KEY POINTS:

- Risk assets bid as safe havens retreat

- BoC’s Macklem sounded cautiously optimistic…

- …but is he too concerned about CAD…

- ...and not enough about housing?

- FOMC expectations & what would be possible surprises

- PMIs on tap: Eurozone, UK, Japan…

- …after Australia’s jumped higher

- US retail sales likely to reflect a weak start to holiday shopping

- UK & Canadian CPI on tap

- US stimulus meetings to continue

TODAY’S NORTH AMERICAN MARKETS

Risk assets held onto a decent bid as safe havens stumbled during the North American session. Canadian markets paid relatively little heed to BoC Governor Macklem’s speech which is probably just a-o-k by him, but his comments on CAD struck a bit of a nerve (see below).

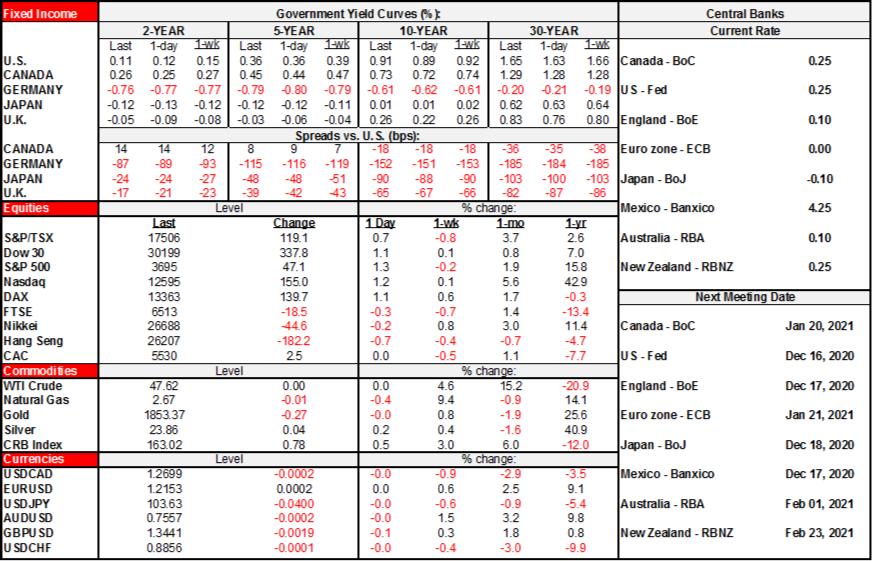

- Equities were up by over 1% in the US and about ¾% in Toronto. European markets ended as mixed as they started.

- Gilts underperformed all other sovereign curves as longer-end yields backed up by 5–6bps. US Treasury and Canadian yields rose by 1–2bps toward the longer end. EGBs were generally little changed except for spread narrowing over bunds by Italian and non-markets.

- Oil posted a slick 1% gain on average across WTI and Brent.

- The USD weakened again today with leading crosses including the Mexican peso and sterling.

BoC Governor Macklem’s speech (here) and press conference didn’t really shake up CAD or short-term rates trading, but it’s worth highlighting what I thought were the main takeaways while also emphasizing some curious remarks about the currency.

- he's fading near-term downside by looking through to later upside when vaccines become more widely available. His remarks on near-term growth risks indicated they view Q4 GDP growth as likely being stronger than they figured back in the October MPR given a stronger start to the quarter, while a potential Q1 setback is likely to be much less significant than the Q2 retrenchment;

- he didn't elaborate on rate cut options other than to say “if” they need to do more, then they have tools available but negative rates are not among them. That conditionality dismisses near-term risk;

- The concerns he expressed toward CAD were somewhat puzzling.

- I thought he was too sanguine toward housing risks.

The most succinct indication of the overall tone of the speech was provided early on. This wasn’t a downbeat sounding Governor out to spit in anybody’s holiday ’nog. He’s a nice guy, so he wanted a cheerful message going into a rough stretch for Canadians. If anything, the broad tone of his remarks leaned a bit more toward the optimistic side. Here’s one passage to consider:

"Because we all need to lift our spirits as we head into the holiday season, I want to end the year with some cautious optimism. My message is that exports and business investment could bounce back from this recession more quickly than they did after the global financial crisis. But for this to happen, we all have some work to do."

Another notable quote to this effect was delivered during the press conference:

"I have to say I've been very impressed by the resilience of the Canadian economy."

That doesn’t sound to me like a Governor preparing to enter the new year with some token half cut.

On CAD, the Governor said several things in his speech and the press conference

"More recently, the Canadian dollar has been appreciating, largely reflecting a broad-based depreciation of the US dollar. This is hurting the competitiveness of Canadian exporters in our largest market."

“The Canadian dollar has been appreciating, and for the most part that appreciation doesn’t reflect made-in-Canada factors. It largely reflects a broad-based depreciation of the US dollar.”

The C$ has been “relatively stable” against other currencies.

“We don’t target the dollar, we don’t have an objective for the Canadian dollar, it’s set in the markets.”

“It’s on our radar screen.”

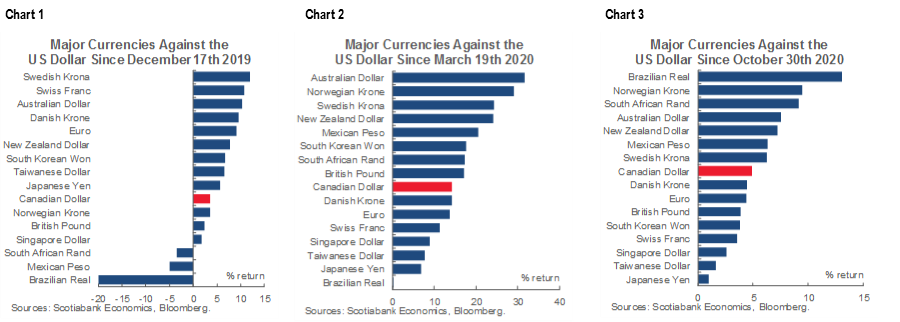

While I appreciated the broad tone of his speech, I found the concerns expressed toward CAD to be puzzling quite frankly. Charts 1–3 show the appreciation in multiple major currencies to the USD over different periods of time. Compared to a year-ago, CAD has barely budged while underperforming multiple other stronger crosses against the USD which is notable since currency moves that are sustained and carry longer lagging effects should be the focus. Compared to CAD’s weakest point last March, it’s rise since then has only at best made it a middle of the pack performer against the USD. Ditto when the starting point is instead the end of October to reflect the more recent period of appreciation. The first point is therefore that CAD’s appreciation has been unspectacular compared to multiple other major currencies and not just the USD and especially over the smoothed period of the past year.

The second point questions why this would seriously bother the BoC. If CAD’s rise along with many others currencies over the past nine months reflects an improvement in risk appetite that sparked less demand for safe havens like the USD, yen and Swiss franc that have all underperformed, then shouldn’t that be viewed as an encouraging development by way of confidence in the macro backdrop? In other words, it’s the market saying we’re repricing your currency because we think the global growth outlook has improved and along with it demand for your products. Put another way, would the BoC prefer to go back to the world where USDCAD stood at 1.45 instead of today’s 1.27??

Further, even if CAD is a concern to the BoC, it can’t really do a whole lot about it anyway. My advice? Don’t walk into a room of FX traders and start waving a BB gun at them.

The Governor’s remarks on CAD’s effects, however, need to be taken in the full context where he spoke of upside and downside risks to exports. In fact, on balance, he sounded pretty optimistic that trade and investment could lead the way:

"Nevertheless, there is room for cautious optimism that international trade will recover more quickly from the pandemic than it did from the global financial crisis, and Canadian businesses need to be ready. Since the initial shutdowns last spring, trade has bounced back faster than many economists had predicted. Recent international surveys suggest executives expect trade to be strong in 2021. And the news of effective new vaccines puts a more certain timeline on the resurgence of global demand."

An added area where I’m not sure I agree with the Governor related to his remarks on housing. Macklem stated that “we're not seeing the kind of frothy housing markets we saw in 2016.” See this morning’s note for more on this topic. This is a record year for existing home sales, while resale months’ supply sits at an all-time low and building price pressures are among the upward sources of pressure on Canadian inflation given the way CPI captures housing.

OVERNIGHT MARKETS

A wave of global releases covering purchasing managers’ indices and UK inflation on the eve of the next day’s Bank of England meeting will pose somewhat more elevated macro data risk through the overnight session.

November UK CPI will be released at 2amET. Inflation isn’t expected to change from the 0.7% y/y reading from October. We expect inflation to end 2020 around 0.8% y/y with considerable uncertainty around the outlook in 2021. The tariffs and quotas brought on by failing to negotiate a deal before January 1st, 2021 will likely put upward pressure on prices next year.

The preliminary December Markit PMIs for France (3:15amET), Germany (3:30am ET), and the Eurozone (4am ET) will be released over the early morning. Re-imposed restrictions in the Eurozone to combat rising cases over Q4 should continue to hinder growth. A positive or negative surprise to the PMIs will heavily inform eurozone growth forecasts for the final quarter of the year and how the year is transitioning into the 2021.

The preliminary December UK PMIs will be released at 4:30am ET. The Oxford stringency index showed a loosening of restrictions at the beginning of the month which could lift the composite measure out of contractionary territory. Overall the new targeted measures to combat the second wave have had far less of an impact on economic activity relative to the first wave’s measures.

Japan will also release PMIs for December at 7:30pmET. If Australia is any indication of what to expect across Asia-Pacific markets, then that country’s release of its PMIs after North American markets closed was encouraging. The composite Australian PMI climbed by 2.1 points in December to 57.0 which is getting back toward the pandemic-era peak in July when it hit 57.8.

TOMORROW’S NORTH AMERICAN MARKETS

The main event will clearly be the FOMC communications toward afternoon but ongoing stimulus meetings between US Treasury Secretary Mnuchin, Pelosi, McConnell et al might offer competing risk.

Material data risk will include US retail sales for November (8:30amET) that are expected to record a softer pace of gains reflecting a decline in auto sales but also a fairly tepid start to the holiday shopping season. The US Markit PMIs for December will complete the suite of global PMI being updated this week (9:45amET).

See the week ahead (here) for a full Fed preview with expectations. In summation, I expect revised qualitative asset purchase program guidance at this meeting or at least jawboning where they will go with it soon, no alteration in total Treasury and MBS purchases, unchanged maturity distribution of these purchases and the previously promised new communication tools. What would surprise me would be not only if they extended maturity horizons for purchase activity at this juncture, but also if we saw more FOMC members indicating hikes in 2022 or 2023 than the one and four members who did so respectively in the September dots pre-vaccines. It might be premature to do so now, but it’s likely the direction we’re going into the subsequent dot plots in my view.

For Canadian CPI (8:30amET), I went low at –0.3% m/m NSA and 0.5% y/y on a combination of a typical seasonal m/m drop in seasonally unadjusted prices, a higher than usual prior starting point with the main drivers during the prior month expected to land weaker in November, plus lower gas prices. A wildcard is represented by imputed prices due to incomplete/missing markets that will start to come back in this release due to restrictions and lock downs (and more so in the next December CPI report).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.