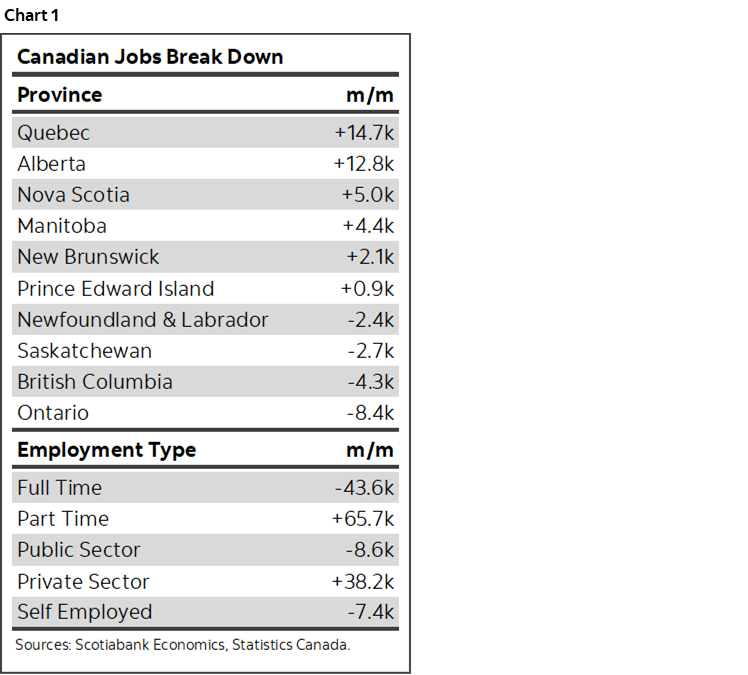

Chart 1 provides some highlights that will be expanded upon.

DETAILS

Canada gained 22.2k jobs in August which was close to most estimates.

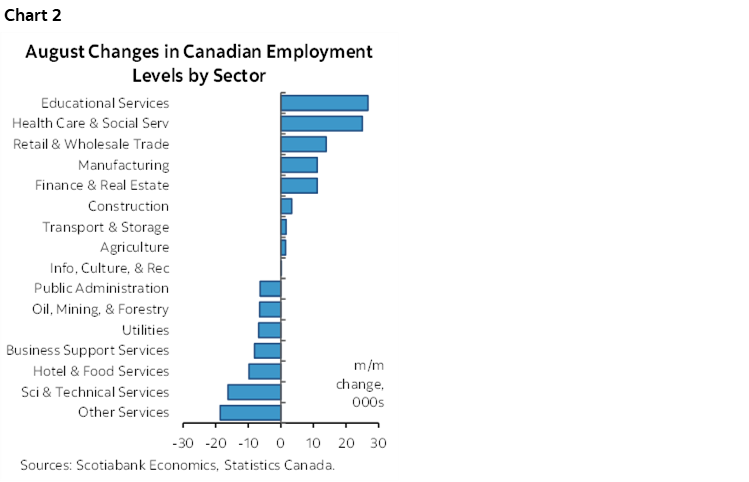

By sector it was a nearly even split down the middle in terms of gainers and, well, call them not gainers since it’s Friday (chart 2).

All of the gain was in payrolls that were up 29.6k. That was all in private payrolls (+38k) as public payrolls were down 9k. Self-employed positions lacking formal payrolls fell 7k.

Gains were led by Quebec and Alberta with little contribution across other provinces. Ontario slipped by 8k.

Full-time positions fell by 44k with part-time up 66k. This reflects volatility more than anything else after f-t jobs surged by 62k the prior month when p-t jobs fell by 64k. Smooth the two months.

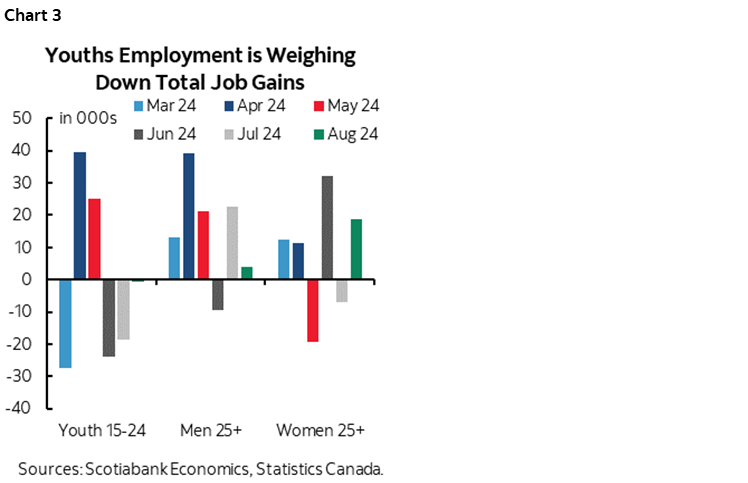

Youth employment was flat (-0.6k) as the 25+ age group gained 23k jobs mostly among women (+19k) with men 25+ up 4k. That extends the pattern of late shown in chart 3.

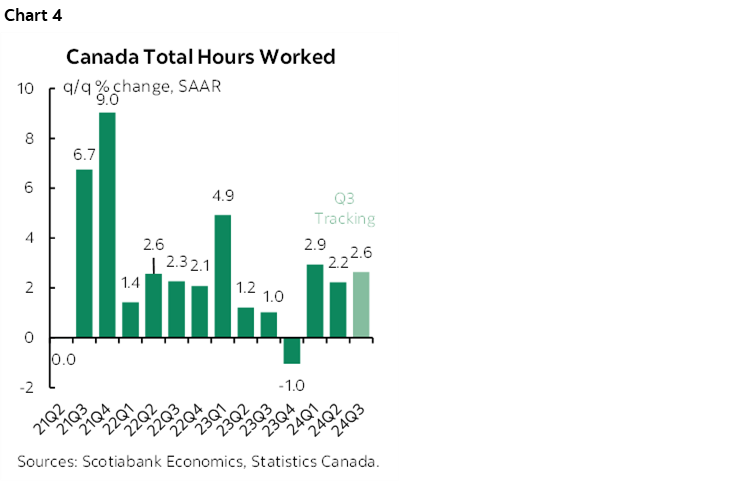

Hours worked were surprisingly resilient in Canada, -0.1% m/m SA. I thought there might have been more downside after the 1% surge in July and so it’s pleasantly surprising to see such resilience. Hours worked are tracking +2.6% q/q SAAR in Q3 (chart 4) which is good for GDP which is an identity defined as total hours worked times labour productivity.

WAGES CONTINUE TO DRIVE INFLATION RISK

Wages ripped again (chart 5). They were up by 4.1% m/m SAAR for permanent employees which continues to exceed inflation. The three-month smoothed measure now stands at 5½% m/m SAAR.

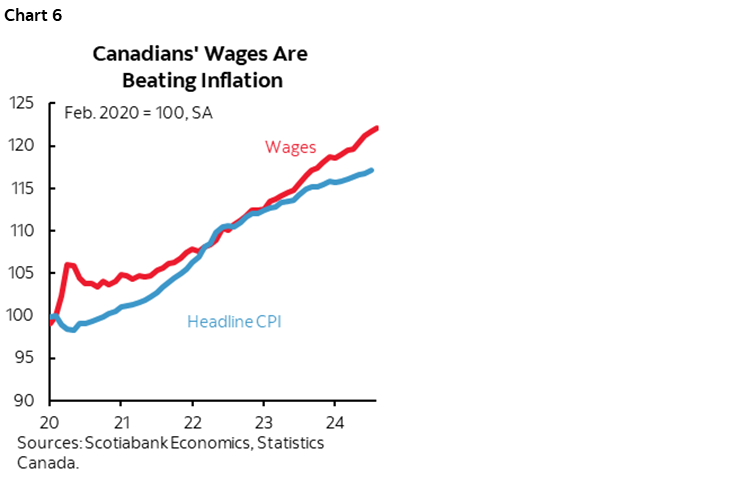

So, do folks still think Canada is merely posting make-up wage gains?? Think again, and again, and again! Chart 6 shows that wage growth has been exceeding inflation since the beginning of the pandemic. The make-up pay argument is a load of horse pucks. Wages are outpacing inflation and real wages are outpacing terrible productivity.

Ergo inflation risk. The loose corporate i/s analog here is to point out that poor productivity impairs revenue growth as the workforce is either not performing to its full potential or not equipment well enough to do so, while rising wages add to wages and salaries expense. The two effects squeeze margins. The incidence effects are uncertain in terms of who is impacted, whether shareholders, governments through lower tax revenues, suppliers ....or consumers through higher prices as the pressures get passed on. Hence inflation risk.

BoC SDG Rogers recently said there is no evidence that real wages are buoying inflation. That’s too strong for multiple reasons. For one, we can’t observe the alternate state absent such wage pressures and so we don’t know if inflation would be weaker in the absence of hot wages. For another, it may not show up in inflation right away. A third reason is that we still face lagging wage resets as the collective bargaining process delivers wage gains above inflation for the 3–4 year contract periods with many contracts still poised to be settled and further lagging effects until these gains show up in wages being paid. Combine this with the massive savings overshoot and it would be imprudent to discount inflation risk emanating from such sources.

THE YOUTHS AND IMMIGRATION DRIVERS OF UNEMPLOYMENT

The unemployment rate edged higher to 6.6% in Canada in line with expectations. It has been rising form a low of 4.8% in July 2022. The UR increased to 6.6% in August because the labour force rebounded by 83k which exceeded the 22k rise in employment. That makes more sense as previously argued, since the prior month's labour force drop of -11k was anomalous to the trend that has been driven by strong population growth. On that note, another 96k was added to Canada's population last month. In proportionate terms that would be around 900k added to the US population in a single month. And that's just the 15+ age population given the report’s focus on the workforce.

Statcan noted that the summertime unemployment rate for youths aged 15–24 was the highest since 2012 at 16.7% (12.9% last year). It’s youths who are experiencing the greatest challenges. The 15–24 UR has risen by 5.2 ppts since July 2022 when the national UR troughed, while the UR for men 25+ is up 1.4 ppts and the UR for women 25+ is up 1.0 ppt.

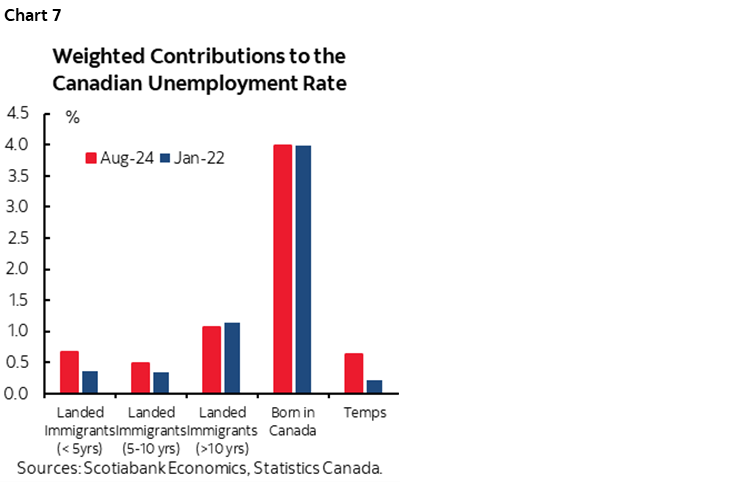

Why have adults also seen a more modest rise in unemployment? Chart 7 continues to show the impact of excessive immigration. The categories for those born in Canada and immigration of permanent residents that have been here for a while have seen little change in URs. The rise in the UR has been entirely concentrated upon nonpermanent residents (ie: temp foreign workers, int'l students and asylum seekers) and the more recent permanent residents category of immigration. Ergo, slow it down....you’re wayyy behind Ottawa!

Canada needed higher immigration that I’ve long supported. It's an economy built on immigration. New arrivals make fantastic contributions to the economy. But it's like a great trade idea that gets poorly executed and loses money in the end. Canada overshot on immigration with too much too fast relative to the ability of the country's job market and infrastructure to absorb so much. Unfortunately this risks backfiring now and making it into a political issue because of how badly Ottawa has mismanaged immigration and housing files.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.