FIGHTING PANDEMIC REMAINS PRIORITY, BALANCE DELAYED TO DECADE-END

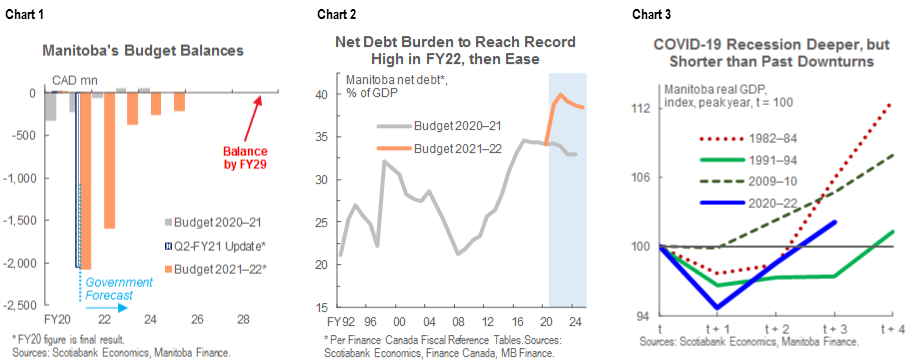

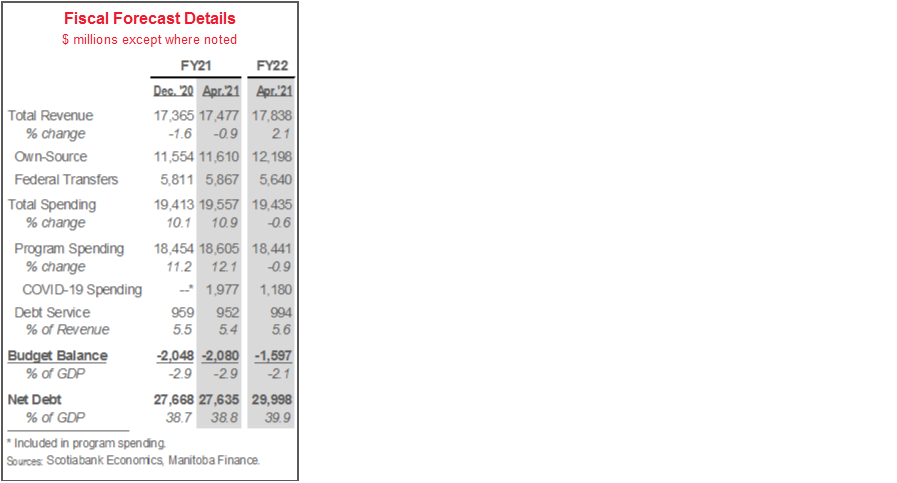

Budget balance forecasts: -$2.1 bn (-2.9% of nominal GDP) in FY2020–21 (FY21), -$1.6 bn (-2.1%) in FY22, -$374 mn (-0.5%) in FY23; return to balance targeted for FY29 (chart 1) as already announced.

Net debt: expected to peak at an all-time record 39.9% of nominal GDP in FY22, then ease to 38.4% by FY25—a trajectory 5‒6 ppts higher than forecast in the pre-pandemic Budget 2020 (chart 2).

Real GDP growth forecast: -5.3% last year, +4.1% this year, +3.6% next year, which puts the provincial economy on track to reach to its pre-pandemic, 2019 annual average in 2022 (chart 3, p.2).

Borrowing requirements: $5.7 bn in FY22, of which $2.7 bn is associated with refinancing activity.

Budget appropriately aims to mitigate the health impacts and economic fallout of COVID-19 and also sets a timeline for a return to surplus; economic growth forecasts imply some upside for near-term balances.

OUR TAKE

Manitoba’s long-run fiscal position has deteriorated as a result of the COVID-19 pandemic—just like in other provinces. In FY20, the province reported its first annual surplus since before the Global Financial Crisis and had projected a steady decline in its net debt-to-GDP ratio. Now, it anticipates that a return to black ink could take until FY29, and that its debt load will reach a new record-high share of provincial output in FY22, having already done so last fiscal year. The government notes its concerns with respect to Manitoba’s $38k per person gross debt load—estimated to be the highest of any Canadian province last fiscal year.

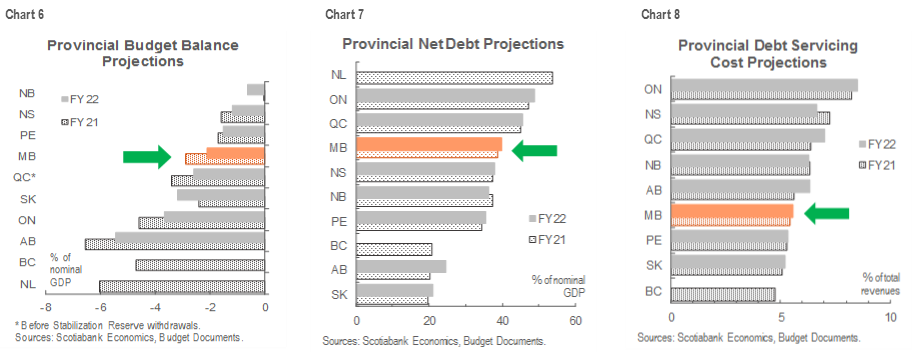

Still, Manitoba compares favourably to other jurisdictions on some key fiscal indicators. Its projected deficit, while elevated in FY21‒22, is not expected to reach a record share of GDP and—as it stands—is towards the lower end of current provincial plans. As a share of revenues, debt servicing costs are also expected to stay smaller than those of peers. While rising bond rates could certainly push financing charges higher, the easing path projected for the debt-to-output ratio may help contain upward pressure. Charts 6‒8 on page 3 summarize Manitoba’s forecast fiscal indicators relative to those of other Canadian provinces.

COVID-19-related expenditure is significant. The $1.2 bn (1.6% of nominal GDP) in related spending in FY22 is down from last year’s $2 bn (2.8%), but less so than in several other provinces that have broken out COVID-19 expenditures in their fiscal plans. The bulk of the $1.2 bn total is associated with vaccine rollout, personal protective equipment, and preparation for future pandemic waves.

Accordingly, medium-term spending plans have changed. Recall that the pre-pandemic blueprint included average annual total expenditure growth of just 1.1% during FY22‒24. Net of FY22 pandemic spending, the last three years of the current plan are built on mean yearly growth of more than 3% (chart 4). Revenue and expenditure plans beyond FY25 were not detailed.

Policies to advance economic growth include a range of targeted sectoral supports. Sales taxes will be waived on personal services such as haircuts and salon visits, and rebates will be offered for education property taxes. Tourism and accommodation sector operators will receive financial assistance. Funds for workforce training aim to help firms fill labour shortages during the economic recovery. As announced in January, the government has created a Department of Advanced Education, Skills and Immigration, dedicated to aligning post-secondary education and immigration programs with provincial labour market needs. Infrastructure spending is expected to reach $2.1 bn in FY22.

Economic forecasts are less sanguine than many current private-sector projections, which suggests some near-term upside for budget balances. Our last forecast update—completed after the passage of US President Biden’s fiscal stimulus package—assumed an expansion of just over 5% in the Keystone Province in 2021. Should the economic backdrop evolve as we anticipate, it could bolster government coffers and reduce the projected deficits. Under the province’s more optimistic growth scenario—based on above-average projections in its Survey of Economic Forecasts—balance could be achieved as early as FY23 and net debt would fall below 33% of output by FY25. A pessimistic scenario is associated with fiscal shortfalls in the $1.5 bn range throughout FY23‒25.

The province’s Fiscal Stabilization Account adds a modicum of prudence to the plan. The fund is expected to have a balance of $585 mn by the end of FY21 (chart 5), following a draw of $215 mn that was allotted to COVID-19-related spending. Details of FY22 balances will be announced later this fiscal year.

Manitoba projects gross borrowing requirements of $5.7 bn in FY22. About $2.7 bn of that figure relates to refinancing, and at budget time, $771 mn of pre-financing had been completed. The government further estimates new cash requirements of $3 bn (net of estimated repayments); that includes general government, capital investment, and Manitoba Hydro-Electric Board borrowing.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.