CANADA: SUPPORTING DECARBONIZATION BY SMALL AND MEDIUM SIZED ENTERPRISES (SMEs) IS KEY TO MEETING CLIMATE TARGETS.

- SMEs represent 98% of employer businesses, employ 68% of the workforce, and are responsible for 39% of national GHG emissions in Canada.

- SMEs face barriers that impose constraints on their available choices for reducing GHGs, including limited access to capital, insufficient resources for project implementation, and lease agreements.

- These barriers are preventing many SMEs from taking action to reduce GHGs at higher rates, even as market and policy pressures climb.

- Policy, in particular, is creating urgency to act—industry currently pays roughly two thirds of federal fuel charge revenues, and ESG supply chain reporting regulations offer additional incentives.

- Evidence suggests more is needed to support emissions reductions from SMEs, as SMEs receive little from fuel charge revenues, existing policies are disorganized and SME decarbonization is a stated policy for only two provincial governments.

- The dialogue for supporting SMEs needs to shift away from what governments alone should do, and towards creating stronger partnerships between governments, financial institutions, large businesses and civil society that offer better choices for Main Street.

- These partnerships should prioritize bolstering available capital through blended finance tools, capacity development support to help collect and use ESG data, and stronger targeting of upstream and “building footprint” emissions.

SMEs are a big (and diverse) part of the national emissions picture. SMEs represent 97.9% of employer businesses in Canada, employ 67.7% of the labour force, and contributed 50.4% to private sector GDP in 2019. Despite this, there is no official data on their associated greenhouse gas (GHG) emissions. Using data from StatsCan and the Canadian Climate Institute, we estimate that SMEs are responsible for 38.7% of national emissions (equivalent to approximately 261 megatonnes). This means SMEs are responsible for 44.9% of emissions from all businesses across the country, with contributions varying by sector (chart 1). This is a significant percentage of national GHGs that will need to decline to meet emissions reductions objectives.

What is creating pressure for SMEs to reduce their emissions? Same as elsewhere: Markets and policy. Many SMEs are subject to the fuel charge under federal and provincial policies, as they do not surpass the 50Kt/CO2eq annual threshold needed to report under federal or provincial industrial carbon pricing system. Major factors pushing SMEs include disclosure requirements for publicly–traded firms and large emitters. A 2023 Business Development Bank of Canada (BDC) report identified 59% of SMEs that supply large organizations are already required to report their ESG performance, expected to increase to 72% by 2029. Disclosure requirements come from EU Corporate Sustainability Reporting Directives, similar SEC and California measures, and voluntary reporting programs. SMEs who form supply chains make up part of Scope 3 emissions for larger firms, and need to report, or risk clients shifting elsewhere. Another factor is voluntary and mandatory steps to improve building performance from commercial landlords, focused on energy and water usage.

Despite these pressures, many SMEs are not taking steps to reduce GHGs. StatsCan data shows between 61.3–73.3% of businesses with under 100 employees have no current climate commitments, and are not considering setting net–zero goals. Numerous surveys echo this lack of focus. A 2022 survey from the Canadian Manufacturers and Exporters Associated identified that only 11% of small businesses and 17% of medium sized businesses had set targets to reduce their greenhouse gas emissions by 2050. A 2023 survey on net-zero maturity from the Conference Board of Canada also identified that 37% of businesses currently didn’t discuss emissions at all within their business.

Self-identified barriers to reducing GHGs highlight that SMEs may not be able to respond to policy and market pressures as easily as modelling might predict. Data from groups such as the Canadian Federation of Independent Businesses (CFIB) and the Business Development Bank of Canada (BDC) identify a number of business-reported challenges to advancing GHG reduction projects (chart 2). These include lacking capital, insufficient resources to support project implementation, and lease agreement issues (71% of small businesses were tenants as of 2020, limiting the changes they can make to their physical footprints). Many of these challenges are also identified by SMEs as barriers for adopting productivity-enhancing digital solutions, showing that there may be common barriers faced by SMEs in adopting any novel solution. Some barriers, such as a lack of available end-use alternatives, are beyond the control of any single technology-taking SME to resolve. Others, such as a desire to focus on other higher priority issues, may indicate a lack of internal resources available to manage additional priorities.

These barriers should be understood as “optimization constraints” that limit the actions SMEs can take to reduce GHGs. Optimization constraints prevent firms from making choices that offer the highest welfare outcomes (such as reducing their emissions and minimizing how much they pay into the federal fuel charge). In many cases, SMEs who cannot overcome barriers may be unable to act, and have to either absorb higher input costs or pass them onto consumers.

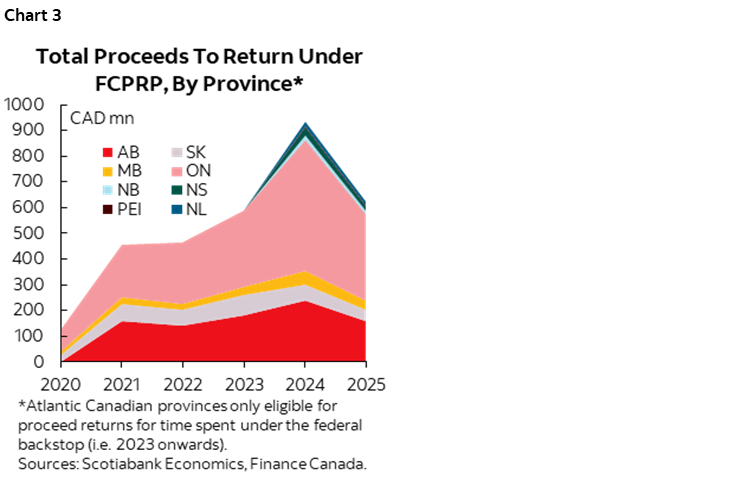

Potentially because of these barriers, there has been discussion around the cost impacts of existing climate policies on SMEs. Both CFIB and the federal Commissioner for the Environment and Sustainable Development (a member of the Auditor General’s Office) have highlighted the fuel charge’s disproportionate impacts on small business, and called for changes. To evaluate these claims, we estimated how much SMEs are paying under the fuel charge versus how much they are set to receive in funding through the federal Fuel Charge Proceeds Return Program (FCPRP). The FCPRP is a revenue return program developed to support SMEs in emissions-intensive and trade-exposed (EITE) sectors in jurisdictions where the federal emissions price applies. Although funds have yet to be distributed, the FCPRP will be scaled back starting in 2024/2025, with the federal government announcing a smaller percentage of revenues raised from the fuel charge would be returned to SMEs in different provinces (chart 3).

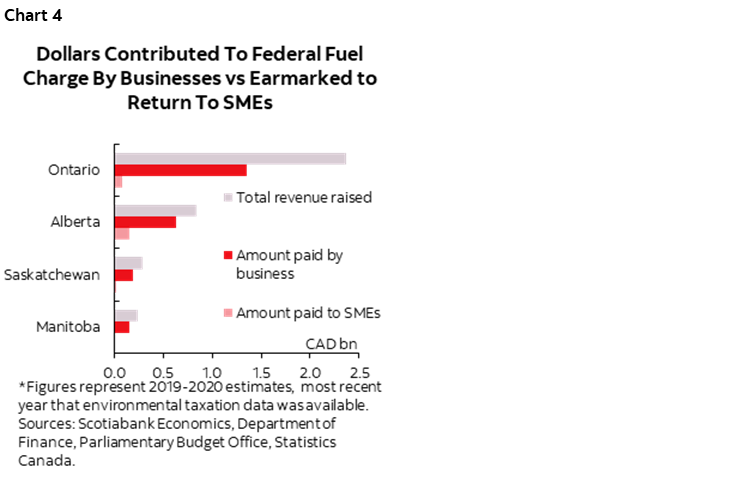

Revenues set to be returned to SMEs would amount to 7.9% of total fuel charge revenues in 2023–2024, but this will decline to 5% from 2024/2025 onwards. Returning 5% of revenues would mean returning approximately $1.25B CAD to SMEs in the year 2030–2031, when the fuel charge will be equal to $170/tonne. This is $723M CAD less than they would have received, had proportions of revenues returned remained unchanged. The amount contributed by industry in each province vs. what will be received in return varies, with the stated 5% goal representing a national figure (chart 4). Overall, industry is contributing roughly 4.8x–9.5x more in fuel charge revenues than SMEs are set to receive back in support through the FCPRP, a gap that is set to grow as revenues returned are scaled back (see methodology for full details on calculations, assumptions and caveats).

Despite this discrepancy and the constraints faced by SMEs in reducing their GHGs, SME decarbonization does not receive significant policy attention. The majority of climate-focussed SME policies are aimed at helping start-ups develop clean technology, rather than helping firms reduce their GHGs. Currently, no federal, provincial or territorial government has a strategy for supporting SME decarbonization, and the challenge is only mentioned in two provincial mandate letters (Nova Scotia and British Columbia). Existing policies are a mix of disconnected, inconsistent approaches that vary by region, sector and eligibility. This lack of focus means it is currently unclear whether SMEs as a whole are on track to meet climate targets, and if they are receiving the help they might require.

There are macro-risks if greater steps are not taken to support emissions reductions by SMEs to reduce their emissions. One is higher credit risk for lenders, as businesses who are unable to pass on higher costs and remain competitive may be at increased risk of closures. Another is policy instability. A policy environment that adversely impacts SMEs could diminish political support for policies that reduce GHGs, thereby raising the chance of changes in policy direction in future elections. That uncertainty creates risk for investors and could lead to further declines in capital investment (as well as a potential failure to meet climate objectives).

There is a need to shift the dialogue about SME decarbonization beyond the impacts of individual policies and use of public dollars. It is clear that SMEs face barriers to reducing emissions, and that they would benefit from greater support. Yet a myopic focus on what governments should or should not do fails to recognize that governments need not act alone. More focus should be dedicated to discussing how all actors can help SMEs overcome the constraints they face to reducing GHGs (ideally at a rate aligned with meeting climate targets), creating better options and driving tangible progress. Increasing the pool of available capital, supporting capacity development and improving data collection and use, are all areas where governments can build partnerships with financial institutions, larger businesses, commercial building managers and civil society groups to achieve results.

Bottom line: The goal is to advance climate action in ways that create better options for Main Street. Three priorities should be advanced to achieve this goal. The first is to focus on reducing emissions from factors external to what SMEs can control: Continue to reduce emissions from the energy that lights, heats and cools buildings, while accelerating greater action from asset and building owners. The second and third are to use novel measures to increase the availability of resources for SMEs looking to act, by leveraging public and private capital, and supporting ESG data collection and use. Governments and lenders should create blended finance tools for SME decarbonization projects, and ensure these tools are flexible enough to support all business types. Special focus should be given reducing emissions in spaces where SMEs physically operate, and lowering the costs of accessing existing government funding programs. Governments and larger businesses should also support outreach and capacity development programs for SMEs undertaking the essential steps needed to advance decarbonization (such as collecting and using performance data around GHG emissions, and assessing ESG performance for supply chain reporting). Advancing these three priorities would improve the options (and resources) available to SMEs facing pressure to act, and ensure the firms responsible 50% of private sector GDP and 45% of business emissions are supported as Canada advances climate action.

Methodology

Forecasting greenhouse gas emissions from SMEs: Data from the emissions intensity database created by the 440 Megatonnes initiative by the Canadian Climate Institute (developed using emissions and input-output data from 2021) was used, and multiplied Scope 1 and 2 national emissions data with the sectoral GDP contribution of SMEs. These contributions were from 2020, the most recent that data was available. It is assumed that the 2021 contribution from SMEs will be similar to 2020 contributions. Analysis excludes embodied emissions that could contribute to their overall emissions footprint through the procurement practices of SMEs, which likely increases this total.

Estimates of costs paid vs revenue returned under fuel charge and FCPRP: Total revenue raised under federal fuel charge was taken from 2020 data (most recent year available) within four backstop jurisdictions from StatsCan Table 36–10–0678–01, with figures for overall totals, and contributions by industry. Data were then compared against proceeds specified by Finance Canada that would returned under FCPRP.

All estimates in nominal terms. Caveats: Figures represent total industry contributions to carbon pricing revenues, not the contributions from SMEs (no public data exists for contributions by business size). FCPRP revenues are not intended to fully compensate all SMEs, only those in emissions-intensive and trade-exposed sectors who could suffer competitiveness impacts. No details on recipients or funding mechanisms have been announced at the time of publication. There is currently no publicly available data on revenues returned to Alberta in 2019–20, so 2020–21 data was used. In other provinces, revenues returned increased by 205%–253% in this one year interval. An estimate that reduced Alberta’s returned revenues by this much would revise revenues returned figures to SMEs in 2020 from 19.1% to 8.1%.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.