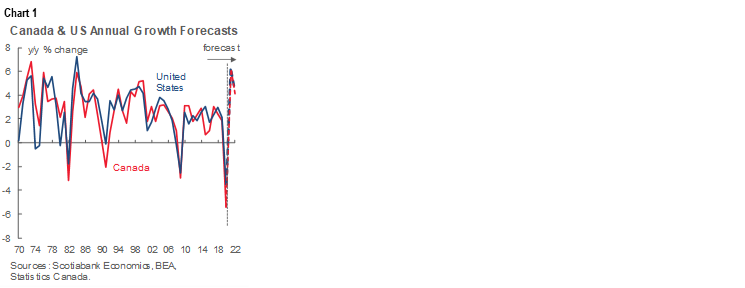

Record Canadian GDP growth and strongest US GDP growth since 1984 are expected in 2021.

Strong momentum observed across a range of variables early in 2021 despite the spike in the number of new COVID-19 cases observed internationally.

Even with the high likelihood of another wave in the pandemic, risks to the outlook seem tilted to the upside.

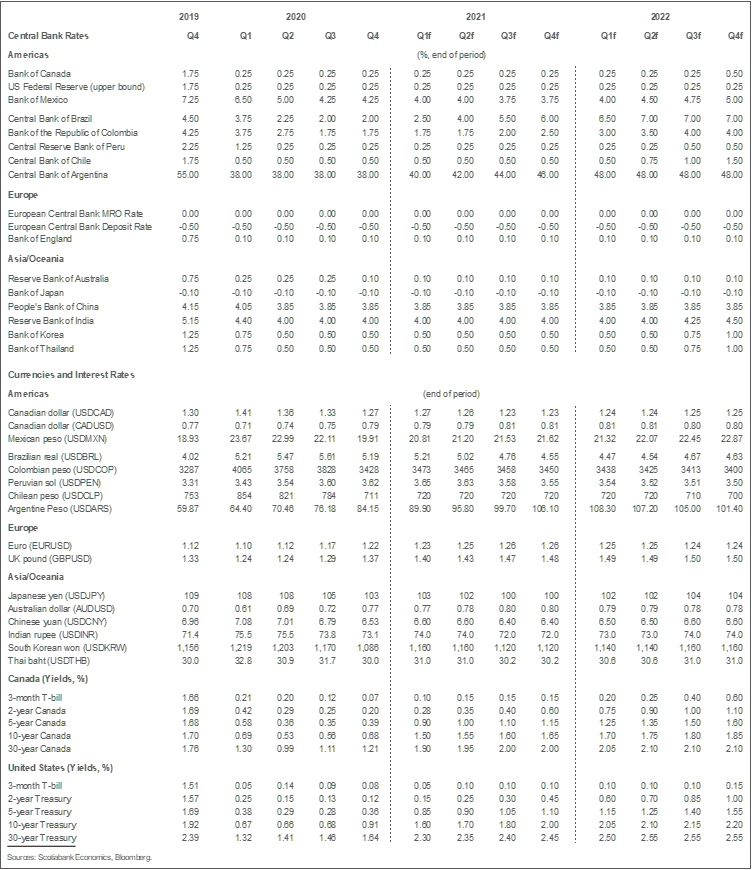

The Federal Reserve and Bank of Canada may need to raise interest rates more rapidly than in their most recent guidance of 2024 in the US and 2023 in Canada.

Another month, another upward revision to our forecasts. While COVID-affected sectors generally continue to struggle given restrictions on activity, most other sectors are showing considerable vigour. The global economy is on track to record its most rapid pace of expansion in at least 40 years, thanks in large part to US fiscal policy. This optimism and the upside risks to the outlook remain in place, despite our anticipation of at least one more wave of COVID-19 arriving in the coming weeks.

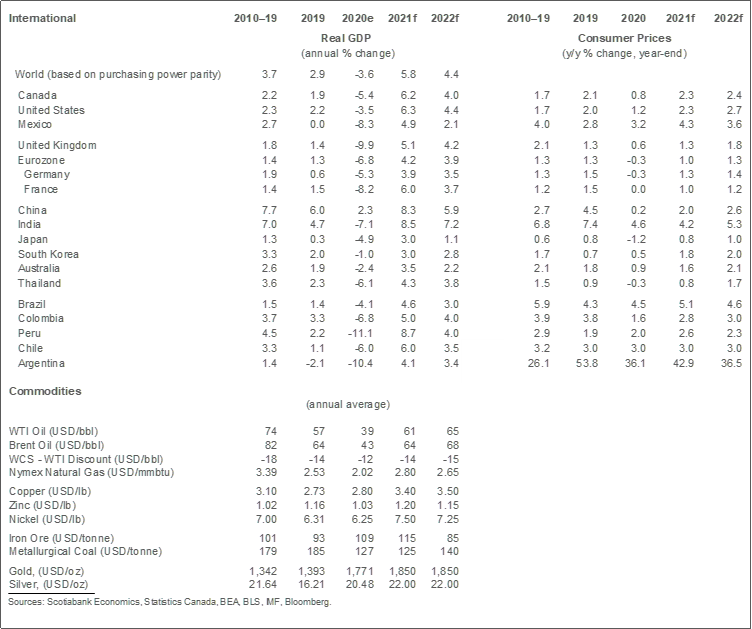

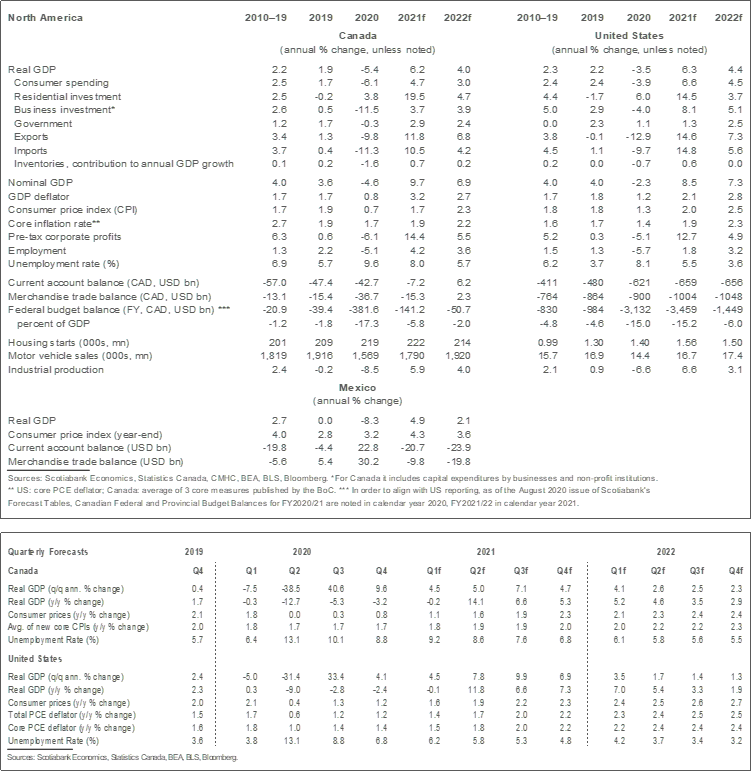

The expected vigour in the United States is nothing short of astounding. A rebound from the pandemic was always expected to lead to solid growth this year, but the stimulus cheques paid early in January and the $1.9 trillion American Rescue Plan will turbo-charge the recovery. In this update, we are revising our forecasted growth in the US to 6.3% in 2021 and 4.4% in 2022. This would be the strongest growth, by far, since 1984 and would see US economic activity in 2022 exceed where it would have been had pre-COVID trends been maintained. This is the only country in the world where this is expected. Moreover, risks are tilted to the upside. In line with the past experience with transfers, we assume very low multipliers on planned fiscal expenditures given the fact that they are mostly transfers to individuals. That may prove overly pessimistic given the surge in retail sales seen in January, shortly after the $600 cheques were mailed out. Moreover, President Biden has made it clear he wishes to launch an infrastructure program later in the year which could, at the margin, further boost growth this year and next.

The speed of the recovery, if eventually confirmed by the data, continues to suggest that the Federal Reserve may need to tighten interest rates sooner than publicly communicated. While we do not believe inflation will rise in an uncontrolled manner, we anticipate core PCE will rise to 2.4% y/y by the end of 2022. The steepening of the yield curve is roughly consistent with this view at present, though we expect additional but more gradual steepening in the quarters to come. The move observed thus far is, in our view, entirely consistent with the improvement in the outlook and does not represent a headwind to growth.

Canada stands to benefit from the US rebound directly, but also indirectly through the increase in financial assets and commodity prices seen in recent months. Relative to our earlier expectations, the rise in commodity prices is quite spectacular. We expect a gradual pullback from current levels as supply adjusts to the strength of demand across almost the full range of commodities. Even so, commodity prices would be highly supportive to the Canadian outlook and should, on average, be well above our previous forecasts.

Adding to these external factors, we are seeing further signs of resilience in retail sales in our internal tracking of transactions which suggests to us that consumption will advance sharply this year (March 4th issue is available here). This will of course be supported by strong job growth, wealth effects from housing and equity markets, government support programs, and strong household balance sheets. Similarly, housing construction is off to a strong start this year and January building permits are pointing to a potentially record increase in residential investment this year. Housing-related activity should also remain strong given low mortgage rates and the shortage of supply relative to demand as already seen so far this quarter. One risk to the outlook on this front: record low levels of homes for sale could prove to be a headwind to sales in the weeks and months to come.

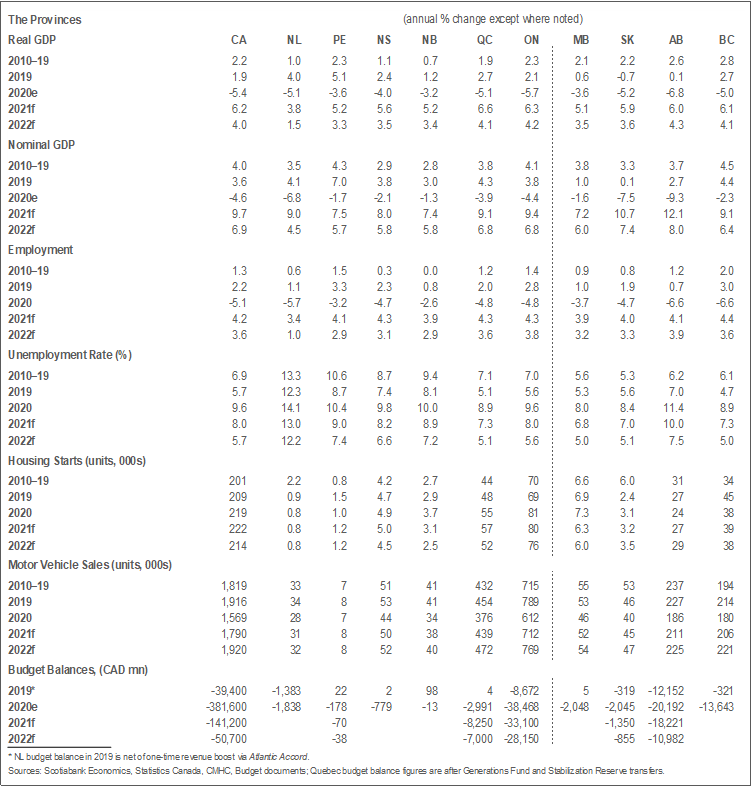

We assume a third wave of the virus will hit Canada by early April. There are likely to be some additional containment measures that result from that. Given the experience with the second wave and the resilience of a range of economic variables to strict containment measures, we assume this third wave would have only a modest impact on second quarter GDP, shaving only about a percentage point from annualized growth. This would lead to quarterly GDP growth of 5.0% in 21Q2. This may well prove to be an overly optimistic judgement, but we are learning by doing: we had originally forecast a decline of 2.1% in 21Q1 and our tracking now suggests a lift of 4.5% q/q given the strength seen in incoming data. We now forecast growth of 6.2% this year and 4.0% next year.

We expect that progress on the vaccination front will allow a broader lifting of containment measures in the second half of the year. Should that occur, the recovery baton will pass to the sectors currently most affected by COVID. A surge in activity in the tourism, arts and entertainment, and food and accommodation sectors is likely. There is already clear evidence of pent-up demand for these services.

As is the case in the US, we don’t think the Bank of Canada will wait until 2023 to raise interest rates. As currently measured, we think the output gap will be closed by the end of this year and that Canada will recover output lost to the pandemic by the third quarter. Core measures of inflation should gradually rise to the Bank of Canada’s 2 per cent target by the end of the year and peak at 2.3% by the end of 2022 if they raise interest rates in the second half of 2022.

Though we believe upside risks to the forecast dominate, we cannot exclude the possibility that mutations of the virus throw the recovery off track, nor can we discount challenges associated with vaccine rollouts in Canada. These are material downside risks to our view. Likewise, our call that a third wave would have limited economic effects could well be overly optimistic. Looking further ahead to 2023 or 2024, there is a risk that the US overheats by then, creating imbalances that may be problematic in these outer years. That may well be a good problem to have given the experience of the last year.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.