- Record population growth is forcing an upward adjustment to forecasts of economic activity this year and next.

- The impact of this demographic boom is most felt on consumption and labour supply.

- The strength in population growth is leading us to raise our estimate of potential output such that inflationary pressures coming from the output gap are roughly unchanged from our previous forecasts. Inflation is still expected to hit the Bank of Canada’s 2% target in 2025.

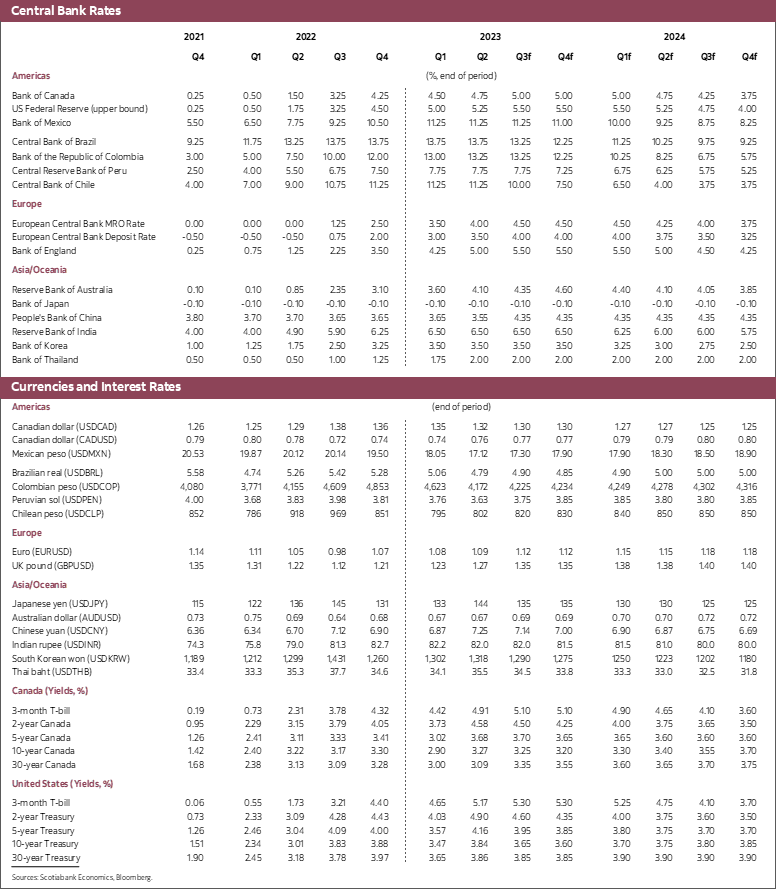

- Owing to the stability of the output gap and inflation relative to previous forecasts, we are maintaining our view that the Bank of Canada will keep rates at current levels until 2024Q2, at which time a series of gradual cuts will begin.

- As in our previous outlooks, risks to the rate path are tilted to the upside given the latest in a series of upward revisions to growth.

An upward revision to forecasts is once again necessary for Canada. Incoming data so far this year have remained surprisingly strong, particularly in the interest-sensitive sectors of the economy. Much of this can be accounted for by residual pent-up demand for consumption and housing, which are both linked, in part to the record increases in population that have been observed in Canada (among a broad range of other factors). Those increases have boosted demand as new residents purchase goods and service, but also likely dampened upward pressure on wages as they join the workforce by boosting the supply of labour. This surge in population growth is leading us to revise our estimate of potential output—the economy’s non-inflationary growth rate—by about 0.2% per annum, in line with the Bank of Canada’s own revisions to this measure of activity. This leads us to revise upwards our forecast for economic activity in Canada this year and next, with minimal impacts on our inflation forecast as the output gap—a measure of inflationary pressures defined as the difference between actual output and potential output—remains relatively unchanged. As a consequence, this forecast update does not foresee any changes to our rate outlook relative to our previous forecast despite this stronger growth.

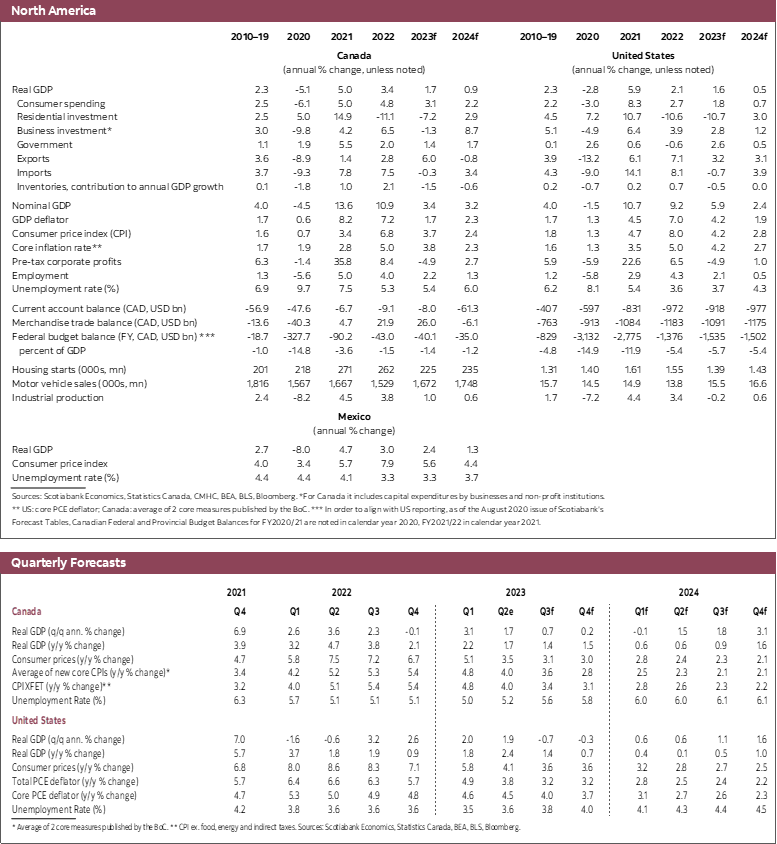

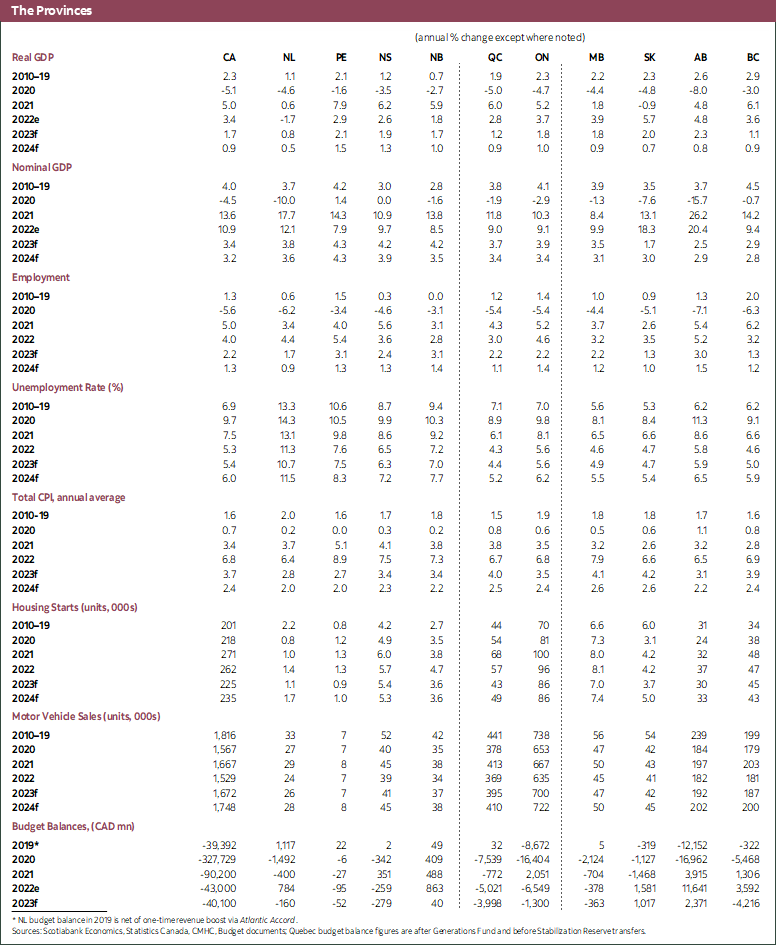

The rapid pace of population growth sets a very high bar against which to see outright reclines in economic activity. As a result, we are now only expecting a mild one quarter decline in economic activity in 2024Q1 with only modest growth of 0.2% in 2023Q4, following an advance of 0.7% in 2023Q3. We had previously expected very small declines in GDP growth in both 2023Q3 and Q4.

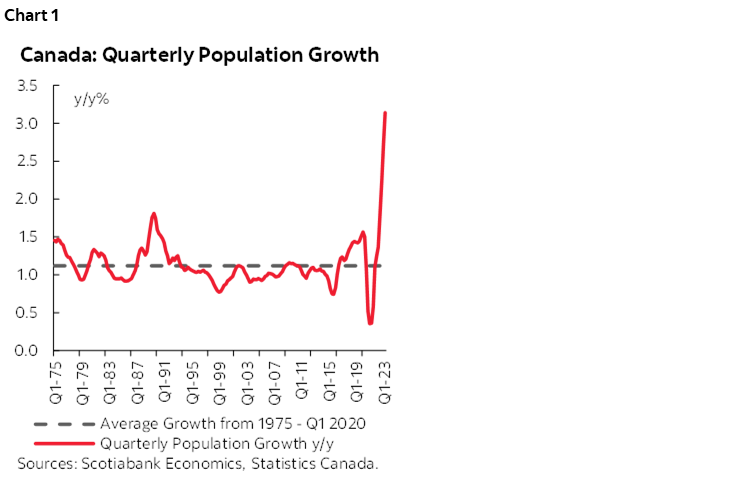

The spectacular rise in population growth and its impact on economic activity must be viewed in a historical context to truly appreciate the extraordinary outcome. Population growth is on pace to exceed the record growth observed last year, in which roughly one million new residents landed. Population growth in 2023Q2 is nearly triple the pre-pandemic historical average (chart 1). That record pace accelerated through the end of the second quarter setting the stage for an even larger acceleration in the third quarter. With such powerful tailwinds, it seems highly unlikely that the economy will contract in the current quarter.

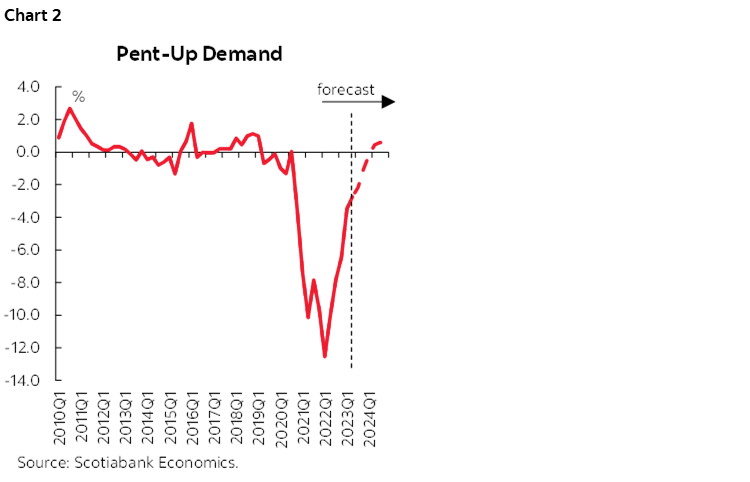

Moreover, this population growth is contributing to the strength in consumption observed thus far in the year. We wrote some time ago about the pent-up demand on the household side and how that would lead to strong consumption. This has clearly been the case. Though pent-up demand for goods and services is slowly falling as consumption remains healthy (chart 2), the surge in population is keeping the demand for these items stronger than we had thought possible.

While the strength in population growth is clearly raising growth, a different picture is revealed by real GDP per capita. Population growth is exceeding that of the economy and in so doing is depressing output per capita. It is no surprise then that Canadians indicate some discomfort with the state of the economy even though the outlook is better than earlier forecast. There may not be a technical recession in the country (defined as two quarters of falling economic activity) when looking at GDP, but we should see a sizeable decline in real GDP per capita this year.

Given the upward revision to potential output and largely matching increase in real GDP, inflation pressures are forecast to be in line with what) we have been expecting in the last few forecasts. Headline inflation is still expected to continue to decline gradually as the impact of year-ago developments (largely gasoline prices) are reflected in incoming data. We expect total inflation to average 3.7% this year and fall to 2.4% next year. Core measures of inflation should follow a similar path as the impacts of monetary policy on output cumulate. Inflation, either total or core, is expected to return to the Bank of Canada’s 2% target in 2025.

Owing to the relatively stable inflation outlook relative to our previous forecasts, we have not changed our rate forecasts in Canada. We believe the Bank of Canada’s tightening cycle is at an end and that it will begin a series of gradual cuts beginning in 2024Q2. That view is of course conditional on the economic slowing we project. If the economy remains more robust or if core measures of inflation remain stubbornly above 3%, Governor Macklem would need to raise rates further. As a consequence, the risks to the policy rate in the short run are clearly to the upside.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.