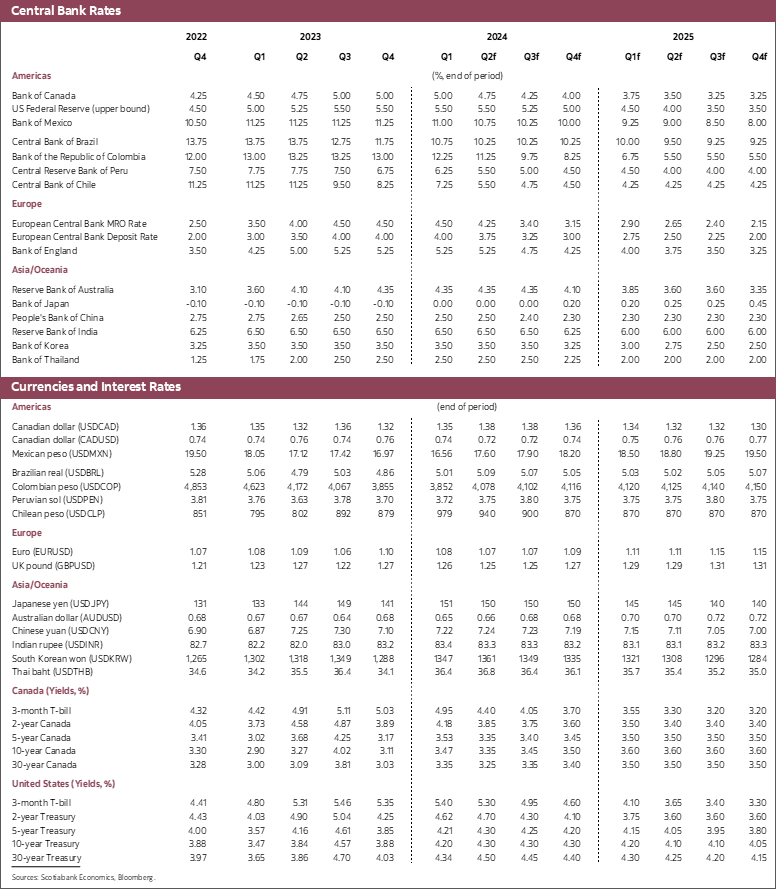

- We expect the Bank of Canada to cut by 25bps at each of the next three meetings.

- Inflation is on a good downward path though growth in the interest rate-sensitive parts of the economy remains surprisingly strong.

- Positive risks to the outlook for growth and inflation remain as interest rates come down. We are particularly mindful of the response in real estate markets and household spending. Any materialization of upside risks would imperil future rate cuts.

Rate cuts have finally begun in Canada. With inflation hopefully on a sustained downward path despite the interest rate-sensitive parts of our economy performing surprisingly well, it is now clear that the Bank of Canada has decided rate relief is necessary. That is great news for borrowers if the Bank of Canada follows through with additional cuts. We think they will, though we remain concerned about upside risks to inflation given rising wages and falling productivity, the surprising strength in consumption, the serial over-stimulation by the federal and provincial governments, and the potential for a housing market rebound. As a result of the latest decision and the communications around that we are changing our Bank of Canada view and now expect that Governor Macklem will cut the policy rate at each of the next three meetings, for a total of 100bps of cuts this year.

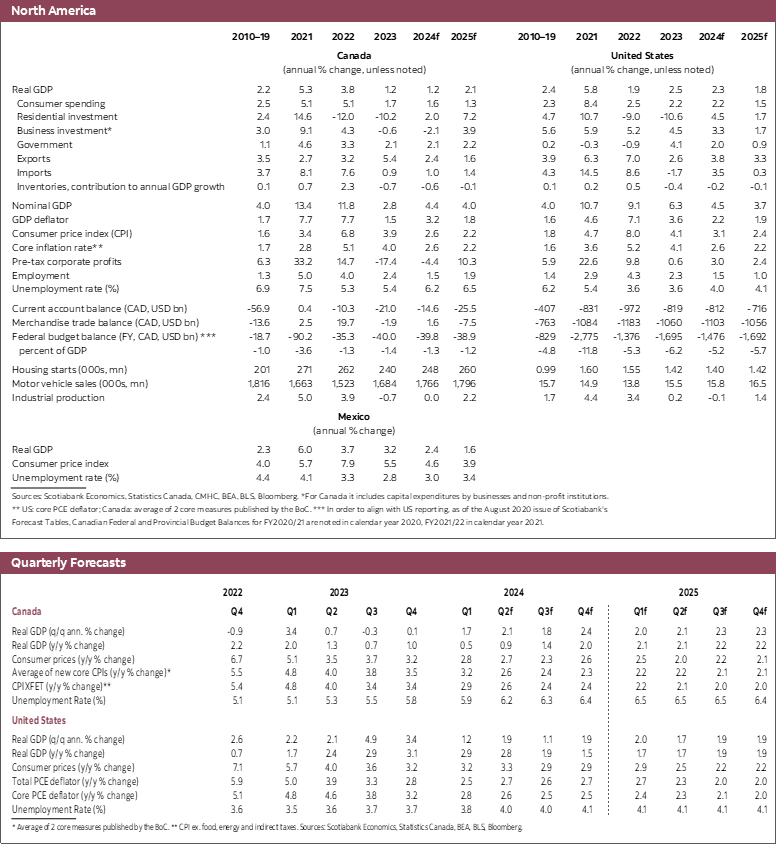

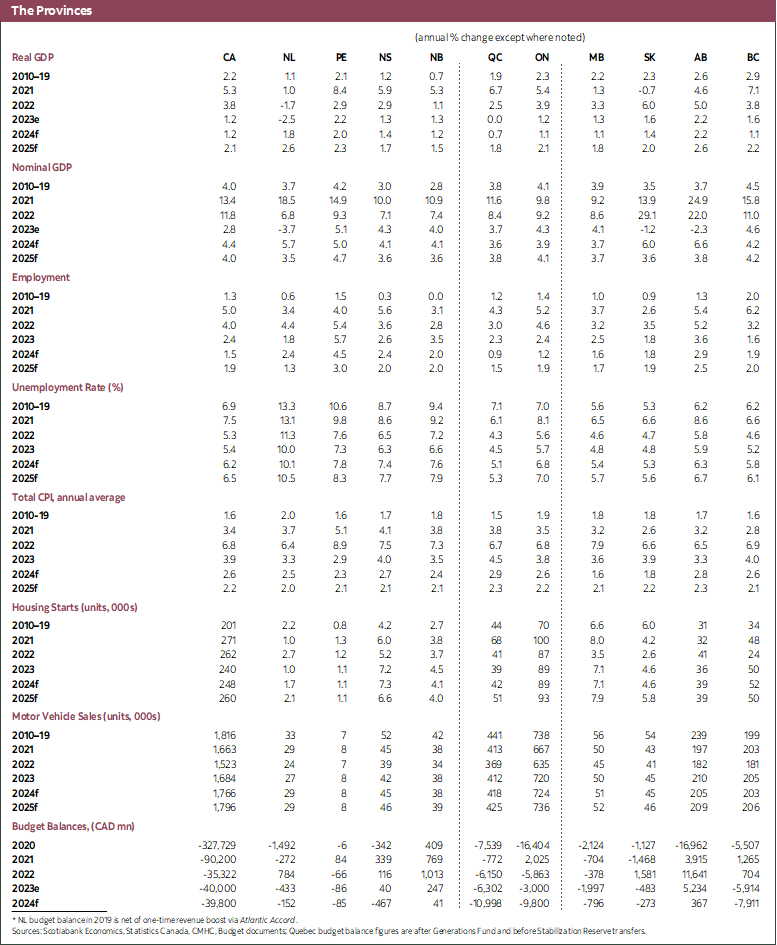

We expect well below potential growth this year of 1.2%. This is lower than our previous forecast of 1.5% owing to competing factors: while final domestic demand (which includes consumption and investment along with a few other components of GDP) is much stronger than expected, that strength is leading a large drain on inventories. Inventories subtracted 1.5% from growth in the first quarter. On balance, the drag from inventories offsets the strength in other components of GDP, accounting for much of the downward revision to our growth outlook this year. More specifically in the remainder of the year, we assume a gradual pickup in housing market activity but a moderation in consumption given the strength seen so far. This is despite an expected reduction in the saving rate as the past impact of rate hikes continue to work their way through the economy. Reflecting that past increase in rates, we see the unemployment rate rising a bit in the remainder of the year and that should put downward pressure on wage growth, and therefore income, constraining consumer spending.

There are meaningful risks to that forecast now that interest rates are on the way down. The housing sector will be the biggest beneficiary in the short run. Buyers have been waiting for interest rates to come down in a deeply and structurally undersupplied housing market. While 25bps is not a large reduction in borrowing costs, market costs have fallen markedly more. The yield on 5-year government of Canada debt is down almost 40bps in the last two weeks, for instance. The expectation of more cuts will lead to a rebound in sales. The only question is when this will occur and how aggressive of a rebound. Our hope is that the rebound is relatively muted only because a strong return in sales volumes and higher prices could imperil future cuts by the Bank of Canada. There is clearly a risk of a strong return in activity given the pent-up demand for housing and the clear fear of missing out.

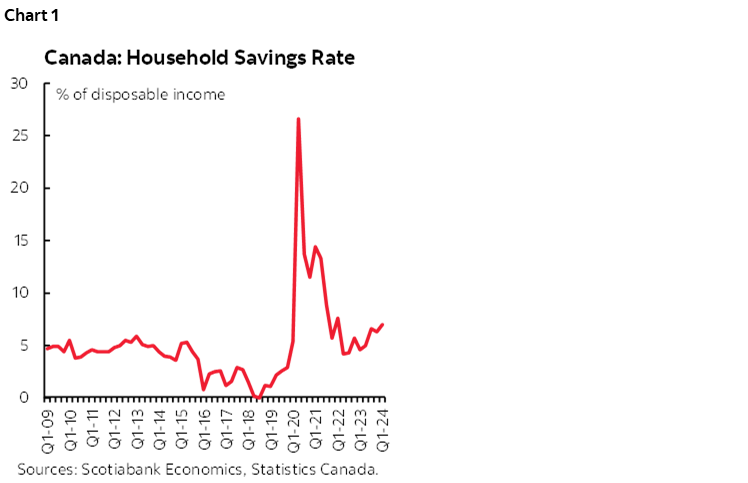

Another area of focus will be on the consumer spending side. Consumption growth has been tracking significantly higher than expected in the last two quarters. There are a multitude of reasons for that, including still-reasonably healthy household balance sheets, strong employment growth, strong wage growth, and of course record population growth. What is remarkable is that even though consumption growth has been stronger than anticipated, disposable income has grown even more rapidly leading to a very high level of the personal savings rate (chart 1). It now stands at close to 7%, more than double the historical average. This results from spending growth being below that of income growth and is an indication that consumers were accumulating some level of pent-up demand. As interest rates come down, we expect savings behaviour to change for some of the pent-up demand to be very gradually released. One area where this is particularly evident is in motor vehicle sales, which have slowed in the last three months as buyers put off purchases in anticipation of lower rates to come. As in the case of housing, a pronounced rebound on the spending side could delay further rate cuts by the Bank of Canada.

Population growth remains a key driver of activity and despite commitments to reduce the flow of new arrivals, the pace of population growth has accelerated this year. This is not such a big surprise as there will no doubt be a rush of students and non-permanent residents that try to beat the application of new immigration rules and targets. As a consequence, it is possible that we continue to observe very rapid population growth in coming months. This would push up growth in household spending and GDP, though it might also require an upward revision to potential output.

Lower rates may also impact the Canadian dollar. We have not changed our views on the Federal Reserve. We continue to expect 50bps of cuts, the first 25bps occurring in September. That would mean that the gap between Canadian and US policy rates would rise to 100bps if the Bank of Canada cuts in July. This rising rate differential should have some impact on the Canadian dollar, which we now expect will fall to 72.5 cents to the US dollar. Here too there is risk: if the Bank of Canada proceeds in line with our forecast and the Federal Reserve delays cutting interest rate, the interest rate differential would widen further and put even great downward pressure on the Canadian dollar. The Governor has noted that he would be unperturbed by the impact of rate differentials on the currency as pass through to inflation is low, but a weaker dollar raises the cost of imports of capital goods and would thus be an additional headwind to productivity growth.

The factors above suggest that upside risks to inflation remain significant, even if inflation has softened in recent readings. It is clear that the Bank of Canada takes great comfort from the recent performance of inflation, as they should. That comfort and the Governor’s observation that rates will continue to come down if the economy and inflation perform as expected going forward suggest a real commitment to lower borrowing costs. We interpret that as the Bank of Canada cutting at each of the next meetings unless developments, such as the potential for those above, throw things off track.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.