- Strong data leading to an upgrade in growth forecast for Canada and the US in 2024.

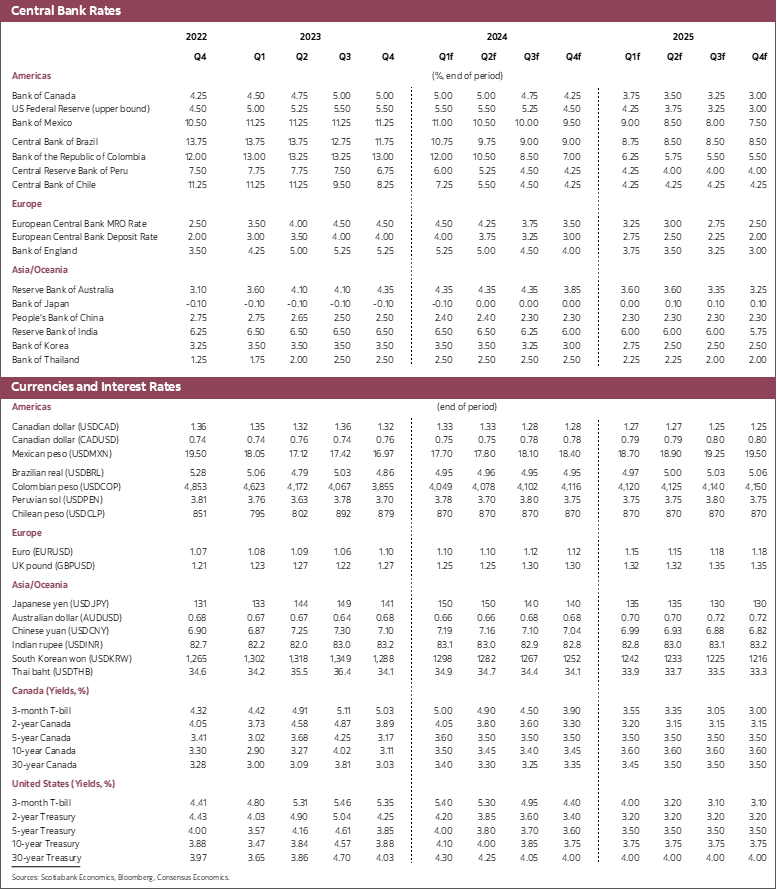

- That strong growth comes at an inflationary cost. Despite cooling of inflationary pressures in the United States, stronger growth is leading us to push the first cut to the third quarter of this year for a total cut of 100 basis points.

- Stronger growth in Canada, robust wage gains combined with falling productivity and still-elevated measures of underlying inflation all suggest the Bank of Canada will need to delay cutting rates until late in the third quarter. We now expect cuts of only 75 basis points this year.

- In both countries, growth and inflation dynamics could imply that even these revised forecasts may be too optimistic in terms of expected rate cuts. Further strength, or a delayed reduction of inflation could see no cuts at all this year. This is definitely not our expectation, but it is a meaningful risk to our views.

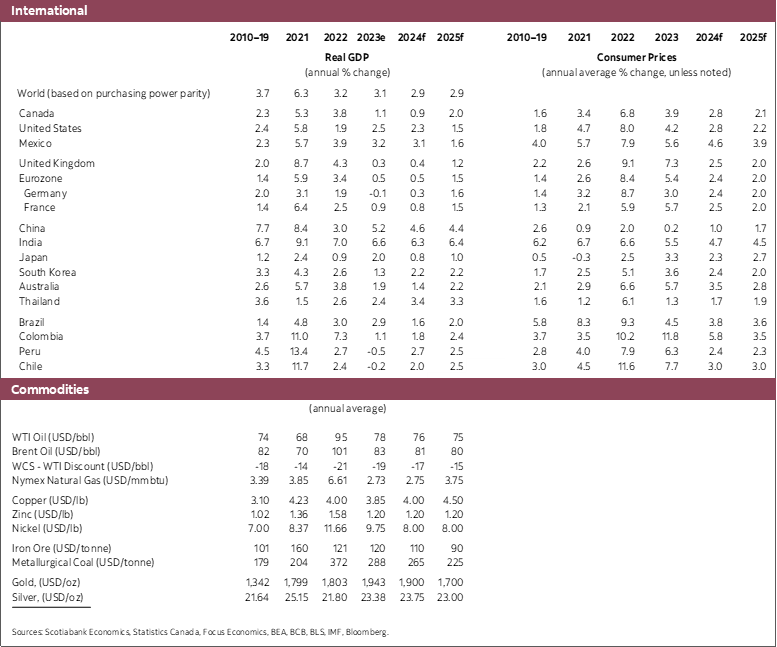

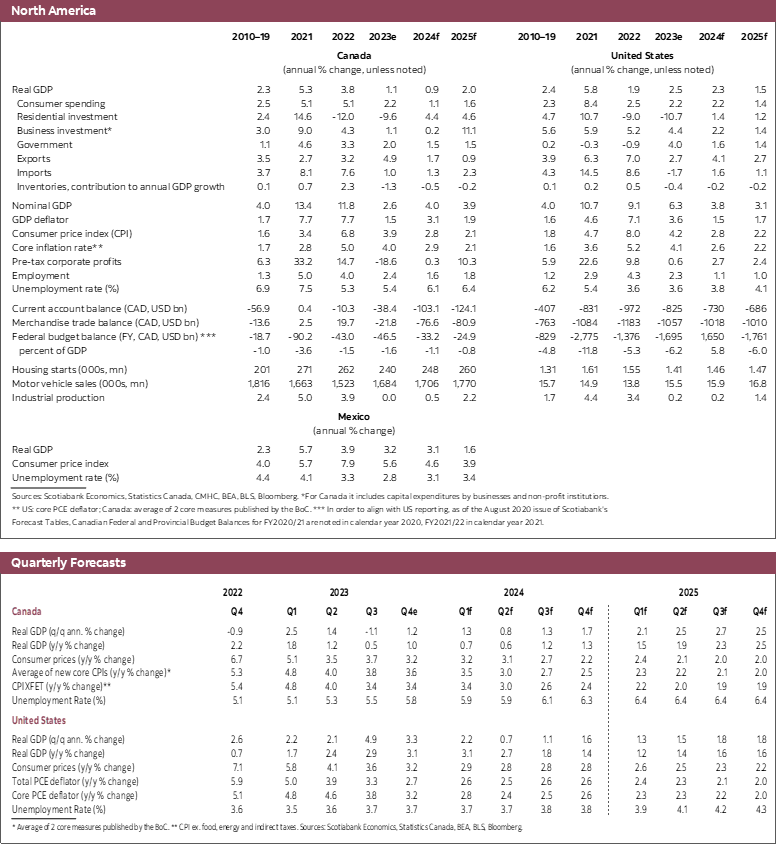

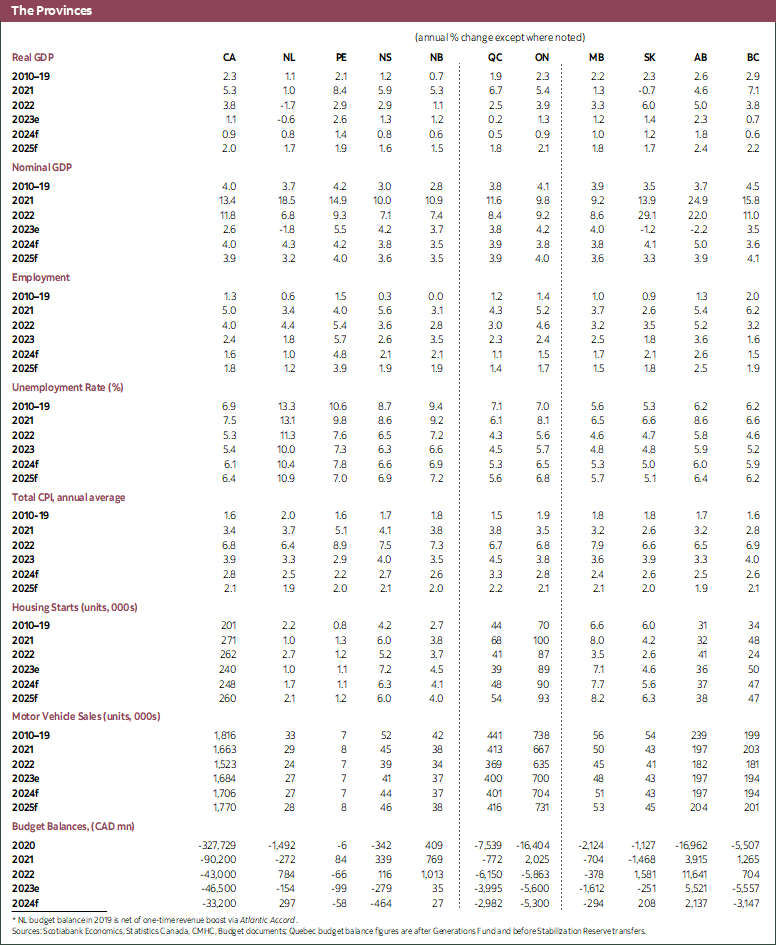

Economic data have been almost unanimously better than expected in Canada and the United States over the last few weeks. The resilience narrative continues to play out, as households on both sides of the border continue to spend at a higher pace than expected. The impact of elevated policy rates remains less negative than feared. As a result, 2023 ended on a much stronger footing than expected. Combined with early indications of the strength persisting in 2024, we are revising our forecasts up sharply for the year. In the US, we now expect growth will be 2.3% in 2024, a full percentage point above our previous view. Our view for 2025 remains essentially unchanged, with expected growth of 1.5%. In Canada, we are nearly doubling our forecasted growth rate to 0.9% this year from an earlier forecast of 0.5%, but this comes at the expense of lower growth in 2025, which we now forecast will expand by 2.0%. While there are reasons to cheer this development, stronger growth adds to inflationary pressure and will force central banks to delay the process of monetary normalization. We expect the Federal Reserve and the Bank of Canada to cut rates in the third quarter rather than the second and expect both central banks to cut less than previously expected. By year-end, we forecast the upper end of the policy rate band in the US to be 4.5%, and for the BoC’s policy rate to be 4.25%. There is a risk that central banks cut even less than that.

We continue to expect a slowdown in US economic activity as the past tightening in interest rates work its way through the economy. That being said, recent economic performance has been nothing short of spectacular. Growth in the final quarter of 2023 stood at 3.3%, well above expectations. That builds on a nearly 5% increase in the previous quarter. The Atlanta Fed’s GDPNow suggested tracking of above 4% growth in 2024Q1 as of February 1st. Employment growth in January was robust though it also revealed strong wage gains. The economic strength observed is reasonably broad-based, but consumer spending stands out, despite elevated interest rates. Perhaps most surprising of all has been the very rapid pace of productivity growth, which has helped inflation slow meaningfully. While the moderation of inflation is of great comfort, the strength in economic activity poses upside risks to the inflation profile. There is a limit to the speed at which productivity gains can be generated in the US, and there ultimately is a link between economic activity and inflation. In our view, the stronger-than-expected growth in the US will push the Fed to cut rates later in the year than previously anticipated. A further disruption of supply chains owing to developments in the Red Sea and Panama Canal add some uncertainty to the inflation outlook that may need to be considered by the central bank. Markets have a high likelihood of a rate cut priced in as early as May. We think this is unlikely and consider a move sometime in the third quarter more likely and appropriate.

In Canada, growth is also surprising to the upside but to a lesser extent. Statistics Canada tracking for December GDP growth is solid as a number of indicators confirm stronger-than-expected activity late last year and early this year (chart 1). That is not to say that spending is robust. It isn’t, but it has slowed less than expected. As a consequence, we now expect there to be less weakness in 2024H1 than in previous forecasts.

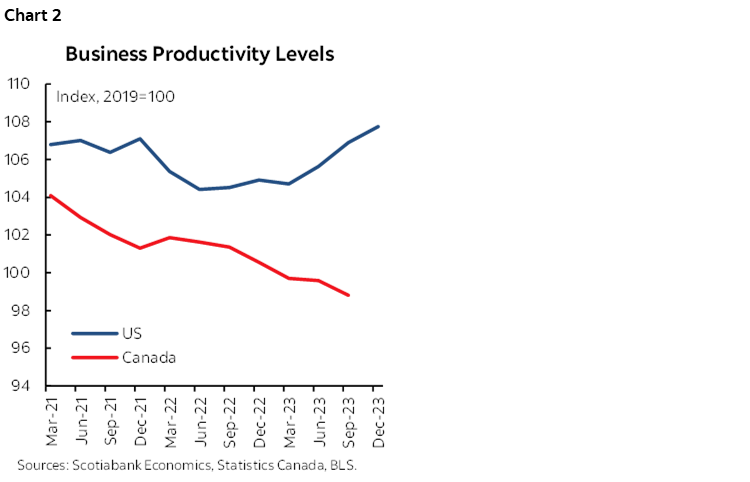

This upward revision to growth in Canada is more problematic for our central bank than it is in the United States. Inflationary dynamics in Canada remain a concern. Measures of underlying inflation tracked by the Bank of Canada have accelerated to close to 4% at the end of 2023. Wage gains remain totally incompatible with the inflation target productivity growth. Productivity declines mean those wage gains are a greater challenge for firms in Canada than the United States, and therefore more inflationary (chart 2). Inflation expectations remain some distance from 2%. Adding to that, shipping disruptions in the Red Sea and Panama Canal are straining supply chains and add further upside risks to inflation. These inflationary pressures would be more manageable if the economy decelerated more sharply than now expected. Recall that the Bank of Canada is expecting slowing growth to create excess supply which will put downward pressure on inflation, ultimately allowing it to return to the target sometime in 2025. Upward revisions to growth that are not accompanied by stronger productivity will cut the amount of excess supply and reduce disinflationary pressure.

This likely makes the Bank of Canada more sensitive to growth outcomes than the Fed. This is of particular concern given the massive amount of pent-up demand for housing in Canada. As seen in the December real estate sales data and anecdotal data for January, sales of existing family homes are accelerating rapidly as purchasers react to a decline in longer-term mortgage costs and/or expectations of lower short-term rates. It may well be that unleashing this demand for real estate early in the year puts upward pressure on economic activity (along with prices and rents), further reducing the amount of excess supply in the economy. That should be of grave concern for the Bank of Canada given the risks identified above. As a consequence, we now believe Governor Macklem will cut the policy rate later rather than earlier in the third quarter, and that there is also a risk of a later or even no move this year.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.