SUMMARY

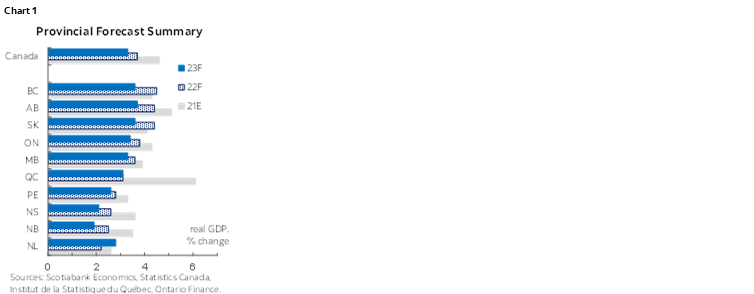

- All provinces expected to experience continued above-trend expansion in 2022 and 2023 as the recovery from COVID-19 advances, but we have downgraded the growth outlook this year in light of omicron variant impacts.

- BC expected to lead provincial growth this year, Alberta to take the top position in 2023 (chart 1); Saskatchewan forecast to get a major boost this year from work related to the Jansen potash mine project.

- K-shaped recovery to persist as sectors like tourism, accommodations, and information and cultural services—and provinces with high concentrations of them—expected to bear the brunt of omicron lockdowns.

- Oil and gas sector recovery to continue, which should benefit Saskatchewan and Alberta, though the omicron wave will likely hamper commodities demand and weigh on market sentiment in the first part of this year.

- Housing markets to cool across Canada as interest rate hikes, construction industry labour shortages, and land use constraints bite; supply-demand imbalances and price appreciation likely to continue.

- Business investment broadly expected to improve, prompted by capacity constraints, supported by major projects, and—eventually—encouraged by reduced COVID-19 uncertainty.

- Above-target inflation to persist through 2023 and across all provinces, but pace of price growth to ease as we progress through this year.

MAJOR THEMES AND OUR VIEWS

COVID-19 continues to anchor the rate of economic and employment growth. Given the broad-based nature of surges in case numbers and hospital admissions and the reimposition of restrictions, we have assumed that the omicron variant of COVID-19 will have a roughly equal negative impact on all provinces’ expansions this year. We then see a solid rebound effect in the middle of 2022, with further reopening plus household and business adaptation to virus conditions expected to contribute to above-trend gains again in 2023. We project similar trajectories for job creation.

Some persistence in pandemic population trends. Since the first wave of COVID-19, there has been a notable increase in net outflows from Ontario to other provinces. In our view, this reflects the widespread adoption of remote work as well as affordability pressures in Ontario’s major centres; both these factors should remain in place post-pandemic. However, we still suspect that the eventual easing of mobility restrictions will encourage movement to Canada’s biggest province, and that Ontario’s large and diversified economy will continue to be a draw in the future. Immigration should remain a driving force for population gains going forward.

Inflation to remain above target in all provinces. We still expect price gains well in excess of the desired 2% rate in Canada as transportation networks continue to grapple with pandemic-induced shortages of input products. Given the global shortage of input products, our expectations of continued and broad-based housing affordability pressures, and the fact that regional consumer price indices have historically tracked the national measure closely, we forecast similar paths for the provincial CPIs over the next two years.

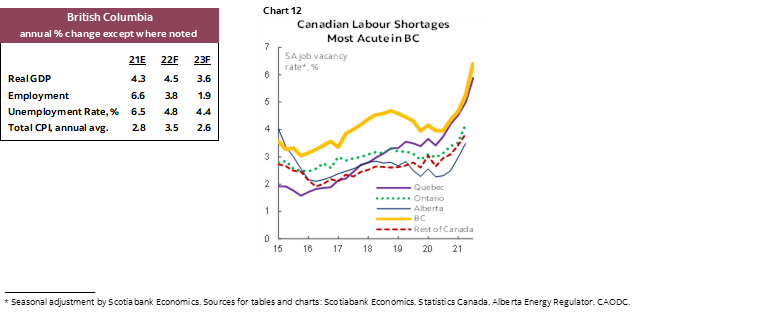

Labour markets to remain tight over the next two years. All provinces reported record or near-record job vacancy rates late in 2021, an unusual dynamic given that we are still in the early stages of the recovery. Alongside increases in workplace absences during this wave, omicron could very well contribute to additional hesitation about returning to in-person work once restrictions are eased—particularly in high-contact sectors. Labour shortages continue to represent a significant impediment to economic growth and profitability, especially among independent business.

The course of provincial fiscal policy to crystallize in 2022 budget season. In the 2021 budget season, most provinces planned to ease policy support in fiscal year 2022–23 (FY23) on the assumption that the worst of the pandemic would be behind us. Since then, nearly all have reported significant improvement in their financial positions in light of stronger-than-anticipated economic growth and inflationary pressures. Increased fiscal room may enable measures that target longer-run growth or more gradual removal of pandemic policy supports in the coming months’ plans; for now, our forecasts largely assume government outlays in line with the latest government blueprints.

Climate change represents a growing risk to the outlook in all provinces. In 2021, severe flooding shut down Canada’s largest port and likely undermined BC’s recovery, while drought brought about in part by extreme heat weighed on agricultural products and government finances in the Prairie Provinces. Though we do not incorporate any extreme weather events into our projections, many researchers have concluded that they will become more common in the coming years.

BOOSTING CANADIAN PRODUCTIVITY

Much of recent Canadian economic development policy has targeted population gains—rightly so given our aging workforce—but long-run growth also requires a sufficient level of capital stock. That is driven primarily by business investment. Otherwise, any contributions to the expansion by workers will be limited by a lack of tools, technology, or capacity.

Available data suggest that pre-pandemic trends of diminishing per-worker stock and weak productivity growth remain intact (chart 2). The increase in 2020 reflects the significant loss of employment during early waves of COVID-19. We project that Canadian non-residential business investment fell last year.

While major project activity helped some provinces and we anticipate that more meaningful gains in business sector capital outlays will come during 2022–23 as pandemic uncertainty eases, more can be done. Early in the pandemic, we argued for a temporary 25% matching grant for investment in machinery, equipment and intellectual property to spur capital outlays in the recovery phase of the pandemic. This is just one measure that could ensure that the Canadian economy receives the maximum benefit from a medium-term injection of skilled workers.

NEWFOUNDLAND AND LABRADOR

Weak population growth anchors soft forecast expansion versus other provinces. NL has the oldest population of any province in Canada; that should increasingly limit the pool of available workers going forward. We expect outflows to other regions to pick up again as COVID-19 infections and restrictions ease.

Oil production outlook still weak. With the Terra Nova field shuttered, offshore output was down by 9% y/y ytd as of November 2021—if maintained in December, that would represent the worst result since 2015 when operational issues and natural declines drove a 21% plunge. In 2019, Terra Nova accounted for 12% of provincial production. The government only expects operations to resume in late 2022; that should generate a boost in 2023.

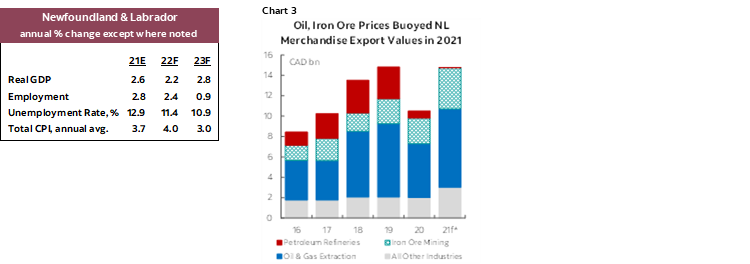

Non-oil mining to see more moderate gains in 2022. Benefiting from record prices and stepped-up production, NL iron ore shipments surged by 50% in 2021 (chart 3). We expect softer iron ore values in 2022–23, but still-strong nickel prices and output ramp-up at several metals mines should provide a partial offset.

Capital investment prospects also muted. The $3.2 bn West White Rose extension project was cancelled in the pandemic’s initial stages; a resumption date has not been announced. As well, construction of the beleaguered Muskrat Falls hydroelectric dam concluded last year. More positively, work on the Voisey’s Bay underground nickel-copper-cobalt mine expansion continues, and offshore oil exploration activity represents an upside forecast risk over the long-run.

Sale of the Come by Chance refinery bodes well for petroleum upgrading industry activity. Expected operation by mid-2022 should support local employment and reduce the province’s reliance on imports for fuel products.

PRINCE EDWARD ISLAND

Employment recovery lagged other provinces, but picked up in late 2021. A November–December surge in manufacturing hiring anchored gains, while summertime year-over-year spikes in accommodation and food services jobs—likely due to recovering tourism activity—also offered a boost. With relatively modest pandemic restrictions, that momentum should help PEI consumer spending in 2022.

Housing market activity looks to be slowing. In 2021, PEI residential building construction growth exceeded that of all other provinces; however, it cooled in H2 and home sales and price gains consistently lagged the national average last year. This provides a soft handoff for 2022, though continued immigrant attraction should support household formation and residential investment over the long term.

US potato export ban raises uncertainty about trade outlook. The Canadian Food Inspection Agency’s recent national survey reported no wart fungus in seed potatoes in fields not regulated by Ottawa, which should reassure Washington. However, the ban remained in place at the time of writing. We suspect that there will be a catchup effect later in the year if the ban is lifted.

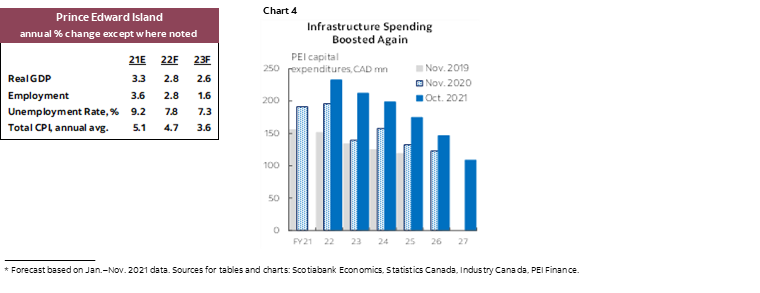

Infrastructure budget increased again. The plan released in October 2021 bolstered FY22 outlays (chart 4), and the 9% rate of decline scheduled for FY23 is far softer than anticipated in the prior blueprint. These represent solid efforts to meet the needs of PEI’s growing population. The Island had the lowest capital stock per worker of any province last year.

NOVA SCOTIA

Nova Scotia has arguably benefited from shifting pandemic population flows than any other sub-national Canadian jurisdiction; we see this effect moderating over time. In particular, we suspect that provincial migration will converge towards pre-COVID rates as restrictions are eased sustainably. That said, low housing costs relative to larger provinces and Nova Scotia’s status as Atlantic Canada’s high-wage services hub will likely continue to contribute to its draw to the extent that remote work is widely adopted by Canadians.

Business investment gains to continue. Based on the quarterly constant price measure, Nova Scotia was one of the few provinces in which non-governmental capital outlays increased versus year-earlier levels over the first three quarters of 2021. Private non-residential construction should benefit from ongoing work on the QEII hospital expansion and a broadly improving investment backdrop in 2022–23.

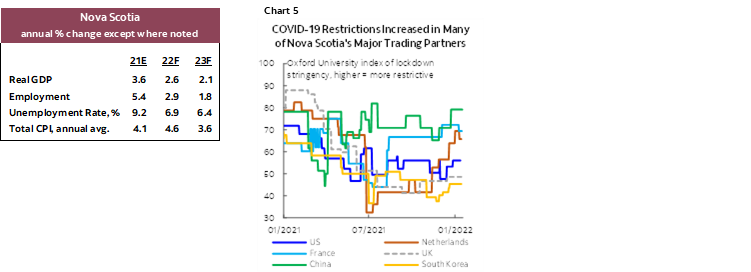

Omicron wave likely to hamper international export flows in early 2022. The province’s diversified export sector has strong links to China, Japan, and Europe, all of which implemented measures to combat the new variant’s spread late last year (those in the latter region were particularly early and intense) (chart 5). More optimistically, we expect tourism flows—especially from within Canada—to rebound meaningfully in this second year of widespread vaccination.

Public finances much improved. Due to stronger-than-predicted economic growth, Nova Scotia now anticipates a $108 mn surplus (0.2% of nominal GDP) in FY22, a nearly $700 mn improvement versus budget projections. One of only two provinces to expect black ink this year, NS has fiscal room to address economic needs and cost pressures that may arise in the months ahead.

NEW BRUNSWICK

Interprovincial migration gains almost as large as in Nova Scotia. New Brunswick has seen a significant jump in net migration from other provinces during the pandemic, the vast majority of which is sourced from Ontario. Again, we suspect that this effect will ebb as COVID-19 is brought under more control, though affordability advantages and greater acceptance of remote work will likely support New Brunswick’s draw beyond pre-pandemic levels.

Housing activity still strong. Gains in MLS unit sales, purchase prices, and residential building construction outlays were all some the strongest of any province last year. That no doubt partly reflects the effects of interprovincial migration and should ease as these flows cool alongside housing conditions across Canada.

Backdrop still supportive of staple New Brunswick commodities. We expect the major lumber price benchmarks to remain historically elevated in 2022–23—though softer than last year’s record highs—in part because of post-GFC high housing starts in the US—New Brunswick’s primary export destination. Demand for refined petroleum may take a hit from omicron-related mobility restrictions as in earlier lockdown periods, but we think this effect will fade as the year progresses.

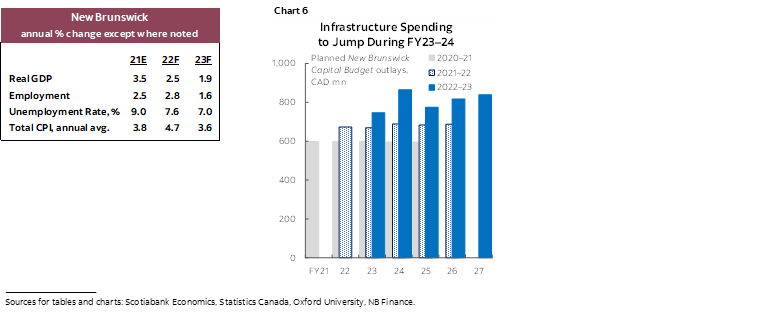

New Brunswick’s finances resilient to COVID-19. NB maintained a budget surplus during FY21 and expects to do it again in FY22—in part because of increased federal transfer payments. With the benefit of more fiscal room, it increased FY23–24 infrastructure spending plans by more than $250 mn (about 0.4% of 2020 nominal GDP) (chart 6).

QUEBEC

Growth expected to cool from unsustainably high 2021 rate. Quebec’s expansion outperformed that of rest of Canada last year—in part because of the arithmetic of quarterly growth (see our analysis here)—and was already easing to close out 2021. Slightly earlier implemented omicron variant restrictions than in other provinces may further weaken the handoff into this year.

Labour constraints to weigh on expansion. Quebec’s Q3-2021 job vacancy rate approaching 7% was a provincial record and trailed only that in British Columbia; that speaks to the severity of labour shortages in La Belle Province. Omicron’s spread will almost certainly contribute to further reluctance to return to work in the high-contact sectors most impacted by lockdowns; though rising immigration levels and retention of temporary workers may help fill vacancies in other industries over time.

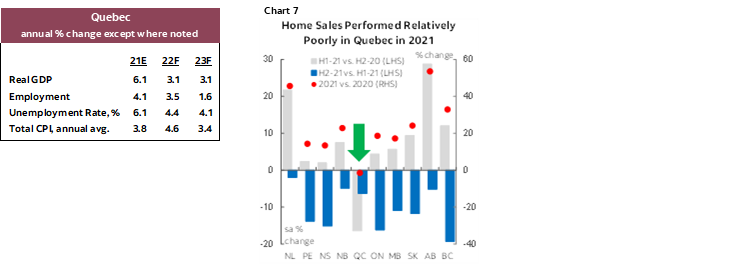

Housing market to cool significantly. MLS unit sales plunged to such an extent in H2-2021 that it drove the only annual contraction of any province last year (chart 7), and residential building investment clearly slowed in late 2021. Easing of population inflows from Ontario should contribute to further moderation alongside rising interest rates and capacity limits in the construction sector, though strong household balance sheets relative to other large provinces may shield against reduced demand impacts from higher borrowing costs.

Government a contributor to growth. Quebec’s mid-year update forecast the largest percentage program spending increase in any province (11.8%) in FY22; the planned 19% FY23 boost to infrastructure outlays in Budget 2021 was also the provincial leader.

ONTARIO

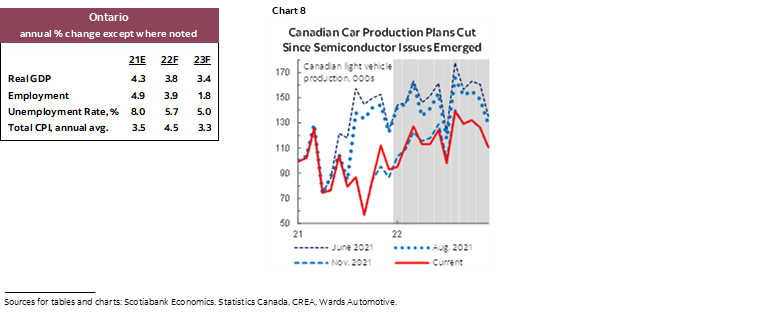

Auto sector vulnerability. The industry accounts for about one-third of Ontario merchandise exports in a typical year and Ontario makes up nearly all of Canadian production. Disproportionately hindered by the global shortage of semiconductors, output guidance was reduced throughout 2021, which weighed significantly on Ontario trade volumes. In line with current projections, we expect a bounce-back this year, but production is on track to remain below pre-shortage levels for the next year (chart 8).

Population flows shifting. Immigration significantly ramped up last year, in large part due to policy that provides a path to permanent residency for prior temporary workers; newcomer admissions should remain high in 2022–23. As well, Ontario residents have flocked to other provinces during the pandemic. We expect that these outflows will ease in 2022, but housing affordability challenges and remote work should continue to push some workers to settle outside Ontario. The pandemic appears to have accelerated movement out of Toronto, a trend already in place before COVID-19.

Fiscal picture improved, but growth implications marginal. A faster-than-anticipated economic recovery contributed to a much stronger FY22 starting point for Ontario budget balances. Program spending growth rate forecasts were increased versus the prior plan, though some of the boost represents re-profiled outlays originally planned for FY21, and infrastructure plans were only slightly raised. Beyond this year, program expenditures are set for modest increases.

MANITOBA

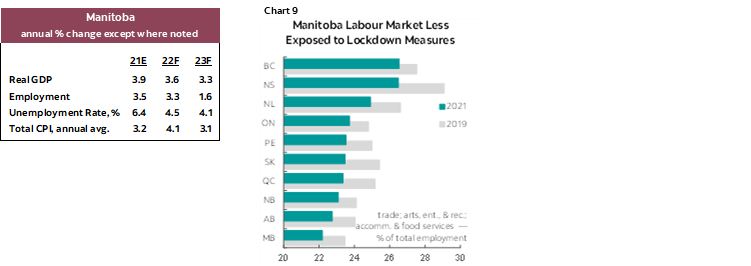

Small high-contact industry presence may prevent more severe economic hit from omicron wave. Manitoba’s economy and labour market are less concentrated towards retail and sectors related to tourism and accommodation than most other provinces (chart 9); that helped mitigate the size of the downturn during past lockdown periods.

More normal weather should help agricultural sector. The severe drought that hit the Prairies this summer hurt yields across the region and looks to have weighed on Manitoba crop receipts in Q3-2021; exports of crop products also fell late last year—likely affected by Port of Vancouver closures. Luckily, commodity price gains offset some of these losses. Even average growing conditions would translate into strong volume gains this year, though extreme weather events will likely become more common as climate change advances.

Other key industries should also eventually gain from more normal conditions. Aerospace output—stubbornly weak last year—will likely be held back by reductions in travel activity prompted by the omicron wave but experience a bounce-back later in 2022. We expect pharmaceutical product shipments to benefit from easing supply chain pressures as the year progresses.

Food manufacturing remains a strength for Manitoba. Sectoral shipments increased significantly last year—supported by elevated food price gains that we anticipate will continue through 2023—and the Roquette pea processing plant in Portage la Prairie—the world’s largest—remains on track to reach its full production capacity this year.

SASKATCHEWAN

Oil production growth poised to pick up this year. Output of the province’s primary export product rose was up by only about 1.5% y/y ytd as of October last year; we assume that it will rise more meaningfully in 2022. Provincial drilling data suggested significant increases versus year-earlier levels in late 2021, momentum that provides a strong handoff into this year.

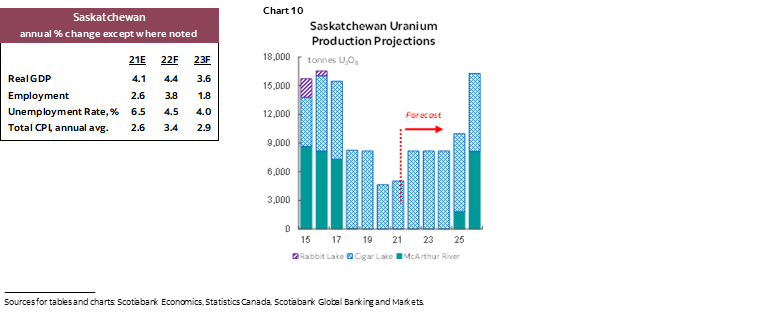

Uranium production forecast to rise in 2022. We assume U3O8 output just north of 8,000 tonnes from the Cigar Lake mine this year following its mid-2021 restart (chart 10); that would represent an annual increase of more than 50%. While we do not anticipate that the McArthur River mine will restart until the middle of the decade, steady prices in the 40 USD/lb range—materially higher than in recent years—should support miners’ bottom lines.

First stage of Jansen potash mine to add handsomely to capital investment over forecast horizon, put Saskatchewan among top provincial performers this year. Construction is expected to take six years at a total cost of CAD 7.5 bn, with first ore in 2027. Absent a construction schedule, we have assumed that outlays are roughly evenly split over the six-year period, with some omicron variant-related delays this year.

As in Manitoba, we expect more normal weather to help the agricultural sector this year. Saskatchewan crop incomes similarly took a hit amid this year’s Prairie drought despite strong pricing for staples wheat and canola; that also had a significant adverse impact on FY22 provincial government finances.

ALBERTA

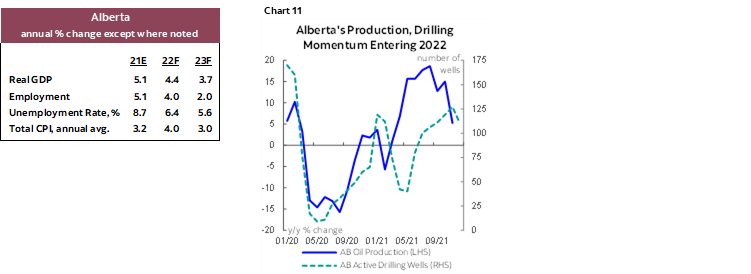

Entering 2022 with strong momentum. Alberta oil production is back above pre-COVID-19 levels, and drilling activity rose by almost 60% in 2021 (chart 11). As of Q3-2021, Canadian oil and gas investment had risen by 5% y/y ytd, though it still sat about 20% below its pre-pandemic, Q4-2019 level.

Housing market results were mixed in 2021. Alberta MLS unit sales rose by more than 50%—more than in any other province—and starts gained solidly, but residential building construction investment was down by more than 7% y/y ytd as of November—a decline that trailed only that of Newfoundland and Labrador over the first 11 months of the year.

Only gradual oil and gas investment gains over the next few years. Factors expected to limit capital outlays relative to past periods of rising crude values include: producer caution following several years of volatile prices, greater competition from the US shale patch, and investor response to climate change.

Non-oil and gas investment outlook more auspicious. Spending related to commercial building has risen steadily since the winter—though it remains below pre-pandemic levels—and petrochemicals manufacturing and renewable energy should contribute to capital outlays going forward. Amazon Web Services plans to allot $4.3 bn by 2037 to a cloud computing hub in Calgary.

Massively improved financial position incrementally beneficial for near-term growth. After a nearly $26 bn reduction in FY22–24 budget deficit projections, the province increased FY23 capital spending plans by $850 mn; still, that leaves infrastructure outlays on track to drop by 12%. Program spending reductions are also built into each of the next two years.

BRITISH COLUMBIA

Storm saps 2021 growth, rebuild boosts expansion in 2022. Assuming closure of the Port of Vancouver and shutdown of flooded areas for two weeks, plus lower transportation industry capacity into 2022, we estimate that the disaster cut 0.5 ppts off of growth in BC in 2021 (relative to our pre-storm forecast). Reconstruction on a timeline similar to the post-2013 Alberta floods adds 0.5 ppts in 2022.

Major projects on track to drive growth. Work on the LNG Canada liquid natural gas terminal and export pipeline and Site C hydroelectric dam should continue to support non-residential capital outlays—in fact, they contributed to an advance of more than 10% during the first year of the pandemic. However, the risk of delays remains.

Labour shortages limit gains. BC recorded a record all-industry job vacancy rate in September 2021, as well as the highest one in Canada (chart 12). Though that certainly reflects the province’s elevated share of lockdown-vulnerable high-contact sectors, shortages are particularly acute in BC’s construction industry, a trend that could put a ceiling on capital investment gains.

Staple BC commodities in high demand. We expect strong pricing for metals such as copper and nickel in the coming years as global industrial activity improves and the green energy transition progresses. We forecast mean Western SPF lumber prices of about 650 USD/k board-feet this year and about 560/unit in 2023, supported by tight supply and hefty US homebuilding.

Outsized interprovincial migration gains likely to ease as omicron is brought under control. However, continued growth in BC’s vibrant technology sector may sustain the province’s attraction post-pandemic.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.