KEY POINTS:

- Markets cautiously optimistic as key deadlines near

- Brexit talks stuck on fish

- US stimulus talks face last minute snafus

- Will the BoJ extend stimulus supports overnight?

- Other CBs: BanRep, CBCT, Russia

- The BoC should keep ignoring small market deviations from its overnight target rate

- UK retail sales probably sank on lockdowns…

- …while lagging Canadian sales were probably flat

TODAY’S NORTH AMERICAN SESSION

It will be a pretty light overnight session through tomorrow in terms of calendar-based risk. Brexit and US stimulus talks remain the dominant focus. Brexit still seems hung up on fisheries given the tone of comments by Johnson and van der Leyen following their call a short time ago.

The US needs at least a funding deal tomorrow before midnight or else government agencies start to shut down. In a pandemic. In 2020. With Christmas one week away. It’s not impossible that we get at least a short technical shutdown this weekend, especially given the last minute snafus on disaster funding and ending Fed programs. One bone of contention is rising controversy surrounding whether Treasury Secretary Mnuchin really had to withdraw US$455B in funding for Fed lending programs, or not. He reasoned that CARES Act legislation passed by Congress required that he respect the year-end expiration. Others stepped forward today to challenge this interpretation, suggesting he had the authority to extend funding for the Fed programs. If so, it not only seriously questions Mnuchin’s intentions, but has also raised an important dispute in stimulus talks.

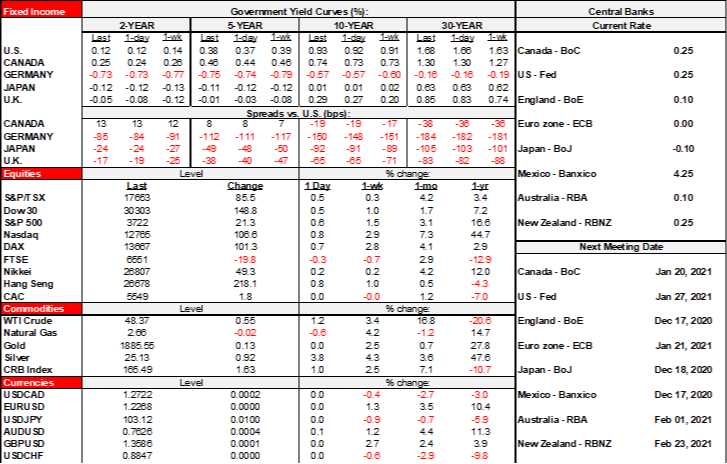

- Stocks ended higher with US and Canadian indices up by ½% to ¾%. London slipped on sterling strength, Paris closed flat and the rest of Europe was up as much as ¾% in Frankfurt.

- The USD slid against all major crosses, but once again, CAD underperformed.

- Sovereign curves bear steepened a bit with the US long-end leading the way as 30s cheapened by 2bps.

- Oil ended up about 1% across WTI and Brent.

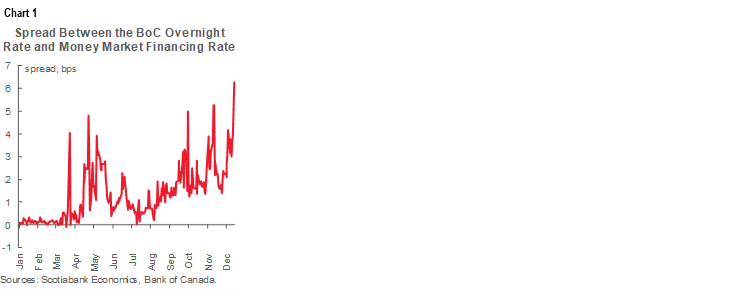

As a market aside, see chart 1. It won’t win any chart of the year prize, but it shows the spread between the BoC’s overnight rate and the BoC’s estimated overnight money market financing rate this year. It’s worth noting that the BoC has looked through when the market rate has slipped 4–5bps beneath the o/n target on several occasions this year. The more recent episode is only a point or two lower than those prior episodes, and sparked by Governor Macklem’s open speculation during his parliamentary testimony on November 26th. Macklem’s comments were then followed up by Deputy Governor Beaudry’s speech a week ago that stated that marginally redefining the effective lower bound is among the options for adding stimulus, but only if developments became persistently worse. Nothing we’ve heard from the BoC leans toward persistence and in fact goes the other direction in terms of cautious optimism.

I’m therefore still of the view that the risk exceeds the token reward to further fiddling with the effective lower bound. Markets have witnessed the BoC bounce around –0.5% to +0.25% with its definition of the ELB and by contrast to the RBA that never defined its ELB to be negative even before the pandemic. A token BoC cut could well result in markets pushing them negative whether they’d like it or not and it could risk being somewhat destabilizing at this juncture. Suggestion? Stop talking about negative rates and messing with the ELB until we’re well past this pandemic mess. The BoC’s communications have arguably been at the root of the small problem in short-term rates trading.

OVERNIGHT MARKETS

The main event overnight will likely be the Bank of Japan’s decisions (est. 10pmET) and Governor Kuroda’s press conference (est. 1:30amET). One option is to extend corporate bond and CP purchase programs beyond the March 31st expiration and perhaps by six months, while leaving other policy variables unchanged.

Other overnight releases will include:

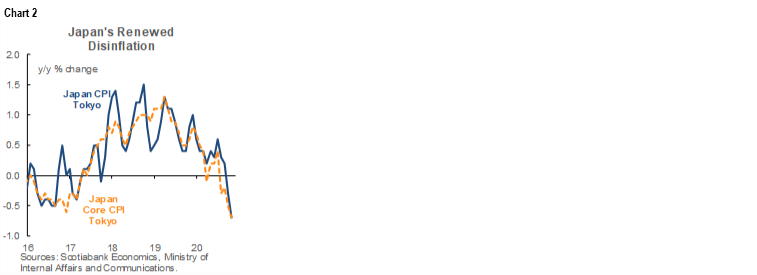

- Japan CPI inflation will be updated for November (6:30pmET). It could provide cover for the BoJ. Consensus expects further weakening with headline and core inching closer to -1% y/y that would bring inflation to a decade-long low. The fresher Tokyo gauge is already there (chart 2).

- CBCT decision (time TBC). Taiwan’s central bank is expected to hold at 1.125%.

- UK retail sales for November (2amET). Consensus expects a 4% m/m drop in sales as COVID-19 lockdowns returned.

- German IFO business confidence will be updated with the December reading at 4amET. There may be upside risk if it follows the modest rise in purchasing managers’ indices.

- Russia’s central bank is expected to hold at 4.25% (5:30amET).

TOMORROW’S NORTH AMERICAN MARKETS

Most of the attention in tomorrow’s markets will remain upon Brexit and US stimulus talks, plus spillover from the Bank of Japan if any.

Canada updates retail sales for October as the final reading on the path to next week’s GDP estimate (8:30amET). StatsCan has already guided that sales were “relatively unchanged” based on 50% of survey responses.

Colombia’s central bank is expected to hold at 1.75% (1pmET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.