Next Week's Risk Dashboard

• What are bonds saying?

• The end of the reflation trade?

• The 2013 debt ceiling parallels

• CBs: BoC, BoJ, RBNZ, BoK, Chile, Turkey

• Fed’s Powell to testify

• Inflation: US, UK, Sweden, NZ, India, Peru

• Jobs: UK, Australia

• US retail sales

• Chinese GDP

• US earnings

• G20 FinMins and CBs

Chart of the Week

INTRO—WHAT SIGNALS ARE BONDS SENDING?

It didn’t take much this past week for headlines to aggressively declare the end of the reflation trade in favour of piling into bonds allegedly because of deepening growth concerns, rising Delta variant cases, over-valued stocks, earnings uncertainty and more dovish central banks. What’s the evidence? Plus, while there is some supporting evidence for concerns, is there a more dominant alternative theory?

We’ll hear more about several of these topics over the coming week, but the bar for suddenly abandoning narratives and chasing markets is apparently rather low. The S&P500 closed Friday at yet another all-time record high for the nominal index level, yet I still see articles on stocks being worried about growth. Hmph. The USD on a DXY basis has appreciated by less than 3% since the bottom in late May and is back to early April levels while the drivers are at least as much about Fed tightening risks as they are about any safe haven effects. WTI oil is less than a buck below its peak—hit on July 1st—after a year-to-date run up of about $25/barrel. Bonds have had the bigger moves. The US 10 year has fallen back to ~1.35% and hence shed about 40bps off the peak that was set around early April. That takes us back to levels in February while remaining at 85bps above last summer’s lows.

This leads to the first point: if most of the action was in fixed income markets, then is it the curve playing its classic role as a harbinger of woes that may lie ahead for other asset classes, or are there more idiosyncratic factors disproportionately impacting fixed income markets?

Let’s decompose some of the evidence behind those theories of bigger moves across asset classes than we’ve actually seen so far. The start of another batch of US inflation figures will add to the reflation debate this coming week and is covered below. Core inflation may continue to push higher at least for now. Instead of the end of reflation, markets may simply be correcting an overshoot of expectations for high inflation sustained over many years ahead. How to define transitory inflation remains contestable in any event. The view it won’t remain at 5% y/y forever and therefore buy bonds seems wanting for its rigour. A sustained period of on- or just-above-target inflation over a medium- to longer-term scenario could still be possible once we move past short-sighted definitions of transitory pressures through year-end.

Are central banks really turning more dovish? That wasn’t apparent in the FOMC minutes that flagged upside risks to inflation with a tapering debate that remained on track. Nor was it apparent in the conclusions to the ECB’s strategy review when they refused to go down the Fed’s average inflation targeting path. The PBOC took a tepid step in the direction of easing by cutting its required reserve ratios, but the motive is that its own economy is relatively underperforming (see below).

Is the Delta variant running at a rate that merits panic stations? It’s a risk to the outlook but so far hardly one that is alarming. It’s difficult if not impossible to confidently gauge Delta variant cases globally, but the aggregate COVID-19 new case trends remain generally well behaved across most countries with possible exceptions including rising and elevated trends in the UK, Spain and Malaysia.

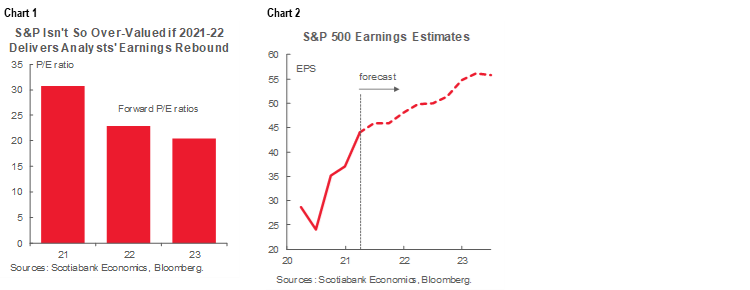

Ok, but clearly stocks are over-valued. Right? Most in the markets know better than to waste time on price-to-trailing-earnings coming out of a pandemic. There are many alternative measures, but price-to-forward earnings on the S&P500 don’t look terribly overvalued to me (chart 1). Further, the dividend yield on the S&P500 is now roughly tied with the ten year Treasury yield but with expectations for further dividend hikes ahead and particularly for the recently unleashed US banks. It’s more likely that turbulence is being sparked by cyclical rotations, sector-specific policy challenges (e.g. so-called FANG stocks) and uncertainty ahead of the coming week’s unofficial kick-off to the Q2 US earnings season. Chart 2 shows the analyst consensus for earnings per share on the S&P500 going forward with the focus turning toward 23 firms slated to release this coming week and led by financials.

As for growth risks, we’re bound to see GDP growth ebb from the initial spurt coming out of lockdowns but that doesn’t mean the expansion will fizzle out. Most major economies haven’t really even begun the full rebound in the dominant services sector that still lies ahead. We’re getting there but not even at herd immunity levels of protection with likely potential benefits to reengaging with the economy. But some still say it’s over.

A better theory of what is driving global market risks that are concentrated upon fixed income markets concerns liquidity and US debt ceiling issues. Expectations are for additional excess liquidity and relative debt scarcity to get worse yet as the Treasury redeploys its General Account at the Federal Reserve down to the required US$450B by the debt ceiling’s reinstatement on August 1st, as the Fed continues to buy (too many) Treasuries and MBS and the Fed’s overnight reverse repo facility struggles to keep up with the flows. The coming week will see among the last returns to auctioning off more Treasuries before the debt ceiling becomes binding. What fixed income markets are pricing now is likely a protracted bun fight that will cause a relative shortage of new issuance relative to ongoing liquidity pressures that could amplify risks to fiscal policy and the continuing operations of the US government later this summer.

OVER TO YOU CHAIR POWELL

It’s probably too soon for Chair Powell to start directly commenting on all of this when he testifies before the House Financial Services Committee (Wednesday, 12pmET) and then again before the Senate Banking Committee (Thursday, 9:30amET). The ostensible purpose is to deliver the semi-annual Monetary Policy Report to Congress that has already been released (here).

In the wake of 850,000 new jobs having been created and with the benefit of another round of CPI inflation figures that get released on Tuesday, it’s not impossible we hear a slightly refreshed version of what the Fed communicated in the recent round of meeting minutes. They indicated that a “substantial majority” of FOMC members expect upside risk to their inflation projections that are already sustainably, though modestly, above the 2% target throughout 2021–23. Powell is likely to maintain guidance that there is much further room ahead before achieving “substantial further progress” toward tapering and to condition it upon nearer term data.

A wildcard risk (beyond taper bombs…) is whether Powell is grilled on preparedness ahead of what could be divisive debt ceiling developments. If he is, then at this point Powell is likely to distance himself from Congress and adopt observer status for now while standing ready to act under any potential scenarios.

That was the course of Fed-speak the last time we saw an intersection between debt ceiling talks, government shutdown risks and Fed tapering back in 2013. In 2013, the minutes tended to be rather quiet on the issue until the fracas rose to a crescendo. Here is a recap of references to the ceiling/limit in minutes from 2013’s meetings up to the shutdown.

- Jan 2013: flagged perceived bond market optimism toward a debt ceiling deal.

- March 2013: nothing.

- May 2013: nothing.

- June 2013: nothing.

- July 2013: nothing.

- Sept 2013: “However, a number of others pointed to heightened uncertainty about the course of federal fiscal policy over coming months, including the potential for a government shutdown or strains related to the debt ceiling debate, which posed downside risks to the economic outlook.” Those minutes also noted “…a number of potential shocks could prove challenging to markets and institutions, including a failure to raise the US federal debt limit…”

- October 16th 2013: An unscheduled FOMC conference call was led by Chair Bernanke specifically on the ceiling and potential responses should the ceiling be breached. The transcript from that meeting included potential policy options (here). By then, however, it looked like the issue was already passing.

Recall, however, that market participants and almost all US primary dealers broadly expected the Federal Reserve to taper bond purchases at the September 2013 meeting. Scotia Economics did not, along with one other US primary dealer. The Treasury market rallied big time upon the no-taper decision. At the time, the foundation for the no-taper call was simply this: Bernanke basically said he wouldn’t and too few people listened when he said it! Recall the Q&A from Bernanke’s testimony to the Senate Banking Committee on July 18th 2013:

"One of the reasons that the economy has been so slow in the early part of 2013 is because of fiscal factors. It's hard to judge how long those factors will last. But if the economy begins to move beyond that point and fiscal restraint becomes somewhat less pronounced then we should see as you said a pick-up in growth. We're obviously going to look at the data, it's a committee decision (on whether to taper QE in September), and it's going to depend on whether we see the improvement which I described." [ed. emphasis added.]

The prospect of a government shutdown and payments prioritization clearly did not meet the criteria of Bernanke’s described improvement. But is it relevant to today? I’d say perhaps even more so. Fiscal policy has been a substantial contributor to the recovery and now we’re at a delicate hand-off point to how behaviour responds to vaccines. After passing an infrastructure bill that was smaller than initially targeted by the Biden administration, Congress—specifically the GOP—may be itching for a fight over the next round of proposals within the American Families Plan. Anything that rattles confidence in policymakers—such as a debt ceiling fight—and hampers priced fiscal stimulus may at least temporarily influence thinking at the Fed about when and by how much to taper bond purchases. That is unless Chair Powell believes so strongly in the outlook and the transitory nature of a possible showdown into a mid-term election year that he seeks opportunity to reduce purchases anyway as Treasuries are rallying.

BANK OF CANADA—GRADUAL AND MEASURED VERSUS SUDDENLY HURRIED

A full set of communications is due out on Wednesday including the policy statement and Monetary Policy Report including updated forecasts (10amET) followed by Governor Macklem’s press conference at 11amET. A further step away from the QE program is expected but with little to no change in hike guidance.

A further reduction of Government of Canada bond purchases from $3 billion per week down to $2 billion is expected. The key is striking a balance on the magnitude of the adjustment that retains future flexibility but without signalling a greater rush that could bring forward overall exit pricing. It’s feasible that a greater reduction is offered, but we err on the somewhat more cautious side since a greater reduction might compromise the desire to exit in ‘gradual and measured’ fashion as the BoC puts it. Reducing purchases down to, say, $1 billion in one swoop at this meeting would likely set up expectations for an end to the purchase program, perhaps at the September meeting, with pulled-forward expectations for a reinvestment phase and rate hikes. That’s not inconceivable—and would be what I’d personally like to see in ending the purchase program sooner than later—but would signal a greater rush to exit than Governor Macklem’s guidance has tended to indicate to date.

The main argument in favour of tapering again now is to look beyond the bumps and wiggles in the near-term developments while keeping an eye on where the BoC wants to be roughly a year from now and how to get there in their so-called ‘gradual and measured’ fashion. The April forecasts indicated they expected spare capacity to shut over 2022H2 and Governor Macklem has previously indicated this would be about the time to expect the beginning of rate hikes. Deputy Governor Gravelle’s speech (here) had indicated the BoC would gradually reduce net bond purchases to zero and follow this with a reinvestment period of uncertain form and length before hiking. We may learn more about the outlines of such reinvestment plans at this meeting such as the potential length of reinvestment before hiking and subsequently, plus whether they will match maturing flows as they arise or target, say, a steady pace of around C$1½ billion per week that would equal the expected volume of maturities in 2022.

The point is that there is not much time between today and possible rate hikes beginning around mid-2022 per our forecasts during which to compress a lot of action toward eliminating net purchases and reinvesting maturing flows for a meaningful period of time before raising the policy rate. The BoC has to act in opportunistic fashion along that path if they want to stick to proceeding in “gradual and measured” fashion versus a more rushed manner.

Beyond this strategic framework perspective is how tracking recent developments fits the picture. The drivers of the decision to taper purchases include the following points:

1. They have said that adjustments to net bond purchases “will be guided by Governing Council’s ongoing assessment of the strength and durability of the recovery.” This implies benchmarking progress to their forecasts to date. We are tracking about 3½% GDP growth in Q2 and hence in line with the BoC’s forecast published in the April MPR. At that time, they said they expected restrictions to ease in late May which they did. As a consequence, 80% of the jobs lost in April and May during third wave restrictions have already been recouped in one report for June.

2. The April MPR indicated that the BoC expected “broad immunity…later in 2021 in Canada.” The country is getting to this point sooner than they anticipated. In fact, Canada will likely cross the 75% herd immunity proxy for double dose vaccinations soon after the meeting (chart 3). That could give cause to upgrade implied growth forecasts for Q3 onward. They are likely to repeat that the inputs to an output gap framework remain uncertain at this point such that there is little to be gained from deviating from prior guidance that spare capacity will close by 2022H2.

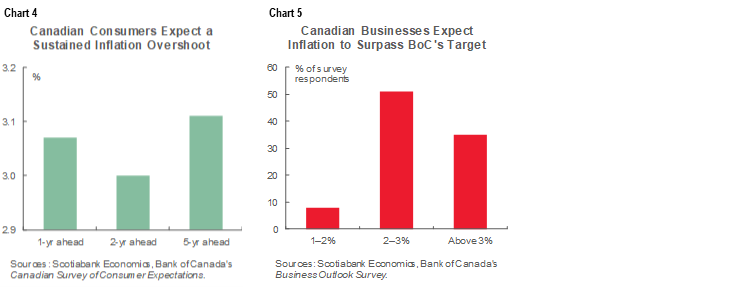

3. While they are hardly airtight measures, the BoC’s surveys of inflation expectations point toward the risk of unmoored inflation expectations above the 2% mid-point target of the 1–3% band. Consumers expect 3% inflation across all time horizons while 86% of businesses expect inflation to exceed 2% over the next two years with a record 35% above 3% (charts 4, 5).

5. Core inflation measures continue to be roughly on or slightly above the BoC’s target (chart 6).

6. Jobs have indeed begun to rebound rather quickly if imperfectly so out of lockdowns (recap here).

A potential risk in the press conference could well involve grilling Governor Macklem on potential wage-price connections. Macklem has so far leaned in favour of a fully inclusive job recovery but some mistake that as guidance he may not hike until every conceivable unemployed and underemployed worker is fully employed. Instead, a fully inclusive recovery likely speaks more toward the pace of hikes once they begin with the guidance likely to remain in favour of a starting point toward mid-year next year. I would, however, like to hear Macklem discuss his views on poor Canadian labour productivity and faster increases in unit labour costs than in the US and how this could feed into inflation risk. A discussion about labour utilization is incomplete without discussing productivity challenges relative to labour costs.

MORE HIKE SIGNALS ACROSS OTHER CENTRAL BANKS?

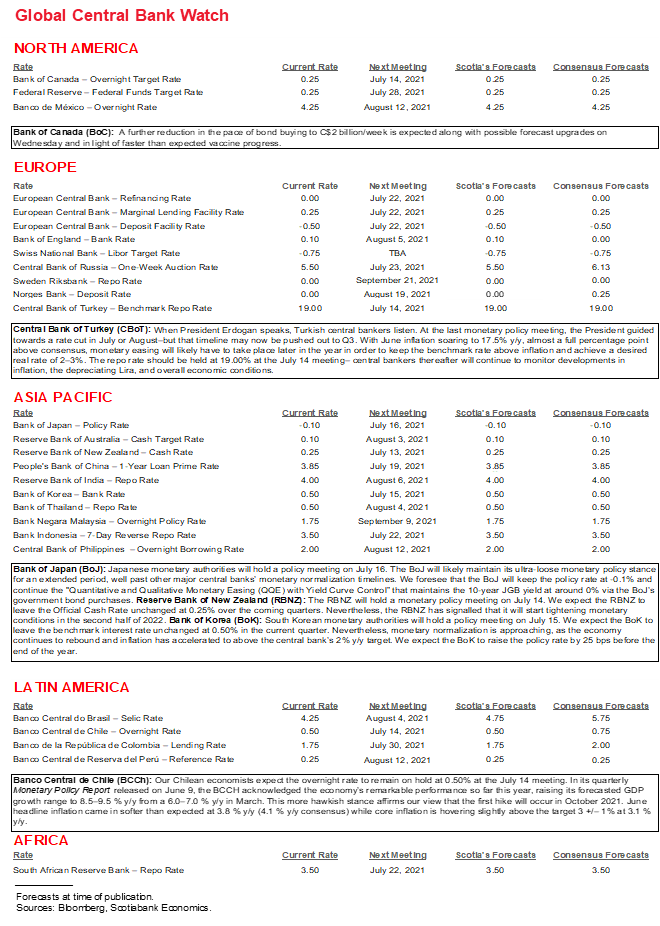

Five other central banks are expected to weigh in with updated policy decisions and views.

- RBNZ: New Zealand’s central bank is expected to stay on hold at a cash rate of 0.25% on Tuesday night (ET). Guidance will further inform expectations for a hiking cycle to begin as early as later this year. Its expectations for Thursday’s Q2 CPI figures are likely to factor into the guidance. CPI is expected to rise another 0.7% q/q (non-annualized) and lift the year-over-year rate to 2.7%—above the RBNZ’s 2% inflation target and pushing toward the upper end of the 1–3% medium-term band.

- Chile: Wednesday’s decision might bring forward hike risk by possibly following Banxico and Brazil, but our economist in Santiago expects the central bank to prime markets for hikes commencing later this year. Inflation at 3.8% y/y recently climbed by less than expected but is well above the 3% target, while core CPI was unchanged at 3.1% and perhaps signalled less urgency to act.

- Turkey: A hold at 19% with hike risk is expected. That may not quite be what President Erdogan wants, which matters as an omnipresent career threat to whomever happens to be head of the central bank at any moment, but recent inflation surprised higher than expected on both a headline (17.5% y/y) and core (also 17.5% y/y) basis.

- Bank of Japan: The meeting on Thursday into Friday will be monitored primarily for what the BoJ does on potential climate policy changes. Reuters has reported that sources indicate the BoJ will offer 0% long-term loans to lenders that support measures against climate change. How it defines and monitors such activities is uncertain. Whether unelected central bankers from the ECB to the BoJ should be picking winners and losers and accordingly distorting markets is another matter very much open to debate.

- Bank of Korea: No major policy changes are expected at the mid-week meeting. Guidance will be closely watched for timing rate hikes as soon as later this year. Headline inflation is running at 2.4% y/y with core at 1.5% and rising through more than just base effects and relative to the central bank’s 2% inflation target.

THE END OF REFLATION OR JUST CORRECTING AN OVERSHOOT?

Is the reflation trade done? Next week’s inflation figures won’t settle the matter, but before getting into them it’s worth commenting on market expectations. Chart 7 shows one such set of measures. All time horizons for US TIPS breakevens remain well above 2%. So does the Fed’s preferred 5 year, 5 year forward inflation breakeven rate, which is less sensitive to distortions affecting TIPS measures such as relative liquidity of nominal Treasuries and the Treasury Inflation Protected Securities of comparable maturities. They have fallen from their peaks—for example, the 10 year topped out at 2.56% in mid-May—but rather than calling that the end of reflation bets it should be viewed as a moderation compared to what may have been an unrealistic overshoot of a sustained long-term pace of expected inflation.

US CPI will inch along the path of informing inflation expectations through hard data (Tuesday). The headline year-over-year rate is expected to top out at 4.9% (5.0% prior) but with another notable month-ago gain of about ½%. Key, however, is core inflation and that is expected to continue climbing toward 4% y/y with another 0.4% m/m rise. June is typically a soft month for seasonal price changes in a ‘normal’ year and so we’re left with base effects, gas prices and figuring out supply chain and reopening effects to inform the estimate. One reason that the pace of month-ago increases may ebb compared to the prior two months when core prices were up 0.7% m/m and 0.9% in May and April, respectively, is that used vehicle prices appear to have slightly cooled off (chart 8). Also keep an eye on Wednesday’s final demand producer prices for June in terms of potential pass-through risk from supply chains into CPI.

The UK also updates CPI for June on Wednesday. Core inflation is expected to be little changed from the prior month’s pace of 2% y/y but reopening effects—if the UK stays on track—could continue to exert upward trend pressure on prices over summertime reports.

India (Monday), Sweden (Wednesday), Peru (Thursday) and just for giggles Argentina (Thursday) will also update inflation figures for June.

CHINA’S ECONOMY—NOT GOOD ENOUGH!

China updates readings on Q2 GDP growth and higher-frequency gauges for June over the coming week. GDP lands on Wednesday night (eastern time). This is expected to be another relatively soft reading by China’s standards.

The year-over-year rate is irrelevant in the pandemic environment and so pay attention to the seasonally adjusted and annualized quarter-ago growth rate. In Q1 that rate was just 2.4%. The median consensus estimate is for a gain of about 4.1% in Q2. That would also be treated as inadequate by China’s Communist Party in relation to the growth rates needed in order to raise average living standards. Even with years of strong growth in the past, China still ranks at the bottom of the G20 on a real GDP per capita basis in USD terms at purchasing power parity rates of conversion (chart 9). Growing at present rates while other countries enter strong rebounds would only further harm China’s international ranking on average incomes.

This is likely the overall motivation toward taking modest steps to add stimulus including the cut to required reserve ratios that takes effect on Thursday. Still, China is in this position in part because it resisted going down the same path it has travelled. This time, it has not embraced easing to the degree to which other countries have embraced it, and the country’s inflation-adjusted policy rate is one illustration of this (chart 10). China has so far been reticent to follow the prior playbook in part because of memories of what that did to stability and excesses.

China also updates June readings for retail sales, industrial output, exports and the jobless rate over the first half of the week. I’ll write more about those readings in daily notes over the coming week.

AMERICAN CONSUMERS—MOVING BEYOND AUTOS

The main additional US release will be Friday’s retail sales figures for June. It’s not looking good for this report’s headline number, but a major wild card concerns the reopening effects on the over two-thirds of the spending tally that is difficult to observe in advance. I went with a 1% drop in headline sales and a 1% rise in sales ex-autos.

New auto sales, which carry about a 22% weight, fell by almost 10% m/m for a weighted drag on total sales of about 2%. Higher gas prices might contribute a minor ¼% or so. Retail sales under-represent services spending which is where the bulk of the reopening effects are likely to be concentrated and so it’s doubtful we’ll see much of a services lift in this report. Still, at a minimum, one should probably immediately skip past the headline advance sales number given the supply chain distortions including chip shortages that are expected to continue to impair auto sales for an uncertain period of time.

UK JOBS—ALL EYES FORWARD

Thursday will bring forth several updates on the state of the UK job market. Job growth and the unemployment rate plus wages during May will be updated along with jobless claims during June. The UK has been a slowpoke in terms of relative job market recoveries by comparison to other Anglo-American economies (chart 11). Then again, the UK is “only” just under 600k lower than where employment stood in February 2020 which, scaled to population, remains a milder overall hit than Canada experienced. A further gain is expected in light of ongoing relaxation of restrictions but the forward-looking emphasis is likely to remain upon whether the UK remains on track to end all social distancing requirements by July 19th as planned, given the ongoing rise of the Delta variant.

AUSTRALIA’S JOB MARKET—JUST A BLIP?

Australia updates job growth figures for June on Wednesday. Key is whether momentum can be sustained or if the prior month’s surge was just a technicality. Recall that May saw a gain of 115k following the prior month’s dip that was caused by the end of the Job Keeper wage subsidy. May could have simply been a forced re-entry effect into the job market as a harbinger of what could happen elsewhere in countries like the UK and Canada in a few months. Consensus expects a mild gain.

MINOR ADDITIONAL CANADIAN RELEASES

Canada will update a few relatively minor indicators. Manufacturing sales during May (Wednesday) will probably rise by ~1% m/m based on preliminary guidance from Statistics Canada. Wholesale trade during May (Friday) is expected to rise by ~1.1% m/m. Housing data is more uncertain but solid building permits should keep housing starts elevated around the 275k range (Friday) while most of the reopening effect for existing home sales may lie beyond Thursday’s resale figures for June.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.