ON DECK FOR MONDAY, DECEMBER 21

KEY POINTS:

- COVID, Brexit drive risk-off start to the week…

- ...as markets ignore the US stimulus and funding deals

- PBOC leaves LPRs unchanged as expected

- Canadian momentum spills over into November

- Global COVID-19 case charts

INTERNATIONAL

Broad risk-off sentiment is sweeping across global asset classes to start the week. Brexit negotiations continue to spin their wheels as negotiators are stuck on sharp differences over how much the EU should cut its catch in UK waters and over what phase-in period. Further, while news of a new COVID-19 strain in London first emerged a while back, tightening restrictions by the EU and Canada and deepening lockdowns are sparking heightened concern. The WHO has guided that it will take some time to evaluate the effectiveness of vaccines on the new strain but sounded cautiously optimistic for now.

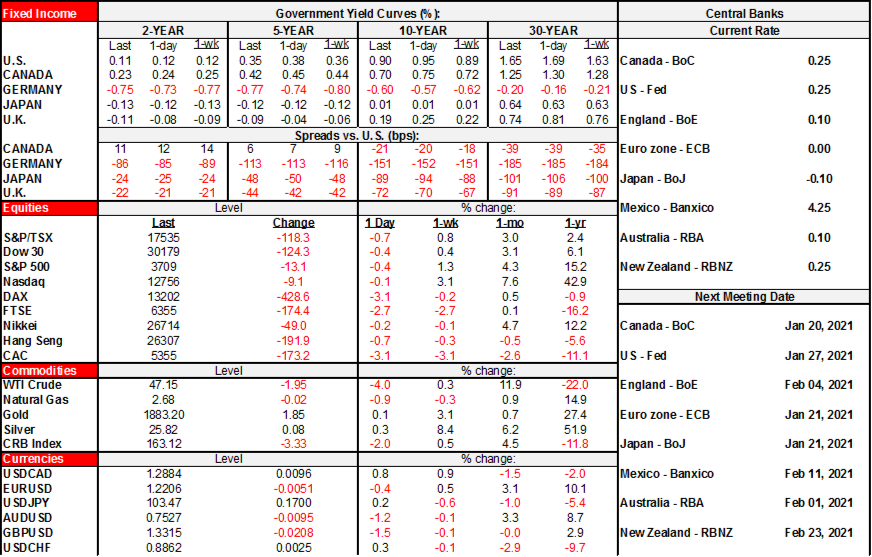

- US S&P equity futures are down by 1¾% with TSX futures down by over 1%. European cash markets are down by 2½–3½% or so. Asian equities outperformed with stocks up by ¾% to almost 2% in China, ¼% in Seoul, 1% in Taiwan, but down ¼% in Tokyo, ¾% in HK and 3% in India.

- Sovereign yields are under sharp downward pressure led by the gilts curve’s flattening with yields down by 5–8bps across maturities. The US Treasury curve is flattening and led by 10s rallying by 5bps. Canada’s curve is performing similarly with a slight degree of outperformance up to 10s.

- Oil is off by about 4%. Gold is dead flat.

- The USD is appreciating against all major currencies.

There was nothing material on the overnight macro calendar and nothing is expected today. China’s PBOC kept its one- and five-year Loan Prime Rates unchanged as expected.

UNITED STATES

Markets are ignoring the weekend movement toward the US$900B US stimulus and US$1.4 trillion funding bills with voting expected today in the House and then the Senate. The broad outlines of the stimulus package include US$284 billion of funding for the Paycheck Protection Program, US$600/person stimulus cheques, a $300/week unemployment benefits extension, a one-month extension of the eviction moratorium through January, plus targeted aid to airlines, education, and vaccine distribution. The stimulus cheques will go to those earning up to US$75k/yr with the amount reduced and then eliminated for those earning over US$99k. The deal does not include aid for state/local governments or COVID-19 liability protections. The funding bill would avert a government shutdown and fund the government until September 30th 2021.

The Federal Reserve’s flexibility was generally preserved despite last-minute movement to curtail it. The clawed-back US$429B of funding for the Fed’s emergency facilities that expire at the end of the month will be put toward offsetting the cost of the stimulus package while the facilities will expire as previously understood and new ones would have to be approved by Congress. That’s better than prohibiting them in the legislation as Senator Toomey had initially sought before he changed his position on Saturday by noting that the way his original proposal was worded was too brought and restrictive to the Fed’s future ability to response to shocks.

CANADA

Momentum continues into November with StatsCan guiding on a preliminary basis that wholesale trade was up by 1% m/m in November with gains widespread across subsectors. The agency also reported that new house prices were up another 0.6% m/m in November which generally backs up the imputed housing replacement cost driver in last week’s CPI figures for November.

This follows earlier indications that hours worked were up by 1.2% m/m in November, housing starts were up 14.4% m/m, retail sales were “relatively unchanged” and existing home sales slipped by 1.6% m/m.

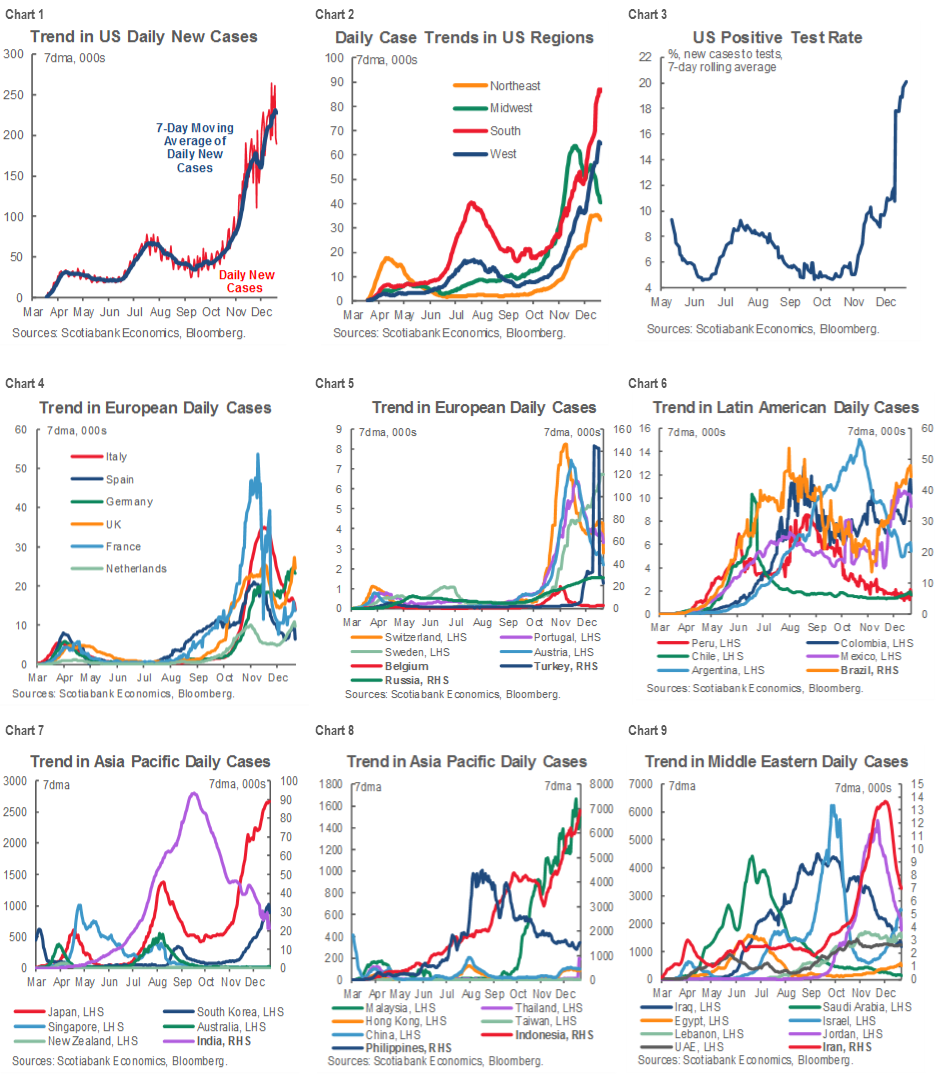

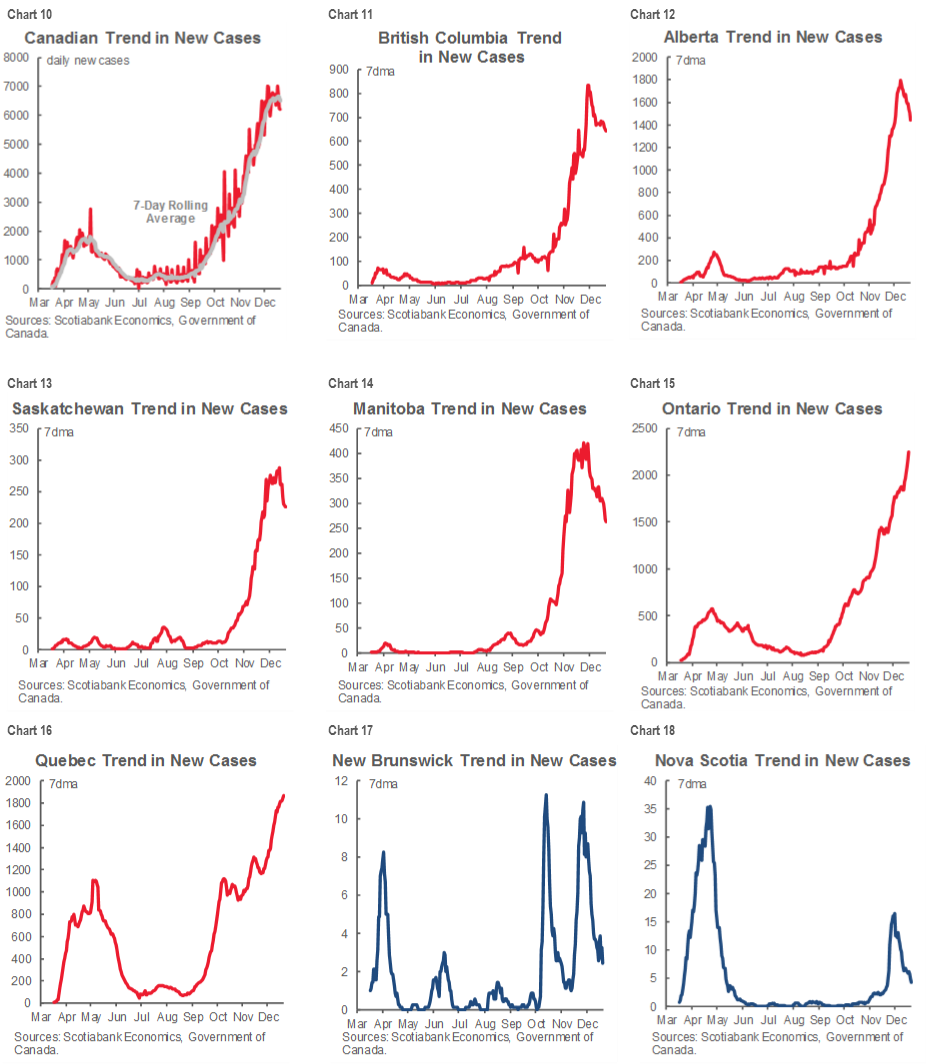

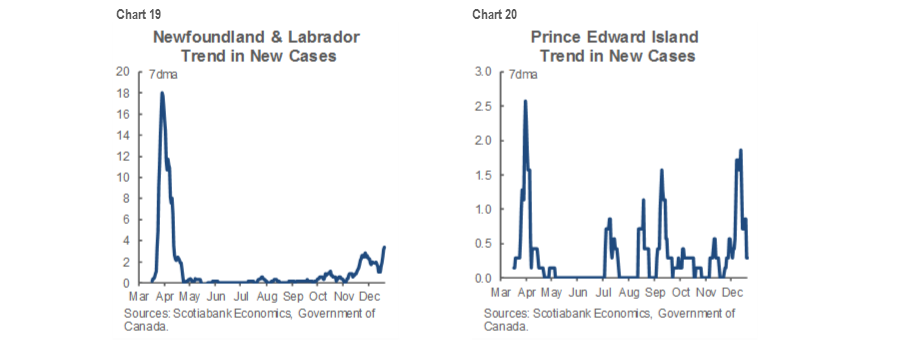

GLOBAL COVID-19 CASES

Each Monday brings the accompanying collection of updated COVID-19 charts. Select summary observations follow.

- the US trend in new daily causes continues to soar and is being led by the southern and western regions of the country. The US positive test rate is also still rising and is at a record, although higher testing frequency and differing samples distort a fuller interpretation.

- European new daily cases are back on an upswing in December in several major countries.

- Latin America is registering upward trends in Brazil, Colombia and Mexico. Case trends in Argentina, Peru and Chile are generally better behaved.

- Across Asia-Pacific countries, cases are sharply rising in Japan, Indonesia, Malaysia and South Korea. They are falling in India and the Philippines and flat elsewhere including containment in Australia, New Zealand, China, Hong Kong, Singapore and Thailand.

- the Middle East is witnessing an upward trend only in Israel, as other countries are flat to falling.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.