- A global semiconductor shortage is adversely affecting a large variety of industries, highlighting chips’ strategic importance to countries worldwide.

- Several simultaneous events contributed to the shortage; the crunch is set to continue in the medium-term with some easing expected over the course of 2022.

- Asia is a key link in the semiconductor supply chain, yet geopolitics add to the chip industry’s uncertainties.

- Increased investment in chip production capacity globally will do little to alleviate the current shortage due to long project times.

- The semiconductor shortage is set to push up inflation until supply catches up with demand; we expect semiconductor-related price pressures to peak before mid-2022. Simultaneously, the impacts of the shortage are distorting economic output as activity is shifted out.

- The impact on the auto sector provides an illustrative example of why bottlenecks will take time to unwind with knock-on effects for the economy and inflation.

GLOBAL CHIP SHORTAGE—WHAT AND WHY?

The ongoing global shortage of semiconductors has spread to a variety of industries, from cars to consumer electronics and home appliances. Given the importance of chips in today’s manufacturing, the shortage has highlighted vulnerabilities of many firms, sectors, and economies that arise from integrated trade links and lack of supply chain diversification. This has prompted policy interventions globally to increase investment in the semiconductor sector in order to raise capacity and improve countries’ self-sufficiency. Supply chain issues are also triggering concerns regarding global manufacturing prospects and inflationary impacts for the remainder of the year and into 2022. This report aims to shed some light on the reasons for the semiconductor shortage and its expected impacts, and study the implications for the auto sector in particular.

Most semiconductors are integrated circuits, or “chips”, and are the brains of modern electronics; because of semiconductors, electronics products are able to process, transfer, and store data. Their applications are numerous in such areas as transportation, computing, communication, defense, medical devices, clean energy, artificial intelligence, quantum computing and advanced wireless networks. The semiconductor industry has grown rapidly in recent decades; global semiconductor sales totalled USD 440 billion in 2020 (chart 1). Networking & communications and data processing together accounted for around two thirds of the semiconductor market share by applications, followed by consumer electronics and the auto sector (chart 2).

The World Semiconductor Trade Statistics (WSTS) forecasts the market to grow by about 25% and 10% in 2021 and 2022, respectively, reaching a market size of USD 606 billion. Indeed, year-to-date data show that semiconductor chip production and sales continue to strengthen. Semiconductor sales were up by 29% y/y in July (and 2.1% m/m), according to the Semiconductor Industry Association (SIA), with American production continuing to accelerate through August (chart 3).

The acute global shortage of semiconductors is a result of several simultaneous events. First, the pandemic triggered an unprecedented surge in demand for computers and other work-from-home devices as well as for home entertainment electronics. Computer-related chip demand, for example, surged by over 20% y/y in 2020. Second, chip producers had been running close to maximum capacity already before the pandemic, limiting their ability to respond to rising demand. Due to the long and complex manufacturing process, ramping up capacity is not a quick solution but a multi-year process. Third, the automotive industry, which scaled back its chip orders significantly at the early stages of the pandemic, was taken by surprise on how quickly car sales rebounded, which further contributed to the shortage. Fourth, tensions between the US and China as well as the roll-out of 5G networks had translated to stockpiling of semiconductors by their end-users. Finally, unforeseen disasters, such as a severe weather event in Texas and resultant power outages, as well as a fire in a Japanese plant have exacerbated the shortage.

SEMICONDUCTOR SUPPLY CHAIN RELIES HEAVILY ON ASIAN LINKS

The semiconductor industry is highly globalized with deeply integrated supply chains. While the US leads the world in chip design, North Asian countries dominate semiconductor production, accounting for over 70% of global manufacturing (as of 2019), led by China (35%), Taiwan (15%), South Korea (12%), and Japan (9%); the US and Europe account for 19% and 10% of global chip manufacturing, respectively. Once domestic use is stripped out and focus is on the global supply chain, China’s dominance is reduced; Taiwan is the largest exporter of semiconductors globally, accounting for 19% of shipments (chart 4), leaving China in second place (18%), yet likely only for the time being. While China has continued to increase its exporters’ market share, the US-China dispute has simultaneously impacted Asian semiconductor production dynamics and we expect the trend to continue. The United States’ import tariffs on Chinese goods have prompted manufacturers to shift some production from China to the rest of Asia, cementing its role as the global manufacturing hub. The Regional Comprehensive Economic Partnership (RCEP)—the world’s largest trade pact that is in the process of being ratified by its 15 signatories in Asia-Pacific—will reduce the region’s tariffs and harmonize the rules of origin, deepening the regional supply chains further.

Like the supply side, semiconductor demand is highly global as well. Based on the location of the end-users that purchase the devices, the US, China and Europe are the main chip consumers with relatively even shares; they account for 25%, 24% and 20% of global demand, respectively. Given China’s expected economic growth outperformance over the coming years, combined with the rising role of the Chinese consumer and the government’s technology-focused industrial policy, we assess that semiconductor demand growth in China is set to outpace the rest of the world in the foreseeable future, increasing China’s share of global demand notably.

GEOPOLITICS RISK CORRODING SOME LINKS IN THE SUPPLY CHAIN

The persistent US-China conflict that is heavily focusing on technology adds to the semiconductor industry’s uncertainties, particularly as the US has recently strengthened its relationship with Taiwan. While Taiwan is the largest semiconductor exporter globally, it is also a producer of the most advanced chips, highlighting Taiwan’s importance in the global supply chain. While we note that China’s geopolitical ambitions regarding Taiwan pose a risk to the industry, we expect status quo in the cross-Strait relations over the foreseeable future.

Simultaneously, lack of transparency in China’s technology goals and in its security standards have raised concerns about China’s rising global power. For instance, the Quad—consisting of the US, Japan, India and Australia—has agreed to increase cooperation to improve the safety of the group’s semiconductor supply chains, partially on national security grounds. As the shortage has exposed supply chain vulnerabilities around the world, we expect more countries to add semiconductor security to their policy agendas, particularly as the rollout of 5G networks progresses.

AUTO SECTOR EXEMPLIFIES THE CHALLENGES

The impacts of semiconductor shortages on the auto sector have been highest profile. In addition to factors affecting broad chip supply, there are also factors unique to the auto sector. For one, the sector has embraced just-in-time supply chain practices for several decades now, generally maintaining very low inventories relative to other manufacturing sectors. Chipmakers had reportedly borne more demand risk on auto chip orders relative to other sectors (though terms of such contracts are confidential, hence difficult to substantiate). There is also a high concentration of production of microcontroller units (MCUs), a common semiconductor chip used in auto production (chart 5).

An overly pessimistic outlook for auto sales in early stages of the pandemic also played into the shortage. According to WSTS, automakers had cut chip orders by over 30% y/y in the worst months of the pandemic when the sales outlook appeared dire (chart 6). Automakers right-sized their order books relatively quickly as the strength of the auto sales recovery became apparent, but meanwhile delivery times stretched out from ~3 months pre-pandemic to 9+ months. Factoring in these delivery lags, it is not surprising that the acute shortage became biting by early 2021. Global sales had already attained pre-crisis levels, as chip orders—trimmed by nearly a third—were arriving.

Pandemic and other idiosyncratic factors have continued to pummel auto-related chip production over the course of 2021. In the first half of the year, the Texas ice storm affecting several chip facilities and the fire at Japan’s Renesas plant exacerbated the supply imbalance. Just as these disruptions were showing signs of stabilization this summer, the Delta variant necessitated lockdowns in Malaysia (which produces about 13% of global MCUs). Production is not expected to resume normal operations until later in October at which point the backlog will be almost 3 months.

The impact on auto production has been felt around the world. Global production had initially rebounded modestly above pre-pandemic levels by the fall of 2020, owing mostly to the earlier and weaker dip in Asian production, but still finished the year with a -16% y/y contraction (and with 2 mn fewer vehicles produced relative to sales). But a deceleration in North American production was already underway by the end of 2020 as American automakers reportedly maintained lower inventory than, for example, Japanese automakers that had built higher provisions following the 2011 tsunami. However, the latest round of set-backs in South Asian chip production has taken a toll across all regions. While global production data is lagged, it likely sits roughly 90% below pre-pandemic levels currently (chart 7).

Forecasters are busy revising down the outlook for the remainder of the year as the global production-to-sales deficit grows. By the end of the first quarter of 2021 (latest available data), sales already exceeded production (chart 8). The gap is expected to have sunk deeper into negative territory in the second and third quarters of the year. IHS Markit has recently revised down its global production forecast by 5 mn units for 2021 (on top of earlier haircuts). More curtailments can be expected in the coming weeks and months. AutoForecast Solutions, which applies judgement to publicly-stated plans, currently projects 10 mn fewer vehicles will be produced worldwide in 2021 (chart 9).

The impact of the shortage is most visible on dealer lots. Inventory levels as a share of sales in the US fell below one for the first time ever in May and have shown little sign of turn-around since then (it averaged 2.5 in the decade prior to the pandemic). This is near-universal in major auto markets. China’s Vehicle Inventory Alert Index sits well into contractionary territory even though its government has not provided nearly the same levels of stimulatory policy response as the US (chart 10).

These shortages have put the brakes on sales. Global purchases pulled back sharply again in August by -8% m/m (sa), in a broad-based contraction that saw American sales plunge by -11% m/m and Chinese sales by -7% m/m. This was a fourth consecutive month of global sales contractions. Annualised sales rate globally stood at a paltry 61.5 mn units in August (versus 69.5 mn ytd saar and 2019 annual sales of 75 mn). September auto sales in the US have since contracted by another -7% m/m to a mere 12.2 mn saar units.

Substantial pent-up demand is growing. In North America alone unmet demand by the end of the year could be in the order of 2 mn units, and likely closer to 10 mn globally by the end of 2021. This would be pushed into 2022 where new auto demand—based on economic fundamentals—should already be close to, if not higher than, pre-pandemic levels. The sector would push up against production capacity working at historic utilization rates even before accounting for this pent-up demand suggesting more balanced market conditions would exist only into 2023—and this is predicated on an assumption that auto production starts normalising in the fourth quarter of this year (discussed in more detail here).

INCREASED INVESTMENT TO THE RESCUE?

The global shortage has pushed the semiconductor industry to boost capital expenditure in order to increase production capacity; however, such efforts will do little to alleviate the current shortage. The production of semiconductors requires both specialized know-how and scale, making it one of the most capital- and R&D-intensive manufacturing processes. While capital investment supports economic activity both in the short- and longer-term, we note that the pickup in investment will mostly impact the future supply and demand balance; in fact, it may take years before new capacity comes on stream.

Simultaneously, governments around the world have highlighted the sector’s strategic importance and introduced national industrial policies to achieve stronger domestic production capabilities. In March 2021, the European Union announced the “2030 Digital Compass Initiative”, which encompasses around USD 20–35 billion in total incentives for the next 10 years. In May, South Korea’s “K-Belt Semiconductor Strategy” was unveiled, which will provide investment incentives totalling USD 55–65 billion for the next three years, according to estimates by the SIA. Meanwhile, China’s 14th Five Year Plan, covering years 2021–2025, has a heavy focus on technology, aiming to make China self-sufficient in chip production. Total Chinese investments are projected to amount to around USD 150 billion for the next 10 years. In the US, the semiconductor sector has yet to digest a USD 52 billion investment by US President Biden, along with strategic talks around supply with Japan and South Korea. Other similar investment incentives have been announced around the world and the trend will likely continue over the coming quarters. While we acknowledge the strategic significance of semiconductors and the pressure on governments to act, we also point out that the semiconductor industry is highly cyclical with the most recent glut experienced in 2019. Government intervention—which typically does not represent the most effective resource allocation—may lead to even stronger swings over the coming years if it leads to overdevelopment now and larger supply and demand imbalances in the future.

CHIP SHORTAGE WILL CONTRIBUTE TO HIGHER INFLATION

For the time being, price pressures in the semiconductor and electronic product manufacturing industries remain contained. In the US, year-over-year price gains in the semiconductor and other electronic component manufacturing industry are about to turn positive after a notable slump over the past 18 months, while producer prices for computer and electronic product manufacturers are already above year-ago levels, and continue to climb (chart 11). As demand will continue to exceed supply over the coming months, prices are expected to adjust upward despite a recent softening (chart 12). Taiwan’s TSMC, for instance, has already advised its clients that it will increase prices by 10–20%, effective in 2022. As electronics product manufacturers enjoy higher pricing power due to strong demand, it seems likely that some of the higher input costs will get passed over to end-users.

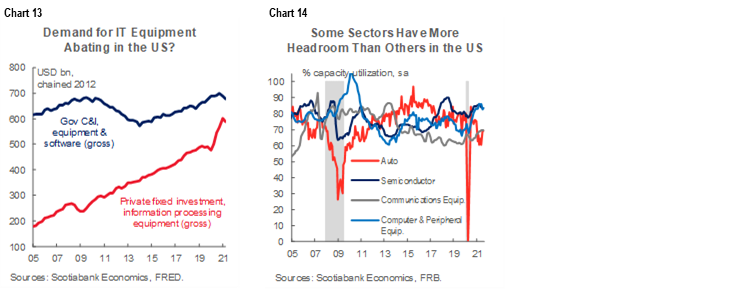

Nevertheless, we highlight that such price increases are unlikely to directly translate to broad-based inflationary pressures. Electronics, for instance, account for a small share of consumption baskets globally; in the US, the information technology hardware share is 0.4% of the Consumer Price Index. We are also starting to see signs of abatement of demand—though still elevated—in some chip-intense industries that received temporary boosts from remote-work such as IT equipment in the US where both government and private investment started softening earlier this year (chart 13). Nonetheless, we assess that the chip shortage will likely boost near-term inflationary pressures in a variety of product categories until supply increases on the back of easing capacity constraints and demand normalizes as pandemic-related temporary factors start fading away. While chip-intensive sectors in the US have variable headroom with respect to capacity utilisation, chip potential is the binding constraint, as we have witnessed in the auto sector (chart 14).

Dynamics in the auto sector illustrate the sectoral inflationary pressures. Supply factors have driven extraordinary price gains in new and used vehicles in most major markets (limited supply in new inventory has seriously impacted used supply). According to Black Book, used vehicle retail prices sit 25% above prices at the start of the year alone in the US. Manufacturers are feeling this through producer price increases; for example, motor vehicle costs continue to be an important driver behind the increases in the US Producer Price Index. This is translating into higher consumer prices with inflation prints around the world reflecting higher vehicle pricing (chart 15). At a not-immaterial share of most CPI baskets (7% in the US, for example), these dynamics will continue to impact inflation until bottlenecks are unwound.

Another consideration for the price outlook is the ongoing surge in COVID-19 cases in Asia, particularly in ASEAN—a group of ten Southeast Asian countries—where vaccinations against COVID-19 remain at low levels in certain countries. Lockdowns and factory closures across the region that is deeply integrated into the global electronics supply chains will add to the near-term supply bottlenecks and price pressures. The region has become an increasingly important provider of semiconductors to the US and Canada in recent years, partially reflecting the US-China conflict; in 2020, ASEAN supplied 59% and 36% of the US’s and Canada’s chip imports, respectively, up from 2018 when the corresponding shares were 34% and 28% (chart 16).

While the chip shortage’s inflationary impact is expected to prove transitory, we note that “transitory” in this case will likely mean several quarters. We expect the demand-supply balance to start normalizing in the first half of 2022; accordingly, we foresee the chip shortage and its inflationary implications to become less acute issues over the course of next year; in fact, we estimate that semiconductor-related price pressures will peak before mid-2022. Nevertheless, the forecast is subject to considerable uncertainties. Moreover, potential structural changes including onshoring of supply chains could add to pressures over the medium term, while growing production capacity over the next couple of years may ultimately lead to excess supply and downward price pressures.

KNOCK-ON EFFECTS FOR OUTPUT

The impacts of the chip shortage are also distorting economic output as activity is shifted out. While the global semiconductor industry is valued at USD440 billion—just a fraction (0.5%) of global economic output at USD88 trillion—the knock-on effects have been (or could be) outsized depending on the sector, geography, and the persistence (or structural component) of the shortages. For example, the SIA, along with Oxford Economics, estimates that the broader impact of chip production on American output is almost 4.5 times that of the direct impact of chip production. Namely, it scales up USD55.8 billion in direct US chip production by another USD98.6 billion for indirect (supply chain) effects, as well as another USD92 billion induced effects (wage spending) for a total contribution of USD246.4 billion in 2020 (or about 1.2% of US GDP).

Material impacts on the auto sector are already being incorporated into country outlooks as the auto production recovery remains elusive. The IMF has valued the sector’s gross output (i.e., the sum of its value added and intermediate consumption) at about 5.7% of global output. A shortfall in global auto production of 8–10 mn units in 2021 would represent over 10% of earlier forecasts. A 10% hit to auto production and its supply chains alone would dampen the global rebound by 0.5 ppts in 2021. (This is a ‘muted rebound’ as opposed to a contraction given auto production was similarly depressed in 2020.)

Larger effects may yet lie ahead. The computer and communications (i.e., cellphones) industries currently consume a combined 63% of global semiconductors by end-use versus 11% for the auto sector. Big players, so far, have navigated the chip shortage relatively well, owing in part to higher inventory stocking, stable orderbooks during the initial phases of the pandemic, and better leverage with supply chains despite high pandemic-induced demand distinct to these sectors. Earnings in these sectors have generally been robust (if not record-setting) through the second quarter of the (calendar) year, but most major players have signaled concerns for the quarter(s) ahead. Apple, Microsoft and Samsung are just a few names that called out the chip shortage in recent earnings calls.

The math could add up if these sectors are hit materially in quarters ahead. Using SIA’s scaling factor at the global level for illustrative purposes, about USD2 trillion (or over 2%) of global GDP would be ‘at risk’. For example, a 10% contraction (or more likely, in these other sectors, unmet demand in the order of 10%) would amount to 0.2% of global GDP with concentration in both producer- and consumer-intensive economies. But this scaling factor may miss the ‘linchpin’ effects that are unfolding in the auto sector. The Groupe Spécial Mobile Association (GSMA) estimates mobile technologies and services generated 5.1% of global GDP in 2020, while estimates for the global IT industry are roughly comparable.

While it may be premature to start revising down forecasts just yet, it would also be premature to write off these risks to the outlook. At least in the American context, production capacity does not offer much buffer against continued strength in demand. Whereas capacity utilization has tended to ebb and flow with the economic cycle, the retreat in this downturn has been minimal opening up very little headroom to accommodate unusually strong demand over the near term. In this context, the WSTS forecasts for global semiconductor growth of 25% and 10% in 2021 and 2022, respectively, increasingly looks like a lost opportunity.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.