REVENUE WINDFALL TO OFFSET DROUGHT-INDUCED HYDRO LOSSES

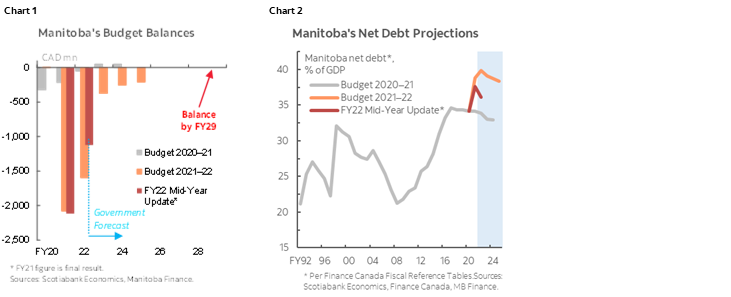

- Budget balance forecasts: -$1.1 bn (-1.4% of nominal GDP) in FY22, an improvement of $474 mn versus Budget 2021 (-$2.1 bn, -2.9%) (chart 1).

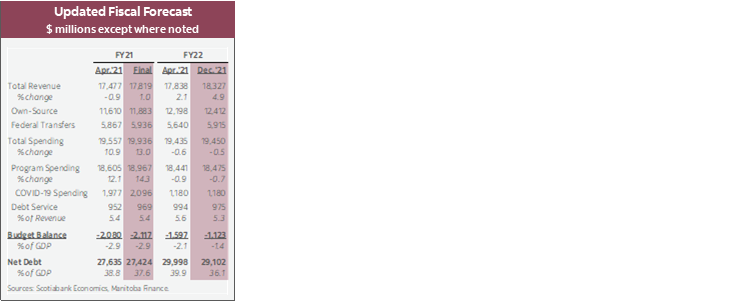

- Net debt forecast: lowered by $896 mn to $29.1 bn (36.1% of GDP) (chart 2) for FY22, down from the record high of 39.9% projected in Budget 2021, helped by smaller deficits and stronger GDP growth forecast.

- Real GDP growth forecast: raised from 4.1% to 4.6% in calendar year 2021; nominal GDP projected to grow by 10.1%.

- Despite the unforeseen drought conditions affecting Government Business Enterprises (GBE) income, the lower-than-anticipated deficit level speaks to a robust economic rebound and positive outlook in the province.

OUR TAKE

The Update projects a sizable reduction ($474 mn) of the FY22 deficit from the previous estimate in the 2021 Budget, driven by robust economic recovery. Most of the upward revision to FY22’s total revenue forecasts were attributable to the province’s own-sources income, which was lifted by $483 mn versus the Budget, and is set to grow by 5.7% from the fiscal year prior. Federal transfer payments contributed to the rest of revenue gains with a $275 mn improvement pencilled in versus Budget 2021. On the downside, own-source revenue windfalls are expected to be eroded by a hit to Government Business Enterprises (GBE) incomes, namely a decline in export revenues of Manitoba Hydro due to drought conditions.

Expenditure forecasts were largely in line with what was laid out in the 2021 Budget, with minor increases in program spending on areas such as family, health and senior care. The government committed $1.18 bn to COVID-19 efforts at the time of the 2021 Budget, 1/3 of which were left unallocated after the third wave and would provide contingencies for the rest of the fiscal year. In addition, Manitoba’s Rainy Day Fund stood at $585 mn after a withdrawal of $215 mn at the end of FY21 in order to save debt servicing costs.

A smaller deficit in FY22 helped bring down Manitoba’s net debt burden as a share of GDP to 36.1%, a slight improvement from 37.6% in FY21. Albeit still elevated by historical standards, the province expects the ratio to taper off in the coming years. A narrower fiscal shortfall implies lower borrowing requirements than the $ 5.7 bn forecast for FY22 at Budget time. Unexpected drought costs, though seemingly transitory at this point, should add to liabilities taken on by MB Hydro. The Crown Corporation’s borrowing accounts for 1/4 of provincial requirements in FY22 and 43% of total outstanding debt.

Nevertheless, the improved fiscal projection for FY22 is a positive step that puts the province on track to balance the budget before the FY29 target outlined in Budget 2021. This also speaks to the scale of the economic rebound in the province. Manitoba experienced a lower-than-national average contraction in 2020, as well as strong job gains. The Update showed confidence in projecting solid growth in real and nominal GDP of 4.6% and 10.1%, respectively, representing the largest increase in nearly four decades. That said, volatilities remain for the rest of the fiscal year, particularly in light of the continued battle with COVID-19’s further variants as well as extreme climate events. The Update has taken a more conservative stand since the Q1 Update by lowering the economic forecast slightly, highlighting risks around supply chain issues and the pandemic.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.