MAINTAINING FISCAL ADVANTAGES DESPITE RED INK

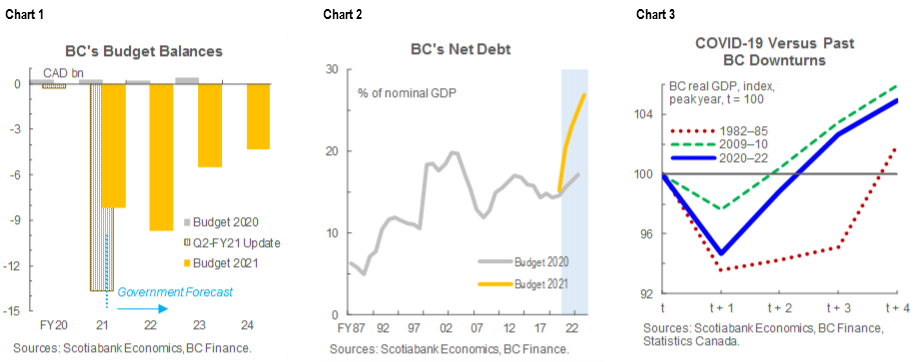

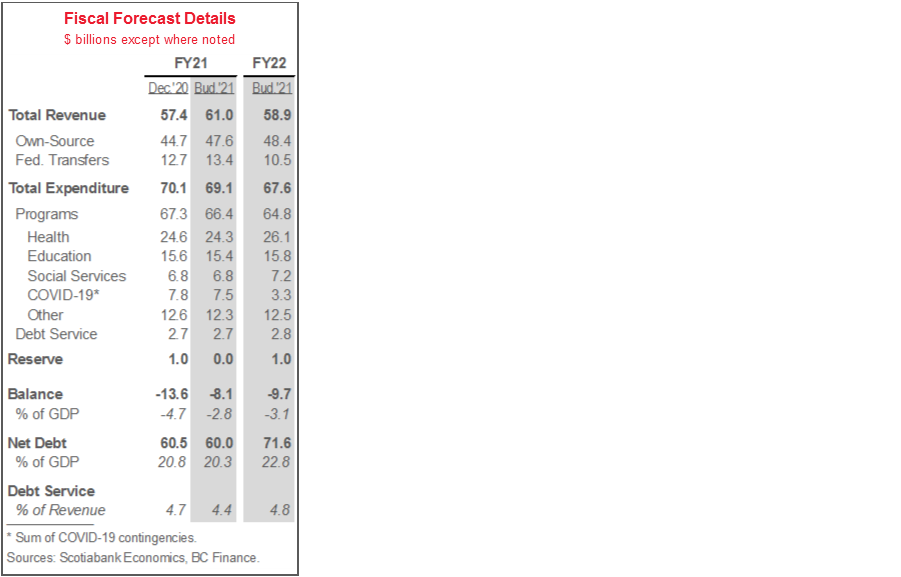

Budget balance forecasts: -$8.1 bn (-2.8% of nominal GDP) in 2020–21 (FY21), -$9.7 bn (-3.1%) in FY22, -$5.5 bn (-1.7%) in FY23, -$4.3 bn (-1.3%) in FY24 (chart 1); timeline for balance be presented in Budget 2022.

Net debt: expected to climb steadily from 20.3% of nominal GDP in FY21 to 26.9% by FY24—nearly 8 ppts higher than forecast in the pre-pandemic Budget 2020 by FY23 (chart 2).

Real GDP growth forecast: -5.3% last year, +4.4% this year, +3.8% next year—a shorter and shallower downturn than in the 1980s that sets BC’s economy up to return to its pre-pandemic peak in 2022 (chart 3, p.2).

New borrowing: $18.2 bn in FY22, $18 bn in FY23, $15.2 bn in FY24.

Budget is a cautious plan that maintains BC’s pre-pandemic fiscal advantages relative to other Canadian provinces; new infrastructure outlays offer the most scope for greater near-term growth.

OUR TAKE

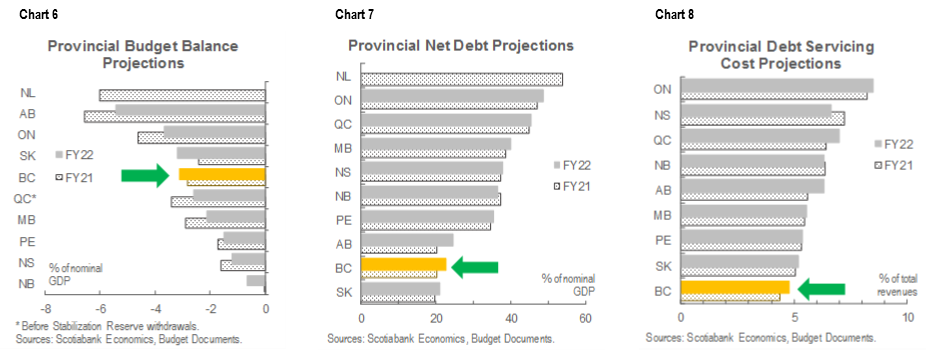

The deficits projected through at least FY24 may dominate headlines, but BC appears poised to maintain the fiscal advantages it held versus other provinces prior to the pandemic. Though its net debt burden is set to reach record heights after several years of surpluses before COVID-19, it should exceed only that of Saskatchewan over the next two years. Debt servicing costs, though expected to climb through FY24, are well below the highs north of 10% of total receipts witnessed in the late 1990s, and the lowest as a share of revenues forecast by any province so far. The estimated FY21 fiscal shortfall beat the prior forecast by $5.5 bn in part due to improving economic conditions. Charts 6‒8 on page 3 summarize key fiscal indicators in BC and those in other provinces.

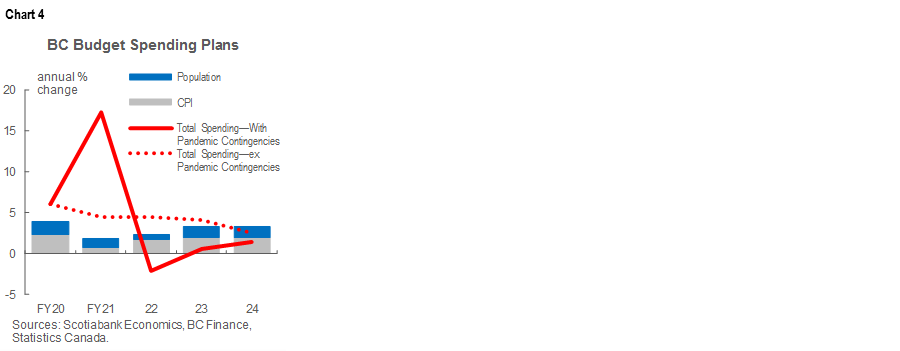

Fiscal planning includes shorter-term policy support and realistic initial steps towards medium-term consolidation. The plan includes $3.3 bn in pandemic and recovery contingencies this year—building on $7.5 bn in FY21—and a further $1.3 bn over FY23–24. Those funds come with the province in the midst of a new wave of lockdowns, and are split across health and safety measures, essential public services, tourism and arts sector supports, and efforts to encourage hiring and retraining as reopening proceeds. Any unused funds will be applied to operating deficit reduction. Net of these allocations, the government expects total expenditures to advance at a mean annual rate of 3.7% over FY22–24, roughly in line with forecast inflation plus population growth (chart 4, p.2).

Budget contains a smattering of supports for businesses, many of which were announced in the province’s Fall 2020 Recovery Plan. These include: grants for firms that adapt their services and physical space during COVID-19, tax credits for payroll hiring and worker compensation increases, and time-limited sales exemptions for qualifying machinery and equipment purchases.

Other policy detailed in the plan similarly builds incrementally on ongoing initiatives. Almost $2.3 bn was allotted over FY22–24 for child care; the government broadly aims to continue to create new spaces and improve affordability. The province has allotted $1.1 bn per year to advance affordable housing construction objectives underway in its Homes for BC plan. Applications for the BC Recovery Benefit—a one-time, tax-free payment of up to $1k for eligible families—remain open until June 30. To fight climate change, the province unlocked some new capital and operating funding for clean transportation and energy-efficient buildings, and will extend its Climate Action Tax Credit that offsets carbon tax payments through FY24.

Economic forecasts are characteristically prudent and leave room for upside on budget balances. BC has long mandated that fiscal blueprints be based on economic growth less than the private-sector mean expectation. That approach is reflected in this plan with real advances 0.5 ppts lower than anticipated by the province’s Economic Forecast Council in both 2021 and 2022. The outlook has improved since the February forecast submission. Based on BC’s own sensitivity estimates, a nominal 2021 expansion in line with our recent estimate in the 9% range—rather than the current 6.4% projection—could generate another $600 mn in revenues. The plan also includes forecast allowances of $1 bn in FY22, $750 mn in FY23, and $400 mn in FY24, plus general program contingencies of similar size.

Following several other provinces’ leads, BC intends to boost infrastructure spending to bolster its economic recovery. It now expects total capital outlays to average $13.2 bn per year (4% of GDP) during FY22–24—of which about two-thirds represent taxpayer-supported expenditure—with FY22–23 total capital spending more than $5 bn higher than in last year’s budget (chart 5). These levels are among the most significant announced among the provinces so far. The bulk of increases relate to educational and health facility upgrades and transportation infrastructure. Investments in the latter category amount to $7.5 bn over the next three fiscal years and arguably present the greatest opportunity to enhance BC’s potential growth, but the government noted that their timing will depend on Federal funding.

The province expects its borrowing requirements to amount to $51.9 bn from FY22 to FY24. It indicated that these funds will finance operating and capital investments, plus the refinancing of debt maturities. BC forecasts new borrowing of $18.2 bn in FY22, $18 bn in FY23, and $15.2 bn in FY24; these follow an estimated $17.9 bn in FY21.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.