- Material potential upside risks to inflation require continued caution by central banks. We expect the Bank of Canada to hike one more time in 2023, and for rate cuts to be delayed to the second quarter of 2024.

- This move is best seen as insurance against upside surprises to inflation as our model does not indicate a need for an additional hike given our current forecast for the economy and inflation.

- The implied insurance premium of lower output and higher unemployment is the price to pay to guard against the potential impacts of higher inflation. Given the distance between the current and projected levels of inflation in relation to the 2% target, we believe the Bank of Canada does not have the flexibility to go without this insurance.

The resilience of the Canadian economy to the interest rate increases of the past year has made it clear that slightly higher policy rates are needed to achieve the slowdown required to bring inflation back to its 2% target. This is evident in the Bank of Canada’s decision to raise its policy rate in June and leaving the door open for more hikes to come. Indeed, we believe the Bank of Canada will raise interest rates one final time in the third quarter. While our model does not indicate a need for this additional hike, despite economic resiliency and sticky core inflation, we see this as insurance against inflation.

Given material potential upside risks to the inflation outlook, and the outsized costs on households and the economy of such risks materializing, the Bank of Canada is right to put heavy weight on these risks in their policy decisions. Take the housing market for example—recent strength suggests the housing market will no longer act as the drag it has been on economic growth since policy rates started to rise. The Bank of Canada can ill afford for the most rate-sensitive sector in the economy to roar back when they are actively trying to slow growth and inflation. With inflation chronically above its target band, Governor Macklem does not have the luxury to wait and see whether this and other drivers of upside risks to inflation persist.

Taking out insurance has its own costs, however. The additional output and unemployment costs of this insurance is best viewed as the insurance premium needed to guard against a potentially worse economic outcome. In this note, we compare the inflation and economic growth outcomes between a scenario which dictates a rate outlook onto the model and a scenario which lets the model determine the rate outlook.

Chart 1 plots the two different rate paths. The first scenario, consistent with our June 16th forecast, imposes an additional hike in the third quarter of this year, and holds the policy rate at this higher level until the first quarter of next year, before allowing it to slowly decline through 2024. The second scenario allows the model to speak for rates and shows that given our current forecast for the economy and inflation, the model does not view an additional hike as necessary, and sees the policy rate falling faster than in our baseline scenario.

Chart 2 plots the resulting path for economic activity under each scenario. In addition to imposing an additional hike, our June 16th baseline (dashed blue line) incorporates further judgement on GDP growth in line with higher frequency data and recent developments, which results in two consecutive quarters of negative growth in the second half of this year—a technical, mild, recession. Removing this additional judgment on GDP while maintaining the imposed rate path still results in a recession (blue solid line) that is slightly deeper and occurs a quarter later than our June 16th baseline. We compare that scenario with one that allows the model to determine rates without any overlays on our part (red solid line). As evident from chart 2, ending the rate hiking cycle at the current level for the policy rate would allow the economy to avoid a recession later this year. The implication here is that the recession that we are projecting in our baseline forecast is a result of monetary policy tightening rather than underlying economic conditions. This would translate to a 0.5% loss of output.

The compromise on the inflation outlook is shown in table 1—calling it quits without hiking again in the third quarter would result in an inflation rate that is 0.1% higher in 2024 and 2025 than in our baseline scenario. This is consistent with the properties of the Bank of Canada’s DSGE model and their estimate of the impact of a monetary policy shock on inflation.

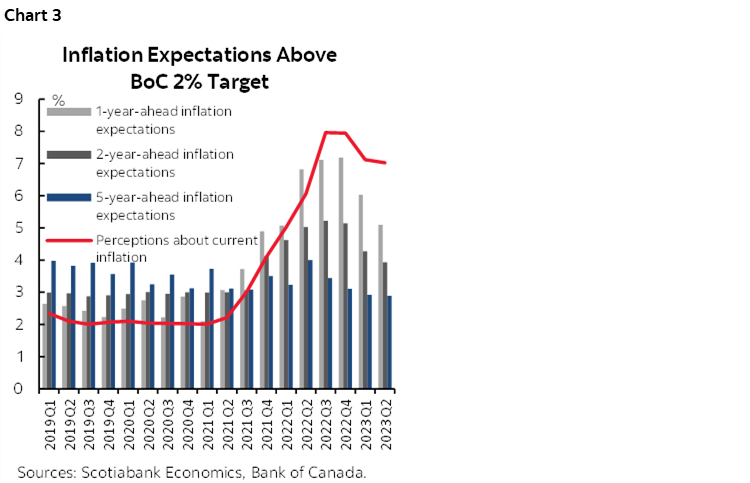

This seemingly desirable outcome, however, whereby the Bank of Canada does not hike again this year, and our economy avoids a recession with a relatively small cost to inflation, is based on our baseline assumptions of slowing inflation in upcoming quarters. It does not account for upside surprises to the inflation outlook. These potential surprises are of dramatically greater policy concern than downside surprises to inflation given the current and projected level of inflation in relation to the BoC’s target and the gap between inflation expectations and the target (chart 3). If inflation accelerates, the BoC risks a decline in credibility and inflation expectations becoming unanchored, necessitating more hikes than is currently baked into our baseline forecast to achieve the needed slowdown to bring inflation back to target. According to our simulations, a further meaningful decline in credibility would imply the policy rate peaking at more than 5.5% compared to 5.0% in our baseline and a policy rate at the end of 2024 that is above 4.5% instead of 3.75%.This would have outsized costs to households who not only need to contend with higher prices but also higher debt payments and less access to new credit to support with these higher expenses, with negative spillovers onto the wider economy.

As such, we believe it necessary for the Bank of Canada to remain cautious in its inflation management and take out insurance against this inflation outcome by hiking again this year and keeping rates higher for longer.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.