KEY POINTS:

- Stocks play defence, curve steepens anyway…

- ...as idiosyncratic factors counted for more than macro factors

- Brexit uncertainty, tech antitrust, ECB risk & vaccines ding risk

- Brazil’s central bank stays on hold as expected

- ECB: how much will be good enough to markets?

- US inflation faces possible further downside tomorrow

- Markets shake off BoC ahead of speech

TODAY’S NORTH AMERICAN MARKETS

Stocks played a bit of defense today but not all for reasons having to do with the macro picture. Vaccine headlines didn’t help as Pfizer advised people with allergies to the vaccine ingredients to pass on the shot and a data breach occurred at the European Medicines Agency that involved Pfizer’s regulatory submission. Tech stocks sold off on an antitrust suit brought against Facebook. A massive oil inventory build in the US sparked volatility in oil prices as WTI initially lost a buck and then regained most of that. Markets quickly shook off the BoC’s policy statement as a non-event (recap here). The thesis that the CUSMA/USMCA deal would not sweep aside trade irritants as sector files would remain hotly contested was somewhat validated as the US filed its first enforcement action under the agreement against Canada’s dairy industry.

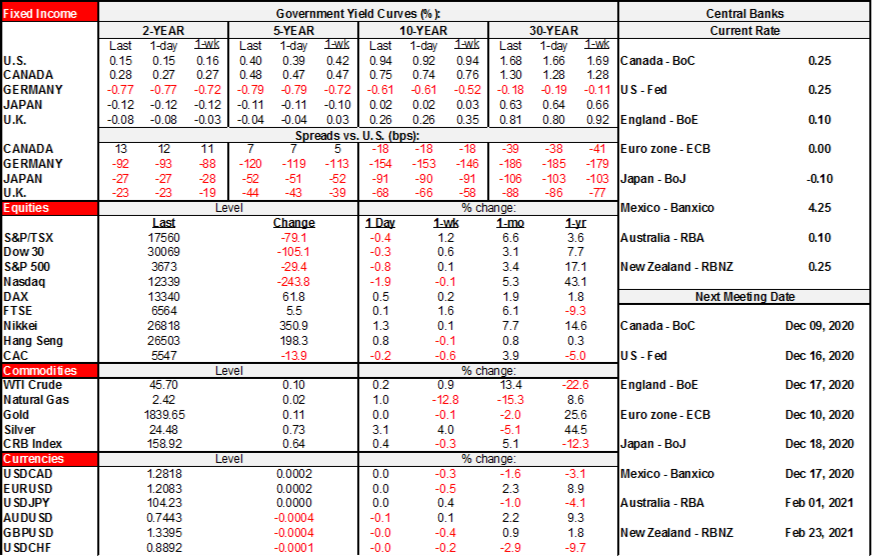

- The US S&P500 fell by about ¾% and the TSX dropped by ½%. Tech fared the worst with the Nasdaq down almost 2% and IT on the S&P down almost 6%. Europe was mixed with Paris down ¼% along with Milan, while the rest of Europe’s bourses closed up as much as ½%.

- US and Canadian longer-term yields cheapened 1–2bps toward the longer end.

- WTI oil recovered after having lost a buck following a surge in US oil inventories (chart 1) to close little changed on the day.

- The USD recovered from earlier selling pressure to post a small gain mostly against the euro in weighted terms and ahead of the ECB as sterling and yen appreciated.

Brazil’s central bank kept its Selic rate unchanged at 2% as universally expected. The full statement (here)

OVERNIGHT MARKETS

Whether Brexit talks bust up or continue may inform risks into the ECB decisions in the morning. Possible remarks following the working dinner between UK PM Johnson and EC President von der Leyen could arrive at any moment as this publication is being distributed.

Independent of Brexit, multiple measures may be more likely from the ECB given the advance hype starting in October and up to recently about reconsidering everything. The statement arrives at 7:45amET followed by President Lagarde’s press conference at 8:30amET. Keys are what they do to the PEPP and TLTRO-III with widespread expectations they extend and expand both. Doing just one could disappoint. Length of extensions and magnitudes are uncertain but unofficial guidance was toward a one-year PEPP extension at “at least” the middle of 2022. With vaccines on the way, one point of debate would be whether utilization of whatever they announce would push to the maximum potential sizes of the facilities.

Other overnight developments through to tomorrow will include:

- Norway’s CPI inflation rate for November is expected to be unchanged from 1.7% y/y (2amET);

- UK macro reports at 2amET will cover the month of October for GDP, industrial output, the monthly services index and trade. Being for October and given Brexit risks ahead of next week’s Bank of England it’ll be a tough sell for markets to care about backward data.

- France updates October industrial output (2:45amET). See line above.

- Sweden CPI for November (3:30amET). Little change from 0% y/y is expected.

TOMORROW’S NORTH AMERICAN MARKETS

The North American calendar will focus upon jobless claims, US CPI, the monthly US Treasury budget results and the follow-on speech by BoC Deputy Governor Beaudry.

Initial claims expectations are mixed with consensus at 725k (prior 712k) and Scotia at 700k (8:30amET).

US CPI for November (8:30amET) is expected to be little changed. I went down a tick to 1.1% y/y with the month-ago rate up a tick to 0.1% m/m due to seasonals, gas and jumping off points. Core is expected to be flat at 1.6% but I went down a tick. Markets are likely to treat it as an historical footnote given the rise in forward-looking inflation expectations (chart 2).

BoC Deputy Governor Beaudry will speak on “Our quantitative easing operations: looking under the hood” with the speech and highlights available at 1:30pmET.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.