PROVINCIAL BUDGET 2024 PREVIEW

- The 2024 budget season kicks off this week on the west coast. An uncertain economic outlook and a multitude of challenges suggest modest incremental pressures on fiscal paths laid out last fall.

- In their latest fiscal blueprints, most provinces anticipate slightly narrower deficits in FY25 (chart 1 and 2). Absent major policy measures, Alberta and New Brunswick will likely maintain surpluses.

- The economic backdrop remains highly uncertain as the economy runs out of steam. Although the cooling in the economy is evident, it might not be enough to instigate a soft landing. Stagflation risks could further dampen public finances.

- The projected fiscal trajectories for the upcoming Budget 2024 will likely weaken, given the multitude of pressing priorities to spend on. To name a few, these include issues such as declining productivity, widespread housing affordability crisis, shortages in healthcare, the energy transition, and the infrastructure needs from a surging population.

- With increased refinancing, projected deficits and heightened capital investments, provinces are likely to collectively raise borrowing in FY25. The aggregate net debt-to-GDP ratio is projected to reach 29.4% in FY24 with an anticipated further increase surpassing 30% in the upcoming fiscal year.

- The provinces need to balance debt reduction efforts with strategic borrowing to support critical investments and economic growth initiatives. We advocate for continued spending restraint along with maintaining prudence in buffers against uncertainty as the best course of action in the upcoming budget season.

OUR TAKE

The provinces brace for a year of tempered growth but remain optimistic about their resilience in steering the economy clear of recessionary waters. Nonetheless, a slowdown looms on the horizon. Most provinces anticipate varying degrees of stagnating employment growth, trailing robust population gains, which will lead to a marginal uptick in unemployment rates, though they should remain closer to the natural rate of unemployment rather than approaching recessionary levels. The resilience witnessed in labour markets in recent months suggests a stronger economic momentum than previously anticipated, which could bolster government revenue projections as the budget season commences this week though we can expect to see buffers maintained or built up. These scenarios closely align with our current view, with the possibility of upside potential in growth for the year.

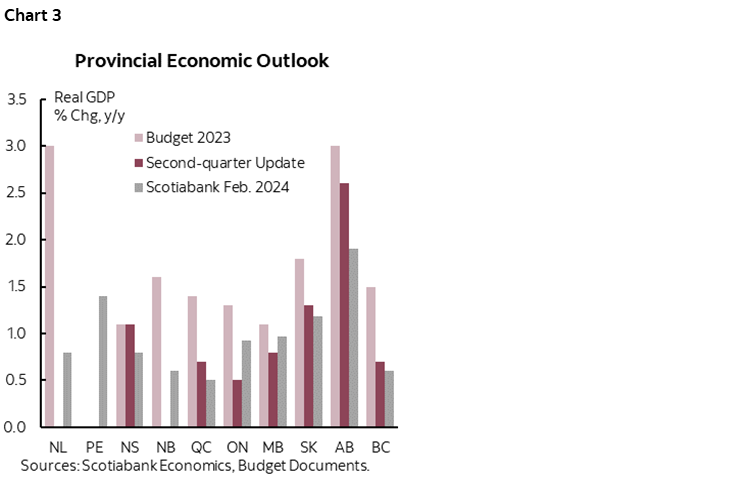

Nevertheless, the economic outlook remains fraught with uncertainty with significant headwinds prevailing. Over the past year, the provinces have adjusted their 2024 real growth forecasts downward due to a delayed slowdown (chart 3). While we consider these scenarios realistic, upside risks to inflation are highly plausible, potentially leading to downside risks to growth driven by central bank policy. Risk of stagflation could also exacerbate challenges for both households and corporate profits while driving up government spending, thereby placing additional strain on provincial public finances. A multitude of geopolitical risks also threatens the current trajectory outlined by the provinces.

Stable revenue trends in FY24 provide a robust starting point for FY25. With the exception of Ontario, which experienced a $1.7 bn reduction in revenue projections due to a tax reassessment, most provinces reported slightly improved revenue forecasts over the course of the fiscal year. Most provinces anticipate revenue growth to persist in 2025 (chart 4), although Alberta and Saskatchewan expect declines in natural resource revenue. Alberta foresees non-renewable revenue decreasing by over 10% with a weaker natural gas price and oil prices softening from US$79/bbl in FY24 to US$76/bbl in FY25, while Saskatchewan’s resource revenue continues to grapple with declining potash prices.

Despite the potential decrease in oil prices, commodity-reliant provinces remain in a favourable position to weather the ongoing slowdown. Alberta’s mid-year fiscal update expects real growth to remain at an elevated 2.6% in 2024, and Saskatchewan projects 1.3% real growth over the same period—both well above the national average. Alberta’s oil production is set to pick up by 8% in 2025 following the completion of large-scale maintenance projects. This combined with a narrower WTI-WCS differential with TMX entering operations bodes well for the region’s outlook. Saskatchewan’s oil production experienced a decline in 2023, leading to expectations of lower growth in 2024, as outlined in its mid-year update. Yet, the province holds a more optimistic outlook for oil prices, projecting WTI to average US$81/bbl in 2024.

The provinces should exercise spending restraint to preserve necessary headroom in an environment with high volatility on the revenue side. Despite lifting spending projections over the past year, the provinces mostly refrained from carrying out major new initiatives in FY24. Program spending is set to grow by 3.3% in FY24 in the largest four provinces instead of the 1.7% pencilled in at Budget time (chart 5). In their latest fiscal blueprints, these provinces expect program spending to continue to grow by 1.7% in FY25—well below inflation and population growth. Debt service cost is projected to rise by 6% in FY25—a similar pace as in FY24—adding $1.8 bn to expenses (0.3% of total revenue) for the largest four provinces.

With a positive revenue outlook and planned spending restraint, most provinces anticipate slightly reduced deficits in FY25 according to their latest medium-term blueprints (chart 1 and 2 again). Absent major policy measures, Alberta and New Brunswick will likely maintain surpluses. Newfoundland and Labrador’s projected surplus in the upcoming fiscal year is contingent on a sharp pickup in oil production.

However, provinces are confronted with considerable spending pressures, making it increasingly challenging to maintain spending discipline as outlined in their current plans. The provinces will continue strengthening their individual plans for enhancing the healthcare system with funding allocated by the federal government. Currently, six provinces have signed healthcare funding agreements with the federal government under the “working together” bilateral agreement, yet additional investments are likely needed to meet increasing healthcare demand beyond the federal top-up. Affordability challenges in housing are pervasive across provinces, prompting many to implement measures aimed at bolstering supply throughout FY24. Additional measures are anticipated in upcoming budgets to address the still-significant supply gap. The impact of public wage settlements cannot be overlooked. In BC, expenditure surged by nearly $3 bn in FY24 due to salary increases under the Shared Recovery Mandate. In Ontario, the impact of elevated inflation on the cost of Ontario public sector salaries and wages was estimated at $8 bn from over 5 years by the Financial Accountability Office.

Given higher refinancing, projected (and potentially deeper) deficits, and escalated capital investments, provinces should collectively expand their financing needs in FY25 relative to the current fiscal year. Ontario raised its borrowing by $6 bn in FY24 to $33.6 bn, with projected borrowing needs exceeding $37 bn in FY25. Quebec and British Columbia managed to reduce FY24 borrowing with funding from alternative sources but anticipate higher borrowing levels in the upcoming fiscal year, at $29 bn and $20.4 bn respectively. Given its stable fiscal outlook, Alberta is expected to maintain a modest borrowing program of approximately $6 bn.

The current path to balance hinges on optimistic revenue growth projections for next year, suggesting a potential delay. Ontario’s return to a balanced budget has been pushed back by one year to FY26, driven by optimistic revenue growth projections of 4.2% annually over three years, while program expenses are expected to grow by 2.8%, leading to a rapid deficit reduction. After Generations Fund deposits, Quebec aims to achieve a balanced budget by FY28 by maintaining program spending growth well below the 3.6% annual growth of own-source revenues. Despite an optimistic revenue growth outlook, British Columbia projects deeper red inks in the next two years without a consolidation plan in place. Overall, while some provinces sit comfortably in surplus territory, others still have a long and winding journey ahead. It may be challenging to pursue aggressive consolidation in the context on slowing economic conditions, but provinces will need to walk a fine line: sharpen their focus on growth-friendly consolidation measures, while preserving space to support longer-term growth-enhancing measures, all in the context of a credible medium-term fiscal plan that preserves sustainability.

Credit ratings remain largely stable, with some jurisdictions showing improvement while others present challenges (table 1). Alberta received a string of positive rating updates, including an upgrade from DBRS to ‘AA’ from ‘AA (low)’ and an upgrade from S&P from ‘A+’ to ‘AA-’. Fitch currently has the province’s rating on positive outlook. Ontario maintains a positive outlook from the three main rating agencies, suggesting a potential upgrade if the updated plan continues to practice fiscal discipline and strategic investments in the province's growth. British Columbia’s credit rating was downgraded by S&P from ‘AA+’ to ‘AA’ and its outlook changed to negative, citing concerns about material increases in operation and capital spending. While Manitoba hasn’t experienced any rating changes, its fall fiscal update unveiled larger shortfalls than previously planned, casting a shadow over its credit outlook for the upcoming fiscal year.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.