ON DECK FOR THURSDAY, DECEMBER 10

KEY POINTS

- ECB does a lot, but still underwhelms markets

- ECB adds to liquidity tools but falls short on bond flows

- Short-term ECB disappointment might work out over time

- US claims spike, but drivers uncertain

- US inflation lands a touch firmer than expected

- BoC’s Beaudry to speak on QE

INTERNATIONAL

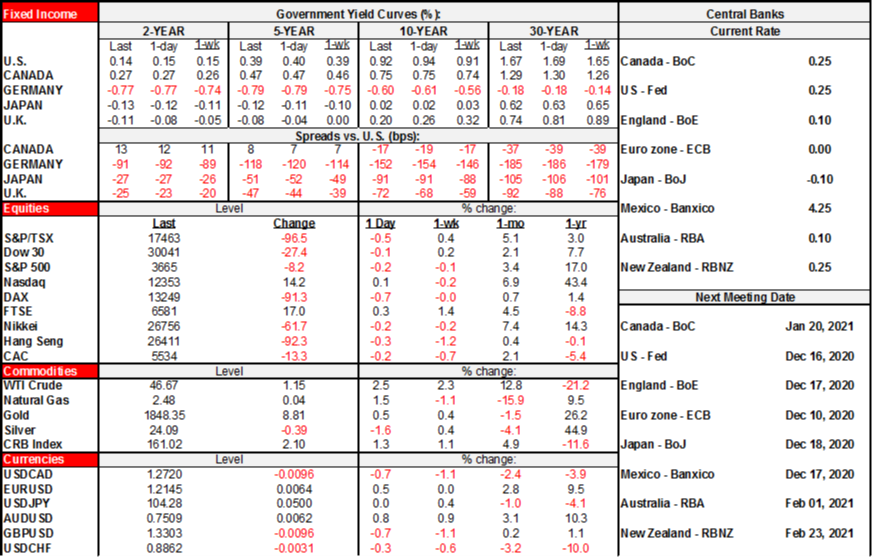

Relative to what was priced in advance, the ECB came across as a tad underwhelming this morning. That is contributing to a slightly stronger euro, cheapening across the EGBs landscape and a mild negative ton in equities. At issue is the difficult balancing act between the ECB’s effort to try to limit the policy overshoot if conditions improve in future versus doing less than their own hype had driven markets to expect in the short-term (see below). US jobless claims spiked higher but resist premature judgement over what caused it, while core inflation held firm last month.

- US and Canadian equities are down by about ½%. European cash markets are down by ½% to 1%. Only London is bucking the trend a touch with a tiny gain that reflects the ongoing depreciation in sterling that has shed 1.3% of its value to the USD over the past week.

- Oil is up by almost 3% while gold is flat.

- Sovereign bonds are outperforming across the gilts curve, little changed but slightly dearer in North America and somewhat cheaper across EGBs.

- The currency space is trading off appreciating crosses to the USD including the A$, CAD and euro versus a sharp drop in sterling as well as losses in the Mexican peso and yen.

The ECB’s policy statement (here) and President Lagarde’s press conference were somewhat of a disappointment to today’s markets relative to what had been priced after all the hype, but it may well work out over time for them. Liquidity programs like the TLTROs and PELTROs were generously expanded, but the key disappointment was that while adding €500 billion to the Pandemic Emergency Purchase Program to take it to €1.85 trillion met consensus expectations, doing so over nine months instead of the expected six months meant a somewhat slower flow into bonds. Further, Lagarde said in her press conference that the expanded PEPP might not be fully utilized:

“If favourable financing conditions can be maintained with purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the enveloped can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.”

That’s a clear disappointment in the short-run relative to what was priced. It might have cost little for the ECB to extend the PEPP for 9–12 months and hike the size of the program at an implied steady flow rate and to leave it more implicit that they stood ready to adjust the program in either direction as conditions warrant.

In the longer run, however, vaccines plus fiscal stimulus being delivered today or tomorrow plus further monetary policy stimulus plus pent-up demand plus easy financial conditions represent a significant chance at seeing a policy overshoot. Indeed, Lagarde’s press conference noted that immunity may be achieved by the end of next year and delivered forecasts to reflect this. While 2021 GDP growth was downgraded to 3.9% from 5%, that was likely due to the distorting effect on the annual math stemming from the hand-off of weaker 2020Q4 growth into 2021Q1 before a presumed acceleration thereafter. That acceleration is forecast to persist into 2022 when the ECB anticipates growth will rise to 4.2% (from 3.2% previously). This has the overall look and feel of a central bank’s final stimulus act with significant risk it won’t all be implemented.

UNITED STATES

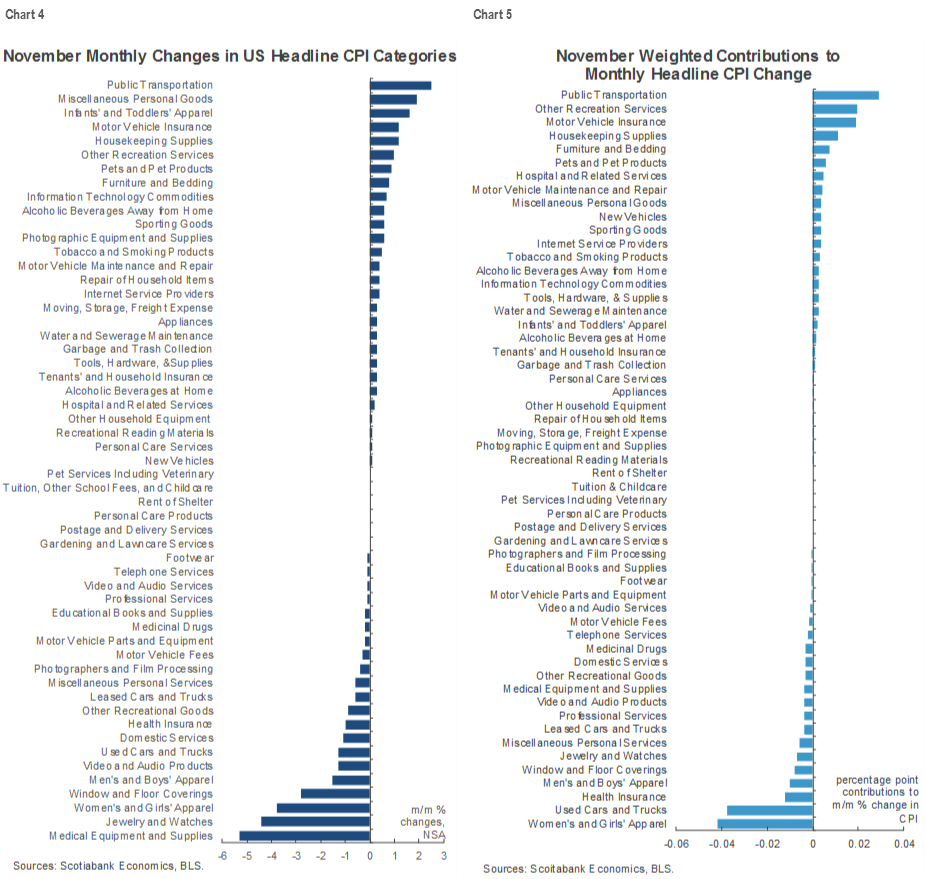

US jobless claims came in higher than expected but I’m not inclined to over-react on the basis of a one week spike with debatable drivers. Initial claims increased to 853k from 716k the prior week and continuing claims also increased to 5.757 million from 5.527 million for the week before last. While logically it makes sense to expect tightening restrictions to impact claims, it’s not clear that’s what drove last week’s spike. Instead, it could have been the case that initial claims filed two weeks ago were artificially low during the Thanksgiving week if behaviour was out of the norm compared to typical seasonal adjustments. If so, pent-up claims may have been filed last week instead. One would expect claims to probably come back down in the next week or two if that is the case.

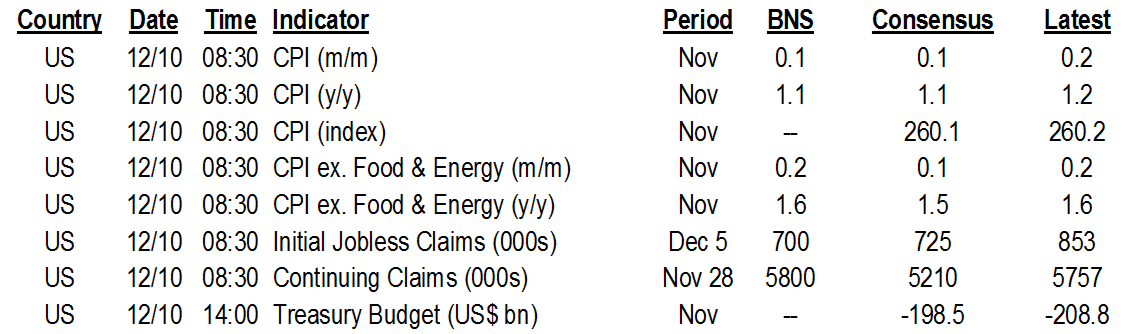

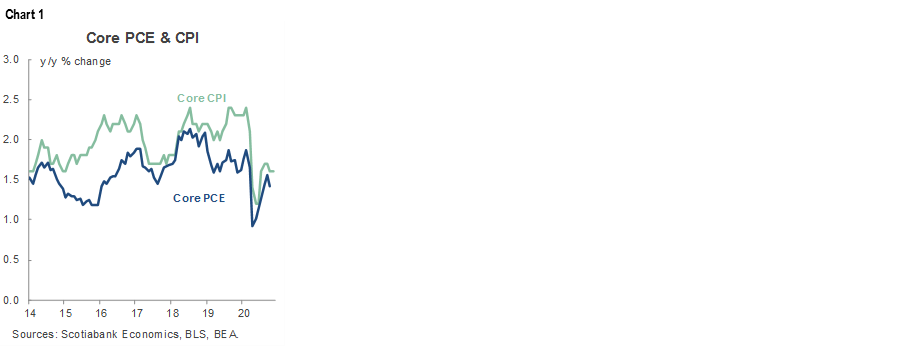

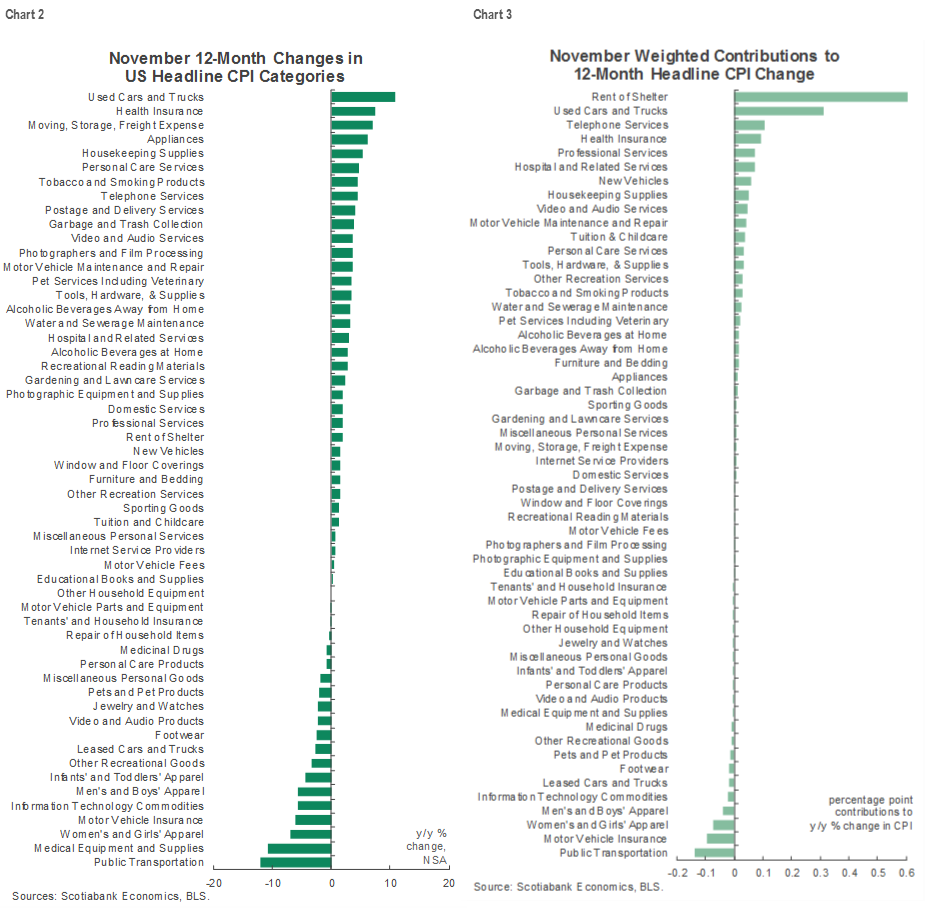

US headline CPI inflation nevertheless surprised to the upside of expectations (consensus and mine), but only by a tick in terms of the year-ago and month-ago rates. Core inflation met my expectations but was firmer than consensus expected which might suggest the Fed’s preferred core PCE gauge will also move sideways when it gets updated (chart 1). The main upsides came from clothing and recreation prices while pricing power in terms of month-ago price changes was generally weak elsewhere. Chart 2 shows the breakdown of the basket in y/y terms while chart 3 does so in weighted contribution terms. Charts 4 and 5 do the same things for the month-ago changes. Also see the summary table below.

US CPI m/m % / y/y %, November:

Actual: 0.2 / 1.2

Scotia: 0.1 / 1.1

Consensus: 0.1 / 1.1

Prior: 0.0 / 1.2

US core CPI m/m % / y/y %, November:

Actual: 0.2 / 1.6

Scotia: 0.2 / 1.6

Consensus: 0.1 / 1.5

Prior: 0.0 / 1.6

CANADA

Bank of Canada Deputy Governor Beaudry speaks on what’s ‘under the hood’ in terms of the central bank’s QE program (1:30pmET). No market effect is anticipated.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.