SUMMARY

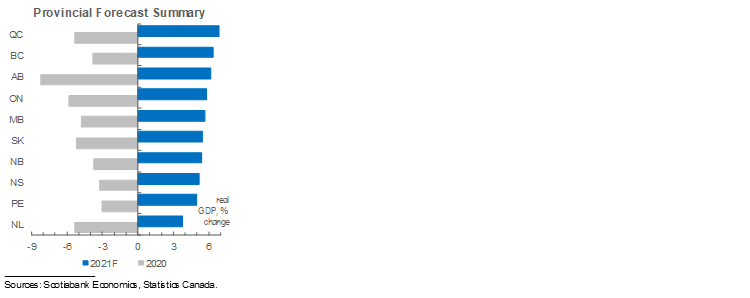

- Strong growth across the board: we still expect that all of Canada’s provinces will witness sharp rebounds in 2021 as they bounce back from COVID-19 lockdowns and benefit from a robust US expansion.

- Third waves: despite Canada’s improved and synchronized vaccination trajectory, severe third pandemic waves—and containment/resilience in some provinces—have led to incremental forecast revisions.

- Commodity price gains: stronger commodity values are supporting the expansion, not just in oil-rich provinces but also in jurisdictions that produce and export metals, lumber, and agricultural items.

- Fiscal: all provincial budgets revealed a significant financial hit from COVID-19, though federal spending has cushioned the blow; all provinces will use infrastructure spending to bolster their recoveries.

- Housing: across Canada, we expect the pace of home sales, price appreciation, and residential investment growth to slow from recent unsustainably high rates, but remain well-supported.

- Industry trends: “high-contact” sectors like tourism and food services continue to struggle and remote work-capable services are leading the recovery; we may eventually see a shift as vaccination efforts advance.

- Population growth: remains a risk. Several provinces have boosted immigration by granting permanent resident status to work and study permit holders, but national admissions remain below the target level.

- The appendix on page 12 provides a high-frequency dashboard of COVID-19 indicators by province.

Newfoundland and Labrador

THE REOPENING VERSUS MAJOR PROJECTS

- Newfoundland and Labrador’s COVID-19 situation has improved since a severe second wave stalled economic momentum earlier this year.

- Softening major project activity and crude oil production should pose drags on growth in 2021.

Newfoundland and Labrador’s fight against COVID-19 is progressing, and that bodes well for reopening and a return to economic growth this year. With the exception of a three-week surge in late January and early February, infection rates in the province have consistently been among the lowest of any jurisdiction in Canada, and that has enabled easing of strict early-year lockdown measures. Encouragingly, some of the weakness seen in indicators such as full-time employment, hours worked, manufacturing shipments, and auto sales in January and February has now reversed. Looking forward, vaccination rates are climbing, and the province aims to begin reopening in mid-June.

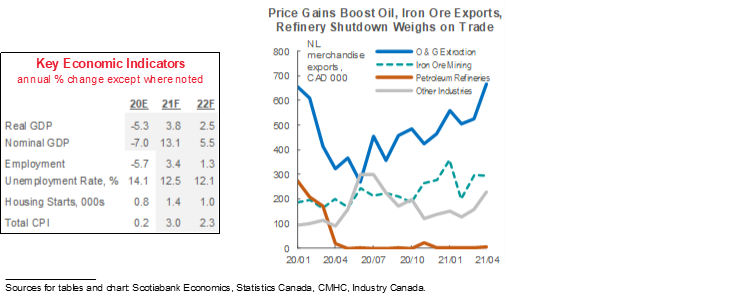

Strengthening iron ore prices and production are also good news. Last year, second half price gains and steady output contributed to a 2.5% gain in related nominal exports and a 9% jump in real iron mining GDP—responsible for about 6% of provincial output in 2020. We expect further ramp-up at key mines and continued strength in iron ore prices to support industry profitability this year.

Despite pricing improvements, the outlook for oil production is less sanguine. Crude oil is by far NL’s largest export, and exports made up a larger share of provincial output in 2019 than in any other Canadian jurisdiction. Terra Nova field operations—responsible for 12% of provincial production in 2019—are indefinitely suspended and yields are falling at other platforms. Our forecast assumes that NL offshore output falls by 5% this year—as in the latest provincial government projections—and rises by 5% in 2022—in line with 2020 Canada Energy Regulator expectations. Efforts to restart work at Terra Nova offer upside potential on this front.

We expect soft major project activity to weigh on capital investment. The Muskrat Falls hydroelectric dam is scheduled to be completed this year, and the West White Rose offshore extension venture remains suspended. We expect that work will resume on the latter project next year, in line with provincial government forecasts.

The Come By Chance Refinery remains in idle mode. In 2020, its closure weighed on shipments of upgraded petroleum—the province’s second-largest trade product from 2017 to 2019. As long as the facility stays closed, related exports will likely remain low—though the drag may ease in 2021—and import reliance will likely remain high.

The province’s first multi-year fiscal plan since COVID-19 reached Canadian shores takes several important initial steps to address well-documented long-run demographic and financial challenges on The Rock. Read our take here. Significant for near-term growth are efforts to improve integration and retention among newcomers to the province, and $600 mn in planned fiscal year 2021–22 infrastructure outlays—which may help mitigate the effects of weak capital outlays.

Prince Edward Island

TOURISM STILL THE FLY IN THE GROWTH OINTMENT

- Control of COVID-19 remains an advantage for PEI.

- Exposure to tourism will likely hold back the Island’s near-term recovery.

Canada’s smallest province continues to carry Canada’s smallest COVID-19 case load. PEI still has not recorded a single COVID-19 death, and its lockdown measures—according to the Oxford University index—are less severe than even those in the other Atlantic Provinces. That enabled relatively unrestricted mobility and one of the smallest economic contractions of any province last year.

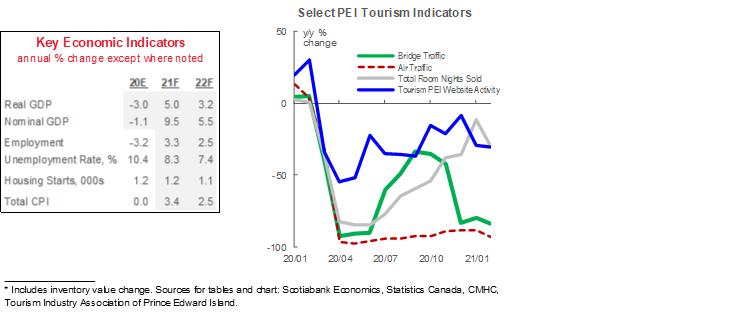

Yet, international and interprovincial travel restrictions weigh heavily on the Island economy given its heavy reliance on the tourism sector. The sector will continue to face significant difficulties so long as COVID-19 restrictions remain in place. Indeed, tourism indicators point to still-very-weak seasonal activity, and cruise ship visits to Canada have been banned until next year. More positively, the Atlantic travel bubble is set to reopen this month and could help tourism activity alongside further vaccination progress..

PEI’s agricultural sector had a positive 2020; early indications for this year’s growing season are mixed. Farm cash receipts surged to an all-time high last year—supported by strong potato prices—but operating costs are also on the rise and last year’s drought—which acutely impacted the potato crop—resulted in the sharpest inventory value decline in over a decade. Weak starting inventories could hurt farms’ bottom lines in 2021, but yields should normalize if weather conditions are more supportive. Dairy product receipts also rallied to end 2020 and begin this year on firm footing, after struggling with storage issues early last year.

Prospects are also mixed for the Island’s wide range of manufacturing industries. On the one hand, food manufacturing—concentrated in seafood and frozen food and accounting for an outsized industry share in the province—looks likely to continue to benefit from strong pricing. On the other, purchases from niche PEI durable goods industries such as aerospace and engine repair will likely be held back by COVID-19-related uncertainty.

As most elsewhere in Canada, PEI’s housing market has gotten off to a roaring start this year. Residential construction investment—concentrated in single-family dwellings—is up more than 50% y/y ytd as of April, supported by still-low interest rates, torrid price gains, and a desire for more space during the pandemic. As of May, repeat home sales were up almost 80% versus the first four months of last year. The key question for housing is how quickly immigration can resume—PEI witnessed the strongest population growth of any province during 2015–19, and newcomers accounted for three-quarters of those gains—more than in any other province.

Stepped-up infrastructure outlays—announced late last calendar year in PEI’s capital budget—continue to factor into our forecast. The province aims to keep capital expenditures at about $196 mn (2.6% of nominal GDP) this fiscal year in order to bolster the economic recovery. Read our take on PEI’s 2021–22 budget here.

Nova Scotia

THIRD WAVE STALLS MOMENTUM

- Nova Scotia began 2021 with very strong gains across a number of sectors and remains positioned for very strong growth this year.

- A severe third pandemic wave and control measures may stall those gains.

Data released to date suggest that Nova Scotia began the year with particularly strong economic momentum. We noted last quarter that the province’s labour market witnessed an impressive rebound in the second half last year—supported by effective COVID-19 containment and its remote work-capable services industries’ resilience to lockdown measures. In the first quarter of 2021, gains in Nova Scotia employment, manufacturing shipments, car sales, and wages and salaries outpaced national-level advances.

Yet, the third wave of the pandemic hit Nova Scotia particularly hard, and has the potential to stall some of the province’s gains in the first half of this year. It was an unfortunate turn for a jurisdiction that had carried a relatively small COVID-19 caseload up to that point. The surge in cases began in late April and strict severe new lockdown measures were in effect through May, those developments impacted full-time employment and hours worked in the latter month. However, infection rates have since fallen and stabilized, and that has allowed the province proceed with reopening plans.

The relatively strong fiscal position outlined in Nova Scotia’s 2021 budget partly reflects resilience to the pandemic. Read our full summary here, where we note that: a) Nova Scotia has the earliest projected return to balance date of any Canadian province (FY25), and b) it aims to keep infrastructure outlays above $1 bn for the second straight fiscal year. The latter move should help support the recovery in 2021.

Federal shipbuilding contracts should support the manufacturing sector over the medium-term. Construction of arctic offshore patrol ships is expected to continue until the middle of this decade.

We continue to monitor international migration flows as the pandemic progresses; Nova Scotia has witnessed some gains on this front. Newcomer admissions are up incrementally versus year-earlier levels—the rally supported by a pickup in Provincial Nominees and likely related to measures to provide permanent resident status to individuals already in Canada. However, newcomer admissions remain below the target level across the country.

Exports have gotten off to a solid start to the year. Tire manufacturing and sales to the United States surged in April to overcome early 2021 weakness. We suspect that demand for these products south of the border will be strong as reopening proceeds and auto production picks up in the US, and pandemic-related uncertainty eases. Seafood manufacturing export values also jumped in April, but sales to China have been soft to begin 2021, which may be related to efforts in that country to support domestic producers.

New Brunswick

HEALTHY FINANCES, POISED TO BENEFIT FROM HEFTY US EXPANSION

- New Brunswick’s control of COVID-19 helped its economy last year; further success to date this year bodes well for growth in 2021.

- Key export commodities are poised for very strong gains this year.

The preliminary estimate of a 3.7% real GDP decline in New Brunswick last year was one of the smallest of any Canadian jurisdiction, and mirrors its successful containment of COVID-19. The only jump in infections witnessed to date in the province occurred in January of this year; other than that period, New Brunswick has consistently maintained one of the lightest caseloads and some of the least restrictive lockdown measures of any region in Canada. At the time of writing, the province had reached the 75% first dose vaccination rate threshold necessary to begin the first phase of its reopening plan. As part of its economic recovery strategy, the province is providing financial incentives for visitors from other Atlantic provinces.

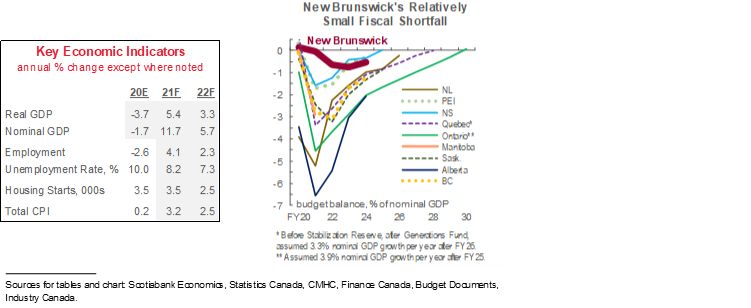

The benefits of successful virus containment are evident in the relatively modest budget deficit and net debt increases outlined in New Brunswick’s 2021–22 budget. Read our full analysis here. The province is the only one in Canada with projected fiscal shortfalls under 1% of nominal GDP in every fiscal year through FY24. Infrastructure outlays—per the province’s Capital Budget released late last year—are set to increase by more than 12% this fiscal year.

We expect base effects to limit the province’s top-line pace of expansion this year. Because of a softer-than-average decline in 2020, the rebound’s effect on economic growth is less significant.

Upgraded crude oil is by far New Brunswick’s largest export commodity; strengthening US fuel consumption and rising prices therefore bode well for incomes and profitability in the province. Those effects are already reflected in hefty 43% y/y ytd growth in nominal petroleum refinery exports through April 2021.

Forest products are another key New Brunswick export industry and should also contribute significantly to provincial growth this year. North American lumber and panel prices remain near all-time records, and we expect demand to remain sturdy amid the strongest levels of US homebuilding since before the GFC. Kraft pulp values continue to benefit from greater tissue paper and packaging use during the pandemic. Upgrades to the St. John pulp mill continue through 2022 and should support short-run capital investment as well as long-run production capacity.

We highlight two developments that may drive economic growth over the longer-term. The first is the potential development of a small modular reactor industry—currently receiving financial support from Ottawa and the province. The second is the $3–4 bn Mactaquac dam refurbishment plan, though the majority of capital costs are not expected to be incurred until the latter half of this decade.

Quebec

READY FOR LIFTOFF

- We still anticipate that Quebec’s economic growth will be among the strongest of any province this year.

- We expect the province to benefit from very strong US growth, a relatively modest third wave, and its own elevated level of fiscal stimulus.

After carrying the largest absolute and per-capita COVID-19 caseloads in Canada throughout 2020 and in early 2021, Quebec’s third wave was modest relative to those in other provinces as well as its own prior rounds. At the time of writing, the province’s infection rate was the lowest outside of Atlantic Canada. That enabled relatively modest restrictions and earlier reopening than many other provinces, which already appear to have translated into stronger economic activity in Quebec than most elsewhere. Gains to date in full-time employment, hours worked, and wages and salaries in La Belle Province have outpaced those at the national level, as did real GDP growth in the first two months of the year.

Alongside the momentum that the province brought into 2021, we believe that Quebec is now poised for the strongest growth of any Canadian province this year. We now anticipate that Quebec’s growth will exceed that national average in both the first and second quarter of this year, with Canada likely to witness a slowdown in the latter period under the weight of third wave restrictions. With the strong gains we expect in the first quarter and the astronomical 60% (q/q ann.) in Q3 last year, that would be three out of the last four quarters in which Quebec’s growth outpaced the national average.

Upward revisions to our US forecast also contribute positively to our projection for Quebec exports; in our view, these broad demand impacts should outweigh potential downsides from “Buy American” policies. More specifically, Quebec’s export profile is oriented towards production of metals—notably aluminum and iron ore—and forest products, both of which appear to be benefiting from exceptionally strong prices and industrial sector demand and homebuilding. Aerospace—the province’s number one export product—took a significant hit last year as global air traffic plunged, but jumped higher in April .

Quebec’s 2021 budget highlighted the impact of COVID-19 on the province’s fiscal position and the significant potential growth impact from provincial fiscal policy over the forecast period. Read our full analysis here. As a share of output, Quebec’s projected budget balances and net debt loads are towards the high end of the provincial spectrum. However, the government prudently targets a declining debt-to-GDP ratio beyond this fiscal year. The province also aims to increase capital outlays under the Quebec Infrastructure Plan through FY24; that includes projected boosts of 10% this fiscal year and 19% in FY23 that amount to total spending of over 3% of GDP over the two years.

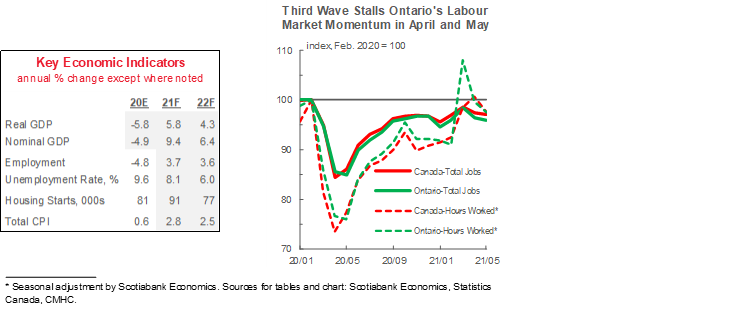

Ontario

THIRD WAVE SLOWS REBOUND, VACCINE PROGRESS SETS UP BETTER H2

- We have revised our forecast for Ontario lower in respect of strict third wave lockdown measures whose impacts are evident in the economic data.

- We expect exports to rally this year, with more meaningful gains in 2022.

Ontario’s third wave of COVID-19 was severe and prompted some of the strictest containment measures implemented to date in Canada according to both the Oxford University and Bank of Canada measures. Incoming data suggest that had a meaningful impact on economic activity. In April—when those measures came into effect—full-time jobs fell by more than 2% and hours worked dropped by almost 8% m/m according to our own seasonal adjustment calculations—the most since the peak lockdown period. We suspect that Ontario’s economic growth will come in weaker than the national average in the first and second quarter of 2021. The significant pickup in vaccination rates and waning of infection rates since third wave restrictions came online bodes well for a bounce-back as we approach Q3.

For automobile manufacturing output—responsible for about a third of Ontario export values—we anticipate a solid gain at the national level this year to be followed by a stronger rise in 2022. That reflects production guidance from automobile companies and should result in a similar trajectory for the province’s external shipments. Last year, Canadian production fell by 28%. Other key Ontario export products include gold, silver, iron, and steel; we still expect all to benefit from metals price gains this year as the global industrial sector recovery proceeds.

Our forecast easing of residential investment in Ontario as the year progresses mirrors and is the anchor of the national-level trajectory. Housing resales and starts have both fallen back to start Q2, likely impacted by limited availability. As the year progresses, we expect stretched affordability and rising mortgage rates to cool the pace of residential sales activity, with a transitory effect from new homebuyer qualification rules. Yet, building activity should remain elevated relative to historical standards, broadly supported by low borrowing costs and tight supply-demand balances. Faster border reopening and population growth present upside potential.

The pace of immigration’s recovery remains important for Ontario. The province had witnessed a year-over-year increase in newcomer admissions from January to April. As in other jurisdictions, it has seen a significant rise in the number of permanent residents who previously held temporary worker and international study permits. We remain cautiously optimistic about a full recovery given rising vaccination rates, national immigration targets, and the province’s status as a desirable destination for workers.

Ontario’s 2021 budget projects a return to balance by FY30—the longest timeline of any province—but we see upside potential for the bottom line given conservative economic forecasts and considerable prudence built into the plan. Read our report here. Total outlays scheduled under the Ontario Capital Plan were increased by $4 bn during FY21–23 versus the November 2020 Budget. The 13% increase penciled in for FY22 should help support the recovery.

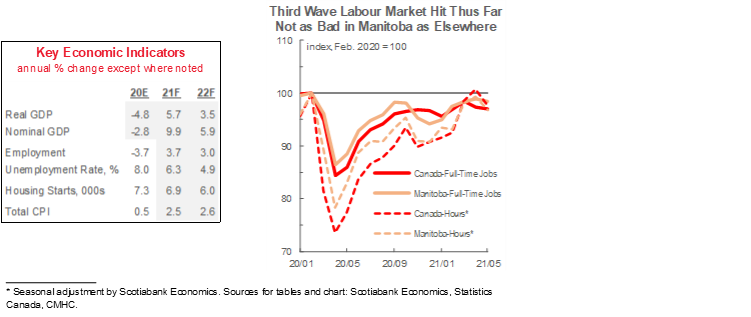

Manitoba

ECONOMY THUS FAR RESILIENT TO STEEP SECOND AND THIRD WAVES

- A steep third pandemic wave will likely weigh on near-term growth.

- Key pharmaceutical and aerospace exports have gotten off to slow starts this year, but agricultural prospects are more promising.

At the time of writing, Manitoba holds Canada’s highest per-capita COVID-19 caseload; however, the impact on growth thus far appears have been limited relative to the experience of other provinces. In May, Manitoba was the only province in which full-time employment was above its pre-pandemic level—despite imposition of new restrictions to combat the third wave—and retail and auto sales growth have outpaced the national average as of March. However, Manitoba’s total hours worked—closely linked to overall economic growth—have not kept pace with the national average to date this year.

Shipments of pharmaceutical products—Manitoba’s primary export by value in each of the last three years—have fallen off to begin 2021, offsetting gains in other categories. Softness in recent months may relate to Canada’s export ban on select prescription medicines—implemented last November to prevent shortages—though the sector had begun to witness declines by September.

Aerospace—another key export industry—continue to grapple with muted travel activity. So long as restrictions are in place, the sector faces challenges, though Manitoba shipments have trended generally higher with rising traveller numbers and an accelerating pace of US expansion.

Agricultural sector profits and export values look poised to gain from continued strength in prices and output. Market values of wheat, canola, and soybeans—Manitoba’s signature crops—are at or near decade highs, the latter supported by voracious Chinese demand for feed as it continues to rebuild its hog herd. A potential wrinkle is presented by early reports of droughts across key growing regions, and many farmers have also reported rising costs, as in other parts of the country. The food processing industry continues to benefit from elevated prices, and the Roquette pea processing plant in Portage la Prairie—the world’s largest—is on track to reach its full production capacity by early 2022.

Through April 2021, Manitoba was one of five provinces in which immigration was above year-earlier levels. However, the rate of newcomer admissions across Canada was still well below pre-pandemic and target levels. Like Saskatchewan, Manitoba had been in the midst of significant population outflows to other provinces before COVID-19 arrived in Canada. Also like Saskatchewan, immigrants in Manitoba’s labour market have traditionally maintained high employment rates relative to newcomers in other provinces, which highlights their important economic contribution.

As across the rest of the country, Manitoba plans to use infrastructure spending to bolster its recovery. The $2.1 bn earmarked for FY22 amounts to just under 3% of nominal GDP (according to the province’s own economic forecast), which ranks in the top half of provincial plans announced for that fiscal year. Read our 2021 Manitoba budget commentary here.

Saskatchewan

BENEFITING FROM BROAD-BASED COMMODITY PRICE GAINS

- Saskatchewan’s oil production remained stubbornly weak in the first quarter of 2021, but we anticipate stronger gains as the year progresses.

- Other commodities and fiscal stimulus should bolster the recovery.

At the time of writing, Saskatchewan had the second-highest per-capita COVID-19 caseload of any province. We are encouraged by the downward trend in infection rates and rising pace of vaccination, though risks remain on this front.

Saskatchewan’s staple oil and gas industry has also gotten off to a somewhat soft start to the year. Crude production was down by 13.5% y/y ytd as of March 2021, though it did see a significant month-over-month improvement between February and March. While we expect output to rally as producers respond to stronger oil prices, the soft start should weigh on the annual growth rate—we assume a modest increase of about 3% this calendar year, in line with provincial government projections. Improving industry conditions to begin 2021 may have helped manufacturing and construction employment and hours, with robust homebuilding.

Yet the province’s other commodities still look set to contribute handsomely to the expansion this year. From January to April 2021, potash production was up over 11% versus the same period last year, and major producer Nutrien has revised H2-2021 potash output guidance by 500 kt, particularly at its Vanscoy mine. The Cigar Lake uranium mine restarted in April after two COVID-19-related work stoppages during the past year; output should ramp up more materially as we near 2022. Finally, prices for key crops wheat, canola, and soybeans are at multi-year highs—anchored by Chinese demand—and helped drive nominal Saskatchewan exports 15% higher than year-earlier levels as of April.

Eventual safe resumption of immigration flows is important for Saskatchewan just as in other provinces. For one, population outflows to other provinces had been steadily increasing before the pandemic, raising the need for an offset. As well, newcomers to Saskatchewan have historically had some of the highest employment rates among immigrants in Canada. Immigration to Saskatchewan has been helped by granting permanent resident status to workers already in the province, but overall admissions were still down 7% y/y ytd as of April 2021.

While Moody’s recently downgraded its rating of Saskatchewan’s debt from the vaunted AAA level, we still assess the province’s finances to be among the healthiest of any subnational jurisdiction in Canada. According to the latest government budget (read our take here), Saskatchewan’s net debt-to-GDP ratio is on track to be the lowest of any region through at least FY24. With low debt servicing costs relative to other provinces, this suggests debt levels are sustainable and leaves room for more fiscal policy intervention if needed. But more intervention may not be needed. Capital outlays across Crowns and government agencies are expected to rise by 12% and account for almost 4% of provincial output in FY22. Those figures are among the largest in Canada and should lend meaningful support to the recovery.

Alberta

SOLID REBOUND TO FOLLOW DEEP DROP LAST YEAR

- We expect early-year momentum and base effects to support very strong growth in Alberta this year.

- Among non-energy sectors, forestry, chemicals, and agriculture have sanguine near-term outlooks.

Incoming data continue to highlight the spillover effects of oil prices on Alberta’s economy. Last year’s estimate of an 8.2% real GDP decline was anchored by crude price plunges and the deepest drop of any province; construction and manufacturing saw even steeper declines than oil and gas extraction. Yet by May of this year, WCS and WTI had returned to pre-virus levels. Supported by that improved pricing backdrop, Alberta oil output is up on a y/y ytd basis as of April, and drilling activity has surged, though it remains historically low. Preliminary Q1-2021 non-residential business investment data suggest that private-sector capital outlays rose to begin the year, an idea reinforced by the 64% (q/q ann.) climb in national-level oil and gas spending. Still, the latter is at its fourth-lowest recorded since at least 2013.

We expect early-year momentum and base effects to result in strong growth in Alberta in 2021, though longer-run prospects are less certain. For oil production, we assume growth in the 7% range this year and about 2% in 2022—in line with recent provincial government projections. That should drive solid 2021 export growth. For investment, we await a strong advance this year, but not one in the range of what might have historically been expected in a year of 50%-plus oil price gains. Capital discipline is widely expected to be the industry trend after last year’s price volatility and amid greater international producer competition plus investor appetite for clean energy sources, though work is proceeding on several renewable projects in Alberta.

Alberta’s labour market looks to have gotten off to a slow start relative to other provinces. In 2020, Alberta witnessed the steepest drop in wages and salaries, and the second-largest falls in full-time employment and hours worked among the provinces. To date in 2021, Alberta is lagging national-level gains across all of those indicators. Lingering effects from lockdown measures put in place to control a severe third pandemic wave may hinder the recovery, but we are encouraged by the recent pace of infection rate decline and the province’s accelerated reopening plan.

Among non-energy sectors, forestry, chemicals, and agriculture have sanguine near-term outlooks. Lumber prices have eased of late but remain historically strong; Alberta production is trending higher as mills aim to meet voracious North American home construction demand. Work continues at the Heartland Petrochemical Complex despite reports of recent COVID-19 outbreaks; as we noted last quarter, chemical manufacturing investment intentions are nearly 25% higher than preliminary estimates for last year. Crop receipts climbed a hefty 31% y/y in Q1-2021—supported by strong wheat and canola prices—and we expect livestock producers to benefit from rising cattle prices and stronger output after plant shutdowns last year. Broadly speaking, the industrial sector should gain from the hefty US expansion forecast this year.

British Columbia

KEY COMMODITY PRICES SURGE, TOURISM STILL A RISK

- BC is already benefiting significantly from the run-up in commodity prices.

- Major project activity and high-contact industry exposure remain risks.

Forest products demand should boost BC economic growth this year. Though lumber prices have eased somewhat, they remain near all-time high levels. This has been particularly beneficial for BC—which last year accounted for 38% of Canadian softwood lumber output. With production up by 10% y/y ytd as of March, BC sawmill and wood preservation export values through April are more than 100% higher than year-earlier levels. Shipments of veneer and plywood are up another 69% y/y ytd in the same period; logging exports have gained nearly 200%. We expect lumber prices to further ease from record highs as the year progresses but stay elevated, anchored by robust US homebuilding and reinforced by supply-side tightness via cut limits.

The economic benefits of strong commodity demand and price gains extend beyond exports from BC’s forest products sector. Nickel, lead, zinc and copper ore mining was the province’s third-largest merchandise export sector last year; to date in 2021, related shipments are 25% higher than year-earlier levels, lifted in particular by the latter metal’s climb to an all-time high price in May. Natural gas, gold, silver, and aluminum production and processing are also important export categories, and have gained significantly this year amid the commodity super cycle.

For services exports, the technology sector continues to be a significant advantage for BC. In past outlooks, we noted its resilience to lockdowns, strong pre-pandemic hiring relative to US hubs, and that it offers a salary premium in a low average wage jurisdiction. In 2020, BC’s ICT industry output rose by 5.6%—the strongest advance by that sector in any province and in contrast to a 3.8% all-industry decline. Over the medium-term, continued growth will require the same resumption of immigration inflows. Like several other provinces, BC has helped skilled newcomer admissions by conferring permanent resident status to temporary workers and students, but immigration is still well below target levels to date this year.

BC’s labour market has started 2021 on firm footing. Since the start of 2021, hours worked, full-time hiring, and wages and salaries gains are all outpacing national-level advances. The key vulnerability is to “high-contact industries” like accommodation and food services and tourism—which make up an outsized share of BC jobs—but there is also upside risk insofar as vaccination accelerates.

We are still generally optimistic about major project activity, but risks remain. Work on the Site C hydroelectric dam continues, and we still expect the LNG Canada Coastal Gaslink Export Pipeline in Kitimat to reach peak activity in the coming years.

BC’s first multi-year fiscal plan since COVID-19 arrived in Canada (full analysis here) showed significant financial deterioration but maintains many of the advantages in place before the pandemic. From a growth perspective, we note that capital spending plans—both taxpayer-supported and self-supported outlays—include a 33% annual increase in FY22 and output shares of more than 4% of nominal GDP. Both figures are the highest among the provinces and should bolster BC’s recovery.

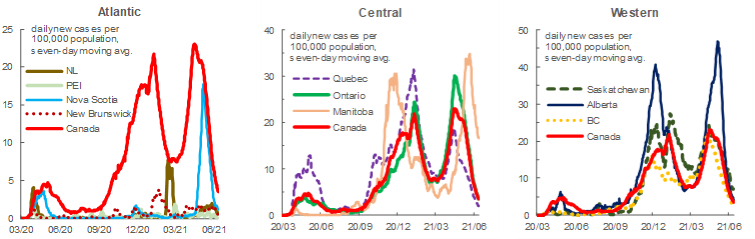

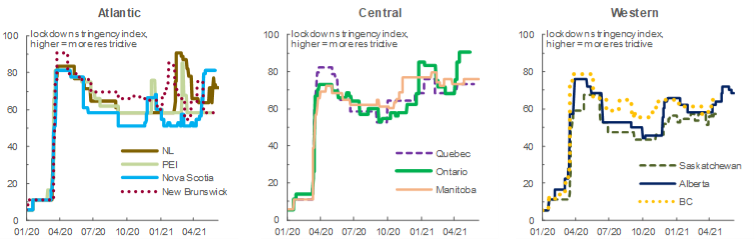

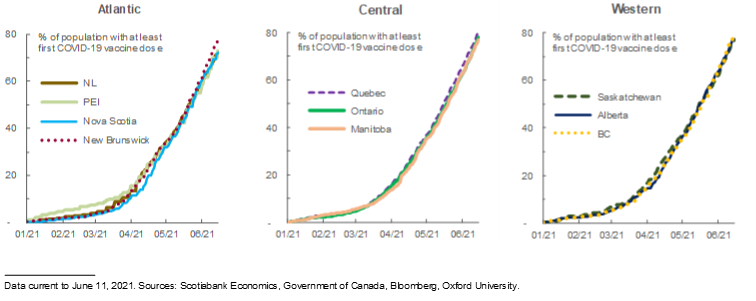

APPENDIX—COVID-19 CASELOADS, RESTRICTIONS, AND VACCINATION RATES

COVID-19 INFECTION CURVES

OXFORD UNIVERSITY INDEX OF LOCKDOWN STRINGENCY

VACCINATION RATES

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.