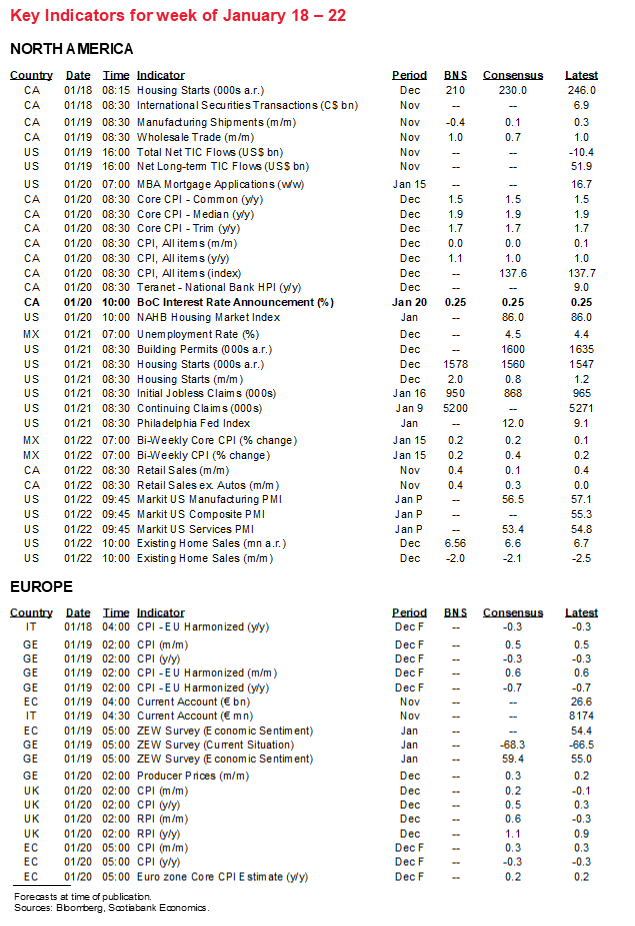

Next Week's Risk Dashboard

• Biden’s inauguration

• CBs: BoC, ECB, BoJ, PBOC…

• …Norges, Brazil, BI, Negara

• PMIs: Eurozone, UK, US (Markit), Japan, Australia

• GDP: China

• Inflation: Canada, UK, Japan, NZ, Malaysia

• Jobs: Australia

• US earnings

Chart of the Week

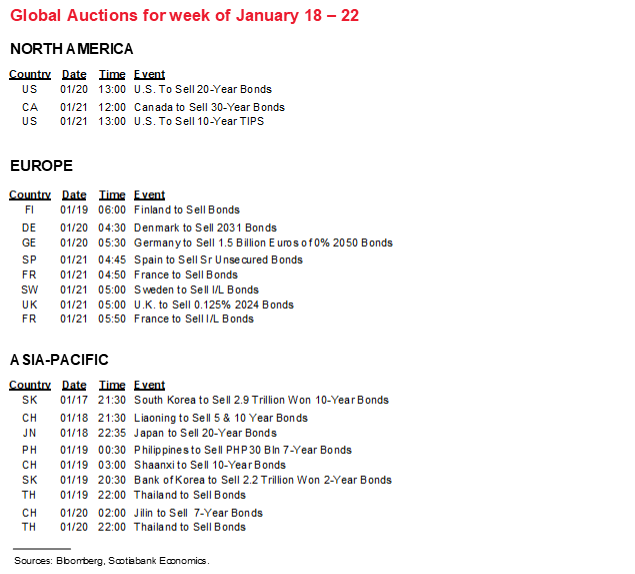

With a lot less pomp and circumstance than usual, the inauguration of Joe Biden as the 46th President of the United States will hopefully go off without a hitch on Wednesday and allow for a return to a more sensible environment within which to consider the nearer term outlook. The coming week will start with US market participants out for the Martin Luther King Jr Day before emphasizing several other key developments including the US earnings season and US debate over stimulus proposals. A wave of central bank decisions will be set alongside multiple top shelf global macroeconomic reports.

US EARNINGS—LOFTY EXPECTATIONS

The US earnings season swings into higher gear with Q4 and full year results due out from over forty S&P500 companies. Forward guidance will inform momentum into 2021. Among the names will be Morgan Stanley, Goldman, BofA, State Street, Netflix, P&G, Kinder Morgan and Intel.

There are rather lofty expectations for earnings growth going forward (chart 1). Some of what analysts expect reflects a burst of pent-up demand that should buoy earnings compared to the steep correction last year. No doubt some of it is also hitched to expectations for stimulus-fed strength in economic growth. Since earnings are nominal, it’s worth noting that we expect nominal US GDP growth on the order of 6-7% per year in each of 2021 and 2022.

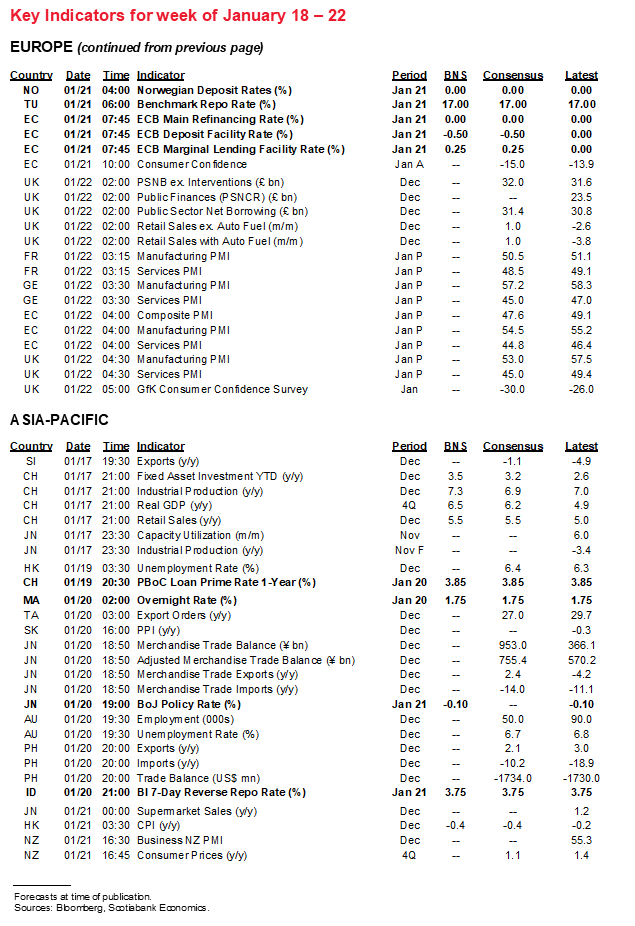

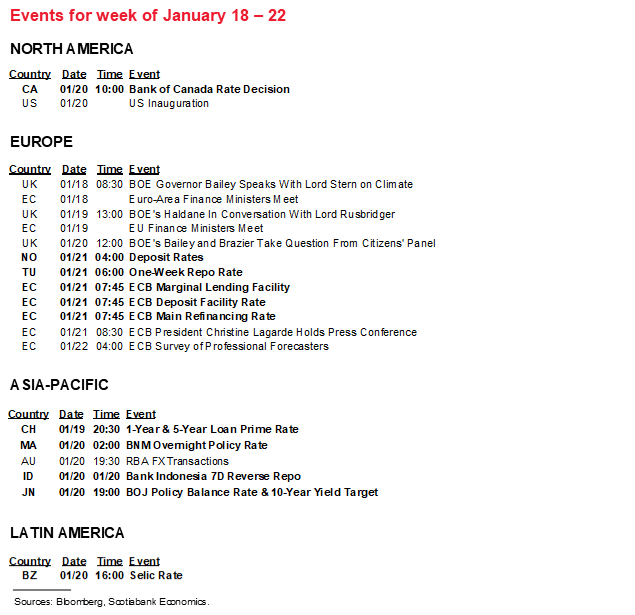

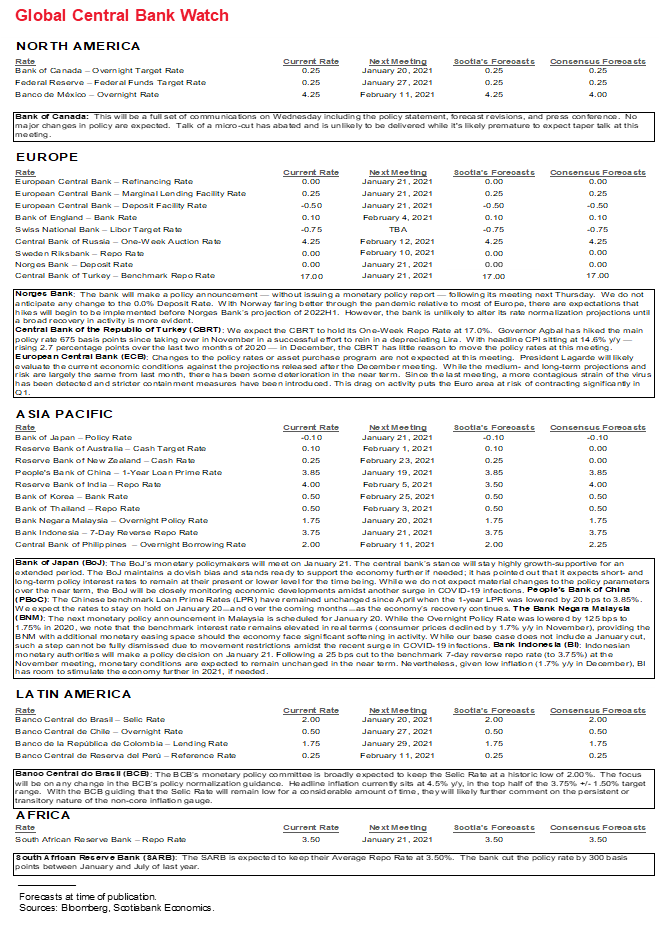

LITTLE ACTION BY EIGHT CENTRAL BANKS

Eight central banks will weigh in with fresh policy decisions and in several instances fresh forecasts. While there are risks of further action, none of them are expected to meaningfully alter their policy stances.

Wednesday’s Bank of Canada meeting will be the full deal with the statement arriving at 10amET along with a fresh set of forecasts in the Monetary Policy Report. Governor Macklem will host a press conference at 11amET absent a Senior Deputy Governor at his side this time. Macro forecasts are expected to revise 2020Q4 GDP growth upward, probably forecast a contraction in 2021Q1 and then a more upbeat rebound thereafter. The central bank’s last forecast was delivered in October and so it has a lot of updating to do. I would expect the composition of medium-term risks to have improved since then and to be driven by vaccines, the Brexit deal, the US passage of stimulus and funding over the holiday period and the settlement of the US election in favour of ‘blue wave’ stimulus prospects. No material policy changes are expected but the overall tone may fade nearer term risks in favour of greater optimism toward the medium-term. One key issue concerns speculation toward a so-called micro-cut to the policy rate, but the central bank is likely to pass on that option. Proxies for its overnight rate are trading near the 0.25% level (chart 2) notwithstanding recent volatility that has been significantly driven by supply shortages of shorter-term paper following a decline in treasury bills outstanding since late last summer while liquidity continued to rise. While there is the distinct chance that spare capacity will be closed earlier than previously guided by the Bank of Canada, it is unlikely to guide as much at this meeting. A discussion about potentially further tapering of bond purchases may be premature at this meeting but is more likely at the March or April meetings.

The ECB is expected to leave stimulus programs unchanged on Thursday after having just expanded them at the December 10th meeting. Recall they expanded liquidity programs like TLTROs and PELTROs, but the key disappointment to markets was that while adding €500 billion to the Pandemic Emergency Purchase Program to take it to €1.85 trillion met consensus expectations, doing so over nine months instead of the expected six months meant a somewhat slower flow into bonds. Furthermore, President Lagarde said in her press conference that the expanded PEPP might not be fully used.

The Bank of Japan is also expected to stay put on Thursday. Soaring COVID-19 cases and rising restrictions alongside increasingly deflationary CPI readings may drive further policy easing if not at this meeting then perhaps in March.

The People’s Bank of China is forecast to leave its benchmark 1-year and 5-year Loan Prime Rates unchanged at 3.85% and 4.65% respectively on Tuesday evening (ET). A minority expects a small hike, although the decision to maintain the Medium-Term Lending Facility Rate unchanged at 2.95% likely reinforces hold expectations next week.

Consensus is divided on whether Bank Negara Malaysia will stay on hold on Wednesday morning (ET) or cut 25bps with the slim edge going to the hold camp. The central bank had indicated willingness to consider further easing when it last issued a policy decision in early November, but that was before COVID-19 vaccine trials arrived and before other global risks improved (Brexit, US stimulus and election) notwithstanding rising global COVID-19 cases. What may tilt the balance in favour of easing, however, could be the fact that cases have been sharply climbing in Malaysia since October.

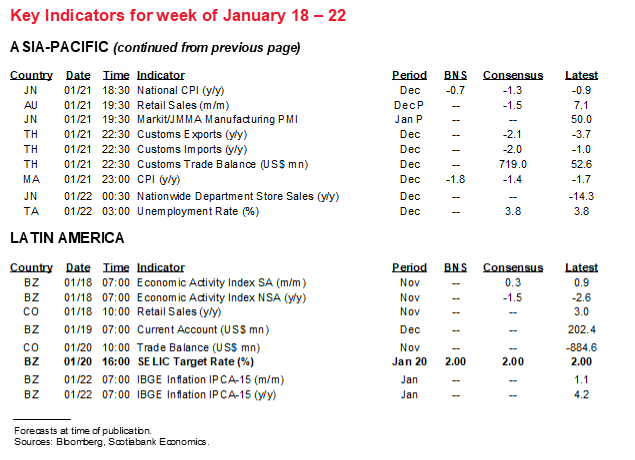

Brazil’s central bank is likely to hold its Selic rate unchanged at 2% on Wednesday after saying last month that it “deems as adequate the current level of unusually strong monetary stimulus.” Bank Indonesia is expected to hold its policy rate at 3.75% on Thursday. Most economists expect Turkey’s central bank to hold its one-week repo rate at 17% that same day. Norges Bank should hold at 0% on Thursday but watch for the low risk it alters guidance toward maintaining the deposit rate at 0% through 2021 followed by the commencement of rate hikes over 2022H1.

DIVERGENT PMIS

Purchasing managers’ indices will be updated for January across several economies over the coming week. They serve as useful signals for tracking GDP growth. The results are likely to show Australia and the US as the leaders while Europe and Japan lag behind.

Australia kicks it off on Thursday evening (eastern time). The composite PMI has been gathering strength as the nation relaxed restrictions following successfully flattening its COVID-19 curve by September. PMIs are indicating stronger GDP growth (chart 3).

Japan will update its Jibun PMIs shortly after Australia against the trend of mildly contractionary readings over recent months (chart 4).

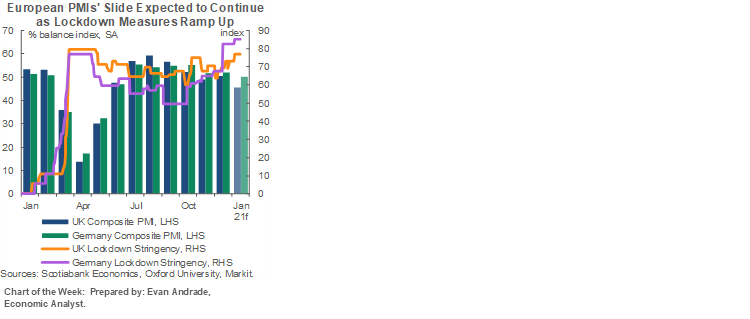

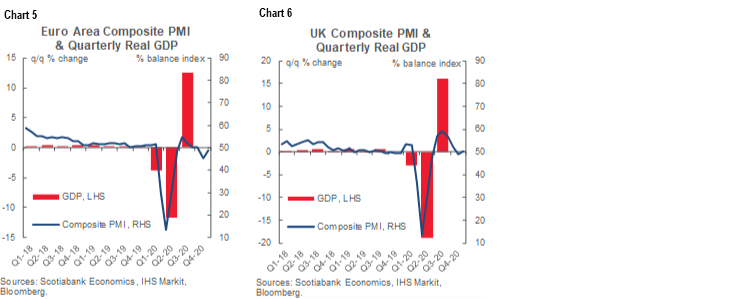

Eurozone and UK PMIs follow that up overnight into Friday and they too have been indicating a drop in GDP (charts 5, 6).

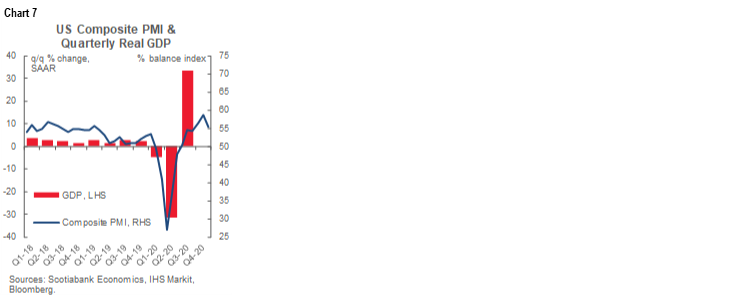

The US Markit PMIs gauges will likely retain a more optimistic slant that comes full circle back to the tone set by Australia’s kickoff. The Markit PMIs may slip but they are expected to continue to indicate positive GDP growth (chart 7).

OTHER GLOBAL MACRO RELEASES

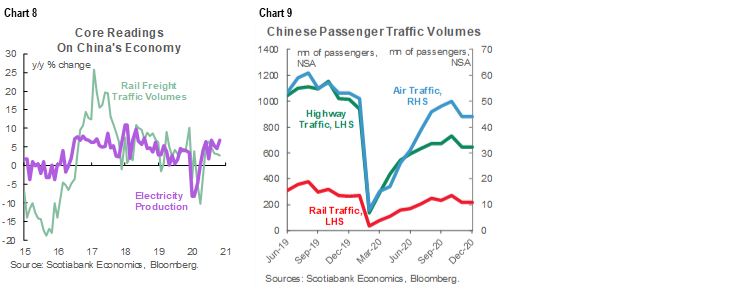

China will report Q4 GDP to start the week and ahead of a policy rate decision by the People’s Bank of China. GDP growth is expected to accelerate in year-ago terms to over 6% y/y. That will partly reflect the weakness in the economy during the latter stages of 2019 into early 2020, but also expectations for 2020Q4 growth over the prior quarter to land at just shy of 3% at a seasonally adjusted and non-annualized rate. China’s economy contracted to start the year as the pandemic raged, but it has enjoyed a solid rebound since then. Momentum is expected to continue through the end of the quarter which will be evaluated when retail sales and industrial output are released for the month of December. Other readings, like electricity production and rail freight volumes are holding up reasonably well (chart 8) but mobility gauges have lost some momentum (chart 9).

US releases will be fairly light and skewed toward later in the week. Key may be weekly jobless claims given the important of establishing whether the prior week’s strong rise was trendsetting. December’s housing starts are expected to rise (Thursday) given strength in permits. The same day updates the Philly Fed’s business outlook gauge ahead of the next day’s Markit PMIs. Existing home sales during December will wrap it all up on Friday and they are expected to follow pending home sales lower.

Several countries will update CPI inflation figures. Canada’s headline CPI inflation rate may rise a tick to 1.1% y/y on Wednesday morning just ahead of the Bank of Canada. Average core CPI is expected to hold around the 1.7% y/y range at which it has been riding for the past four months. UK core CPI inflation could gently rise on Wednesday but still hover around 1 ¼% y/y following a three-year long deceleration. Japan updates inflation for December that is expected to see headline and core inflation fall below -1.0% y/y. New Zealand’s CPI inflation for Q4 (Thursday evening ET) may also decelerate but remain above 1% y/y.

Canada will update retail sales on Friday. Key will be advance guidance for December more so than November’s full report. Statistics Canada had previously guided that retail sales were roughly unchanged in November, but it seems each time it says that of late we wind up getting a solid rise. Also watch for an expected drop in manufacturing shipments on Tuesday but more important may be advance guidance from StatsCan for December. Wholesale trade that same day should rise sharply. Monday’s housing starts might soften given tightening COVID-19 restrictions notwithstanding a solid gain in the prior month’s permit volumes.

Can Australia register a third consecutive job gain for December on Wednesday evening (ET)? Consensus thinks so and in no small part due to the aforementioned relative success in containing the COVID-19 virus. The take back effect might be softer retail sales during December (Thursday) after the large prior gain that was fed by the lifting of restrictions.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.