DOWNTURN UPENDS SURPLUS PLANS, PRIOR STRENGTHS REMAIN

SUMMARY

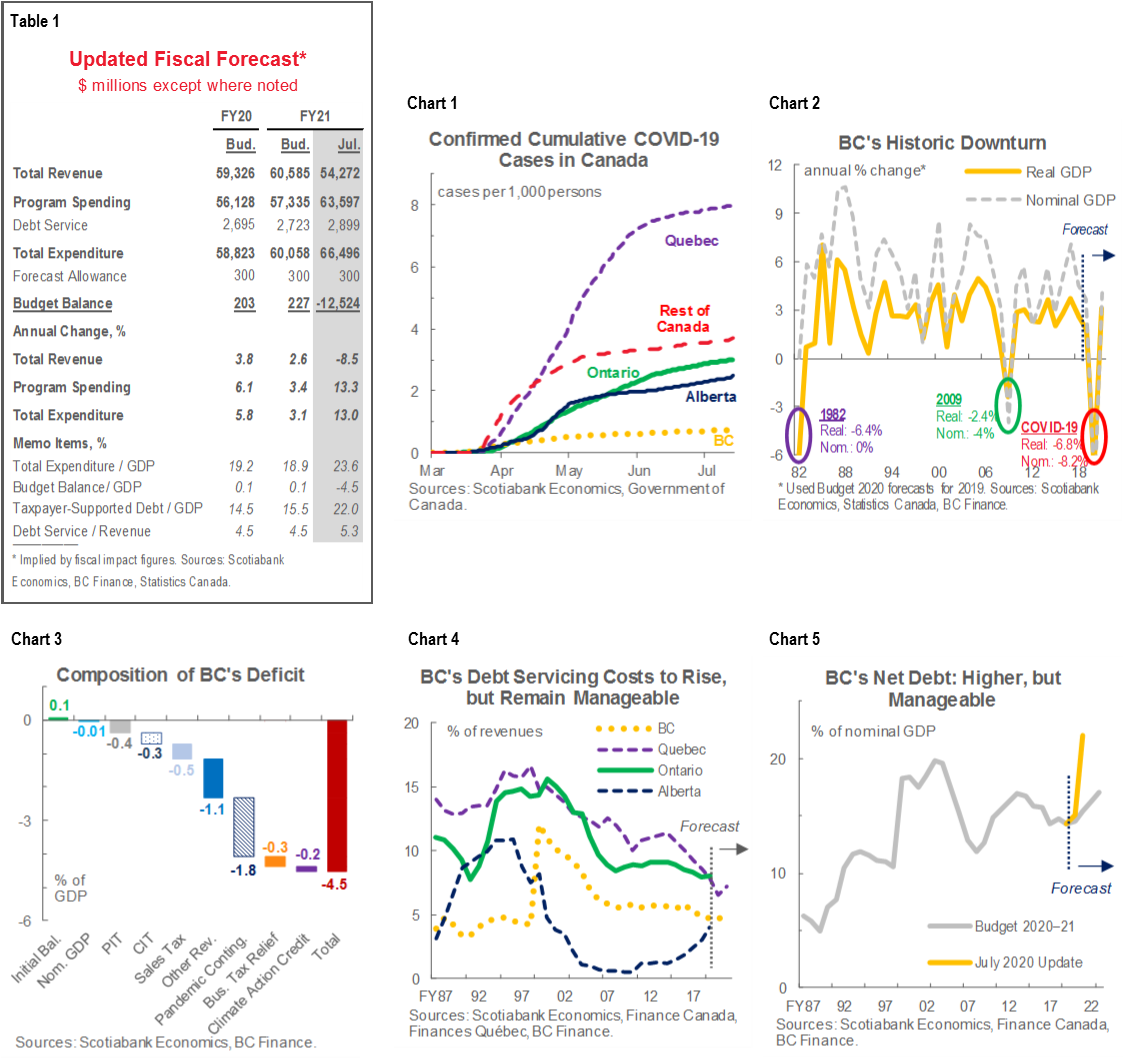

- In another sign of the devastation wrought by the COVID-19 pandemic, British Columbia’s fiscal year 2020–21 (FY21) Economic and Fiscal Update projects a $12.5 bn (4.5% of nominal GDP) deficit.

- That fiscal shortfall is a natural consequence of the government’s projection of an historic 6.8% real economic contraction in calendar year 2020—more pessimistic than our own projections.

- Net debt is expected to reach a still-modest 22% of output, though that would represent the highest-ever recorded share.

- Policy measures detailed in the Update had largely already been announced, but the Province’s robust pre-virus fiscal position leaves room for more support and provides a solid foundation for recovery.

OUR TAKE

As with other jurisdictions around the world—and as will likely continue to be the case—COVID-19 has put BC on a considerably more challenging fiscal path than it faced pre-pandemic. The Province’s impressive run of economic growth and strong surpluses achieved since 2013 is set to come to an end, and the secure surpluses previously anticipated for the foreseeable future are no longer possible. Still, we approve of the relaxation of balanced budget rules as will allow for calibration of fiscal policy to economic conditions.

Despite a more challenging environment, BC maintains several advantages. One is its success thus far in controlling COVID-19’s spread (chart 1). The Province is already in an advanced stage of its reopening plan—progress to the next phase hinges on virus containment elsewhere in the world—which bodes well for a strong rebound versus other jurisdictions in Canada and abroad. Diversified trade flows augur well for firms exporting to countries such as China, Japan, and South Korea where COVID-19—for now—is under relative control, though there are risks here as well. And prudent budgeting before the pandemic keeps BC’s debt levels relatively healthy even after an historic economic downturn, leaving room for further stimulus or sector-specific support if necessary.

Though economic assumptions underlying the fiscal update appear conservative, we would of course be remiss not to highlight a number of risks. Secondary virus waves—at home or abroad—could spur fresh containment measures that further drag on provincial output. Persistent weakness in population growth—via border closures, travel restrictions, post-lockdown apprehension about migration, and the shift to online learning—continues to present downside potential. Finally, BC’s highly promising LNG industry faces new competitive pressures amid pandemic-induced weakness in global commodity prices.

HISTORIC GLOBAL EVENT, HISTORICAL ECONOMIC IMPACT

As in other jurisdictions around the world, the pandemic is expected to result in unprecedented economic losses for BC. The government forecasts that the provincial economy will contract by 6.8% in real terms in 2020—the worst showing since data began to be recorded in 1981 (chart 2)—amid worldwide lockdowns to contain the virus’ spread. By contrast, the deep recession experienced across Canada in the 1980’s included a 6.4% plunge in BC in 1982, and real provincial GDP fell by just 2.4% in 2009 at the height of the last global downturn. Nominal GDP is projected to fall an even worse 8.2% in calendar year 2020, also a steepest-ever recorded drop. A more pessimistic scenario could result in provincial output falling by as much as 9.8%; better conditions could keep the drop to just 4.7% in 2020.

As witnessed across the world, no sector of the economy is expected to be immune to COVID-19’s historic economic fallout. Corporate profits are forecast to drop by nearly 40% in 2020—the worst result since 1982—while total employment is set to plunge by 9.8%—the deepest fall since at least 1976. BC housing starts—which have held up thus far—are forecast to average about 27k in 2020 as economic weakness lingers, and nominal merchandise exports are down sharply so far in 2020. A gradual recovery is expected to crystallize with a 3.1% real GDP gain next year.

BC’s anticipated 6.8% output contraction is weaker than both our most recent projection of a 5.5% real output drop in 2020 and the average of private-sector forecasts (5.4%). Our relatively optimistic forecast fundamentally reflects BC’s success to date in controlling COVID-19`s spread and expectations of significant major project-related support. Risks on these fronts notwithstanding, our view at this time is that that there is some upside for the economic and fiscal outlook, though the Province will next update its forecasts in September of this year, and rightly notes the high degree of uncertainty.

DETAILS OF POLICY MEASURES

Initiatives from BC’s COVID-19 Action Plan announced in March accounted for the bulk of policy measures detailed in the Update. The $5 bn Plan—reflected in a contingencies allocation—is responsible for about 40% of Provincial balance change since the February budget (chart 3). At over $1 bn apiece, health and mental health supports plus the BC Emergency Benefit for workers come with the biggest price tags. Consultations with respect to the previously announced $1.5 bn in economic recovery measures continue until July 21; these are expected to be implemented in September.

Additional tax and fee relief comes with an estimated fiscal impact of $1.3 bn. This figure comprises a one-time, $500 mn boost to the tax credit associated with BC’s carbon pricing system, and a further $762 mn in miscellaneous cost reductions.

Though not associated with a direct hit to the bottom-line, the Province highlights a range of tax and fee deferrals to support household and business liquidity. Payment deadlines have been extended for hydro bills, as well as school, employer health, provincial sales, and tobacco taxes, among others; the total value associated with these deferrals is estimated at over $6.3 bn.

Pre-pandemic infrastructure spending plans remain in place. As it stands, the Province continues to plan some $22.9 bn in taxpayer-supported capital outlays over the next three fiscal years, with expenditures concentrated in schools, roads, transit, bridges, housing, and health care facilities. To date, provincial government projects have not experienced significant delays related to COVID-19.

A SIGNIFICANT FISCAL HIT, BUT PRE-VIRUS STRENGTHS REMAIN LARGELY INTACT

Facing much weaker economic prospects this year, BC’s total revenues are forecast to fall more than 8% versus FY20—in stark contrast to the 2.6% gain anticipated in March and the worst annual decline since at least FY87. That would represent the largest single-year percentage decline ever recorded in BC, and contrasts with a drop of just over 3% at the height of the 2008–09 recession.

Reflecting the Province’s pandemic response, total expenditures are set to climb by 13% this fiscal year—the largest increase since FY98. Debt servicing costs are projected to rise to 5.3% of revenues in what will likely be the first increase in five years for BC; still, that represents a low share relative to history and to other jurisdictions within Canada (chart 4, p.2).

Revenue and expenditure adjustments are poised to result in a record deficit of $12.5 bn (4.5% of nominal GDP). That is far wider than the previous post-FY87 record of 2.8% registered in FY92, and looks likely to end BC’s remarkable run of seven consecutive annual surpluses—the longest streak of any province.

Although no fiscal plan details were announced beyond FY21, all indications are that red ink will continue. For one, BC announced last month that it would suspend through FY24 its Balanced Budget and Ministerial Accountability Act that prohibits deficit spending. This requirement is in place under normal circumstances, but did not represent a binding constraint during the recent period of hefty economic growth and revenue gains; it was also relaxed following the 2008–09 recession.

Given the substantially wider deficit projection and expectations of a record economic contraction, it is no surprise that the Province anticipates a significant jump in its debt burden. Rather than the 15.5% portion of nominal GDP penciled in just five months ago, net debt is forecast to reach 22% of output this fiscal year—the highest share since at least FY87 (chart 5). Presumably, the Province’s net debt will remain under pressure with more red ink likely beyond FY21 and only a modest rebound anticipated next year, pushing borrowing requirements higher as well. Still, that 22% share is sustainable and looks as though it will be one of the lowest of any jurisdiction in Canada—only Alberta’s and Saskatchewan`s current-year loads are expected to be lower—testament to BC’s sound pre-pandemic economic growth and prudent fiscal planning.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.