Next Week's Risk Dashboard

• 3 key market debates

• Jobs: US, Canada

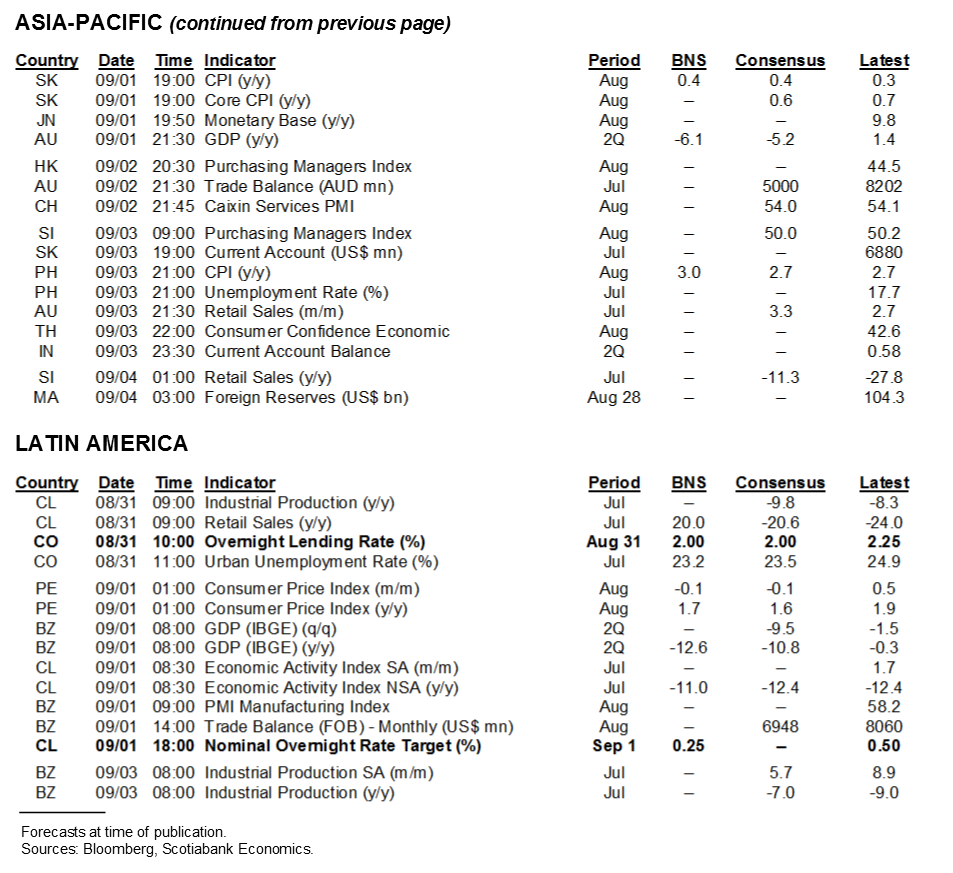

• PMIs: China, US, Canada, Eurozone-r, India

• CBs: BanRep, Chile, RBA

• Inflation: Eurozone-r, Peru, Indonesia, SK, Philippines

• Q2 GDP: Australia, India

• Other global macro releases

Chart of the Week

Two of the most widely followed sets of global macro indicators will be squarely in market sights next week in the never-ending quest for the freshest signals of global economic momentum. In fact, this coming week will be one for the data nerds among us. Toss in a trio of regional central banks with a particular slant toward the Latin American monetary policy environment and that about sums up the coming week in terms of calendar-based risk. Headline risk is otherwise likely to be relatively low and focused upon the same old, same old by way of Brexit negotiations that are at a stalemate, US stimulus negotiations that are at a stalemate, ongoing US-China tensions and the two-month count down to the November 3rd US election.

In the backdrop to these developments are more important market developments that strike to the heart of the global financial system. One is a potentially fundamental reassessment of inflation risk that is ongoing in markets. Chart 1 shows the recovery in the Fed’s preferred inflation measure that proxies expected long run inflation five years out and five years forward from that. It’s a preferred measure in part due to fewer liquidity and other distortions that affect inflation break even rates derived from spreads between nominal Treasury bonds and CPI-indexed TIPS across maturities. This measure has risen by ¾% since the low in March, over 30bps in less than five weeks and by about 11bps in just the past week. The measure has returned to where it was at the start of the year before the pandemic. The Fed’s relaxed posture toward inflation risk explains part of this move of late while preceding moves also encapsulated less deflationary fears in a recovering economy.

Second is whether steepeners have further room to run. The US 10 year yield has rise by about 0.25% to about ¾% during the month of August. The latest move this past week was driven by the Fed’s more relaxed posture toward inflation risk. We had thought that our house view toward steepeners was fairly aggressive, but current yields are now on top of our forecast for the end of the year (chart 2). This may merit accelerating the steepening by bringing forward more of our 2020–21 house view that expects further curve steepening to gradually reflect a recovering economy and relaxed monetary policy concerns toward inflation risk alongside heavy supply to fund large fiscal deficits.

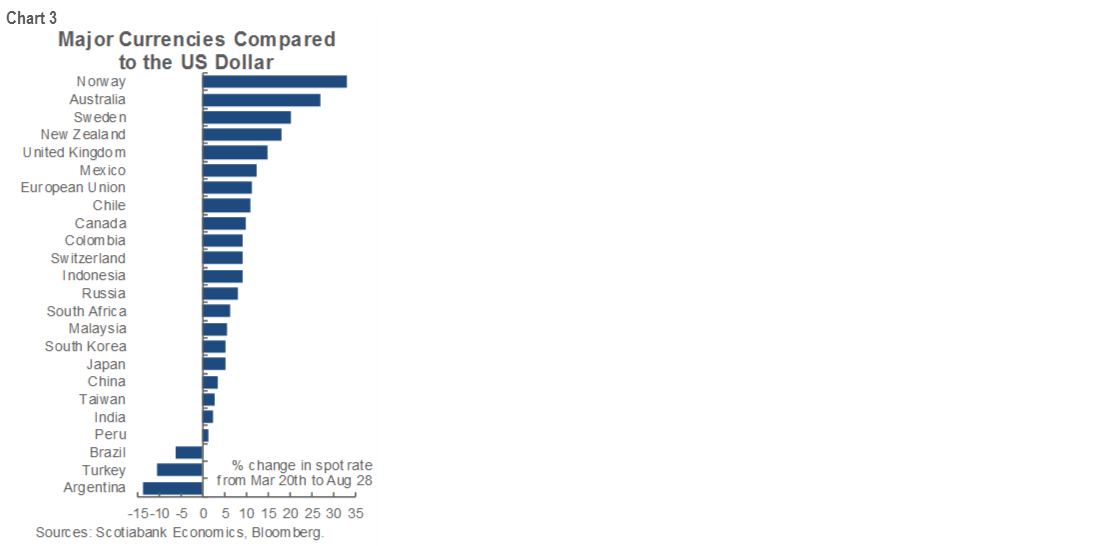

The third fundamental market debate concerns the fate of the USD which is not particularly divorced from the prior two debates. Its weakness against other currencies is demonstrated by chart 3. A currency backed by a dovish central bank that is more relaxed toward inflation risk at the same time as the economy is running large and rising twin deficits coupled with political risk would be viewed unfavourably across many moments in time and economies. The US advantage that insulates against some of this currency risk is the country’s reserve currency status, but there is a limit to this advantage. A crowded consensus view is therefore that the USD will continue to sell off in linear fashion into next year. Maybe. I’ve heard enough currency forecasts over time to be wary of such crowded views. Key in this case is the tolerance of foreign central banks toward simply accepting a negative terms of trade shock through local currency appreciation given the implications for their economies that are proportionately more trade dependent than the US economy and for inflation. The international financial order—whatever that is these days—has also typically frowned upon large, abrupt and disorderly upheavals in currency markets.

JOBS

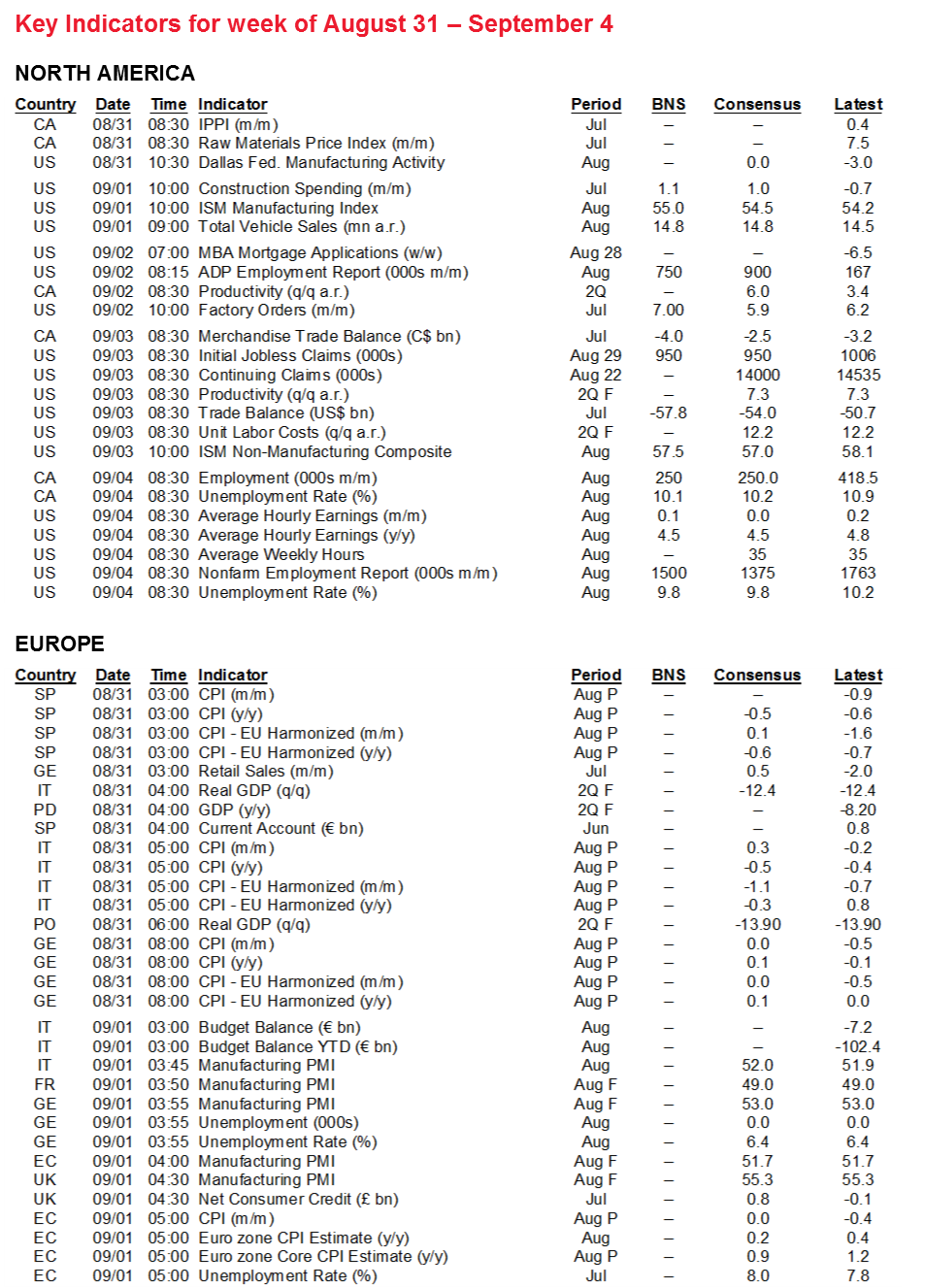

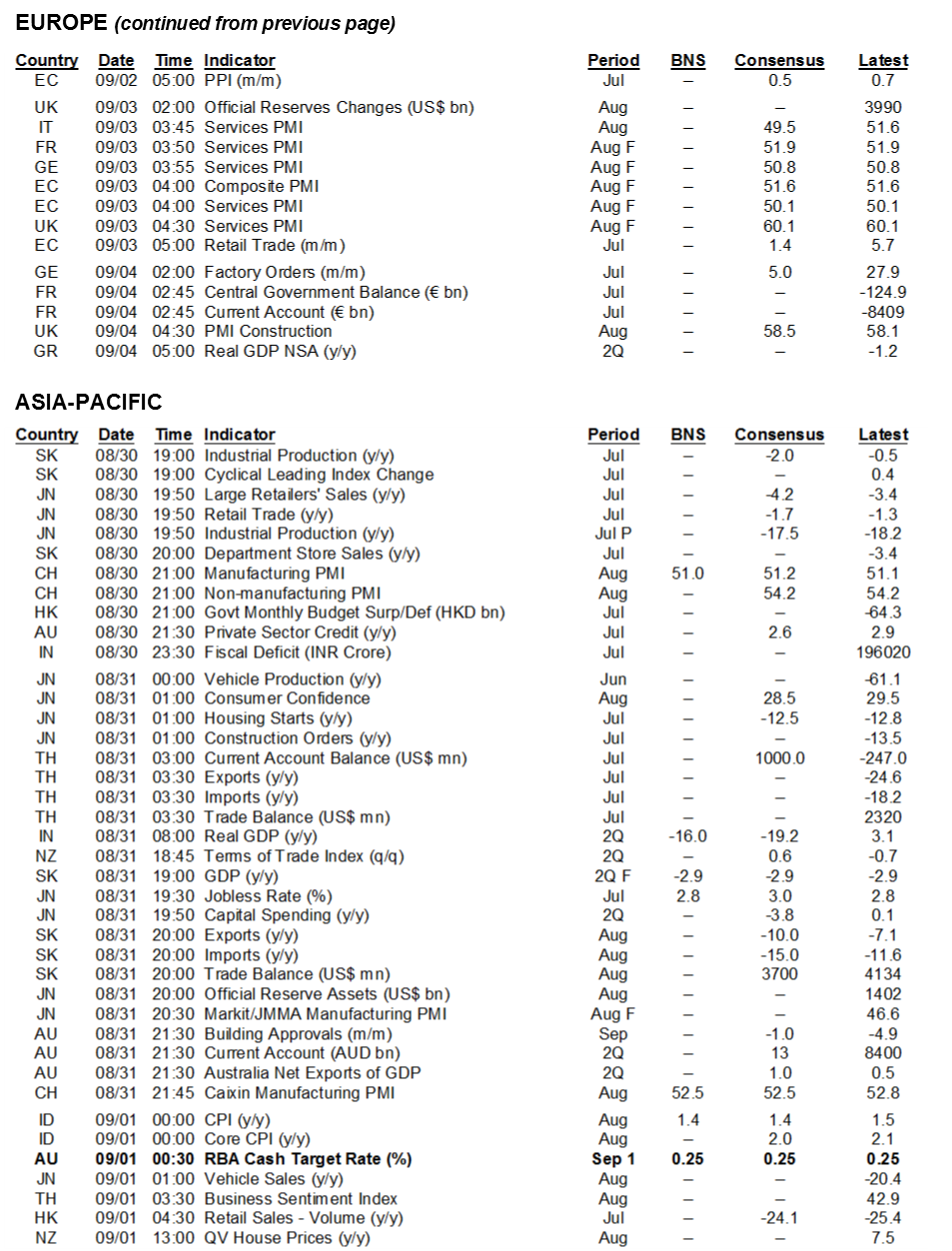

The US and Canada both release estimates for job growth and broader labour market conditions during August on Friday.

Nonfarm payrolls

Payrolls and the companion household survey are expected to post another solid gain of 1.5 million, another decline in the unemployment rate to 9.8% from 10.2% and a further deceleration in reported wage growth to 4.5% y/y. Initial jobless claims continued to decline between reference periods by several hundred thousand filings. Next week might reveal more about job market signals through the employment gauges in ISM readings and ADP, but that’s doubtful. Decelerating wage growth continues to be mostly driven by lower wage service workers coming back into the job market after having borne the brunt of the pandemic hit.

Canadian Jobs

It’s that time again for the Great Canadian Jobs Skeet Shoot! With the usual degree of trepidation, I went with +250k and a decline in the unemployment rate to 10.1% from 10.9%. Wage growth should also slow again for the same reason as stateside, but this isn’t the measure of wage growth that matters to the Bank of Canada that uses the wage common composite instead. The main reason to expect another gain is that Ontario’s ongoing reopening plans shifted into higher gear at the end of the reference week for the July jobs report and Toronto joined subsequently to other regions of the province. Therefore, the call back effect should be skewed to Ontario in leading job gains. If so, it would be the fourth consecutive strong gain after +290k in May, +953k in June and +419k in July. If this estimate is on the mark, then it would mean that about two-thirds of the three million decline in jobs from February to April has been recovered.

PURCHASING MANAGERS’ INDICES

The poor cousin to jobs reports and particularly nonfarm is no slouch itself. Several countries will release August versions of purchasing managers’ indices that will inform growth momentum in the third quarter and potential transitions to the fourth quarter given their correlations with GDP movements.

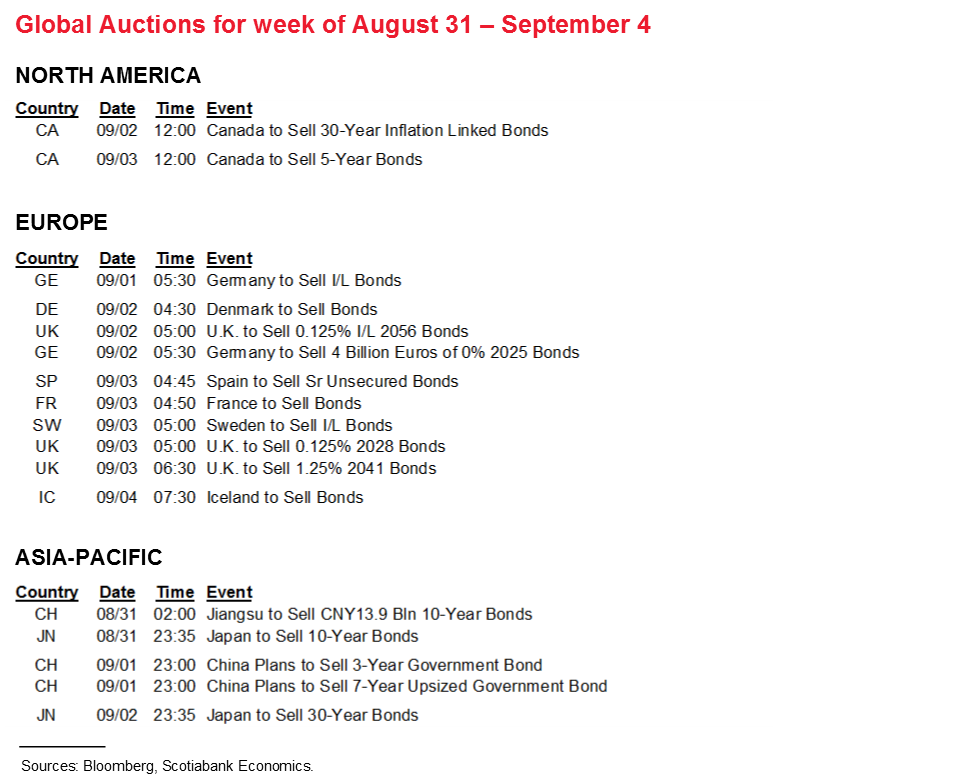

First up will be China’s state PMIs on Sunday evening into the Asian Monday open. Little change from the mildly expansionary readings is expected. The private sector versions of China’s PMIs arrive on Monday evening and Wednesday evening (all times eastern as usual).

Next up will be the US ISM-manufacturing (Tuesday) and ISM-services (Thursday) readings. Based upon the regional manufacturing surveys and auto sales tracking, we’re expecting a small gain in ISM-manufacturing but this could be offset by potential softening in the services gauge as reopening plans either stabilize or in some cases reverse in parts of the country.

Canada’s two PMIs will be updated on Tuesday (Markit’s manufacturing gauge) and Friday (Ivey) for the month of August. Both have sharply recovered (chart 4). Reopening plans across the country including lagging moves by Ontario could maintain a favourable trend. A caution is that Markit’s gauge is purer relative to Ivey that covers all aspects of the private and public sector economies.

Italy and Spain release PMIs on Tuesday (manufacturing) and Thursday (services and composite PMIs) that may inform revision risk to the flash estimate for the Eurozone composite PMI that registered a deceleration from 54.9 in July to 51.6 in August.

India’s PMIs for August will round it all out when they arrive on Tuesday (manufacturing) and Thursday (services and composite). The country’s PMIs have lagged a global recovery with the July readings still deeply mired in contraction particularly on the services side of the economy.

CENTRAL BANKS

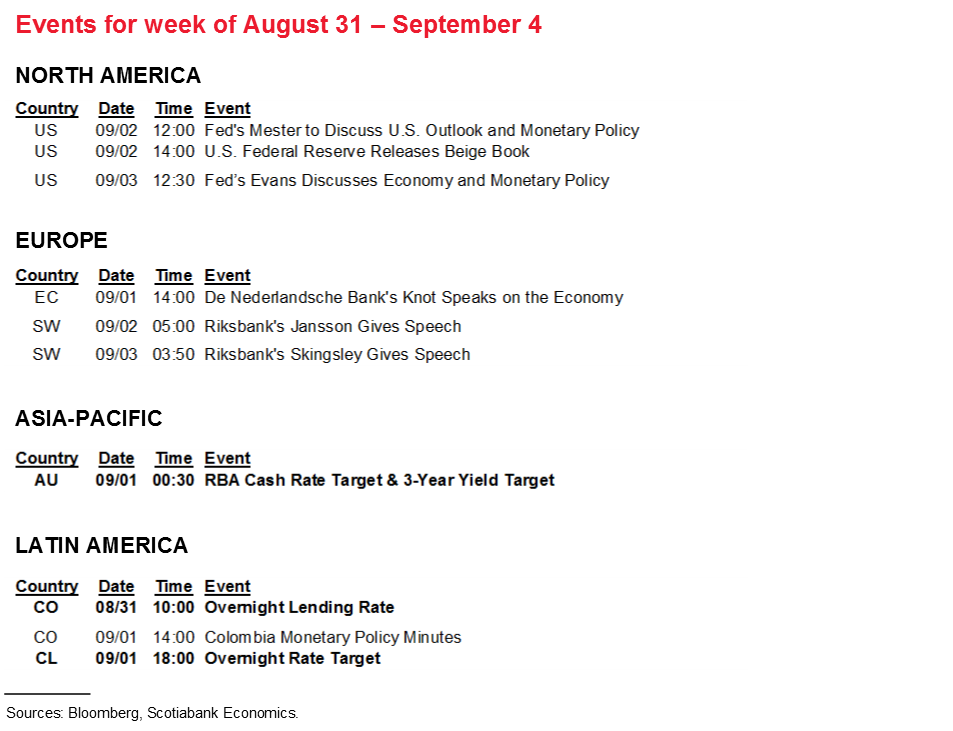

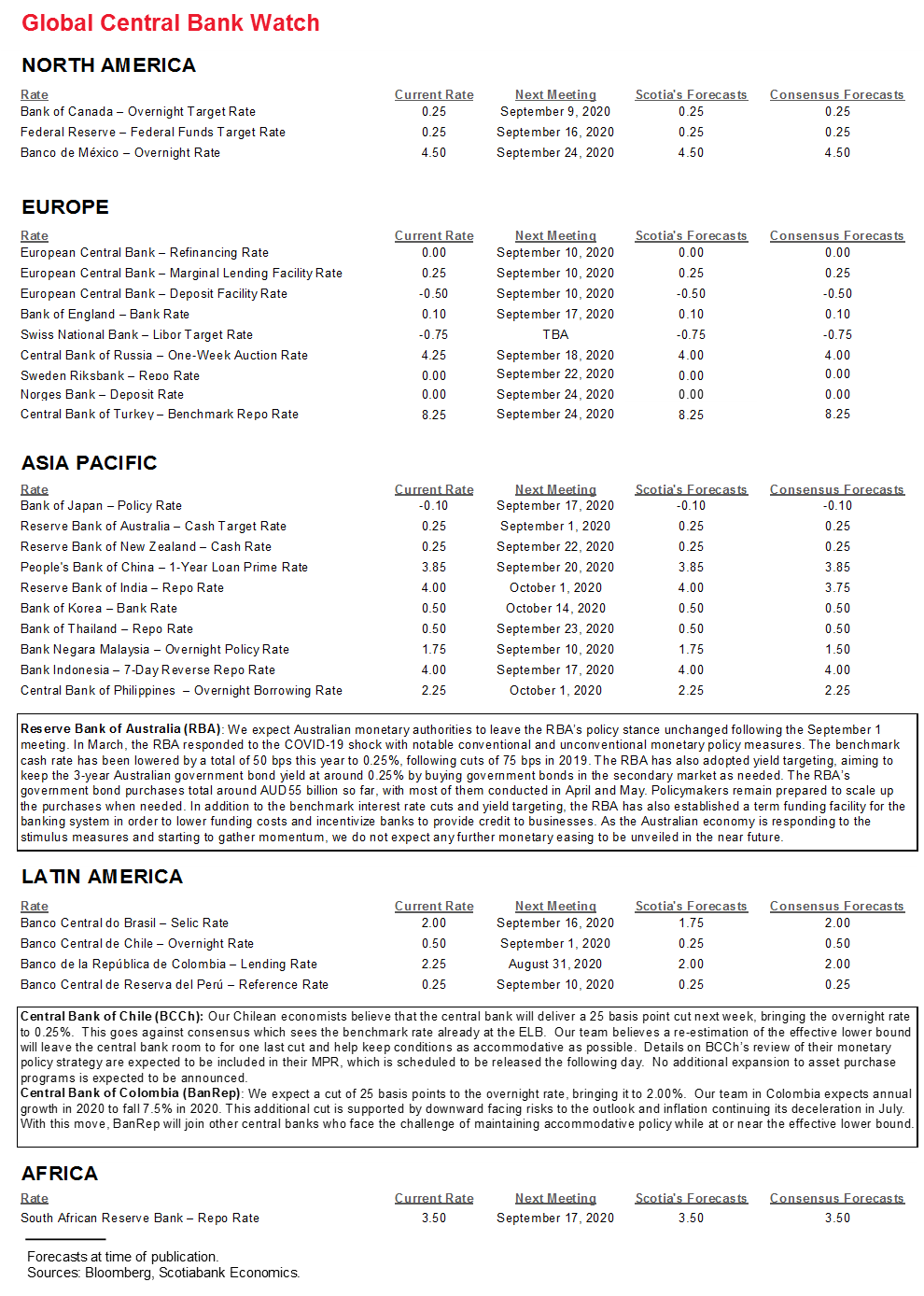

Three regional central banks will make policy decisions over the coming week and two of them are expected to ease.

The Reserve Bank of Australia is not expected to alter its cash target rate of 0.25% or bond purchase and liquidity programs on Tuesday. Having said that, currency risk remains a consideration to the central bank and markets should watch the tone of comments on the currency. The A$ has appreciated by 28% to the USD since the low in March. The appreciation is not just confined to the USD either (and hence the yuan and HK$). The A$ is up sharply against the yen, euro and most other major currencies over this same period.

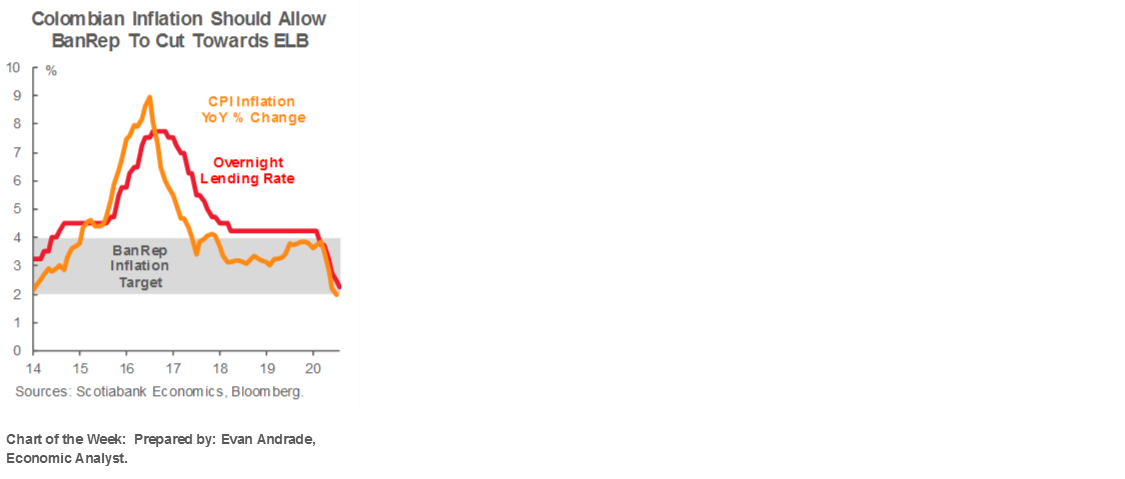

Colombia’s central bank is widely expected to cut its overnight lending rate by 25bps when BanRep issues its decision on Monday. The 9% appreciation in the Colombian peso to the USD and further risk if the USD continues to weaken in the wake of a dovish Fed could combine with recent downward pressure upon inflation to merit additional easing.

Chile’s central bank is also expected to cut by 25bps according to our Santiago-based economists but this is a more divided consensus call. It would require a re-evaluation of the central bank’s estimated effective lower bound to go below 0.5%. the 11% appreciation in the Chilean peso to the USD since March and a more dovish Fed could merit such a move.

MISCELLANEOUS

I’ve got to come up with a better section header for this. Miscellaneous might as well be labelled by some as the irrelevant residual stuff. Maybe. Quite possibly from a market pricing standpoint. It’s still nevertheless worth briefly flagging several other expected developments.

Inflation reports will be released by several regions. Eurozone CPI revisions will be captured on Tuesday and will incorporate potential revisions to figures from Germany, Italy and Spain on Monday. First inflation readings from Peru, Indonesia and South Korea arrive on Tuesday and the Philippines on Thursday.

Q2 GDP releases will be offered by India (Monday) and Australia (Tuesday) that will likely be treated as backward looking footnotes by markets that are more focused upon recovery signals.

Several regions will provide updated assessments of consumer sector momentum including updates for retail sales with August figures from Japan (Sunday), Germany (Wednesday), the Eurozone (Thursday) and Australia (Thursday).

Finally, the US, Germany, Canada and Japan will provide additional macro updates. US releases will include vehicle sales and construction spending (Tuesday), ADP payrolls, factory orders and the Fed’s Beige Book (Wednesday), weekly jobless claims and trade figures (Thursday). Germany updates job market conditions in August (Tuesday) and factory orders in July (Friday). Japan kicks off the week with Q2 cap-ex figures that may inform GDP revisions and July readings for industrial output, housing starts and the jobless rate. Canada updates export and import figures for July on Thursday to further inform Q3 growth tracking.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulation

s. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.