INITIAL STEPS ON THE ROAD TO RECOVERY

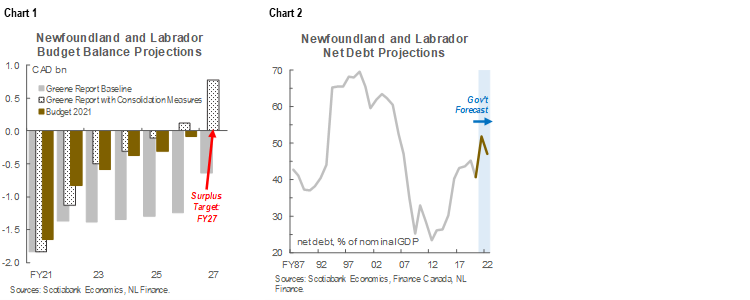

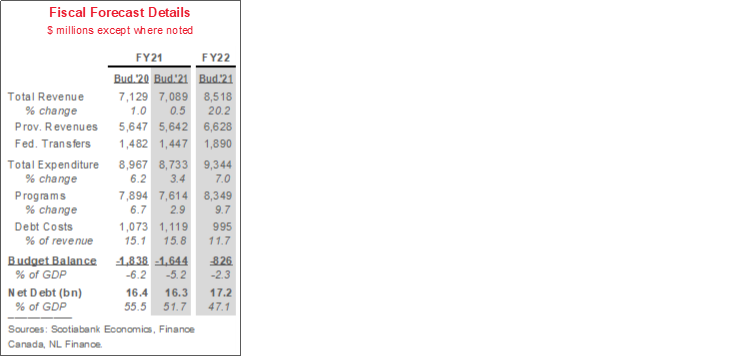

- Budget balance forecasts: -$1.6 bn (-5.2% of nominal GDP) in 2020–21 (FY21), -$826 mn (-2.3%) in FY22, -$587 mn (-1.6%) in FY23; surplus targeted for FY27, one year later than in Greene Report (chart 1).

- Net debt: expected to reach 52% of nominal GDP in FY21, then decline to 47% in FY22 (chart 2).

- Real GDP growth forecast: +5.6% in 2021, +2.6% next year—consistent with the provincial economy returning to pre-pandemic level this year.

- Borrowings: $1.7 bn in FY22, following $2.8 bn total in FY21.

- Budget highlights the depth of the fiscal challenges facing NL, presents better-than-expected near-term results, and serves as a first step on the path to longer-run fiscal sustainability.

OUR TAKE

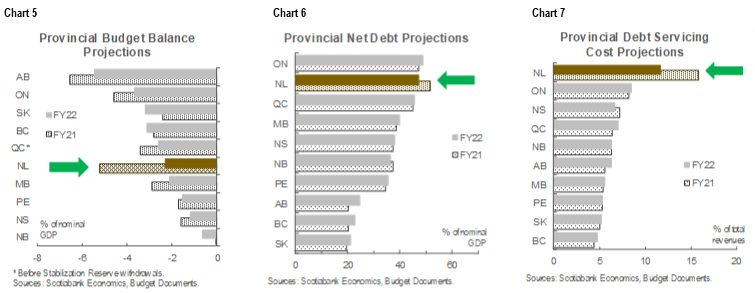

It was well-established before the release of this fiscal plan that Newfoundland and Labrador faced a challenging fiscal and economic outlook following COVID-19; Budget highlights some of those challenges. Rather than a return to balance in FY23 as planned before COVID-19, surplus will have to wait until FY27. In FY21, among the provinces, NL is estimated to have carried the largest net debt burden per capita and as a share of GDP, as well as run the second-largest deficit as a portion of output. Long-run economic growth prospects remain constrained by population aging.

However, current-year and outer-year fiscal projections are stronger than anticipated and set in motion a plan to return to financial stability. As a share of GDP, the province anticipates that its net debt and deficit will decline significantly in FY22, with the latter expected to ease steadily and remain well below 2% of output through FY26. Projected interest costs as a share of revenue are elevated relative to those of other provinces, but remain well below the record highs experienced in the late 1990s and early 2000s. Alongside the commitment to balance by FY27, these figures should be positively received by the province’s creditors. Charts 5–7 on page 3 compare key fiscal indicators in Newfoundland and Labrador to those of other Canadian jurisdictions.

A hefty projected economic rebound this year is partly behind the expected near-term improvement in NL’s finances. The 5.6% real GDP gain penciled in for calendar year 2021 compares with a 3.8% private-sector average, and would be the strongest advance witnessed in the province since 2007, when crude output peaked. The forecast reflects expectations of a strong reopening effect as vaccine rollout continues, robust iron ore production, and the spillover impacts of strengthening crude and mineral prices. Accordingly, total revenues are forecast to rise by over 20% in FY22, with about one-third of the gain sourced from offshore royalties. That expansion is expected to come despite suspended activity at the Terra Nova oil field and West White Rose project in 2021.

Federal transfers are set to increase by more than $440 mn in FY22. The bulk of that increase relates to “Cost-Shared and Other Federal Revenues,” an umbrella category that includes all federal funding except for health and social transfers.

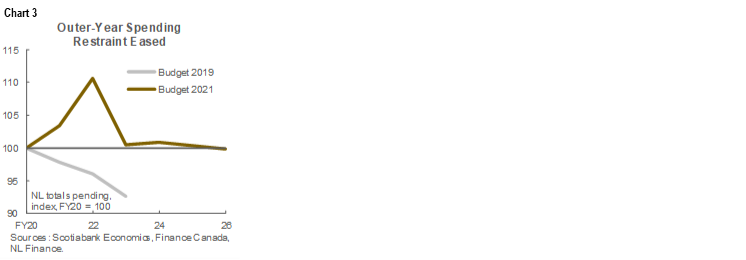

Helped by revenue gains, achieving the targets outlined in Budget requires less outer-year spending restraint than projected in the last multi-year pre-pandemic plan. Before COVID-19, the planned return to balance by FY23 relied on mean total expenditure annual declines of 2.5% in the last three years of the financial plan. The government is now targeting cuts of just 0.2% per year during FY24–26 (i.e., after the effects of pandemic-related spending unwind), which would result in roughly flat total expenditures between FY20 and FY26 (chart 3). That compares with forecasts of CPI gains in the 1.5–2% range and a flat or modestly falling population after this year.

The delayed and over-budget Muskrat Falls hydroelectricity project hangs over the financial projections. If the venture’s full costs are not recovered via the electricity rate base, it could result in a rise in taxpayer-supported provincial debt. On this front, we are encouraged by initial reports of constructive electricity rate mitigation discussions between the province and the Federal Government—though details have not been announced. The province will “begin a comprehensive analysis and reorganization” of Nalcor—the Crown corporation tasked with developing the venture—and conduct a review of the NL oil corporation. The Premier’s Economic Recovery Team Report—also called the Greene Report after its chair, Dame Moya Greene—suggested reviewing both entities as part of a plan to restore fiscal balance.

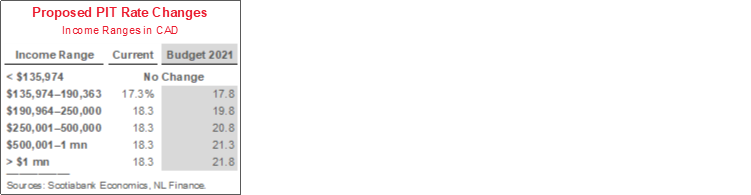

Other key elements of the Greene Report are included in the plan. NL personal income tax rates will be raised for all individuals earning more than $135,973 per annum, with larger increases in higher brackets (table, p.3); the province will study potential sales tax rate increases that minimize impacts to low-income citizens. It also committed to implementing a “Future Fund” to pay down debt and support green energy development and technological innovation. Other new policy moves included: various public sector transformation and accountability initiatives, funds for COVID-19 personal protective equipment and vaccination, support for offshore oil projects, and broadband connectivity upgrades. The province also aims to settle 5,100 newcomers per year by 2026, and laid out funds for a range of integration initiatives.

Budget also announced nearly $600 mn in FY22 infrastructure spending. The province estimates that these funds will generate 4.5k full-time equivalent positions. The largest single component of the allocation is the $170 mn for highway maintenance; the plan also includes funds for healthcare facilities improvements, school construction, and marine infrastructure.

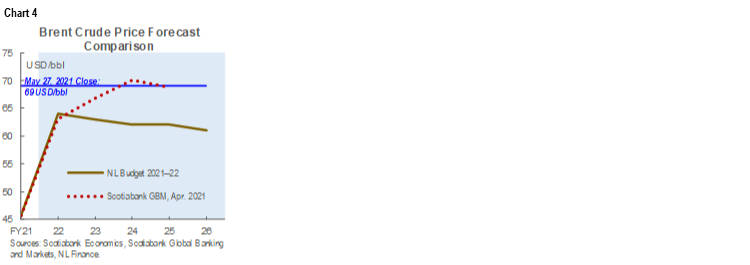

Oil price projections are typically prudent and in line with private-sector forecasts. Budget is based on a composite of price projections from 11 private-sector forecasts, which comes to a mean Brent value of 64 USD/bbl this fiscal year, and average of 62 USD/bbl over the ensuing four years (chart 4). In FY22, every additional 1 USD/bbl is associated with $19 mn in offshore royalties. Budget also includes contingencies for oil price-related risks starting next fiscal year; the value of those provisions increases gradually from $15 mn in FY23 to $45 mn in FY26.

The government anticipates borrowings of $1.7 bn this fiscal year. That follows an estimated $2.8 bn total in FY21.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.