KEY POINTS:

- Stocks drop on escalating virus risks…

- …but selling was curtailed into the close

- Germany likely to be added to the growing list of virus restrictions

- US consumer confidence, durable goods orders and Richmond on tap

- Ontario sets budget date

- South Korean GDP the lone overnight release

TODAY’S NORTH AMERICAN MARKETS

Well that was decidedly uncivil! A significant risk-off tone swept across global asset classes. Nuts to Mondays anyway. Headlines that Germany is also planning lockdowns applied to restaurants and bars but not schools, daycare centers or retail stores didn’t help.

Restaurants and bars are the focus because these high contact venues are thought to be responsible for a considerable portion of cases; this US study, for instance, estimated that contact with people who have gone to them makes one about twice as likely to contract the virus. At times, other jurisdictions, like Toronto, have stated just under half of community transmission can be traced to restaurants and bars. Who needs a study for this; tried scotch through an n95 lately?

If there is a silver lining then it lies in the fact that the final half hour of the North American session brought buyers back into the picture which could be a more encouraging hand-off to tomorrow.

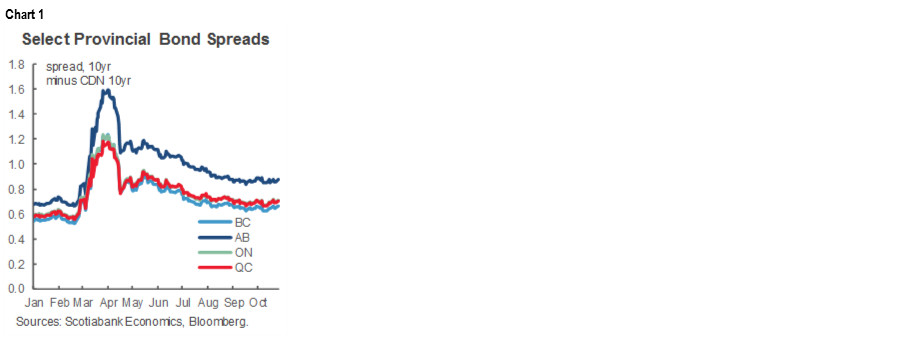

Against this backdrop the Ontario government bravely committed to delivering a three-year budget plan on Fed day (November 5th) after cancelling the March budget. The province’s spreads over Canadas have retained improvement of late but remain slightly wider than pre-crisis (chart 1).

Nothing resulted from the 52-minute stimulus call between Mnuchin and Pelosi, but nothing much was expected at this point in any event.

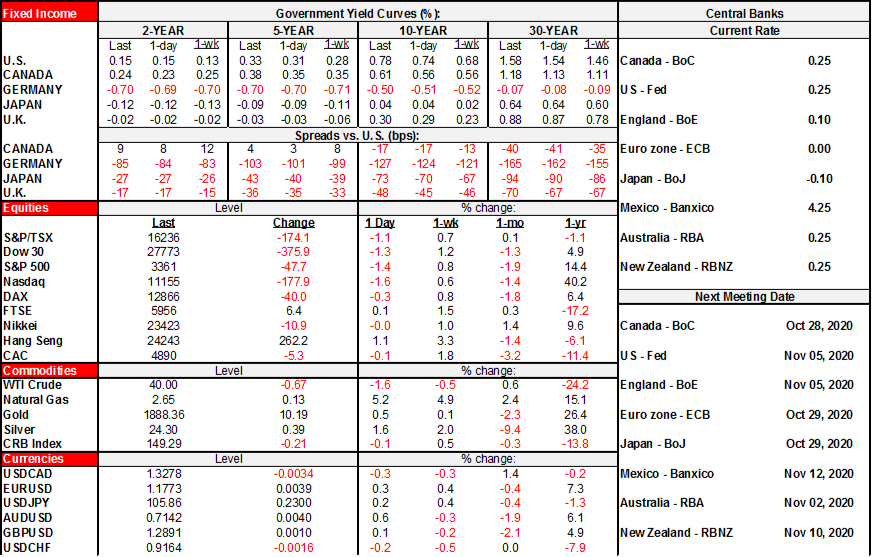

- Stocks fell by 1.9% in the case of the S&P500 and about 1.4% in Toronto. The S&P was down by as much as 2.8% until a half hour before the close but bounced off bottom into the close. Europe closed down by between 1½% and 3¾% with the Dax leading decliners. Good luck Asia!

- Sovereign curves bull flattened with US 10s at 80bps (-4bps) and outperforming everyone else as a safe haven bid.

- Ditto for the greenback as the USD rallied against almost everyone. The C$ wound up being the worst performer among majors with Wednesday’s Bank of Canada meeting in sight and PM Trudeau downplayed incorporation of a fiscal anchor into the pending fiscal update.

- A decline of over 3% in oil prices didn’t help CAD.

OVERNIGHT MARKETS

Overnight markets through tomorrow will focus on light US calendar-based risk. Only backward looking South Korean GDP is on tap overnight (7pmET).

South Korea’s relatively successful containment of the virus is being rewarded with a gradual economic recovery. Q3 growth is expected to register 1.3% q/q non-annualized following a drop of 3.2% q/q in Q2 and should lift them out of a technical recession. However, South Korea is not immune to the effects of a rapidly rising second wave seen in other countries, which has created inevitable headwinds in Q4.

TOMORROW’S NORTH AMERICAN MARKETS

US macro releases will probably be overshadowed by off-calendar developments but consumer confidence will be closely watched.

Durable goods orders during September (8:30amET) are expected to rise again with orders ex-defence and air slated to rise for a fifth consecutive month. Consensus expects the Conference Board’s consumer confidence to be little changed in October’s reading (10amET) after the previously released UofM sentiment gauge increased a touch and with initial jobless claims sharply falling albeit for uncertain reasons. The Richmond Fed’s manufacturing gauge (10amET) will build upon ISM-manufacturing expectations after the Philly Fed’s measure moved higher along with the Dallas and KC metrics but against the decline in the Empire reading. Recall that the regional surveys under-represent transportation.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.