ON DECK FOR THURSDAY, DECEMBER 24

KEY POINTS:

- Mild risk-on sentiment helped by a Brexit deal

- The Christmas European divorce moves to ratification

- CBs: Turkey hikes, BoT holds

- Canada's homebuilders are still going strong

- An updated holiday week ahead…

- ...with a focus on US funding and stimulus options from here…

- ...Brexit ratification…

- ...year-end dollar funding…

- ... and global macro releases

INTERNATIONAL

Good morning Santa’s helpers. You’re doing well in driving mild risk-on sentiment this morning. Santa will treat you well as his sleigh is passing over Australia at the time of writing. Norad is tracking him here. You see, I figure that since they really have achieved a Brexit deal on Christmas Eve, then perhaps we should all begin to believe in Santa once again. Indeed a Brexit deal has finally been struck with UK PM Johnson and EC President Von Der Leyen holding press conferences as this note is being sent. Now it must be ratified and the UK Labour Party has guided they will have a formal response “in due course.”

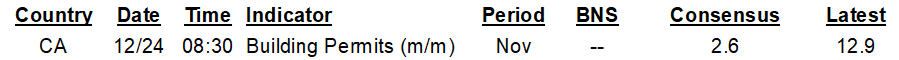

Calendar-risk is basically zero as we only have three minor things to consider. One is that Turkey’s central bank hiked by more than consensus expected by taking the policy one-week repo rate up 200bps to 17% this morning on inflation concerns and that drove lira appreciation. Second is that the Bank of Thailand held at 0.5% as universally expected. Third is a positive signal on Canadian housing markets given a 7.9% m/m surge in Canadian homebuilding permit volumes during November that points to ongoing strength in housing starts (chart 1).

An updated global week ahead that covers expectations from now through to the new year is provided below.

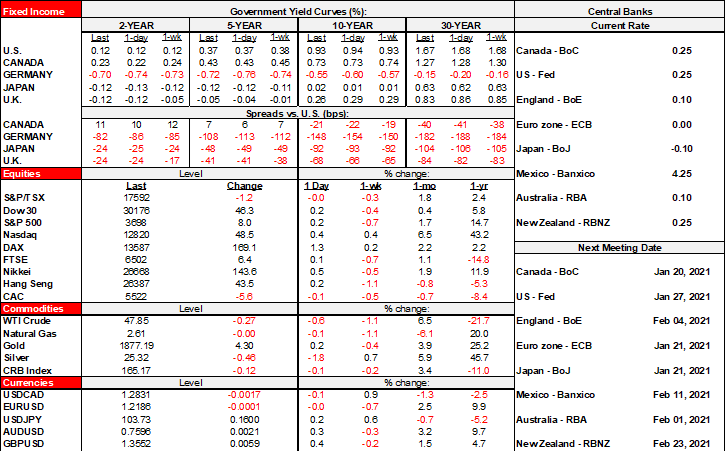

The US bond market shuts at 2pmET and the stock market shuts at 1pmET. The Canadian bond and stock markets shut at 1pmET. Here is the state of markets at present:

- Stocks are slightly bid as a Brexit deal was significantly anticipated and faces ratification. The S&P500 is up ¼% while the TSX is flat. European cash markets are now shut. Germany and Italy never opened, while stocks were up ½% in Spain and little changed in London and Par-eee!.

- Sovereign bond yields outperformed in the UK before the holiday shut things down; if we really do have a Brexit deal then they’re set up for cheapening upon return. EGBs are shut. US and Canadian bonds are very slightly bid toward the longer end.

- Oil is off by ¾% and gold is flat at US$1878/oz.

- The USD is little changed on balance as safe havens like the yen and Swiss franc slightly depreciate while the euro is little changed. Sterling is among the leaders of the pack of appreciating currencies along with the Mexican peso.

UPDATED GLOBAL WEEK AHEAD

I’ll be on vacation after today through next week. Here are highlights of what to expect over this period that expands upon and updates what was covered in the two week version of the Global Week Ahead for this week and next (reminder link here). Most of the risk will be off-calendar in nature.

1. US defense bill: Congress is likely to come back next week with a bipartisan override on Trump’s veto of the US$740 billion defense spending bill. Trump vetoed it because he wants a defense bill to hit tech companies that he views as unfriendly to his administration and to do so through Section 230 provisions that would repeal online liability protections. He also vetoed the bill because he objects to renaming military bases that are presently named for Confederate leaders which is consistent with his behaviour to date on such matters. Trump called the Act a “gift to China and Russia”; others might think that holding up defense funding would be the gift to China and Russia.

2. US stimulus and funding bills: Trump is holding up the US$900 billion stimulus package and US$1.4 trillion agreement to fund the US government through to the September 30th 2021 fiscal year-end. He has not said he will veto the bill, but has said he is seeking bigger stimulus cheques than the means tested US$600/person provision and wants to slash foreign aid as his definition of waste in the bill. It’s also feasible that his real intent is to seek revenge on Republicans who acknowledged his defeat (albeit long after everyone else…) and on his pending defeat at the hands of Congress on the defense bill. It’s also possible he’s doing what everything feared and acting with extraordinary petulance by refusing to cooperate in clear defeat as he issues pardons for yet more unsavoury types. At this point I’m cautiously assuming he’ll ultimately sign it and avoid the expiration of jobless benefit enhancements and eviction moratoriums, but it’s hardly clear this will happen. Here are the options as I understand them.

a. One option Trump has is to sign the bill by December 28th when the Continuing Resolution to fund the US government expires and thus avert a shutdown before year-end. If he doesn’t, however, then Congress can still pass another continuing resolution to fund government into the new year and avert a shutdown. Still, some jobless benefits begin to expire the day after Christmas.

b. Another option is that he vetoes the bill and thereby requires Congress to schedule another vote with a hopefully veto-proof majority like the original votes and the bill passes.

c. A so-called “pocket veto” is another option whereby he just doesn’t do anything within the ten days he has to consider the bill. If he doesn’t do anything within this period, then the bill would normally pass automatically, but the problem is that the current session of Congress expires on January 3rd and hence before Trump’s ten day period will be up. Exactly when that ten day period expires depends on when the bill lands on his desk but at this point it is certain to expire after the current Congress wraps up. Congress would have had to get the bill to him by yesterday in order to avoid the scenario whereby Trump’s period of consideration expires after Congress convenes. So, if Trump does nothing by January 3rd then the bill will die and would have to be taken up in the new year by the new Congress and presumably with retroactive features. Trump would be unable to use the pocket veto option in a new Congress because there would be no repeat of the deadline issue and so even if he vetoed the bill, the new Congress could come back with a veto override super majority and hand Trump another defeat. Thus, the worst case scenario is likely to be that the present stimulus just gets held up by a few weeks.

d. A possibly better scenario for stimulus would be if the Dems took control of the Senate after the January 6th run-offs in Georgia. If so, then we might see an interim measure followed by a much larger stimulus package after inauguration day on January 20th when Biden takes the keys.

e. Finally, Trump could align with Pelosi’s Democrats in seeking higher stimulus cheques, but the GOP would likely revolt against the added cost of $2k cheques person that would cost US$500 billion instead of US$160B for the $600 cheques.

3. Brexit: With a deal having been struck to avert a hard Brexit on January 1st, it must now be ratified by both sides. This will require monitoring over the holiday period.

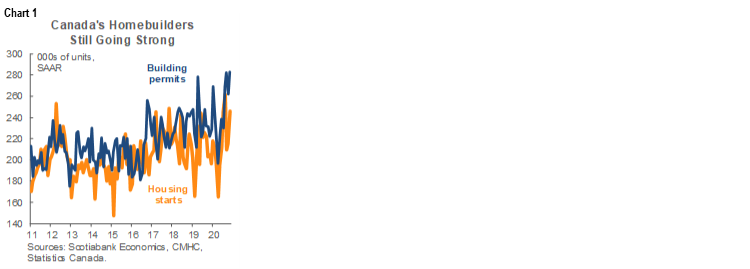

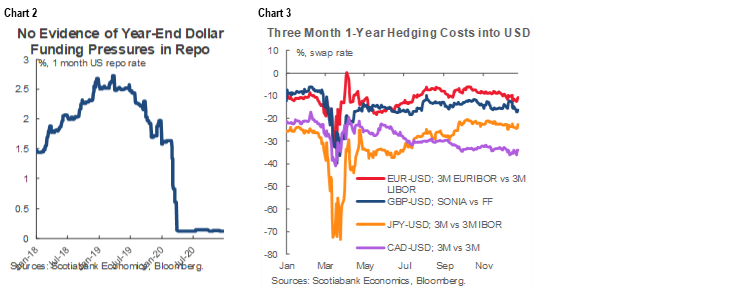

4. Dollar funding: Year-end for US companies normally brings with it demand for dollar funding in part to engage in some year-end window dressing of balance sheets. Sometimes it can spark upheavals in markets. So far there isn’t really any evidence of anticipated pressures in repo markets (chart 2) or in FX hedging costs (chart 3). If risk appetite is shocked by Brexit or US stimulus developments or other random developments, then it’s feasible that a surge in demand for dollar funding within more thinly traded holiday markets could be disruptive. The Fed’s actions to extend dollar swap arrangements with foreign central bank counterparties probably mitigates this risk by continuing the option to spring the taps on dollar liquidity.

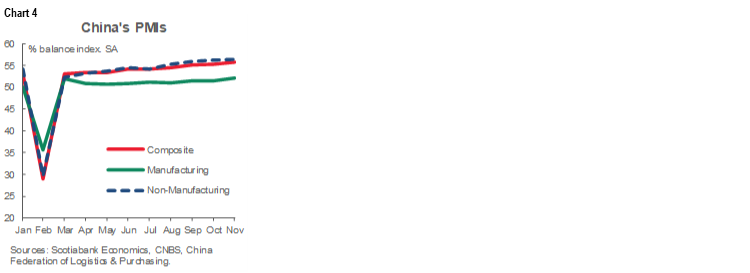

5. China will release the state versions of its PMIs on Wednesday December 30th. As shown in chart 4, they’ve generally been more resilient than across its main export markets in Europe and the US partly because of restocking across western economies but also on domestic strengths in China’s economy.

6. US releases will be very light with only weekly jobless claims due on December 31st which will fall outside of the nonfarm reference period, plus pending home sales for November the day before.

7. European releases will also be very light with just Spanish CPI for December on December 30th ahead of the rest of the Eurozone CPI reports the following week. German retail sales will also arrive at an uncertain time next week.

8. Canadian and Latin American calendars will be dead quiet. The next thing to watch out of Canada will be the December jobs report on January 8th.

And with that, I leave our clients, friends and colleagues with the very best wishes for as merry a Christmas as can be during such times and a better new year in 2021.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.