IMPROVED FINANCIAL RESULTS ENABLE INFRASTRUCTURE BOOST

SUMMARY

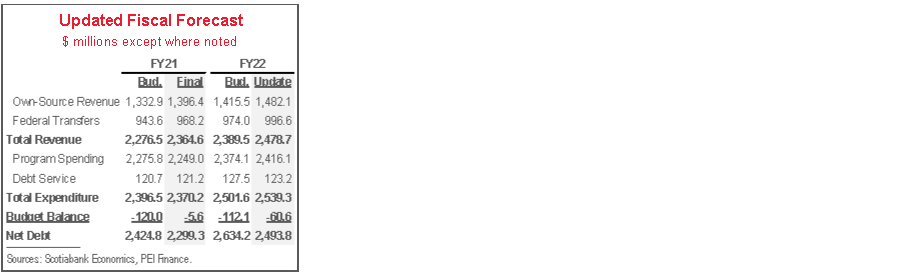

- Budget balance forecast: -$60.6 mn in FY22 (-$112 mn in March 2021 Budget), following final -$5.6 mn reported in FY21 Public Accounts (-$120 mn in Budget 2021) (chart 1); economic forecasts not updated.

- Net debt forecast: lowered by $140 mn to $2.49 bn for FY22, which builds on $126 mn improvement reported in FY21 Public Accounts.

- FY22–26 infrastructure spending plans also increased by more than $200 mn to address priorities in education, social housing, and climate policy.

- Reduced deficit and debt forecasts put the Island ahead of schedule on path to budget balance and fiscal repair; mid-year update should be well-received by rating agencies and the province’s creditors.

OUR TAKE

PEI’s mid-year update builds on last month’s Public Accounts results to put the province on much firmer fiscal footing than projected at Budget time; this news should be well-received by creditors. Most of the upward revision to FY22 program spending forecasts relates to implementation of new federal programs; that overshoots are on pace to be dominated by revenue gains speaks to the strength of PEI’s recovery relative to projections as well as federal government measures that maintained the tax base and supported demand. The Island is now positioned to achieve budgetary balance on an earlier timeline than previously suggested and improve upon its last forecast trajectory that had net debt rising this fiscal year before easing below 34% of nominal GDP by FY24.

Despite much good news on the economic front, conditions in PEI’s key tourism sector remain challenging. Since Budget 2021, COVID-19 cases have remained low, Statistics Canada confirmed that the Island witnessed one of the smallest GDP declines of any jurisdiction in 2020, agricultural prices have gained, exports continued to grow—supported in part by a rebounding aerospace sector. The province also anticipates a return to pre-pandemic population growth rates next year, anchored by a recovery in immigration. Still, August 2021 overnight stays on the Island were nearly 40% below 2019 levels. The prospect of further reopening of tourism-oriented segments of the economy as we approach summer 2022 is more auspicious.

Planned increases to infrastructure spending—announced last month in the FY22 Capital Budget—should generate an incremental boost to economic growth. Projected FY22 outlays were raised by $37 mn versus the last plan (chart 2, p.2), and the wind-down penciled in for FY23 now represents an annual contraction of just 9%—in stark contrast to the 29% decline anticipated last year. Major policy priorities include investments in new schools, social housing, and electric school buses. Given that the province’s long-run growth plans depend fundamentally on a return to pre-pandemic rates of population expansion, meaningful infrastructure spending will be key to providing public services.

Federal transfer projections were lifted by only $23 mn versus Budget but remain an important element of PEI’s post-pandemic path to fiscal repair. The change was attributed to the fact that various aspects of Ottawa’s COVID-19 funding were only confirmed after the March 2021 blueprint and is only about one-third the size of the upward revision to own-source revenues. In recent years, federal transfers have accounted for a larger share of revenues in PEI than in any other province; Budget 2021 assumed that transfers to the Island would rise steadily from FY22 to FY24 to hold steady near 40% of provincial government receipts.

Borrowing projections were not updated, but narrower fiscal shortfalls imply cash requirements more modest than the $276 mn forecast for FY22 at Budget time. That figure included an estimated $200 mn in long-term borrowing.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.