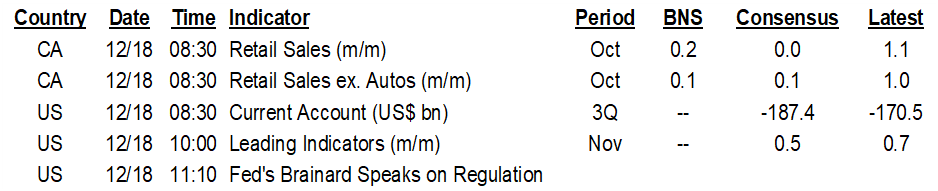

ON DECK FOR FRIDAY, DECEMBER 18

KEY POINTS:

- Mild risk-off on Brexit, US stimulus talks

- UK’s Johnson fish slapped by Barnier

- Unbelievably, the US gov’t is poised to shut down in a pandemic

- Russia’s CB could be facing a repeat of 2014-16

- CDN retail sales keep climbing in Q4, for now…

- ...but lockdowns and school closures will take a toll

- BanRep expected to hold

- All three German surveys posted improvements

- UK retail sales fall as expected

- Bank of Japan extends programs as expected

INTERNATIONAL

Markets are in a bit of a cautious mood so far. Stalled Brexit talks and the likelihood that the US government starts shutting down at midnight tonight due to purely incompetent failure to strike a stimulus and funding agreement in time are the likely causes. Geopolitical risks are hard to assess, but may feed tensions into the new year if Russia’s alleged act of cyberwar invites coordinated retaliation with the ruble continuing to slide. In all, commerce is paying the price for geopolitical risk. Question your leaders indeed!

Sterling depreciated after a Brexit ultimatum was delivered with talks still hung up on fish. British PM Johnson got fish slapped by EU negotiator Barnier who said accept limits on accessing the EU’s single market if he won’t bend on allowing EU access to UK fishing waters or split with no deal.

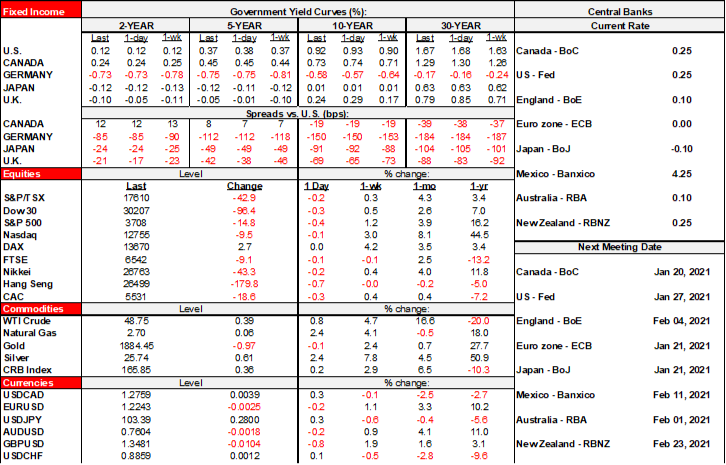

- Stocks are mildly lower by ¼% to ½% in the US and Canada. European exchanges range from down 1% to roughly flat.

- Gilts are outperforming all other curves with yields down by about 5bps across all maturities on Brexit risk. US Treasuries are mildly dearer with yields down about 1bps toward longer maturities. Ditto for Canada.

- The USD is appreciating against most currencies, especially sterling.

- Oil is up half a buck or so and gold is flat.

The BoJ did what was expected by most and extended its corporate credit support programs by six months to the end of September. This followed another decline in headline and core inflation as core hit a decade low of -0.9% y/y. The yen depreciated overnight along with a general strengthening bias in the USD.

German IFO business confidence improved a bit both in terms of present and expected conditions. That completes the sweep of better survey-based readings for the German economy including PMIs, ZEW investor expectations and IFO.

UK retail sales fell sharply in November, though a touch less than expected. Sterling ignored it. Total sales were down 3.8% m/m (-4.2% consensus) while sales ex-fuel fell 2.6% m/m (-4.0% consensus).

Russia’s central bank held at 4.25% as widely expected. Governor Nabiullina remarked that it’s unclear if rate cuts remain possible. Ha! I have a feeling the central bank is going to be headed in the opposite direction in 2021 in order to manage another currency and inflation crisis. If we go from allegations to proof that it was Russian state-sponsored hackers that launched cyberwar against the west and particularly the US, then expect sweeping retaliatory measures early in Biden’s administration. By extension, Nabiullina could well face a repeat of what happened in 2014–16 when the ruble tanked and inflation soared (chart 1).

BanRep is expected to hold at 1.75% this afternoon (1pmET).

CANADA

Canada continues its full retail sector recovery, for now.

Total retail sales beat StatsCan’s earlier guidance by posting a 0.4% m/m nominal rise that was evenly split between higher volumes (+0.2% m/m) and higher prices. Excluding autos, the dollar value of sales was flat and volumes fell 0.3% m/m. Upward revisions to the prior month’s sales tally largely explain this away. The dollar value of total retail sales was revised up to a gain of 1.9% m/m in September (from 1.1% initially) and ex-autos was revised up to a gain of 1.9% (from 1.0%). In volume terms, September posted a revised 1.8% rise in total sales and a 2% rise in sales ex-autos.

CDN retail sales, headline / ex-autos, m/m % change Oct, SA:

Actual: 0.4 / 0.0

Scotia: 0.2 / 0.1

Consensus: 0.0 / 0.1

Prior: 1.9 / 1.9 (revised from 1.1 / 1.0)

November guidance: “relatively unchanged”

Taking September revisions with October’s reading therefore leads to an overall decent set of numbers but with preliminary guidance from StatsCan pointing to November being “relatively unchanged.” That’s based on responses from 55% of surveyed companies compared to a normal pandemic era response rate of about 88%. Take StatsCan’s advance guidance with a grain of salt given that the number that ultimately gets released is often different and then material revisions set in. I have some sympathy for why this may be occurring given that filling out StatsCan surveys might not be priority #1 for retailers these days….plus estimating on-line might be trickier.

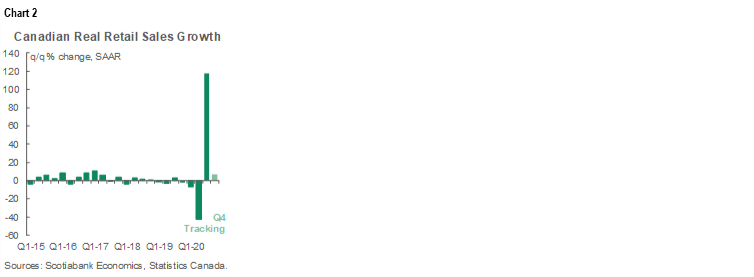

Quarterly tracking is pointing to a Q4 rise of 6.8% q/q at a seasonally adjusted and annualized rate (SAAR) following a 121% recovery-fed gain in Q3 (chart 2). That indicates sustained momentum on a quarterly tracking basis which benefits Q4 GDP growth after adjustments to GDP concepts.

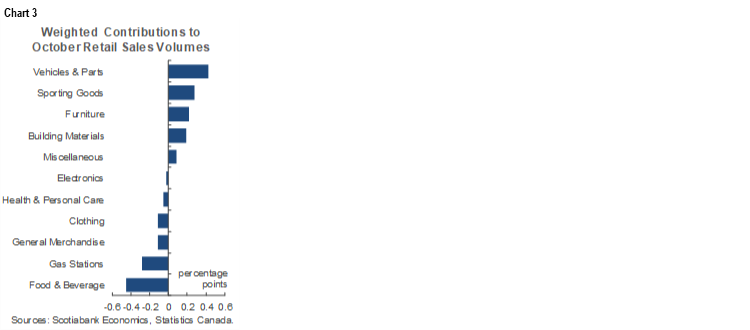

Chart 3 shows the breakdown of growth in sales volumes during October over September in terms of weighted contributions to overall sales growth. Autos, sporting goods, furniture and furnishings and building materials/reno activities led the way.

So where do we stand now in the retail recovery? Total sales volumes are now 5% higher than just before the pandemic hit and so the overall sector has more than recovered (chart 4). Ex-autos sales volumes are up by 5.6% over February levels and ex-autos and ex-gas sales are up by almost 8% compared to pre-pandemic levels.

Put another way, the only sectors not to have fully recovered thus far (and then some!) include ones that probably won't surprise you (chart 5). Gas station volumes are 7% lower than pre-pandemic levels as our cars and trucks sit parked. Clothing is down 8% because we're all wearing pyjamas. Shoe sales are down 5% on similar work-from-home logic. Jewellery & luggage stores are down 2.5% because few are travelling or showing off their bling. Everything else is higher than pre-pandemic.

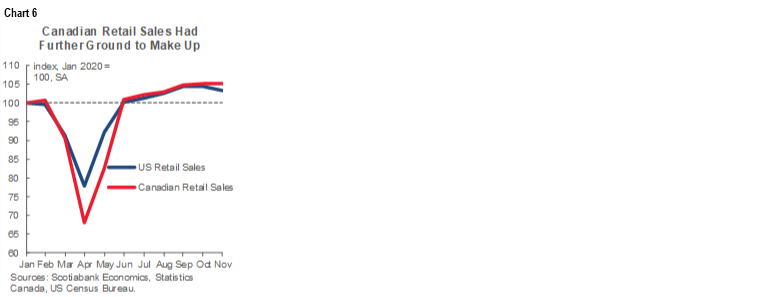

Now, about Canada-US comparisons. StatsCan’s November guidance (flat) is still better than what happened in the US on Wednesday when preliminary numbers showed sales down 1.1% m/m and sales were revised down in October to a mild drop of –0.1% m/m. Is this a Canadian resilience narrative in play? Maybe, but then again, Canada’s retail sector went down harder in the March–June period than was the case in the US (chart 6). Resilience is so far only really a one month preliminary assessment for November, whereas the two countries have been tracking virtually identically to one another for several months since June. That’s despite the fact Canada arguably might have had more pent-up demand from a harsher initial hit, albeit that Canada also dealt with the added commodities punch.

So where to from here? Rising COVID-19 cases and lockdowns are sure to dampen conditions from late November through December and very possibly through Q1. Shutting schools will tip this over.

On that note, recall that Ontario advised parents yesterday to prepare for renewed school closures in January which represents the risk of another serious shock to labour markets. Recall how long it took for employment of mothers to recover (chart 7) after they were hit particularly hard by school closures. Maybe the effects will be less severe this time because a) technology and work from home options are better developed, b) there is some lead time to prepare unlike the shock in March, and c) there are more income and job supports now than obviously at the start of the pandemic and Canada—unlike the US—has already extended those supports well into 2021.

Nevertheless, many jobs don’t have the benefit of being able to do them on-line and from home while supervising their kids. Think front-line workers for one example who get hit by the double whammy of having to deliver care in person while their kids are sent home. It’s a total shame that that the degree of preparedness is not even greater after having nine months to prepare for second and subsequent waves everyone knew would happen since the first wave broke out and shut everything down. Part of that is due to people not following guidelines such that their selfishness and ignorance costs everyone. Still, part of the problem is endemic to our health system that is advising policymakers to shut the whole economy down and put millions of jobs, thousands of businesses and countless despondent individuals at risk. We can make fancy phones by the millions in less time, but not lousy paper N95 masks or vents. China can erect hospitals overnight, the West continues to pay the price for years of cutting hospital beds. Hats off to our front-line workers. The blown opportunity to prepare for the second wave is what hurts everyone.

To end on a more upbeat note, the ultimate hope is that this round of shocks is much shorter-lived in an effort to mitigate holiday season after-effects and with vaccines gradually arriving.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.