WHAT A SLOGAN REVEALS (AND DOES NOT REVEAL) ABOUT NATIONAL QUESTIONS FACING CLIMATE ACTION IN CANADA

- Carbon pricing is in the Canadian spotlight again, due to campaigning and a cost-of-living crunch. Even if most households are left better off through income-tested rebates, discontent has grown.

- Repealing the carbon pricing system (without suitably replacing it) would put Canada off track for reaching climate goals. The policy is currently expected to account for roughly one third of emissions reductions by 2030, with industrial carbon pricing responsible for three quarters of this decline.

- It’s unclear what Canadians might prefer instead of a carbon price, or if broader support for GHG reduction has potentially waned. Any measure to directly replace carbon pricing would almost certainly be more expensive for households and/or taxpayers.

- If no replacement for pricing is implemented, Canadian exports could be at risk of higher costs as border carbon tariffs were adopted by major trading partners. If inaction leads to higher global emissions, it may also worsen damages from climate change.

- The answer for “what comes next” may not be black and white, as balancing emissions reductions with affordability, energy security and other priorities could be possible through creative policy design. Yet any choice will have trade-offs, which should be explicitly identified and communicated.

- Discussions will continue as elections near, but all parties should recognize the challenges policy uncertainty is creating for businesses and investors, irrespective of the policies themselves.

Canada’s upcoming federal election could see changes in climate policy. By the end of 2025, Canadians will vote in an upcoming federal election. This could lead to a change in government, and a subsequent change in federal policies to reduce emissions. Discussion around this shift has focused on one policy change in particular: Repealing the federal carbon pricing system. Rhetoric, in addition to recent policy changes, make it unclear whether the policy will be in fully or partially in place in its current form by the end of next year.

It's not clear where “axe the tax” leaves climate action. The federal carbon price represents a foundational pillar of a climate plan. This plan involved creating a suite of broad-based and sector specific policies to reach two national GHG reduction goals: a 40%–45% reduction in GHGs by 2030, and net-zero emissions by 2050. Yet following the election, Canada may no longer have a carbon price. This would, plainly put, change the plan. If this occurs, deciding what to do next will require answering questions with economic, environmental and political implications. What are the options for replacing the carbon pricing system and still meeting emissions targets? Is a conversation about revisiting climate targets and Canada’s overall approach to climate action on the horizon? Or is a reframed discussion overdue about how to balance environmental priorities and economic realities more explicitly? These questions about national ambitions will need to be answered before a new plan is developed. A clear direction is also needed to reduce broad uncertainty about the future of Canadian climate policies.

BEFORE DIVING INTO “NEXT”, LET’S RECAP “NOW”

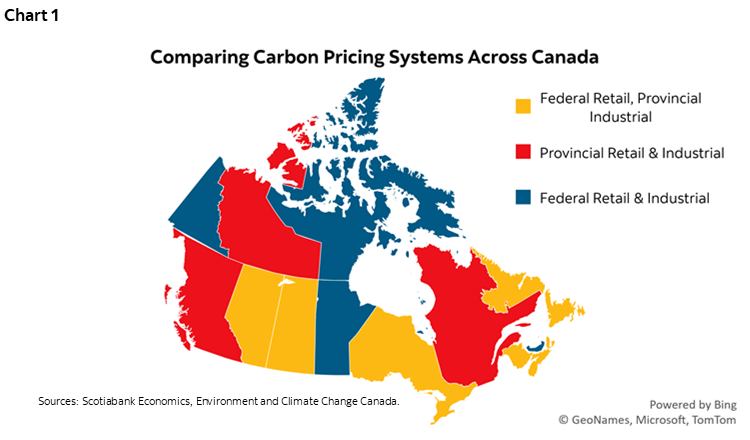

As a reminder of the current climate plan’s design, here’s a refresher on how carbon pricing works in Canada. The federal “carbon tax” is technically two policies. First is a charge paid by fuel distributors based on the carbon content in a given fuel. Distributors then pass these added costs down to consumers. This is known as the retail carbon price. Most of the revenues raised through the retail carbon price are returned to consumers through a cash-transfer program. Second is a separate system for industrial facilities that works somewhat similarly to a cap-and-trade program. A performance threshold is set, and any facility that emits over that threshold has to pay. Facilities who emit under their level can generate credits that can be sold, or used for compliance purposes in years where they emit over the threshold. The industrial pricing system applies only to facilities who emit over 50 KtCO2e/year, although others can opt in if they choose. Legislation underpinning the federal system sets a “benchmark”, meaning it sets a minimum level of stringency. Provinces and territories can choose to adopt one or both parts of the federal system, or create their own version that matches or exceeds the benchmark (currently $80/tonne and set to rise to $170/tonne by 2030). Chart 1 shows where federal and provincial policies currently apply in Canada.

A complicating factor to making changes: Repealing federal carbon pricing legislation does not necessarily mean no more carbon pricing. If the legislation underpinning federal carbon pricing is repealed, then retail and industrial pricing systems would disappear in the provinces where they are currently in place. If both are repealed, the outcome for any one province’s carbon pricing system is unclear. Three paths are possible, and each province/territory could opt for a “choose your own adventure”. Path one would see a province remove their own (federal or provincially-developed) carbon pricing system, and replace it with either an entirely new policy or nothing at all. Path two would see a province develop (or maintain) their own provincial retail and/or industrial pricing system to replace the repealed federal scheme. This could occur in jurisdictions where the federal retail and/or industrial price currently applies. Path three would involve keeping an existing provincial system, but changing the price to whatever level a province sees fit. This last outcome could occur in Alberta, where carbon credits from the province’s industrial pricing system currently represent a revenue source for CCS/CCUS projects supported by the provincial government.

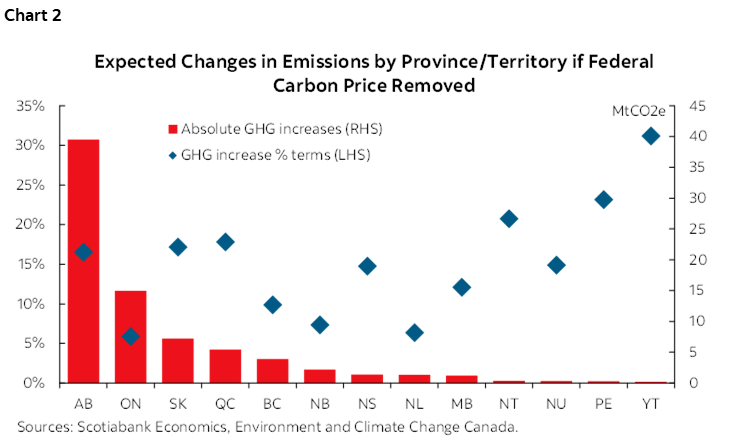

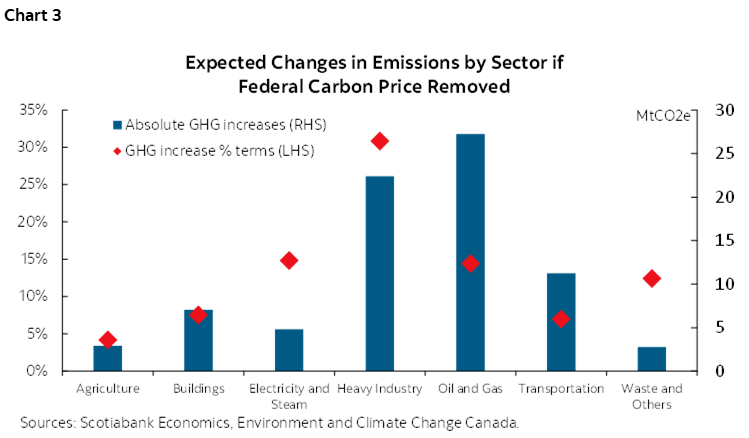

At a minimum, getting rid of the carbon price would mean less progress towards climate goals (if a credible replacement is not implemented). The federal government estimates carbon pricing would account for 78 MtCO2e of emissions reductions by 2030 (roughly equivalent to one third of federal reductions under current and planned policies). The Canadian Climate Institute estimates industrial pricing system could contribute roughly three quarters of pricing's GHG reductions. It is fair to assume that this volume of emissions could go unabated if a repeal occurred and no replacement was implemented. Environment and Climate Change Canada projects total national emissions in 2030 could be 12% higher relative to pricing remaining in place. Repeal would see higher emissions from every sector and province in Canada by the end of the decade than current pathways project (chart 2 and chart 3). This lack of emissions reductions could also increase the costs of climate-related damages by approximately $23B globally. Additionally, were no credible replacement put in place, it is less likely Canada would meet its 2030 climate target, and it would create challenges in reaching net-zero goals.

QUESTION #1: DOES CANADA WANT TO KEEP ITS GOALS, BUT CHANGE HOW THEY ARE REACHED?

If Canada still wants to reduce its emissions in line with meeting climate targets, every alternative would likely be more expensive. Here, there are a range of sub-optimal options. The first is that Canada could do “all carrot, no stick”, offering consumer and industrial incentives in lieu of regulatory or pricing measures. These can have benefits, but at incredibly high costs. An Auditor General report found the Strategic Innovation Fund’s Net-Zero Accelerator (a federal grant program) has reduced emissions at a cost of $523/tonne across its project, while a separate third-party analysis estimated consumer subsidies for ZEVs have cost $355–$964/tonne. The incidence of these costs matter, particularly in a political discussion, but the risk is spending more for a worse outcome. For example, analysis indicates the US (where this approach is being pursued) has reduced emissions but is currently not on track to meet climate goals, despite spending from the Inflation Reduction Act. Another sub-optimal option is creating a “different stick”. This could take the form of a series of flexible emissions standards imposed on different sectors, an already commonly used policy (ex. US fuel economy standards, EU’s renewable portfolio standards). This option would reduce emissions, but the Ecofiscal Commission details that sector-specific regulations would reduce GDP growth more than carbon pricing, impose a similar cost incidence, and have limited flexibility to offset additional costs without creating new subsidies.

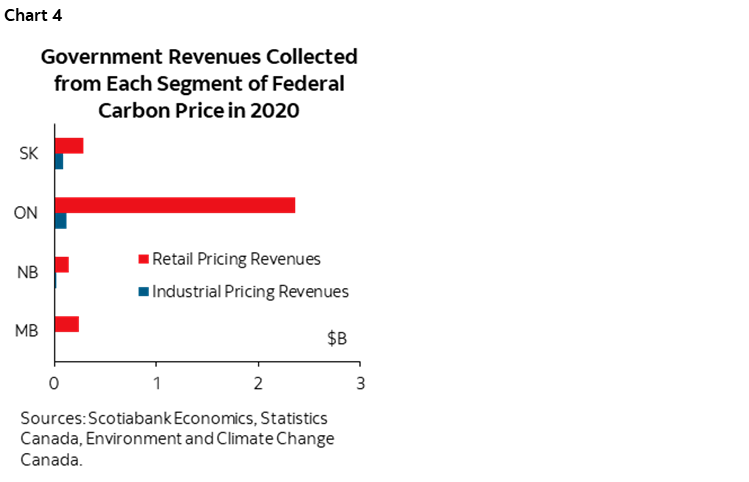

Opting for approaches to emissions reductions that reduces costs on households (such as keeping industrial pricing, but repealing retail pricing) would not fully shield consumers. If this approach is pursued, two impacts are likely. First, indirect costs from industrial GHG reduction policies would likely continue to be passed through. Second, the removal of rebates funded through retail pricing would likely lead to worse fiscal outcomes for most households. One potential way around this would be to create a household rebate program using revenues from the current industrial pricing scheme, but sums from available proceeds would be far smaller than current revenues. In 2022, industrial pricing revenues were only 3% of total carbon pricing revenues in Manitoba, 5% in Ontario, 12% in New Brunswick and 32% in Saskatchewan (chart 4). Assuming rebates were returned to their province of origin, this would equate to smaller household rebates (along with the elimination of existing industrial support programs where this revenue is currently directed), or require supplementing with additional fiscal resources.

QUESTION #2: DOES THE COUNTRY WANT TO REVISIT ITS GOALS?

The world has changed since the most recent climate targets were set. Canada’s most recent climate goals were announced in 2020. Since then, geopolitics, inflation and interest rate hikes, continued declines in home price affordability, and negative headlines have all contributed to a dampened economic mood. These factors have coincided with changes in preferences expressed through polling. Multiple polls now indicate that while overall levels of support for climate action remain high, the number of individuals who believe governments should push ahead with climate action today vs. scaling back environmental initiatives is now roughly equal (a shift from recent years when “climate action now” was more popular). It may be that these factors have combined to reduce the appetite for ambitious domestic emissions reductions, at least among some households. A priority shift along these lines could renew interest in a conversation about Canada’s overall approach to fighting climate action. Were this true, it should be acknowledged that recent declines in inflation, along with interest rate cuts, may potentially reverse the shift in perspectives back towards increased enthusiasm for GHG reductions in future.

Sentiment shifts might see the “Canada is only 1.5% of global GHGs” narrative gain traction. This belief would support an approach to climate action that de-emphasizes domestic emissions reductions, focusing instead on selling things other countries can buy to reduce their GHGs. The federal Conservative party appears to have leaned into this idea in campaigning thus far, with literature, statements and speeches favourably discussing production and investment opportunities and criticizing measures to reduce emissions domestically. This approach would be roughly similar to that of the current Ontario government, who have removed decarbonization policies while offering subsidies for EV manufacturing and production. Under this approach, Canada would rely on other countries maintaining their emissions reduction policies to generate sufficient demand for these exports. Demand may still exist in the absence of broader policies, but it will likely be lower overall, and slower to develop.

That would make Canada a free rider, which is not the same thing as getting a free lunch. Free ridership would make Canada susceptible to incurring punitive economic costs through other countries’ border carbon adjustment schemes. Border carbon adjustments are measures applied at the border to compensate for differences in climate policy stringency between an importer and an exporter. They can raise the price of imports through tariffs, taxes or charges, set by calculating the difference in carbon costs between two countries, or offer subsidies to domestic producers. Countries that make up export destinations for roughly 80% of Canadian trade are currently implementing border carbon adjustments or considering their implementation, illustrating a material risk. Failing to reduce emissions domestically in the near-term may also cause Canada to lose out on domestic innovation and investment into emerging sectors, given the importance of learning-by-doing and technology adoption in advancing innovation.

A “pay less today” approach is potentially implicitly a “pay more tomorrow” approach. The Canadian Climate Institute estimates a higher emissions future could nearly double Canadian household income losses from climate-related impacts by the end of the century, and GDP could be 12% lower relative to lower-emissions scenarios. A move to avoid the costs of decarbonization today would therefore still see economic trade-offs (particularly if this approach is pursued but emissions still increase globally), albeit through impacts that will take longer to realize.

QUESTION #3: WERE QUESTIONS 1 AND 2 THE RIGHT QUESTIONS?

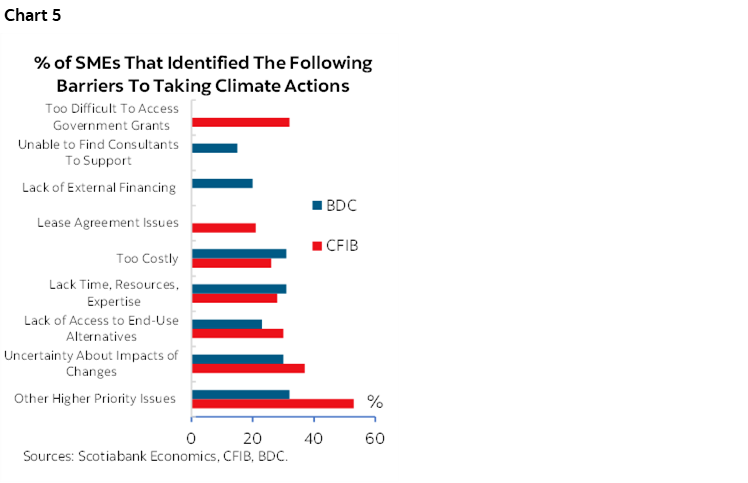

A focus on targets and cost-effectiveness may be ignoring more practical frustrations. For example, a frustration about limited choices available for reducing GHGs (and getting out of paying the carbon price) could be material. After all, the GHG reducing impacts of individual behavior changes are limited by publicly owned energy infrastructure and broader system constraints. Previous analysis from Scotiabank Economics identified non-market barriers, such as those faced by SMEs (chart 5), can create a cycle where climate policies raise costs without making GHG-reducing projects more feasible. Tackling this challenge would entail major investments in electrification and infrastructure to mitigate these constraints, as well as capacity development and outreach. These are sound ideas, but they are outcomes worth targeting, not policies in and of themselves. Selecting policies requires considering how much this could cost and how best to pay for it, restarting the conversation posed under Question #1 (these same questions apply to the campaign slogan of “technology, not taxes”).

Inflexibility appears to be an unpopular design feature for climate plans. Sentiment shifts and polling detailed above could highlight a potential perception issue. Despite carbon pricing’s limited contribution to declining affordability, it is possible that the policy (and climate policy more generally) is seen as insensitive to broader economic conditions, and creating policies whose stringency fluctuates based on economic conditions could be popular. In this case, changes to policy design could help address this desire to balance competing priorities. For example, increases in the level of a carbon price could be made contingent on broader economic conditions (i.e. it only goes up when growth goes up or inflation goes down relative to the previous year). However, a policy that does two things may not necessarily do either one particularly effectively or efficiently. It may also create other challenges, given the importance of reducing uncertainty for businesses and investors factoring climate policy into decision-making. The trade-offs offered by any such ideas should be explored in detail before adoption.

THINGS DO NOT CHANGE, WE CHANGE

After the election, what then? Canada’s overall approach to fighting climate change is a policy decision for a future elected government. However, the backdrop for this decision is different than a decade ago. Clean energy spending now outpaces fossil fuel investment globally, climate change’s impacts have worsened, and apathy is no longer the dominant mood guiding this conversation. The desires of Canadians have evidently shifted as well, and determining the path forward requires better understanding what they want to see next. As an election approaches, before robust game plans are developed, parties vying to form the next government should verify which goals and priorities Canadians want to endorse.

To close, Canada needs a better approach to making decisions about climate policy. The current highly politicized model is one where any change in government results in an almost complete dismantling of existing measures, followed by their partial or wholesale replacement with new policies. Creating this degree of uncertainty every federal and provincial election cycle can slow investment and worsen the broader business environment. A climate compromise, wherein all parties agree to a path forward to balancing economic and environmental objectives, will be required. This approach may be less satisfying than taking an axe to a predecessor’s legacy whenever one wins, but it represents a pragmatic approach over the long run.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.