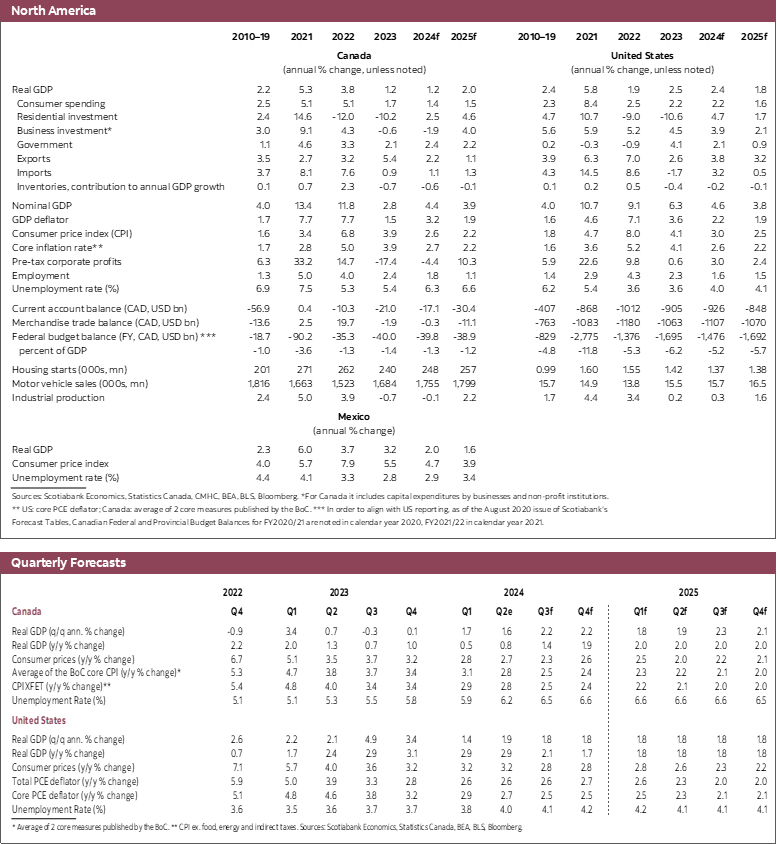

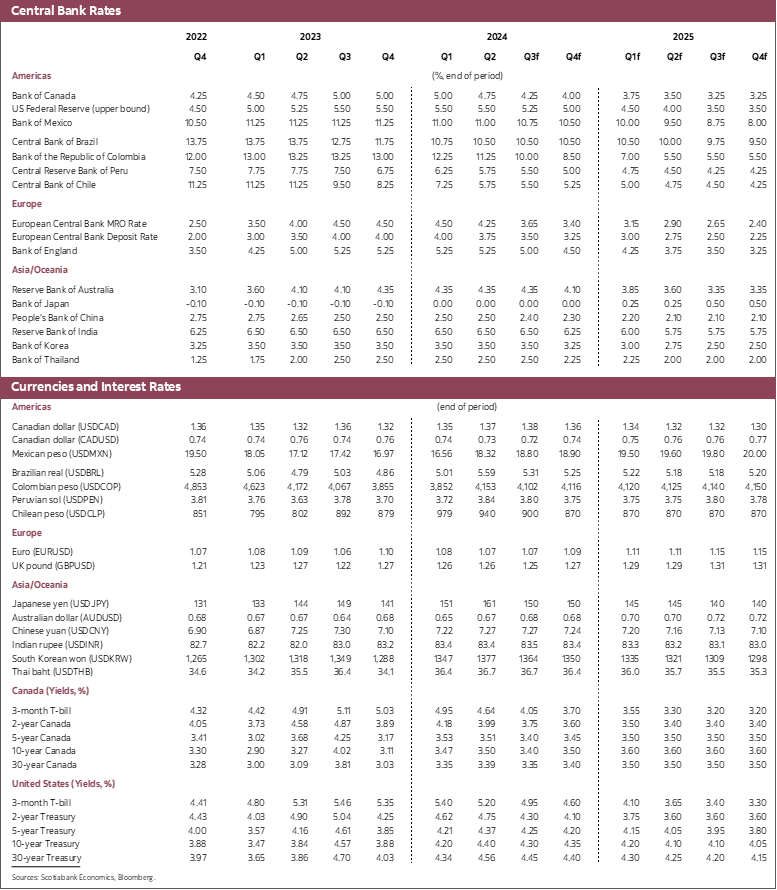

- Further rate cuts in Canada this year a certainty while we continue to believe that the Federal Reserve will cut in September.

- Economic data have come in largely as expected so our forecasts remain largely unchanged. Lower interest rates will provide a mild boost to economic growth later this year, but the full impact of rate cuts will take time to materialize given the lags of monetary policy.

- Clarity on interest rates and the outlook over the next few months may be fleeting. The results of the US election risk muddying the outlook substantially.

The long-awaited rate cuts are finally underway in Canada and are likely to start in the United States in September. These will eventually provide relief to the interest rate sensitive parts of the economy and may also lift business and household sentiment. These rate cuts are occurring in the context of slow, but still-positive growth, and solid progress on inflation management even though there remain substantial risks of higher inflation (linked to the sharp rise in global shipping costs and rapid wage growth and low productivity in Canada). We remain comfortable with our view that policy rates will fall by another 75 basis points in Canada this year and that the Federal Reserve will cut its policy rate by at least 50 basis points starting in September. Moreover, economic data have come in roughly as expected over the last several months, leading to only minor tweaks to the outlook for growth. All told, this forecast update is largely similar to our previous forecast. In this sense, the stability in our forecast combined with more certainty on the interest rate path suggest greater clarity in the outlook for the next several months.

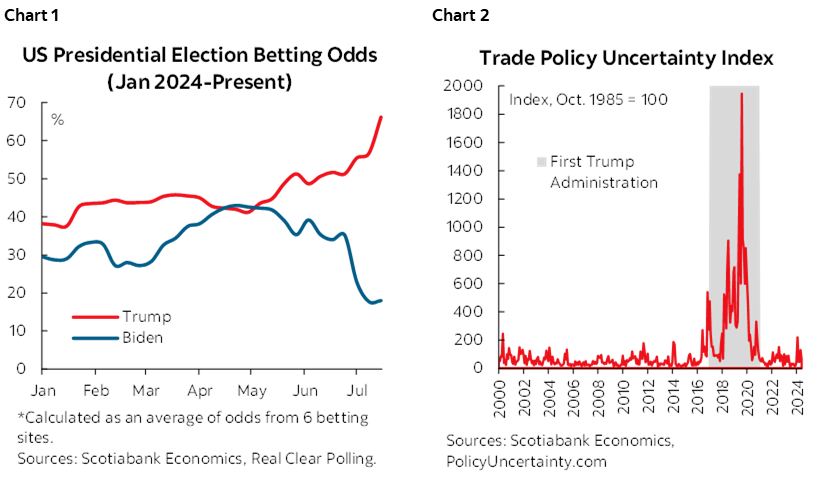

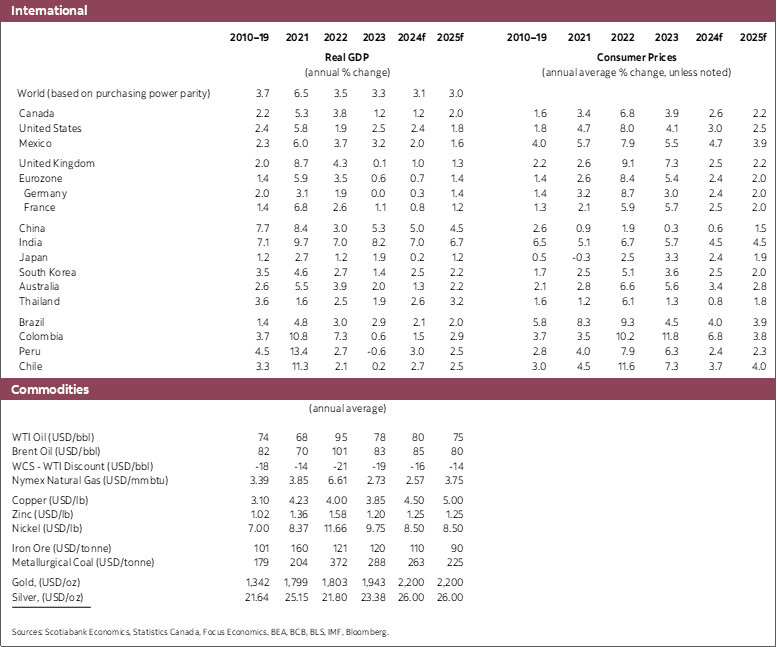

This period of clarity may well come to a crashing stop following the results of the US election. A win by former President Trump, as currently seems likely (chart 1), risks muddying the outlook in a number of ways. He is almost certain to lower corporate taxes and reduce regulation. That would provide a short-term boost to growth and markets while further imperiling US fiscal solvency. He has spoken extensively about his plans to raise tariffs on all imports coming into the US (see chart 2 for the impact his much tamer trade policies had on uncertainty in his first term as President). His VP nominee, along with a number of other advisors, seem to be proponents of a weak dollar policy, which could lead to efforts to devalue the US dollar. As impractical as this may sound, Republicans have been ramping up the rhetoric around the deportation of illegal immigrants. Most recently, Mr. Trump has again signalled some hesitance to support Taiwan. With the exception of lower taxes and less regulation, these developments would all be destabilizing and inject significant downside uncertainty to the outlook. There is of course much uncertainty around what policies a second Trump Administration might pursue. If limited to tax cuts and deregulation there may well be a sizeable boost to growth. Layering on other policies would likely erode all of these gains over time. While there is uncertainty about the net impact of policies on the economy, there is no doubt that all the policies currently being contemplated are inflationary. A second Trump Administration would require upward revisions to inflation forecasts and possibly slower (and less) rate cuts. As should be evident by now, the path beyond the US election is about as clear as mud.

If current polling trends persist, we will adjust our forecasts in September to reflect an anticipated Trump victory.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.