- The government affirmed their commitment with the fiscal rule; however, the environment remains challenging

On Friday, June 14th, the Ministry of Finance (MoF) released the Medium-Term Fiscal Framework (MTFF), Colombia’s most relevant fiscal policy publication. It provides the most precise insights into the government’s thinking about the country’s economic outlook in the long run and current fiscal results. In fact, it gives a general perspective on the most important factors influencing the main fiscal goals and their sustainability over a ten-year framework.

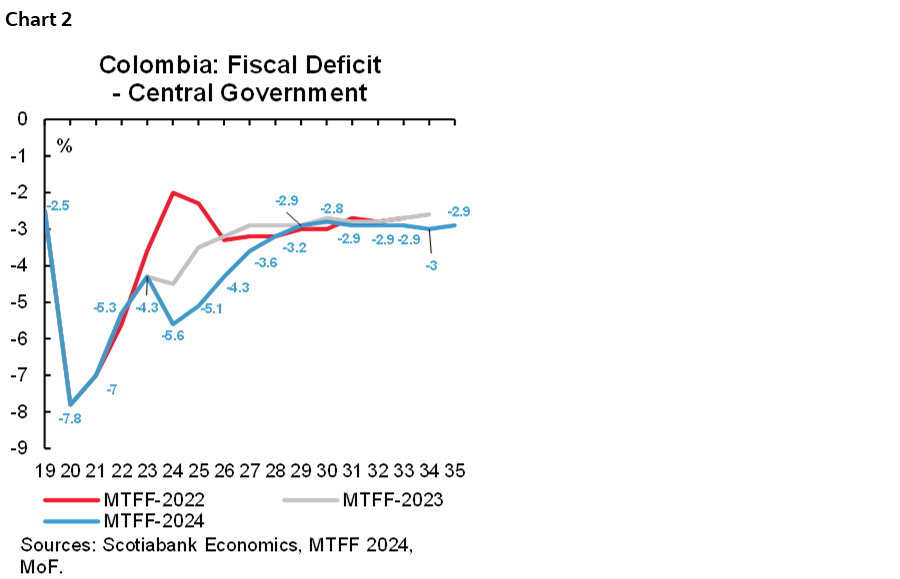

2024 has been a challenging year as the economy has grown below potential, which translated into lower tax collection. Additionally, planned fiscal income around lawsuits and the extra taxes on mining sectors failed to materialize. The government has been in the spotlight as the fiscal income shortfall has become more evident. However, with the Medium-Term Fiscal Framework, we have a better picture of what to expect around fiscal accounts. Our take is that the government is using its disposable buffers to comply with fiscal rules. However, challenges are expected to continue during the rest of 2024 and 2025 as economic activity has not shown a turnaround, and it could still mean further spending cuts and financing needs. Fiscal deficit will remain high: in 2024, the deficit was revised from 5.3% of GDP to 5.6% of GDP, which was aligned with our expectations, while the 2025 projection is 5.1% of GDP, well above the projection of one year ago (3.5% of GDP) and with a political challenge since the MoF assumes that the parametric implementation of the Fiscal Rule could start in 2025, but it depends on the decision of Congress. In our opinion it is reasonable to implement the parametric fiscal rule in 2025.

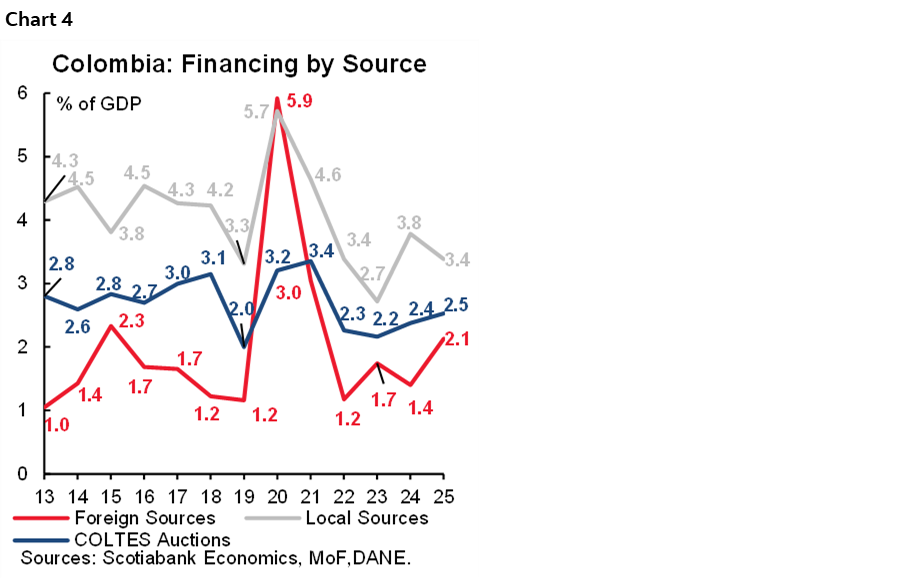

In terms of financing, the MTFF-2024 reveals an increased necessity of financing, with moderately higher COLTES issuances in 2024 passing from COP 38 tn to COP 41 tn, including green bonds, while in 2025, issuances will stand at COP 45 tn (+COP 1.5 tn in green bonds), adding that there will be a strong reliance on international funding. We think markets can absorb this debt; however, it will be expensive for the government. A new COLTES reference maturing in 2046 will be issued, probably with a double-digit coupon, while in international markets, any issuance could also represent a high cost. From a risk-reward perspective, we recognize Colombia still has fiscal risk but is paying for these decent returns to investors.

Let’s start with the deep analysis.

Macro assumptions:

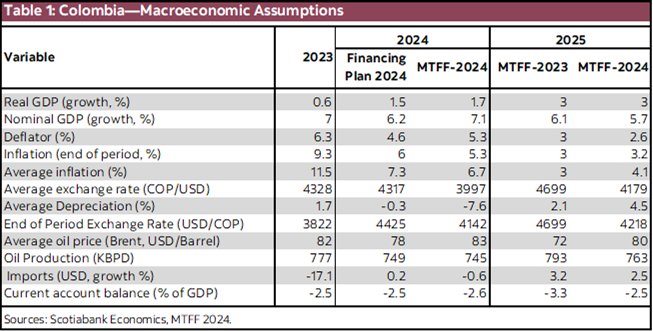

Macro assumptions overall are reasonable. For 2024, the GDP forecast was revised to the upside despite the weak start of the year with a GDP growth of 0.7% in Q1-2024. However, what catches our attention is that the MoF projects a 3% GDP growth in 2025 and forthcoming years, which, in our opinion, could be an optimistic call given the shortfall in investments and the slow recovery in private consumption derived from the slower easing cycle from BanRep. The rest of the variables are broadly aligned with market consensus numbers (table 1).

Fiscal income and spending—above the line accounts:

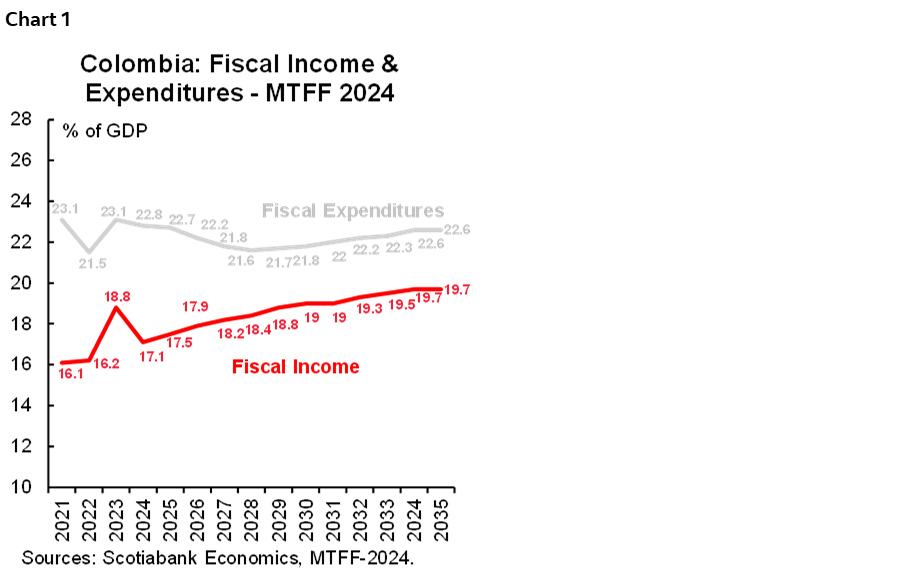

In 2023, one of the main criticisms around fiscal account projections was the optimism of the fiscal income expectation, and time was the main reason for these concerns. Fiscal income fell short of complying with expectations; however, the government has responded in line with their promise to adjust the spending to continue complying with the fiscal rule. For now, the government has buffers to execute the spending cut, but it also is an invitation to the government to use its limited resources to promote economic growth since the main risk in forthcoming months is the possibility of continuing weak growth and, in turn, a lower tax collection.

We highlight that when comparing the Budget Law (approved in 2023) to the MTFF-2024, the government projection of fiscal income went down from COP 352.36 tn to COP 320.34 tn in the Financing Plan 2024 (released early in 2024) and to COP 288.74 tn the MTFF-2024, a total reduction of COP 63.62 tn (~4% of GDP). In the case of spending, adjustment implied a reduction from the Budget Law of COP 426.41 tn to COP 409.69 tn in the Financing Plan 2024 to COP 383.65 tn in the MTFF 2024, a cut of COP 42.76 tn (~2.7% of GDP). Spending cuts are concentrated in administration and investment spending since the main inflexibility is coming now from the fact that interest payments are increasing, passing from 76.86 tn in the Budget Law to COP 79.77 tn in the MTFF-2024, totaling 4.7% of GDP in the new fiscal projections, a share that will also be maintained in 2025 due to the scenario of “higher for longer” that had impacted many countries in the world.

In the medium-term, 2025 and onward, the government expects to be able to maintain a relatively high spending rate as a percentage of the GDP (on average 22.1 % of GDP, which is high compared to the pre-pandemic mark of around 18.6% of GDP in 2019), while in the case of income, they project an average income of 18.8% of GDP in the 10-year window (2025–2035), increasing from the 2024 projection of 17.1% of GDP (chart 1). There is no material explanation about why fiscal income would increase as a percentage of GDP; however, seeing these positively skewed projections is not new, and remember that if, in any case, the government needs to make adjustments, they will do it.

Our take is that the government is reacting to changing conditions and will continue doing so. The spending cut of COP 20 tn will probably be insufficient, but we think they will continue to prevent spending any pennies if this puts the fiscal rule compliance at risk. That said, we expect to see further spending cuts in the future if tax collection continues to be weak. A concerning point is the share of interest payments, which is a consequence of the “higher for longer” environment, and in the future, it will be a significant constraint on fiscal policy.

Fiscal deficit:

The estimation for the fiscal deficit in 2024 increased from 5.3% of GDP to 5.6% of GDP (chart 2). Most of the deterioration is explained by a higher interest burden in local debt during H1-2024 as issuances have been made at higher-than-expected rates. For 2025, fiscal deficit estimation increased from 3.5% of GDP one year ago to 5.1% of GDP, a very high level in which interest payments represent 4.7% of GDP, 0.5% of GDP deficit explained by cyclical components, especially in the oil income, which offset the net structural primary balance of 0.2% of GDP. It is worth noting that 2025 assumptions imply a lower net structural primary balance vs the fiscal rule mandate of 0.5% of GDP. Minister Bonilla said they would pursue the approval of the implementation of the parametric fiscal rule. However, in case this process fails, they will make the necessary adjustments to comply with the rule.

Once again, the most significant issue in the fiscal deficit composition is the interest burden. Recent issuances have been costly, and unfortunately, this trend is expected to continue. The government plans to issue a new COLTES 2046 reference with a potential double-digit coupon, a cost that is already factored into fiscal projections. The question then becomes, what is the solution? A new fiscal reform may be necessary, but it’s unlikely to be implemented by the current government. However, it will be a crucial task for the next administration.

Debt burden and the discussion about implementing the parametric fiscal rule in 2025:

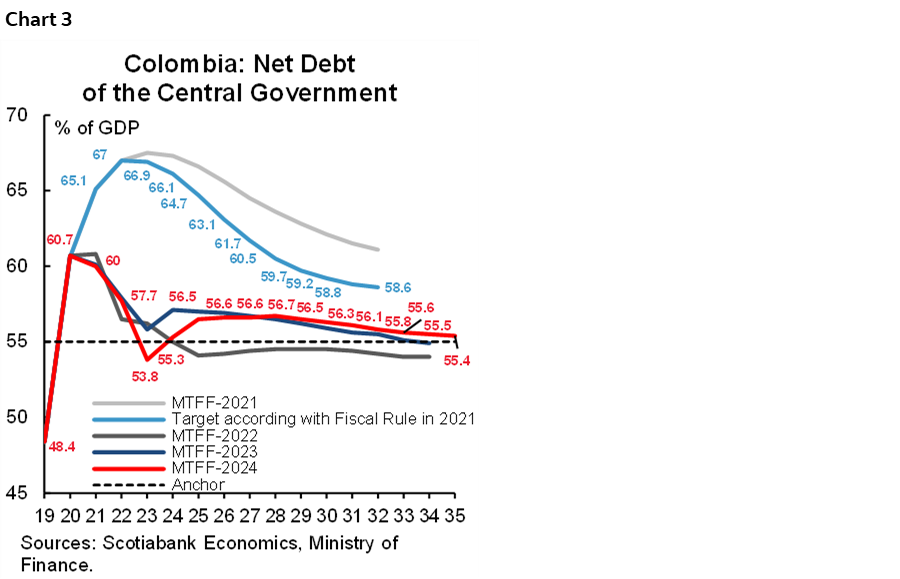

The MoF projected the net debt of the central government to increase less than expected one year ago. For 2024, the expectation is 55.3% of GDP, but after 2025, it is expected to stabilize above the anchor established by the fiscal rule. When we put those numbers in a broad perspective, the debt burden has decreased faster and much more than expected in 2021 (when the fiscal rule was enhanced), in fact for 2024 fiscal rule calculation in 2021 pointed to the possibility of having a net debt to GDP ratio at 66.1% (chart 3). Under this rationale, it is totally reasonable for the government to ask for the implementation of the parametric fiscal rule since, in 2021, the net structural primary fiscal deficit target was set with a trajectory that assumed a slower stabilization in the debt burden. Having said that, for 2025, the fiscal rule mandate is for having a net structural fiscal deficit of +0.5% of GDP, while the government projects +0.2% of GDP following the parametric implementation of the fiscal rule. The final decision is in the hands of Congress, although from a technical perspective, it shouldn’t have a huge discussion.

It is worth noting that Net Debt of the central government at 55% of GDP is not necessarily compatible with an investment grade country, instead it is defined as a sustainable level. Having said that, Colombia is still far away from seeing an improvement in the credit rating profile.

Financing:

The main conclusion of the Medium-Term Fiscal Framework is that despite the government having the capacity to cut spending, it is still necessary to rely on further financing. In that regard, the main points to highlight are:

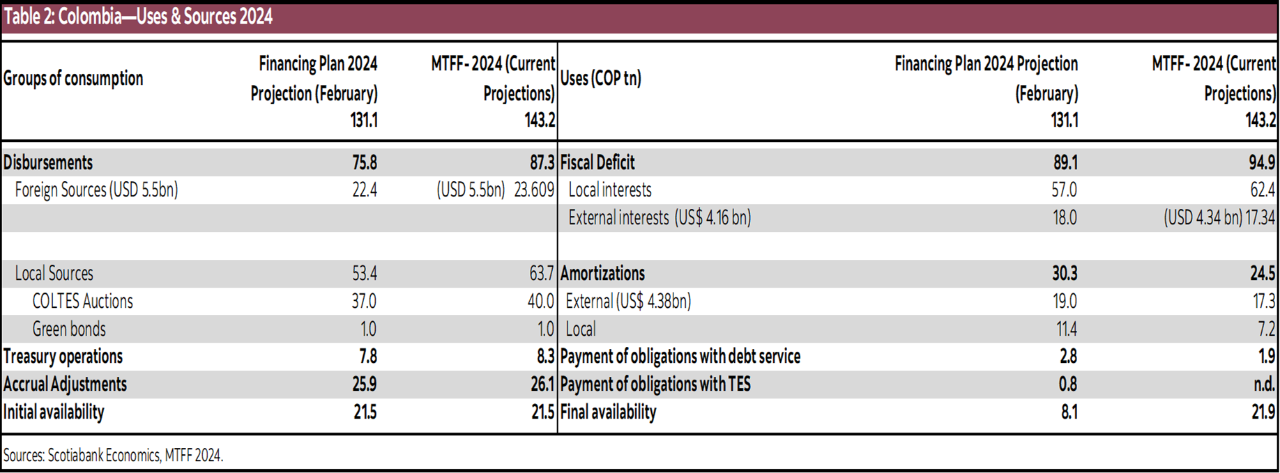

- For 2024, local sources will increase by COP 12.18 tn, where COP 10.27 bn will be in COLTES, split COP 3 tn for new issuances, and COP 7.2 tn for payments of the Oil Price Stabilization Fund (FEPC) to Ecopetrol. During the Market Makers meeting, Treasurer Head José Roberto Acosta explained that the government will try to make transactions with Ecopetrol in COLTES, for example, allowing Ecopetrol to pay earnings to the government in COLTES, something that probably will prevent the market from having significant impact in the supply. That said, auctions will total COP 41 tn in 2024 (including green bonds for COP 1 tn, table 2).

- It is worth noting that if the government is looking to increase diesel prices to target big consumers, to prevent impacting retail consumers, that could involve the truck drivers association. If they implement this strategy, the FEPC deficit could range around COP 5 tn next year.

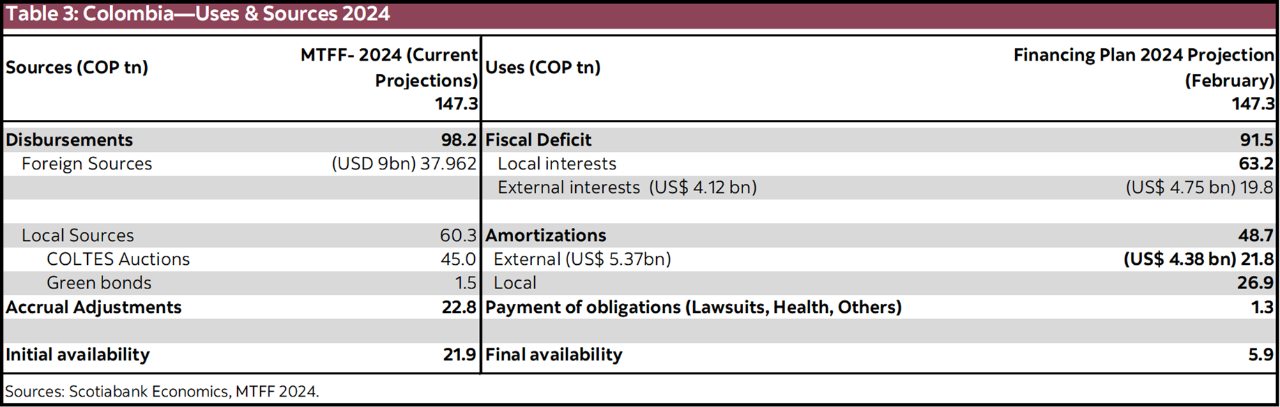

- For 2025, the total deficit to finance is at COP 91.49 tn (table 3). Local sources will reach COP 60.25 tn and COP 45 tn in COLTES auctions; in that regard, Acosta said the MoF will try to avoid pre-financing in 2024, which suggests that COLTES auctions in 2024 can end as early as the previous year. The main question mark is in the external sources since the government is looking for financing equivalent to USD 9 bn, which is 1.5x the target of 2024. Treasury Head Acosta, said the MoF is open to implementing diverse schemes of funding, and they don’t discard having some pre-financing in 2024 if market conditions improve. In our opinion, a higher external debt burden increases the exposure of the budget to exchange rate changes and increases the volatility in fiscal projections.

- Our take is that as a percentage of GDP COLTES, issuances will still be at a tolerable level as a percentage of GDP (chart 4). Additionally, we see the COLTES 2046 issuance as attractive due to the potential high coupon and the maturity.

- Liability management operations are expected to continue; however, in the case of UVRs, the MoF is apparently willing to pursue agreements to implement a potential swap of COLTES UVR 2025. In the case of the nominal curve, they will continue doing the usual operations using the regular market.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.