- Last week the federal government announced an agreement in principle that would provide much-needed financial support for Newfoundland and Labrador’s Muskrat Falls hydroelectricity generating station.

- The deal would provide relief of $5.2 bn including the transfer of an estimated $3.2 bn in Hibernia revenues over its lifespan, along with $2 bn in federal financing, including loan guarantees for transmission assets as part of a financing restructuring of the project.

- Faced with the risk of escalating electricity costs once the project comes on line later this year, along with additional cost overruns, the agreement in principle reduces downside risks to the province’s fiscal outlook.

- While details will only be hammered out over the coming months, the deal could modestly improve the province’s net debt level. Otherwise, it should be fiscally neutral insofar as it removes a tail risk to the deficit trajectory if rate mitigation were brought onto the province’s books.

- Arguably the biggest impact is one of signaling: the provincial government has taken a series of steps over the past months to lay out a path to a stronger fiscal position that should go some way in appeasing market observers. (And conversely, the announcement also reinforces the implicit federal backing behind provincial debt.)

- Much work still lies ahead on delivering on these commitments but the province is heading in the right direction.

A BRIEF HISTORY OF THE MUSKRAT FALLS PROJECT

The Muskrat Falls hydroelectricity project was proposed in 2010 with the goal of generating clean power for Newfoundland and Labrador and Nova Scotia. The venture’s price tag was initially estimated at $6.2 bn, but delays and cost overruns have resulted in that figure increasing steadily to the last-announced level of around $13 bn. Since the announcement in 2010, the federal government has provided loan guarantees totaling $7.9 bn. The project is now nearing completion later this year, and most estimates put the hydro rate increases necessary to cover the construction cost overages at nearly double the current rate near 13 ¢/kWh.

Cost overruns and potential rate increases represent significant downside fiscal and economic risks for the province. Rate increases of the magnitude envisioned would erode regional business competitiveness, ultimately impacting economic growth prospects for a province that is grappling with a rapidly aging population. Project cost obligations could also result in obligations for Nalcor—the provincial crown corporation that manages the province’s energy assets—being booked as taxpayer-supported debt. That would impact market perceptions of Newfoundland and Labrador’s credit as well as the province’s borrowing costs.

In light of these fiscal anxieties, the federal and provincial governments have been in negotiations over financial support since late 2020. In early 2021, the federal government also introduced additional temporary measures to preserve Nalcor’s cash flow, pending the negotiation of financial restructuring of the project to reduce the cost of the capital structure. Newfoundland and Labrador’s 2019 budget also laid out the contours of a plan to reduce electricity rates from the projection of 22 ¢/kWh to 13.5 ¢/kWh. Support from Ottawa was tied to restructuring at Nalcor. Last year, negotiations began in earnest.

A NEW AGREEMENT IN PRINCIPLE

The contours of the deal announced last week would provide an estimated $5.2 bn in financial support. It offers an agreement in principle for the financial restructuring of the Lower Churchill Projects that would reduce the cost of financing through the provision of an additional $2 bn in federal financing. This would include a $1 bn investment in the province’s portion of the projects’ Labrador-Island Link and a federal loan guarantee of $1 bn for the Muskrat Falls and Labrador Transmission Assets. The federal government also offers to transfer net revenues from the Hibernia oil field—estimated at $3.2 bn over the project’s lifetime—to the province. With those funds, the government expects to cap electricity rates at 14.7¢/kWh this year— well below the level projected without intervention.

POTENTIAL FISCAL IMPLICATIONS

Details are scant at this point with negotiations still underway to finalize the deal. This is expected to be completed later this year. At this point, we only make assumptions on how these measures could affect the fiscal outlook for the province and we will be watching carefully as details emerge.

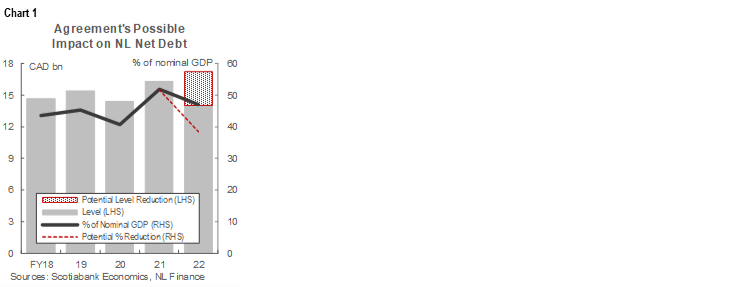

The province could see a one-time downward step-change in net debt in FY22 as a result of the eventual deal. This would be predicated on the assumption that Hibernia revenue transfers ($3.2 bn) would be treated similarly to the 2019 Atlantic Accord, where the unconditional federal transfers were booked as a lump sum of $2.5 bn in revenues in the first fiscal year of the agreement in accordance with Canadian Public Sector Accounting Standards. This would further support the province’s projected downward trajectory of net debt as a share of GDP (chart 1, p.1). We assume these would be actuarial, predicated on future year cash flows so gross debt would not change, hence there would be no immediate savings from lower debt servicing costs and borrowing activity for the province itself would not change.

We also assume that the loan and loan guarantees would not have a direct fiscal impact on the province’s books, rather they would reduce potential contingent liabilities for Nalcor. It is not inconceivable that the full cost of project completion could now sit at around $15 bn. These new measures would reduce further borrowing requirements for Nalcor, along with lower interest charges with additional funds available at the federal rate via the loan guarantee. Recall, Nalcor’s debt is not included in the provincial tally given it is considered a self-sustaining crown corporation. This deal should secure that standing and reduce the real or perceived notion of liability on the province.

The deal should otherwise be fiscally neutral. That is, it should not have a substantial impact on the deficit trajectory as laid out earlier by the government, rather it avoids a tail risk that the province may have had to bear the cost of eventual rate mitigation on its books. Most estimates had pegged this potential cost in the order of $700 mn to prevent an otherwise doubling of electricity rates for Newfoundlanders. The restructuring of financial obligations that reduces equity- and debt-related cash flows, along with the modest electricity rate increases announced presumably closes this gap. This had not been incorporated into the province’s fiscal planning framework so would not change this profile. (On the other hand, absent an agreement, the province would likely face upward budgetary pressures to offset rate increases.)

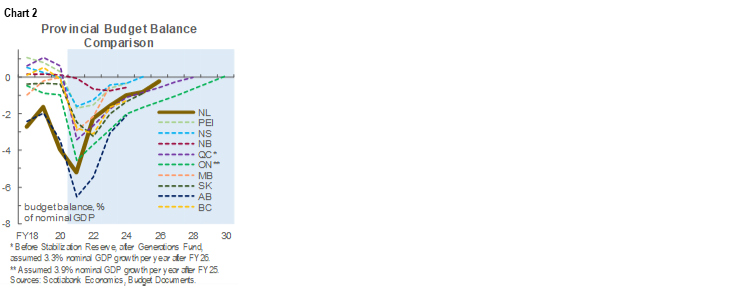

Otherwise, the fiscal trajectory is on a solid downward path albeit from elevated levels. The province expects its deficit to narrow significantly in FY22 as COVID-19 spending pulls back against stronger revenue receipts, then ease steadily thereafter and remain well below 2% of output through FY26 (chart 2, p.2). Notably, there is potentially more upside to this outlook given year-to-date gains in crude values and we anticipate that Brent oil will average more than 71 USD/bbl in FY22. With a Budget 2021 assumption of 64USD/bbl that could translate into an additional $130 mn in royalty receipts based on the plan’s stated sensitivities.

BROADER IMPLICATIONS

Arguably, signalling is the biggest impact of the new agreement in principle. The new government in Newfoundland has taken sequential steps over the past months to set in motion a stronger fiscal framework. While setting out a much-improved fiscal outlook in its recent budget, it also committed in principle to many of the proposals in the Premier’s Economic Recovery Team Report (the “Greene Report”). The Muskrat Falls agreement in principle provides a credible semblance of a rate mitigation strategy that would address looming concerns around its fiscal viability in light of overruns. Taken together, these steps are a positive sign that the government is committed to addressing the province’s financial situation.

Rating agencies have been flagging Muskrat Falls as a concern for several years now. Successive oil shocks since 2014–15 have compressed the province’s own-source revenues, while it is ineligible for equalization transfers from the federal government. For example, in reaffirming the province’s ‘A1 Negative’ rating in April 2021, Moody’s noted that “the negative outlook also reflects the uncertainty on the province achieving electricity rate mitigation which, if unsuccessful, would lead to a realization by the province of some, or all, of the contingent liability of Nalcor.” An execution of this agreement in principle should remove that tail risk and the announcement in principle should be viewed positively by rating agencies.

Markets appear to have largely expected this outcome. There has been no material movement in Newfoundland spreads either in advance of or following the announcement (chart 3, p.2). This is likely owing to a combination of factors. Both the federal and provincial governments have channeled work underway so markets had been expecting some sort of agreement. Markets also implicitly assume federal backing of provincial debt securities. This has been tested only a couple of times in the last century, but the Muskrat deal-in-the-works reinforces the soundness of this assumption.

This is also digested in a global context. Even federal bond securities have been gyrating against largely exogenous factors related to the global recovery, and in particular, developments south of the border. In turn, Ontario bonds—against which other provinces are benchmarked—have been moving closely with federal bond yields. In fact, provincial spreads have broadly narrowed against Ontario benchmarks in recent months on back of expectations of reduced supply owing to better-than-anticipated fiscal outlooks (chart 4).

Still, the province clearly has more work ahead. This includes not only finalizing this week’s agreement in principle, but also delivering on commitments in Budget 2021 to address structural expenditure-side pressures. The necessary fiscal path set out in the budget will require tough measures with material implementation risk as they embark on consultations around the details. In the context of a global recovery and the consequent search-for-yield environment, markets may be less discerning, but as conditions shift so too might market appetite and pricing. The province should be in a good position to ride this transition if it continues to deliver on its commitments.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.