- As economic tailwinds subside, mid-year fiscal updates reveal challenges in provincial public finances. A slew of factors—some transitory—drove the -$5 bn (-0.2% of nominal GDP) deteriorations in provinces’ collective budget balance. Downward revisions were concentrated in Ontario, Manitoba, Saskatchewan and British Columbia.

- Updated economic assumptions factor in a delayed slowdown, in line with our expectations. Economic momentum in 2023 and higher-than-anticipated population growth help offset some weaknesses in revenue, but the tides could turn rapidly entering 2024.

- Amid a highly uncertain revenue outlook, the provinces mostly refrained from carrying out major new initiatives. Additional policy measures announced are incremental and centre on housing supply.

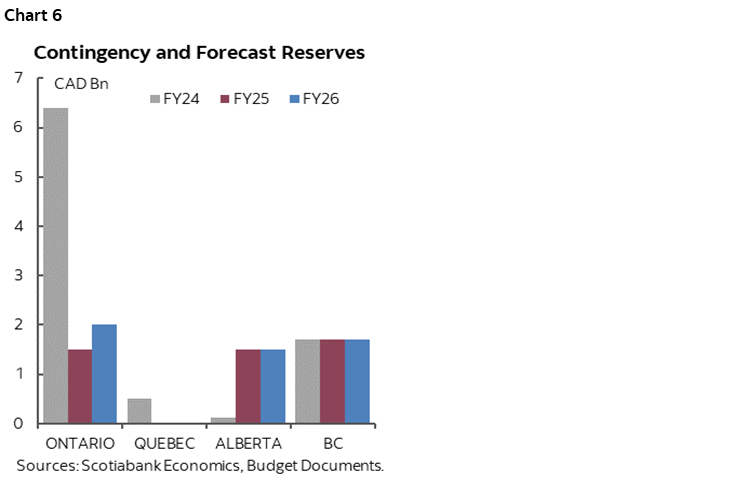

- Ontario, British Columbia and Alberta maintain ample financial buffers in forms of contingency and forecast reserves, while Quebec’s drawdown from the contingency reserve exposes its plan to medium-term risks.

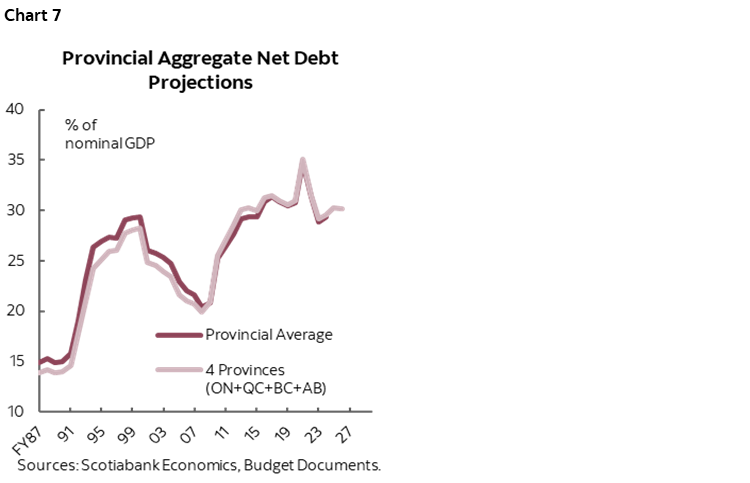

- While their current fiscal trajectories generally appear stable, the provinces still face challenges from an elevated net debt burden (29.4% of nominal GDP in FY24).

- The forthcoming 2024 budgets could reveal further downside as an evident economic slowdown, uncertainty with central banks’ rate cut agenda, and a volatile commodity market introduce risks to the outlook. We could also anticipate heightened spending commitments as provinces respond to energy transition and other structural challenges.

- Political factors also prevail in 2024 with British Columbia, Saskatchewan and New Brunswick heading into provincial elections. Current polling suggests a change of government is plausible in the latter two. The recently elected Manitoba government and the re-elected Alberta government are likely to continue pushing their campaign promises.

STEADY FOR NOW BUT NOT A REASON TO BE COMPLACENT

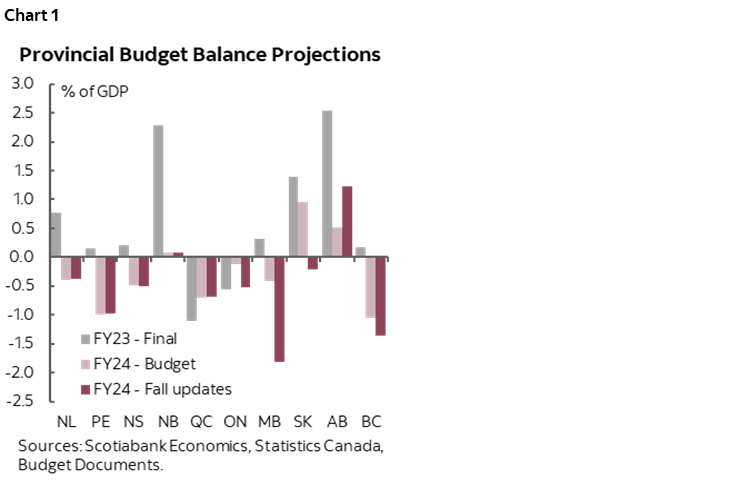

Provincial public finances remain stable with varying levels of fiscal discipline amidst a highly uncertain revenue outlook. The fall update season offered an overview of how provincial governments are faring in a challenging year marked by stalling growth, heightened inflation and rapid population expansion, revealing a slight deterioration across the board, in line with our previous analysis. Alberta stood out as the only exception with evident improvement backed by stronger-than-anticipated revenue projections (chart 1).

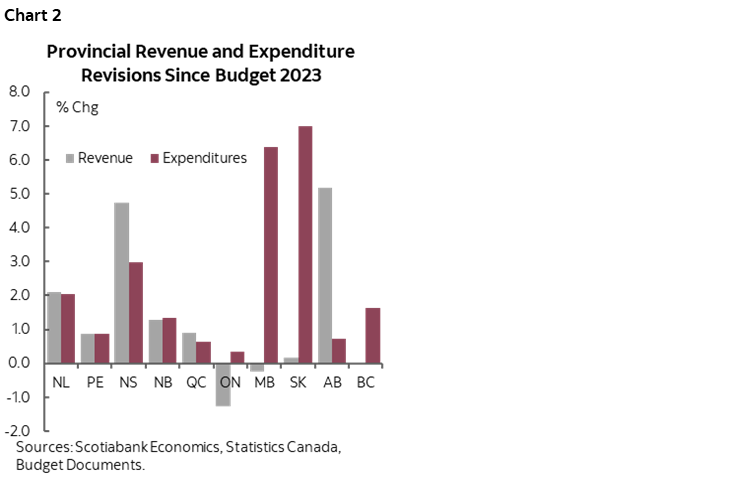

Despite economic resilience observed in the first half of the fiscal year, a slew of factors—some transitory—drove downward revisions in FY24 budget balances. Provincial aggregate deficit is estimated to be -$5 bn (-0.2% of nominal GDP) higher than projected in Budget 2023, with deterioration concentrated in Ontario, Manitoba, Saskatchewan and British Columbia (chart 2). In Ontario and Manitoba, downward revisions of taxes collected from the previous fiscal year revealed notably deeper shortfalls, which could persist in the upcoming years. Lower resource revenue weighs on British Columbia and Saskatchewan driven by weaker prices of natural gas and potash, compounded by weather related spending pressure. Maritime provinces benefited from an upgraded revenue outlooks and maintained stable levels of balance projections.

Additional policy measures announced are incremental and centre on housing supply. New initiatives come with relatively small price tags, including Ontario’s elimination of HST for rental housing construction ($150 mn), Quebec’s pledge to build social and affordable housing ($219 mn), and British Columbia’s permanent housing initiative for residents in temporary housing ($104 mn). Affordability support expenses are set to wind down in FY24 with provinces refraining from announcing new relief measures. Ontario’s extension of the gas and fuel tax cuts and Quebec’s indexation of the personal income tax system were the only two measures announced, tallying up $780 mn in FY24. Absent major policy initiatives, marginal increases in overall program spending are mainly attributable to the impact of wildfires and higher operating costs linked to wage inflation.

DOWNSIDE RISKS AND MOUNTING UNCERTAINTY

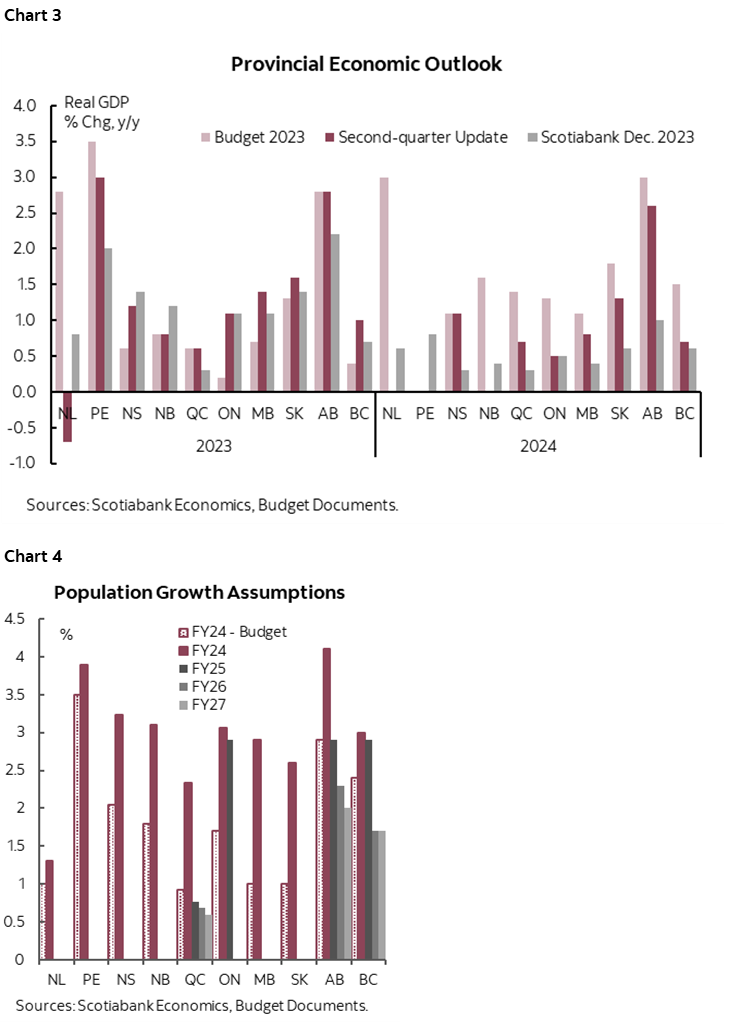

Stronger-than-anticipated economic momentum in 2023 and higher population growth assumptions help offset some weaknesses in revenue, but tailwinds could dwindle rapidly as the tides turn. Current economic assumptions factor in a delayed slowdown, which aligns with our expectations, but with heightened risks ahead (chart 3). Even in a soft-landing scenario, absent major swings in commodity prices, growth should be muted in 2024 across the country. As a slowdown becomes more evident towards the end of 2023, provinces revised down their respective 2024 growth assumptions, although our current baseline forecast is slightly more pessimistic. The upcoming fiscal year could be another challenging one for provincial governments and warrants fiscal prudence. Population assumptions were largely revised up, and Ontario, British Columbia and Alberta expect population growth to continue at a rapid pace (chart 4).

Largely unchanged from Budget 2023, oil price assumptions are in line with our expectations in current year, with heightened volatility ahead. The WTI price assumption remains unchanged at US$79/bbl in FY24 for Alberta and US$79.5/bbl for Saskatchewan. Oil prices should continue facing headwinds from a bleak global outlook that could dent fuel demand, while supply-side politics likely put a floor on prices. Alberta assumes WTI prices will gradually moderate in FY25 and FY26 to an average of US$76/bbl and US$73.5/bbl, respectively—more conservative than the private-sector averages and Scotiabank’s latest forecasts for both years, signalling prudent planning given the high sensitivity to oil prices.

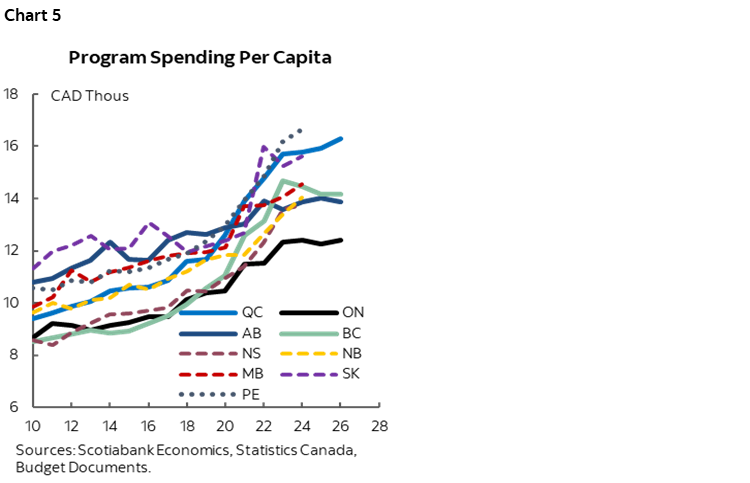

Provinces were able to rein in spending in an environment of high inflation and rapid population growth, but spending levels remain elevated with more pressure down the line. Excluding the impact of population growth, program spending per capita is projected to plateau in FY24, maintaining a relatively flat trajectory after swelling by over 20% since the onset of the pandemic (chart 5). Alberta stands as the exception where the government has made conscious efforts to align per capita spending with levels more consistent with Ontario and British Columbia. Under their current plans, the largest four provinces plan to sustain their current levels of per capita spending over the medium-term, facing increasing challenges amid no shortage of spending pressure. The forthcoming 2024 budgets are likely to reveal heightened spending commitments as provinces respond to the energy transition and other structural challenges.

Despite some drawdowns, the largest four provinces kept an ample level of prudence—setting the stage for narrower deficits should stronger growth transpire (chart 6). Ontario dialled back on medium-term provisions, but the remaining financial buffer is still sizable. Both British Columbia and Alberta maintained similar levels of prudence as in Budget 2023, with Alberta drawing from its current-year reserve to fund expenses related to wildfires. Quebec’s annual drawdown of $1 bn from the contingency reserve enables the province to keep its consolidation path but leaves no provision over FY25–FY26. Hence, we could anticipate further downward revisions to its medium-term bottom line should the economic outlook deteriorate more than anticipated.

TREADING CAREFULLY WITH A GROWING DEBT BURDEN

While generally stable, the deterioration in FY24 bottom lines hampers the consolidation path across most provinces and adds further pressure to provinces’ elevated debt burden. Though the aggregated provincial deficit at -$12 bn is less alarming when compared to the -$40 bn federal government shortfall, it remains high as a share of output in some provinces such as Manitoba and British Columbia. Meanwhile, the aggregate net debt-to-GDP ratio is projected to reach 29.4% in FY24 with an anticipated further increase surpassing 30% in the upcoming fiscal years (chart 7).

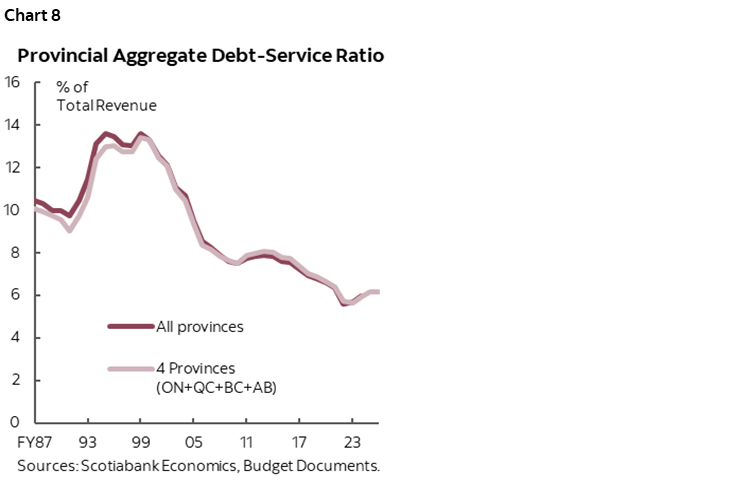

Most provinces raised their estimates of debt servicing costs at mid-year due to a higher-than-anticipated interest rate trajectory, but the overall impact remains constrained as it was offset by lower projected net debt. Alberta projected the highest increase in debt serving costs—still the lowest among the provinces as a share of total revenue. Due to the longer-term nature of their debt structures, the higher interest rates do not currently pose a significant risk to provincial finances. The provinces’ debt service ratio is slowly edging up but still hovers around historically low levels (chart 8).

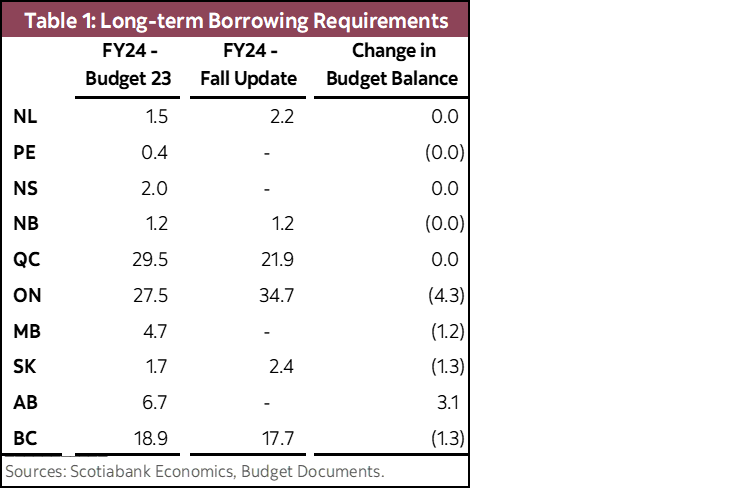

With some deterioration in budget balances, most provinces will need to either borrow more or find alternative funding sources to cover the increased shortfalls (table 1). Ontario, Saskatchewan and Newfoundland and Labrador expanded their borrowing programs, with Manitoba likely following suit. Quebec and British Columbia managed to reduce FY24 borrowing with funding from alternative sources. The Maritime provinces should be able to keep their financing needs relatively unchanged. Over the medium-term, Ontario, Quebec and British Columbia all expect to maintain higher levels of borrowing.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.