- In light of the aggressive monetary policy response needed to curb historically high inflation, markets are increasingly worried about the risk of a recession in Canada. We think the risk of a recession remains low at present, as we expect strong growth this year and next in spite of a forecast 3% policy rate in early 2023.

- In our view, the principal downside risk to the outlook lies in the inflation outlook. Our current forecast is for inflation to average around 6% this year and around 3% next year. Higher inflation would lead to a further erosion of real incomes and require higher interest rates, both negatively affecting growth.

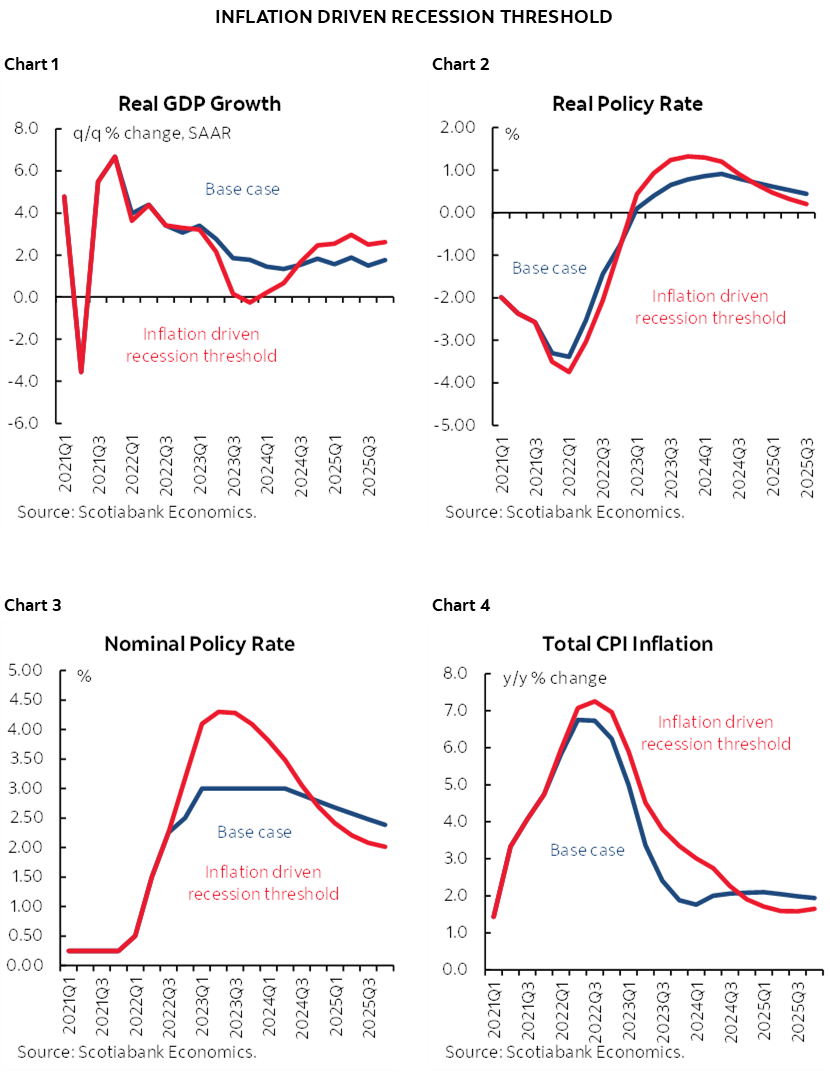

- Using our macroeconometric model, we estimate that inflation of just over 7% in the second half of this year would lead to a monetary policy-induced recession in the second half of 2023 as the Bank of Canada would need to increase their policy rate to 4.25% to return inflation to its 2% target.

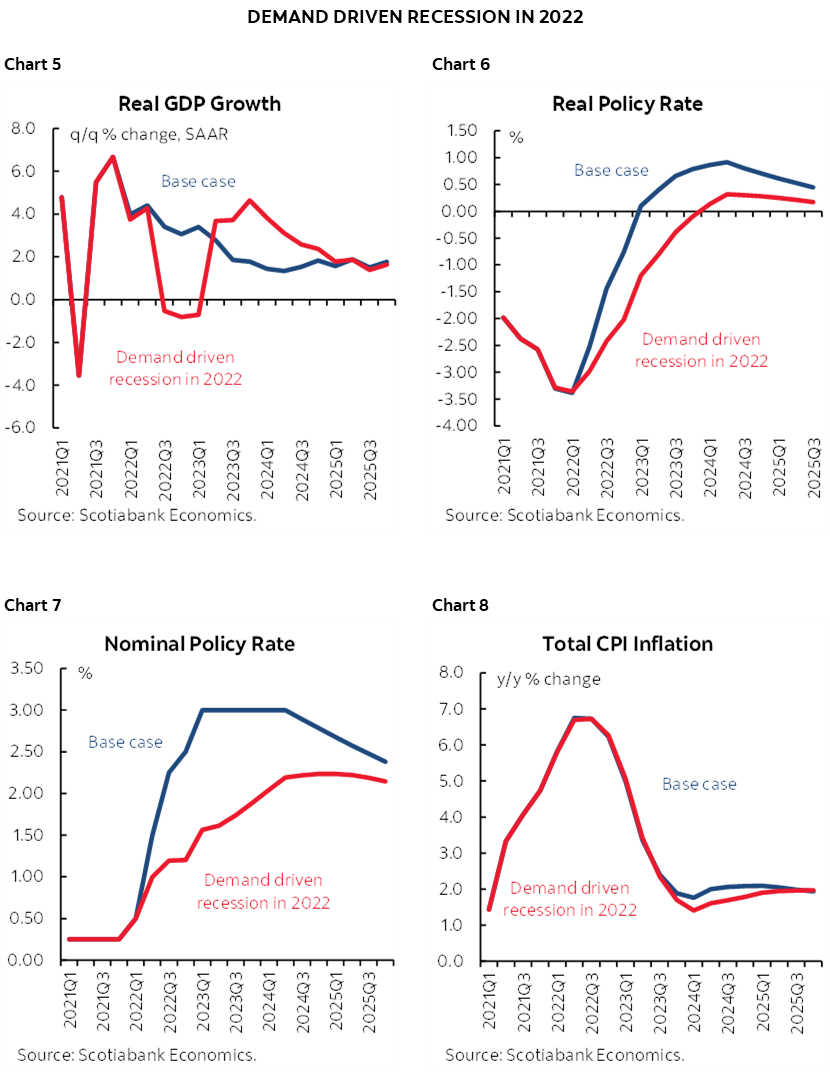

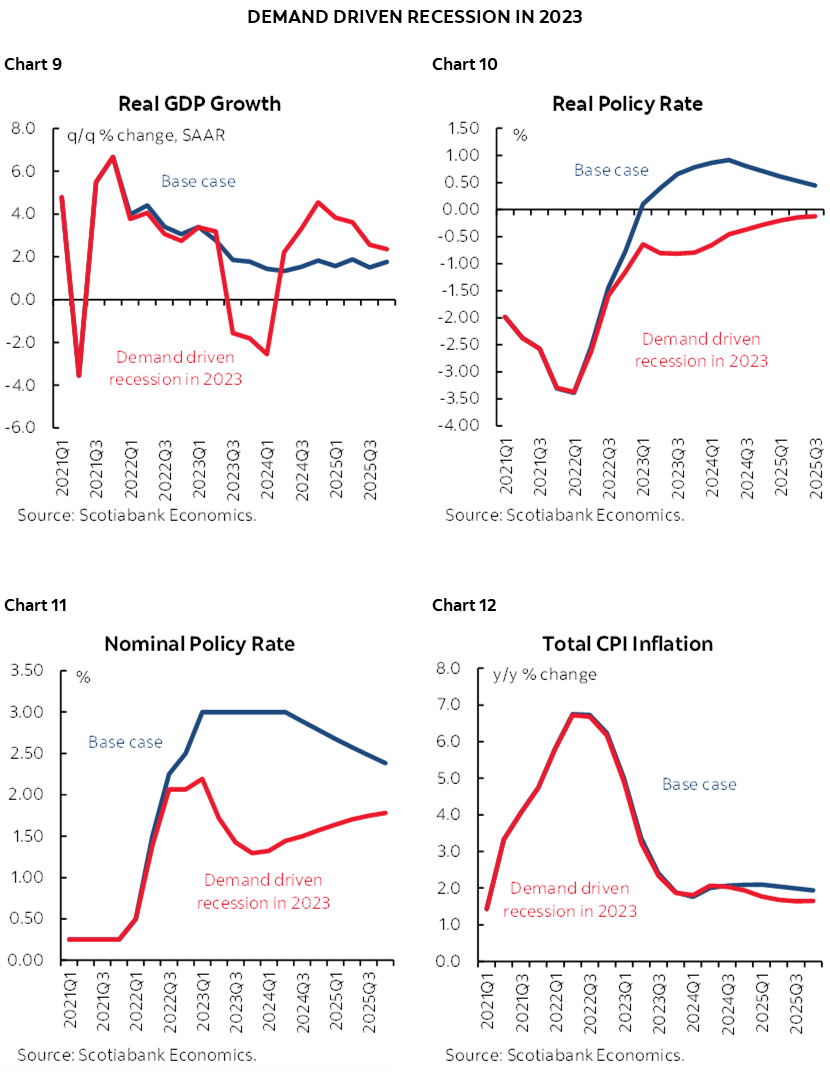

- We also explore the impact of a possible demand-driven recession on the pace of tightening. If the Bank of Canada knew with certainty that a recession would occur in 2023, it would only need to raise its policy rate to 2% by the end of this year and keep it at that level.

The global economic environment has been heavily impacted by the war on Ukraine. That, in conjunction with a repricing of policy rate expectations in some countries, is leading a rising number of analysts to warn of recession risks. We consider these risks to be low in Canada, but additional upside surprises to inflation would change that assessment. At the moment, our recession probability model continues to point to a very low risk of recession in Canada over the next 4 quarters.

The Canadian economy is strong. Fundamentals remain solid, reflected in part by very favourable terms of trade, very high levels of pent-up demand, strong household balance sheets, historically tight labour markets, and still remarkably stimulative policy settings. Reflecting this, the outlook through 2023 is very strong by historical standards. Inflation, on the other hand, is anything but supportive of the outlook. It continues to blow through continuously scaled-up forecasts, and in so doing, is creating uncertainty, reducing purchasing power, and contributing to what is likely to be a rapid normalization of monetary policy in Canada and elsewhere.

Using the Scotiabank Global Macroeconomic Model, we estimate that an additional persistent shock to inflation of about 1% this year would trigger a recession in the second half of 2023.

We also consider what it may take for the BoC to raise interest rates far less than currently forecast. Other than an obvious rapid fall in inflation, a recession resulting from a demand shock, modelled as an amplification of the Ukraine war, would lead to policy rates hitting 2% much more gradually.

QUANTIFYING THE INFLATION/RECESSION THRESHOLD

To find this inflation/recession threshold, we make the following modelling assumptions:

1) Pandemic-related global supply constraints last until 2023-Q3 (a year later than in our baseline forecast).

2) These global supply constraints affect the PMI suppliers’ delivery times index, which is included in our inflation equations, with a larger elasticity than the baseline.

3) Inflation expectations are de-anchored from target—agents base their inflation expectations entirely on inflation’s recent behaviour and expected inflation rather than the 2% target because of the recent persistent deviations from target. Our recent report provides evidence that this is already the case, with inflation expectations already de-anchored as of late 2021 (see here).

4) As a result, central banks, already behind the curve, need to react more strongly to the inflation gap in conducting their monetary policy compared to the baseline.

This leads to a slowdown in economic activity which in turn creates a fall in the stock market and in oil prices—both exacerbate the recession.

The resulting inflation/recession threshold and its impact on economic growth and nominal and real policy rates profiles is shown in Charts 1–4. In Canada, persistent inflation that reaches 7.25% in the second half of this year pushes the nominal monetary policy rate to a peak of between 4% and 4.25% (vs 3% in our baseline forecast) and turns economic growth flat in between 2023-Q3 and 2024-Q1. Inflation that is higher than this threshold would bring about a monetary policy-induced recession in 2023-Q3.

A FURTHER ESCALATION OF THE WAR IN UKRAINE COULD SLOW THE PACE OF TIGHTENING

A recession in 2022, brought about by unforeseen developments on the Russia-Ukraine front, would impact policy rates. This would be a stagflation scenario, with a rise in the price of commodities and increased war-related supply chain constraints, leading to a mild recession in the second half of this year. The recession is calibrated to be a mild one given Canada’s limited exposure to the war and its status as a net commodity exporter that benefits from rising commodity prices.

The resulting growth, inflation, and rates profiles are shown in Charts 5–8. Such a recession would pose a large risk to our policy rate call, despite the stagflationary nature of the shock keeping the inflation profile largely the same as our baseline scenario. With the recession occurring as early as 2022-Q3, the central bank can afford stalling its rate hikes today, which would severely drop the aggressiveness of our forecast monetary policy response. However, policy rates will still have to rise since inflation is also rising. As a result, we have the nominal policy rate in this scenario climbing slowly from 1.0% to only 1.5% by end of 2022, reaching 2% by end of 2023.

Using the same demand shock, we calibrate a recession in 2023. This recession is deeper than the one in the previous section as our baseline growth in 2023 is weaker than in 2022. Charts 9–12 show the impact on our policy rate profiles. The results indicate rates should continue rising today to fight inflationary pressures, just less aggressively. In this scenario, rates reach 2% by end of 2022 before falling in 2023. Therefore, even if the central bank expected a demand-side recession next year, inflationary pressures are too invasive to warrant abandoning monetary tightening.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.