KEY POINTS:

- Market risk focused on nonfarm, US stimulus, Brexit

- Why nonfarm faces high uncertainty

- High noon drama in US fiscal stimulus talks

- Canada’s CIB announcement is like finding lost money

- Mexican peso gains on Banxico guidance

- Eurozone CPI could face downside risk to consensus estimates

- Australia’s restrictions expected to hit retail sales

TODAY’S NORTH AMERICAN MARKETS

We could be in for a sprint to the finish line overnight through tomorrow with several forms of significant market risk. US nonfarm payrolls is an obvious stand-out candidate; as argued below, given the volatility in temporarily laid off workers coming back on payroll, no one should have terribly high confidence in the change in payrolls. US fiscal stimulus negotiations did not appear to make material progress today with the House scheduled to leave after tomorrow following a likely symbolic vote on its own separate package. Brexit risks remain material. The largest currency mover was nevertheless the Mexican peso.

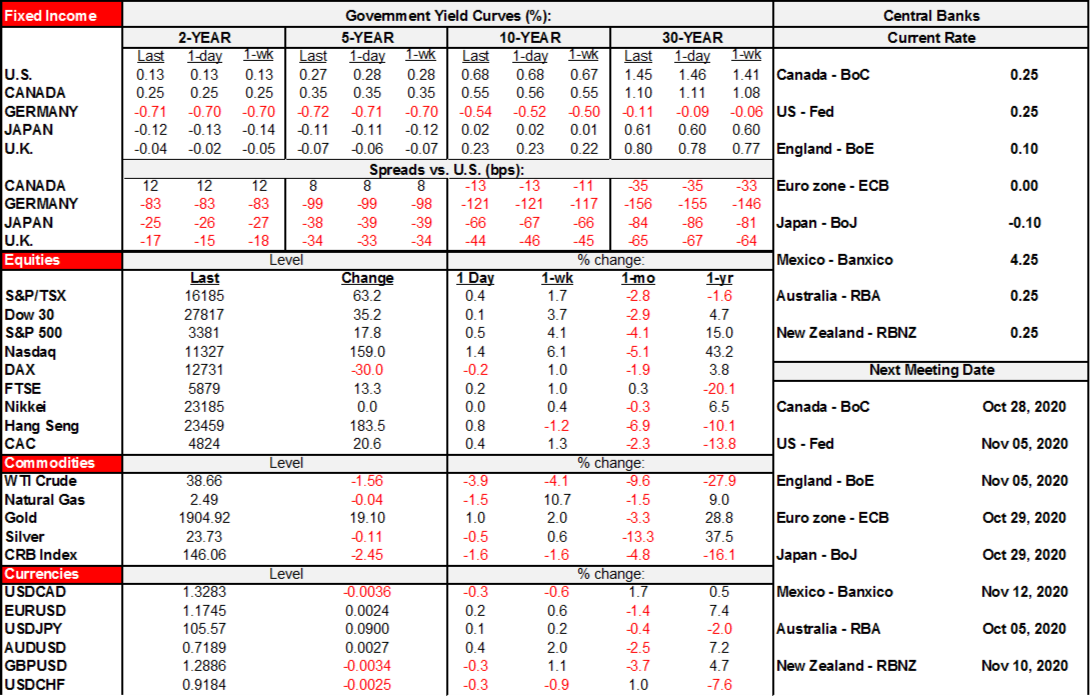

- Equities wavered but closed higher across most markets. The S&P500 ended up ½% while the Nasdaq led the way with a 1 ½% gain. The TSX closed just under ½% higher. European cash markets were mixed with most exchanges up by ¼% to ½% except for a ¼% drop in Germany.

- Sovereign bond yields slipped a touch toward the longer ends except for mild cheapening in gilts and spread compression in Italy that was partly an offshoot of the country’s plan to bring its deficit in line with EU rules within three years.

- Oil prices fell by about 4%. Gold was up 1%. Copper prices plunged by over 5%; they had rallied from March through to about mid-September but have slipped more recently partly on growth and stimulus concerns. Copper inventories fell a touch today which doesn’t explain the incremental price move.

- The USD was little changed over the day. In general, this morning’s dispersed movements generally held into this afternoon as sterling and the yen remained among the softer crosses, while most other major and semi-major crosses were up by ¼% to ½% except for the 1 ½% rise in the Mexican peso that followed last evening’s remarks by Banxico Deputy Governor Guzman that room to cut rates is “getting even more limited” and “the probability that we’ll have to take a pause has increased.”

A US fiscal stimulus package remains elusive, but headline risk will remain high. Treasury Secretary Mnuchin’s US$1.6 trillion offer still falls shy of the Dems’ $2.2T bill that they may vote on tonight as a purely symbolic move that wouldn’t make it through the Senate. In my view, the main stumbling block remains the White House and GOP don’t want to give the Dems a victory by gravitating to their number but the spirit of cooperation among the Dems one month ahead of the election and two days after Trump’s tactics in the debate is probably just as low.

Canada’s announcement that it would target C$10 billion in infrastructure spending through the Canada Infrastructure Bank over the next three years is one part new and one part old. It is part of the original C$35B plan that was announced in 2017 but that has only doled out $4B to date. So, you could say the announcement is old, but the spending had been largely written off given the track record. If revitalizing and repurposing the CIB is successful then it’s like finding money you thought you had lost. Still in an economy that is roughly C$2 trillion in terms of inflation-adjusted GDP, $10B spread over three years won’t move the needle on growth.

OVERNIGHT MARKETS

Overnight calendars are pretty light ahead of nonfarm payrolls.

Australia updates retail sales figures for September tonight (9:30pmET). An advance estimate based on incomplete data suggests that retail sales fell -4.2% m/m in August. An outbreak of cases in July led to the reintroduction of restrictions in state of Victoria. These restrictions were upgraded in early August and likely had a significant impact on economic activity in Melbourne. Sales in the state of Victoria fell by 12.6% m/m and report goes on to say that sales excluding Victoria would be a more modest decline of 1.5% m/m.

Eurozone inflation during September will be updated at 5amET. There may be downside risk to the consensus estimate of -0.2% y/y with core at 0.4% y/y because most economists did not update their estimates after downside surprises to individual country estimates that were released this past week. Euro area inflation is expected to be significantly impacted by German’s stimulus package through the rest of 2020. The package—introduced in July—lowered the standard VAT rate from 19% to 16% and the reduced VAT rate from 7% to 5% until the end of the year. Energy prices will also continue to drag on inflation, which we have seen consistently since the start of the pandemic.

TOMORROW’S NORTH AMERICAN MARKETS

Bring on nonfarm! The week could go out with either a bang or a whimper partly depending on what happened to US jobs last month. Off-calendar risk will continue to monitor US stimulus and Brexit headlines. There might be a pure play on nonfarm for a short interval, but either one of these could conceivably overwhelm any possible nonfarm market effects just as the House leaves town after tomorrow. The House will hold a vote today on the Dems go-it-alone package but that could still just be a pressure tactic so still be careful with conclusions. Also keep an eye on downside risk to consensus estimates for Eurozone inflation but it may already be priced given earlier country releases this week.

For nonfarm, consensus expects 875k. I’m at one million (which this time happens to line up with the whisper number fwiw!) and the trimmed range within consensus runs from approximately half a million to 1.2 million with a handful of outliers in both tails. I went with unchanged wage growth of 4.8% y/y but there may be more downside than upside to this partly if lower-than-average wage workers continue to come back.

There are several reasons for this view:

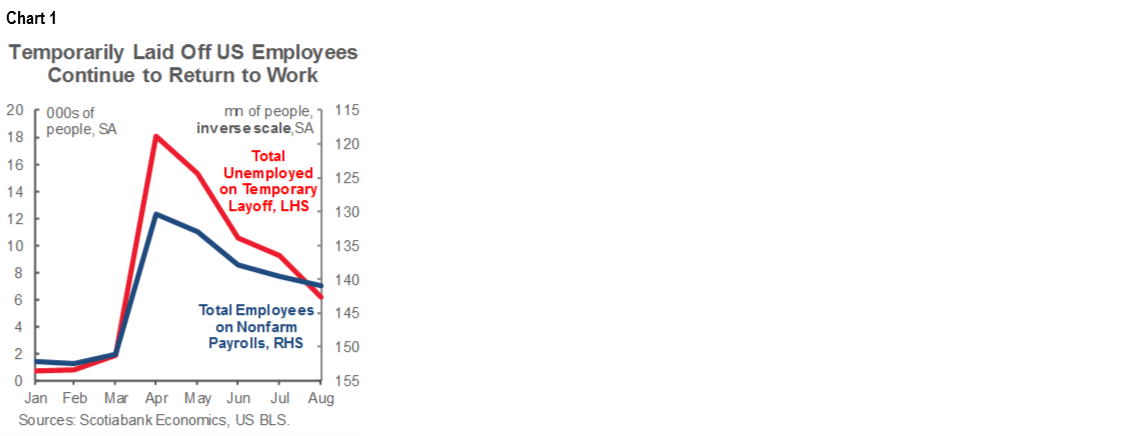

- there are still 6.2 million Americans on temp layoff, down from 18.1 in April but still way higher than the 801k figure in February. I’m expecting continued callback of furloughed workers. This is a hugely variable driver that has seen between 1–5 million being called back each month. With little appetite for new hiring, I would think this is the dominant swing factor. As chart 1 demonstrates, what happens to temp workers getting called back is the dominant driver of nonfarm payroll changes during the pandemic.

- initial claims fell by around 200k between August and Sept nonfarm reference periods. That doesn’t speak to call backs and any new job creation though.

- the Conference Board’s consumer confidence report showed the jobs plentiful minus hard to get gauge improving

- ISM-mfrg employment improved a bit

- ADP landed at 749k and has tended to lag nonfarm by hundreds of thousands over recent months

I also went with 8.0% for the UR derived from the companion household survey but there is a twist on this one. The household survey showed ’uuuuge gains in jobs (3.76 million) and the labour force (968k) during August. Neither are likely to repeat in my opinion. In a relative sense, there is likely more downside risk to the household survey’s job estimate for September compared to August than there is for the labour force which *could* shift the tail risk higher.

It would still be tough slogging to get back to full employment if another million or so jobs land in your laps tomorrow. Barring revisions, that would raise payrolls to about 142 million and hence still about 10 million shy of the pre-pandemic level. Put another way, about 12 million jobs would have been recouped.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.