A DOUBLING OF SOCIAL HOUSING STOCK COULD HELP THOSE IN GREATEST NEED

- Home prices are cooling in an elevated interest rate environment in Canada, but housing affordability remains elusive. Imbalances persist across the housing continuum as a result of pervasive policy coordination failures.

- Fixing the broader housing supply issue remains an imperative and is still the first-best option. Signs that we are on this path are not promising. The recent uptick in housing starts is welcome but insufficient to restore affordability.

- For most Canadians, rising shelter costs will come at a hefty opportunity cost. For low income Canadians, it represents an impossible dilemma. Market-priced housing will likely never be affordable for a serious share of households—and easily those in the lowest income quintile—based on current trajectories (chart 1).

- Over 10% of Canadian households (or 1.5 mn) were in ‘core housing need’ according to the 2021 census. By definition, they have nowhere else to go in the marketplace. Another near-quarter of a million Canadians are homeless.

- The infrastructure to support these most vulnerable Canadians is stark: Canada’s stock of social housing represents just 3.5% (655 k) of its total housing stock, while wait-lists are years long. The moral case to urgently build out Canada’s anemic stock of social housing has never been stronger.

- The economic case is equally compelling. Governments are attempting to alleviate the strain on lower income households with a host of transfers, but the cost to do so will continue to escalate as shelter costs rise, market income provides little offset, and policy failures persist.

- A modest start would be doubling Canada’s stock of social housing to bring it in line with peers in the context of a coherent and well-resourced strategy (chart 2). This would not plug the gap, but it would be a start.

- Such an approach may be more responsive to the needs of Canada’s most vulnerable households and more cost-efficient for governments in the long run.

NO PLACE LIKE HOME

The national housing crisis is well-established. Burgeoning demand against lacklustre growth in supply has driven prices up over time. Scotia Economics elevated the dialogue on mounting structural imbalances last year flagging a per capita housing stock that seriously lags peers. The Canada Mortgage and Housing Corporation (CMHC) has pegged the shortfall at 3.5 mn additional units beyond a business-as-usual build to help restore affordability by 2030. It projects Canada’s housing stock needs to rise to 22 mn by then (from about 17 mn at the end of 2022).

Policymakers have made some headway in recent years, but ambition meets reality. While the National Housing Strategy has provided an important framework to anchor actions, its $78.5 bn funding pales in comparison to Canada’s housing stock at $3.8 tn (or 2% which doesn’t even keep pace with annual depreciation). Major fault lines in execution have also been exposed in a recent report by the Office of the Auditor General (OAG). There has been some traction around last year’s Ontario Housing Affordability Task Force, but tangible results will take time. These and other developments have also reinforced that the political economy of housing in Canada is far from straightforward.

Meanwhile, housing affordability has deteriorated substantially. The Bank of Canada’s Housing Affordability Index—a measure of homeownership versus broader shelter affordability—has spiked over the course of the pandemic (chart 3). The average cost of a home in Canada is 7 times the average annual household disposable income despite the recent cyclical softening in prices against rising interest rates. This crude measure of home price valuation has doubled in the past two decades, accelerating at twice the clip of the OECD average in recent years. The national benchmark also masks extreme price valuations in some parts of the country, for example, Ontario and British Columbia where the multiple sits at 11.5 and 12, respectively.

Not surprisingly, Canadians are increasingly priced out of homeownership. It is not only home prices steering these shifts, but also mortgage (and more broadly debt) payments as a share of income with macroprudential rules acting as a ceiling for some. Both structural and cyclical factors are behind rising costs of (financed) home ownership (chart 4). Recent 2021 census data confirm the trend decline in the home ownership rate—at 66.5%—after peaking at 69.0% in 2011 (chart 5). Growth in renting has outpaced ownership at twice the rate over the last decade with about 1 in 3 of Canada’s 15 mn households now renting.

OUT OF THE FRYING PAN INTO THE FIRE

Renting hardly provides reprieve. Shelter costs—a more encompassing measure of accommodation expenses including direct homeownership and/or rental fees, as well utilities and municipal services—grew by 17.6% for renters versus 9.7% for homeowners between the last two censuses. Keep in mind that rental costs really only took off after census polling in the Spring of 2021. National average rent, for example, was up by over 12% y/y—and approaching 25% y/y in major markets like Toronto and Vancouver—in November 2022, according to rental.ca. (This source measures the market rate of all vacant units versus CMHC’s lagged stock measurement of primary, purpose-built rental units.)

Housing affordability is even more acute for renters. Accommodation—whether owned or rented—is considered ‘unaffordable’ in Canada if shelter costs amount to 30% or more of a household’s before-tax income (also known as the shelter-to-income ratio, STIR). Admittedly, this threshold is somewhat arbitrary and higher income households can likely shoulder higher burdens, but it provides one barometer of affordability. Over 1 in 5 Canadian households (3.1 mn of 14.9 mn) exceeded this benchmark in the 2021 census. For renters, that number is 1 in 3 (or 1.6 mn households). And this count already reflects subsidized housing support that 12% of renting households received at the time.

Renters are also disproportionally likely to be living in ‘core housing need’. Core housing need refers to whether one’s housing falls below at least one of the thresholds for adequacy, affordability or suitability, and the median rent of alternative local housing would exceed 30% of before-tax income (versus actual spending measured by the STIR). Put bluntly, there are no affordable market-based alternatives for those in core housing need. In 2021, 1.5 mn households (10.1%) met this definition with affordability the primary criterion for over three-quarters of this population (though other gauges are indirectly linked to affordability). The prevalence among renters is 20% versus 5% for homeowners (chart 6).

REMOVING THE ROSE-TINTED GLASSES

Today’s count for core housing need is likely higher. The 2.6 ppt improvement registered in the 2021 tally relative to the 2016 census should likely be faded for a host of reasons. Pandemic supports temporarily boosted incomes disproportionately at the lower end of the income spectrum in earlier phases of the pandemic with a 30% y/y uptick in disposable income in 2020 for the lowest income quintile households, for example, versus 9% for all households, according to Statistics Canada. The timing of polling would also not fully capture the aforementioned double-digit growth in rental prices disproportionally affecting lower income households.

Temporarily-halted immigration also likely masks underlying trends. Canada’s borders had effectively been shut for over a year when census polling took place in the Spring of 2021. Arrivals have surged since then. Immigration (i.e., permanent residents) grew by 6.3% in 2022 (to 431 k) on the heels of border re-opening effects that drove a 2021 expansion in the order of 160%. There has also been a rapid uptick in international student arrivals with study permit holders up by 75% in 2021 and holding through 2022 (at about 440 k). Lagged data shows net temporary residents were up three-fold in the first three quarters of 2022 relative to 2021 (to 411 k). These are a mix of stock and flow markers, but they no doubt underpin demand for affordable housing.

This rapid ramp-up in new arrivals could reasonably push core housing needs higher with newcomers and temporary residents disproportionally impacted by housing affordability. While core housing data does not yet provide a breakdown according to immigration status, about 35% of Canadian households in core housing need were immigrants in the 2016 count. Over a quarter of those arriving within the five years prior were in core housing need.

Oft-cited housing affordability metrics may also fail to fully capture broader hardships stemming from high shelter costs for lower income Canadians. CMHC had launched a new Housing Hardship Measure just prior the onset of the pandemic taking a residual approach (i.e., whether households can still cover basic needs after paying for housing expenses). The methodology accounts for different household structures and geographies that affect these expenditures (and incomes). Such an approach holds promise for shedding more light on housing-induced hardship, but data has not been updated since its launch in early 2020. It is nevertheless reasonable to assume that the picture has deteriorated given the cost of housing and other core essentials (and pretty much everything else) has skyrocketed since then.

THE MISSING MARKET

While there may not be high precision to the numbers—or even the definition—of those facing serious housing hardship, even a ballpark number stands in sharp contrast to housing infrastructure to support these households. Canada’s current stock of social housing—defined as subsidized rental units—is among the lowest across OECD peers at just 3.5% of total dwellings (chart 2 again). By CMHC’s count, there are about 655 k social housing units in Canada, the bulk of which are government-owned (at 58%), trailed by non-profit and coop ownership models at 26% and 10%, respectively. Average rent at $613/mos for a 2-bedroom unit is about 50% of market pricing across the stock of primary rental units (e.g., CMHC’s measure) and just 30% of the going market rate for current vacancies (e.g., rental.ca’s measure). Multi-year wait lists across the country for this limited supply suggest that this is not a conscious policy decision to focus on alternative supports.

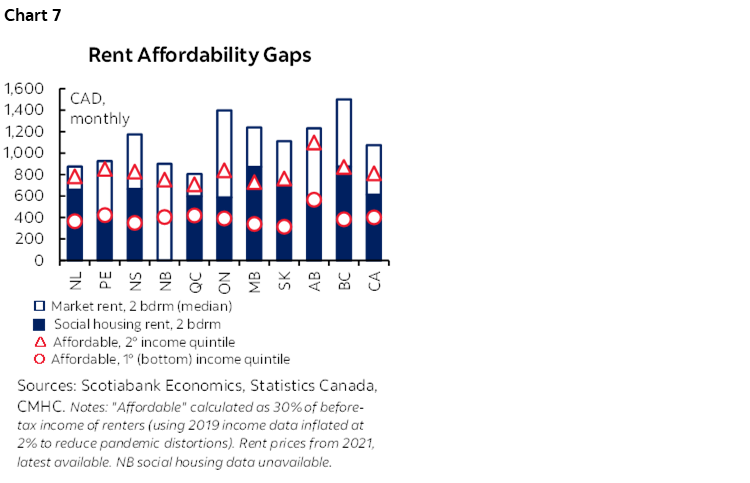

There are enormous shortfalls between market pricing and ‘affordability’ for low income households across the country. Renters in the lowest income (after-tax) quintile would exceed the 30% (before-tax) income threshold even paying the average social housing rental rate for a 2-bedroom unit (and before incorporating other shelter expenses as per the norm) in all provinces except Alberta and Prince Edward Island. Renters in the second income quintile would exceed this affordability threshold at market rates across all provinces (chart 7). Put another way, the average renter in the bottom income quintile would need another $670 monthly to afford a 2-bedroom rental at 2021 prices without exceeding the affordability threshold. In British Columbia and Ontario, this figure exceeds $1000 per month. The average monthly shortfall for those in the second income quintile is about $260 across the country and more than double that in BC and ON (chart 1 again).

Efforts to crowd in private capital further underscore the enormity of the affordability gap. CMHC’s National Housing Co-Investment Fund provides concessional financing to build or repair ‘affordable’ housing units under a condition that rent is less than 80% of the median market rate. The aforementioned OAG report found that typical rent for units approved so far under the initiative are priced at about 63% of the median market rate. The report rightly points out, however, that even at this substantial discount, rent is still unaffordable for lower income Canadians. This is arguably less a design-flaw in the program, rather concretises the magnitude of the government policy failures—and challenges ahead.

Government efforts to alleviate housing affordability pressures through targeted housing transfers are largely trivial relative to the scale of the gaps. The recently tweaked and topped-up Canada Housing Benefit is expected to provide a one-time $500 payment to 1.8 mn low-income renter households (with a $20 k threshold for individuals and $35 k for families whose rent exceeds 30% of household income) at a cost of $1.2 bn. There is also a patchwork of targeted housing supports across the country at lower levels of government with little line of sight on the final tally, but the earlier formulation of the Canada Housing Benefit allocated $4.3 bn (with provinces) over six years to FY28 (that would very approximately translate into $300 annually for 1.8 mn households).

Limited market income exacerbates affordability challenges among lowest income households. The average household income (before tax) for a renter in the bottom (after-tax) income quintile was just $15.2 k in 2019 (prior to distortionary effects of temporary pandemic measures) according to CMHC data. This is not substantially higher than the maximum income available through welfare programs across the country as tallied by the Maytree Foundation. The lift in market income (and broader sources of net wealth including housing equity itself) consequently provides less of an offset for lowest income Canadians against rising shelter costs.

At the extreme end of the spectrum, the number of unhoused Canadians remains highly uncertain. The last point-in-time count registered 235 k Canadians experiencing homelessness, but most experts believe this seriously underrepresents the number since it misses ‘hidden’ homelessness. Signs of progress are unclear despite Canada enshrining the right to housing into legislation in 2019. Moral and legal obligations aside, there is a growing body of evidence that a Housing First principle pays off in the long run. A recent counterfactual study by the Mental Health Commission of Canada estimated that every $10 invested in supportive housing resulted in an average savings of almost $22 through costs avoided on top of social returns (chart 8).

TACKLING THE IMPORTANT AND THE URGENT

Addressing broad-based housing affordability challenges remains as urgent as ever. Policymakers and partners have made some headway in identifying the challenges, setting targets, and even crafting some solutions to this end. But tangible results will take time and, importantly, face serious implementation risk with some cracks already exposed. Meanwhile, the situation is deteriorating, particularly for those most vulnerable, fueling a growing polarization around the public versus private provision of affordable housing in Canada. The enormity of the challenge requires both.

The first-best solution is still to unlock greater supply across the continuum of housing. Shortages in one segment will have—and are having—spillovers across the continuum. For example, as homeownership increasingly becomes unattainable for most, demand for market-based rental alternatives are coming under increasing pressure, in turn pricing out lower income households, putting even more demand on social housing and exacerbating housing hardship. That is not to say that there are not market imperfections, but broadly speaking, it is not a zero-sum game: unlocking greater supply across segments should relieve price pressures across the system.

But it increasingly looks like we won’t achieve scale in new supply in meaningful timeframes that would dramatically shift the affordability landscape anytime soon. There has been a material uptick in housing with new-builds running in the range of 275 k starts (annualised) since the onset of the pandemic versus a pre-pandemic annual average closer to 200 k (chart 9). This falls well-short of the very approximate 600 k+ annual units that would be required to close CMHC’s estimated housing shortfall by 2030.

There is a case to critically consider next-best approach(es) to non-market housing across the country. There are many learnings to be leveraged from crowding private capital into affordable housing and there is still much more to be done in that ‘middle market’. This is essential but insufficient. The largely scathing OAG report on basic access to housing suggests we have neither adequate governance frameworks nor the tools at present to address the magnitude of the challenges at the acute end of the housing continuum.

Canada needs a more ambitious, urgent and well-resourced strategy to expand its social housing infrastructure. Aims to double the stock of social housing across the country could be a start. This would bring Canada just in line with OECD (and G7) averages, but well-below some European and Nordic markets. There is no particular magic behind this number: bringing the stock to 1.3 mn dwellings would not fully close gaps. But it signals far more ambition than the 150 k incremental units targeted under the National Housing Strategy with the bulk of its efforts focused on keeping the current count whole.

A target should not necessarily imply new builds—in fact governments may not be best-placed to do so. It should encompass a broader approach that contains optionality to build, buy, renovate, or retrofit units to add incremental supply to the social housing sector. The toolkit would also involve much higher rates of concessionality (including greater grant-based approaches) in partnering with other actors, while avoiding conflating the potentially distinct roles around building/renovating, operating, owning, and funding the expansion of supply. It will take private, public and non-profit sectors together to revitalise Canada’s social housing sector.

Such an approach may be more cost-efficient for governments in the long run and more responsive to those most vulnerable to Canada’s housing crisis in the near term.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.