- More political than financial impacts

New Constitution to end social unrest? In November 2019, following the political and social crisis that erupted on October 19th of that year (social unrest), representatives of all political forces (with the exception of the Communist Party) signed the “Agreement for Social Peace and New Constitution”. The main commitment that emerged from this agreement was to promote a plebiscite on a new Constitution, as well as the type of body that should draft it. On this basis, in October 2020 a referendum was held, which resulted in 78% of voters in favour of drafting a new Constitution (which would replace the one drafted in 1980), as well as 79% of voters in favour of the drafting body being a Constitutional Convention where its members would be 100% elected by popular vote, rejecting the option of a Mixed Constitutional Convention made up of elected members and parliamentarians.

With this, in May 2021, the 155 members of the Constitutional Convention were elected, where the ruling political parties, the independents and indigenous peoples obtained more than the two-thirds required to approve the norms presented, leaving the center-right wing parties without relevant representation. After a year of work, the Convention delivered the proposal for a new Constitution to President Boric in July 2022, setting the plebiscite for September 4th of that year. In the plebiscite, 62% of the voters rejected the proposal, keeping the current Constitution in force and leaving the way open for a new process.

In December 2022, representatives of a broad group of government and opposition political parties signed the “Agreement for Chile”, whose main objective was to enable a new constituent process. In this agreement, it was defined that the drafting body of the new constitutional proposal would be the Constituent Council, composed of 50 people elected by popular vote. At the same time, an Expert Commission was established, made up of 24 technical and academic professionals elected by the parliament, whose function would be the drafting of a preliminary draft law that would be the main input of the Constituent Council. With this, in May 2023 the election of the 50 Councilors took place, where more than three-fifths of those elected represented center-right wing parties and more than two-fifths represented the Republican Party (extreme right), giving the majority needed to approve the norms to the opposition and the power of veto to the Republicans. Finally, the proposed new Constitution was delivered to President Boric on November 7th, which will be submitted to an exit plebiscite on December 17th.

Recent polls point to a tight result. According to the results of all available polling firms, both options win by very small margins. However, most polls show the “En Contra” (against) option as the winner. In the case of Cadem’s poll, it shows a 54% victory for “En Contra” with a confidence interval between 51% and 57%. In the case of Criteria Research’s poll, it gives a 42% victory for “En Contra” versus 20% for “A Favor” (in favour). The other polls, such as that of Black and White, give a 52% victory for “En Contra”. The polling firm Partner LLC, considered the most accurate in the last two elections (referendum in Sep-22 and Councilors in May-23), gives a 53% victory for “A Favor”.

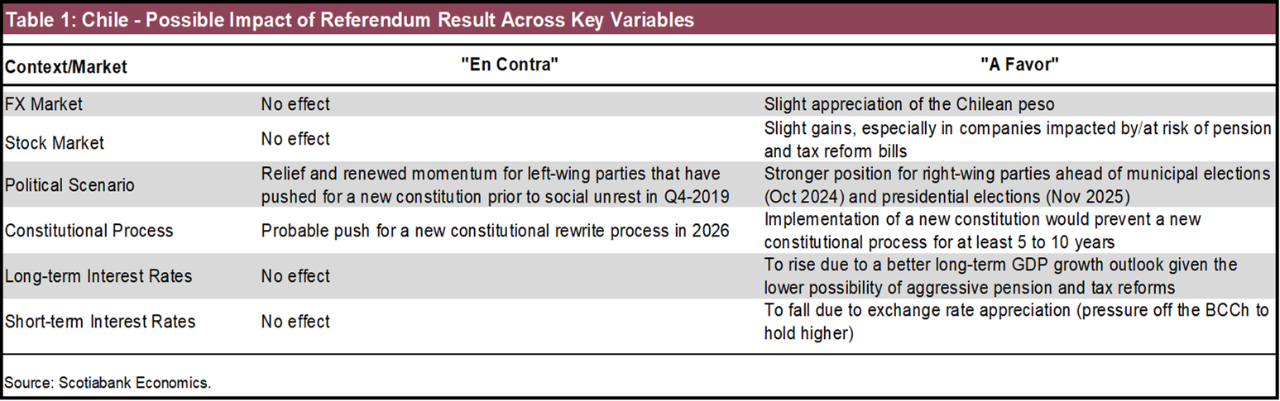

Market implications. Although a victory of “A Favor” should be read positively by local financial assets, especially the exchange rate, we do not expect relevant or significant impacts. We believe that a victory for the option most associated with right-wing political parties would be read favourably by markets since it would represent a (new) third defeat for the government’s political coalition and would favour additional moderation in structural reforms (pensions and tax). The degrees of political uncertainty should decrease somewhat in the event of a victory of “A Favor” given that the constitutional adjustments for the implementation of the new constitution would take between 5 to 10 years, which would make it difficult/impossible for a constitutional process to take place through popular election before the new constitution is implemented.

In the event of a victory of “En Contra”, political uncertainty would also be reduced given that there is an implicit agreement among left-wing parties and government to not launch a new constitutional process during the next two years. The above, however, does not imply that after 2025 voices will emerge for a constitutional process from the left-wing parties, especially those that raised the issue of a new constitution during the social unrest of October 2019 (table 1).

Political implications. The political reaction to the result may be much more important than the implications for local financial assets. Indeed, a victory for “A Favor” would position the extreme right party’s (Republicans) José Antonio Kast as the most likely presidential candidate for the 2026 election. In any case, given that the moderate right-wing parties have also supported the ’for’ option, this practically guarantees that the new president of Chile would come from right-wing parties (E. Matthei or J.A. Kast). A victory of “En Contra” would provide some political respite to Boric’s ruling coalition, avoiding a third political defeat after the rejection of the last constitutional proposal and the overwhelming election of right-wing councilors in the most recent constitutional assembly vote.

A victory of “A Favor” should also have an impact on political support for structural reforms (pensions and tax). Indeed, this would force the government to focus on security and economic growth, with no room for a pension reform with a solidarity component. As for taxes, most likely the door to tax increases would be definitively closed, leaving only the possibility of approval in Congress of measures linked to efficiency in public spending, improvements to the environmental impact assessment system, and corrective taxes. Likewise, a victory for “A Favor” could lead to drastic changes in the heads of key ministries (like Economy and Environment), which, although changes may also occur in the case of “En Contra” winning the vote, these would likely be in much less relevant departments (table 1 again).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.