ON DECK FOR THURSDAY, NOVEMBER 19

KEY POINTS:

- Mild risk-off driven by covid-19

- Ontario expected to tighten restrictions, schools on watch

- IMF confirms what everyone else is focused upon

- US home resales hit highest since 2005

- Mixed signals from US jobless claims

- US Philly Fed points to ISM downside

- Turkey’s lira rallies on rate hike

- Asian central banks surprise with cuts

- Markets ignore Canada’s ADP jobs

INTERNATIONAL

A mild risk-off tone is continuing today. The main catalyst remains concern over rising covid-19 cases and restrictions. The Canadian province of Ontario is expected to announce further measures shortly. Brexit negotiations were impacted by a positive covid-19 test result “for a short period” but negotiations are to continue in person where feasible and on-line. US macro reports were somewhat mixed this morning, but of little consequence overall. The IMF kind of stated the obvious this morning by noting near-term downside risks against longer-term upsides from vaccines (here). Overnight regional developments carried little overall influence on global markets including a much stronger than expected Australian jobs report, a pair of rate cuts by Asian central banks while Turkey’s hiked as expected and South Africa’s central bank took a pass. Canadian markets ignored a less watched jobs report.

- Global stocks are mixed. The S&P500 is flat with the Nasdaq up ½% and the DJIA down by ¼%. Toronto is a touch lower. Europe is selling off a bit more aggressively because it is also catching up to the late yesterday selloff in North America and because of the Brexit headlines.

- Sovereign bond curves are bull flattening with 10s down by 1–2bps across major markets.

- Oil is off by about ½% with gold performing similarly.

- The USD is little changed as most major crosses depreciate a touch except for a gain in the Mexican peso.

The A$ completely ignored a strong jobs beat overnight that was about more than just lifting restrictions. 178,800 jobs were regained in October (consensus -27k) with a slight tilt toward full-time employment (+97k). About 80.5k of the headline rise came out of Victoria where restrictions were eased including around Melbourne. The other 98k, however, was spread out across the states and that indicates greater breadth than just a reopening effect would have suggested.

Sterling largely shook off a move by the EU’s chief Brexit negotiator Michel Barnier to cancel briefings to EU members next Tuesday. Some took it as a sign that this emphasizes progress in negotiations toward a framework by early next week, but that’s not entirely clear. Talks are continuing “intensively” which again would involve a fair degree of literary licence to translate into actual progress given umpteen failures to date. It’s also possible that the subsequent announcement that talks have been somewhat disrupted by a positive covid-19 test may be pushing out timelines for a deal targeted by early next week.

A pair of Asian central banks surprised by cutting their policy rates overnight. Bank Indonesia cut 25bps to bring the 7-day reverse repo rate down to 3.75%. Bangko Sentral ng Pilipinas also cut 25bps to lower the overnight borrowing rate to 2%. Each of the rupiah and peso fell overnight, but the effects of the cuts are mixed in with broad dollar strength.

Turkey’s central bank met consensus expectations for a 475bps hike in the one-week repo rate to 15% but that still resulted in the lira popping higher partly on guidance to settle in with higher rates until inflation declines.

The South African Reserve Bank held its policy rate at 3.5% as expected this morning.

UNITED STATES

US macro reports were on the weak side of expectations this morning.

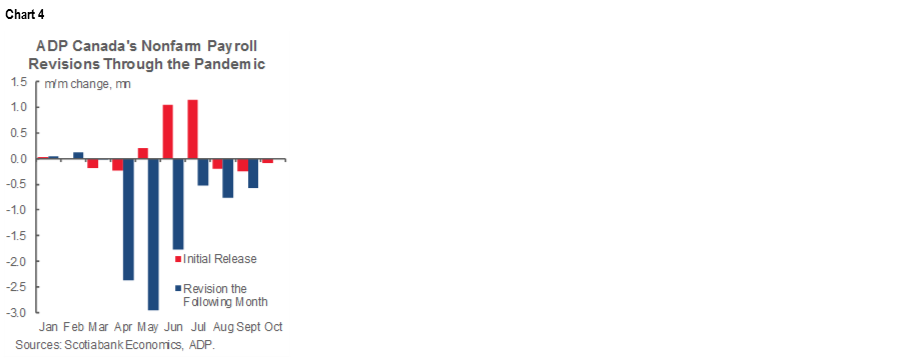

Initial jobless claims increased from 711k to 742k last week. While it’s impossible to prove, this may be an election effect as temporary employment to support the election came to an end. Initial claims increased after each of the 2016, 2012 and 2008 elections for example. Continuing claims were more encouraging as they fell by 429k the week before to 6.37 million. Continuing claims continue to decline to the lowest since the week of March 20th.

The Philly Fed business outlook measure fell to 26.3 (32.3 prior) in November. That follows the earlier decline in the Empire gauge and this morning’s other decline in the KC gauge. Next Tuesday’s Richmond gauge will further inform ISM-manufacturing expectations, but at the moment, it’s looking like the next ISM on December 1st is poised to decline.

US home resales unexpectedly climbed by 4.3% m/m in October on top of mild upward revisions. That takes the annualized pace of home sales to the highest since November 2005.

CANADA

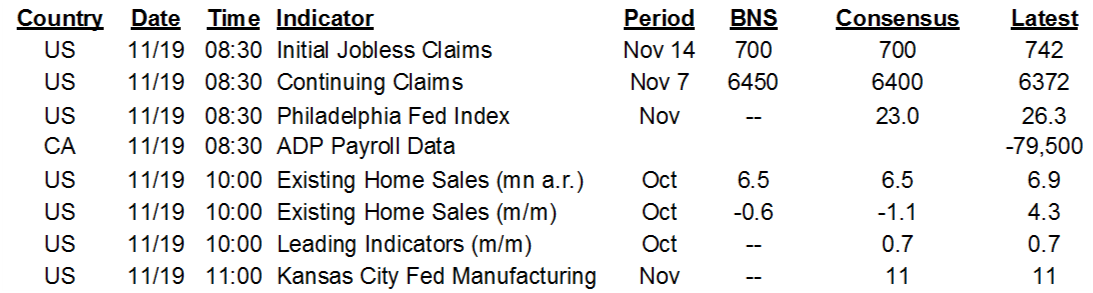

Ontario is expected to announce further restrictions this afternoon. Premier Ford will hold a press conference at 1pmET along with his Minister of Labour and the province’s Chief Medical Officer. He warned yesterday that tightened measures were on the way “in the coming days” which appears to have been more of a singular than plural reference. As charts 1–3 demonstrate, Canada’s and Ontario’s cases are smashing what occurred during wave 1. Ford remarked yesterday that “Right now, we're staring down the barrel of another lockdown in these regions.” ‘These’ being the most populous areas around Toronto.

Keep a particular eye on schools. Ford also said the following yesterday:

“Do not have birthday parties. Do not have sleepovers, having kids friends over, it’s dangerous and it has to stop. We are looking at lockdown if this continues in Peel, Toronto and York. I keep saying it.”

Advising against kids interacting outside of school may appear to be consistent with shutting schools. Ontario registered 91 new cases in schools today including 75 students and 16 staff. 14% of schools have a case and the number of cases is on the rise (here). Note the tragic covid-related passing of a youth worker with pre-existing conditions in one of Toronto’s schools yesterday.

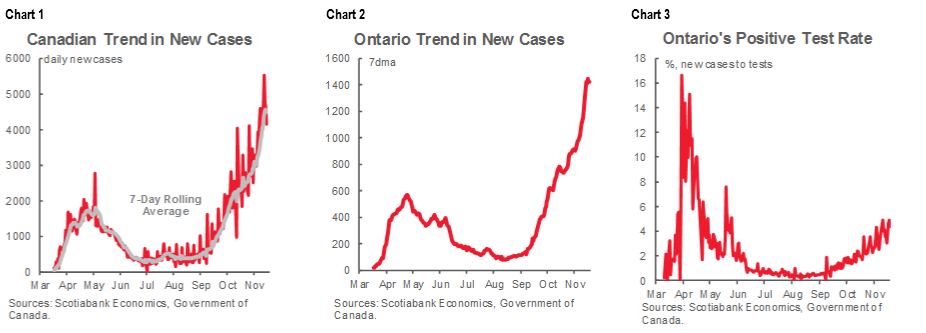

ADP payrolls fell by 79.5k in October. The prior month’s initially reported drop of 240.8k was revised to a drop of 565.4k, or 2.3 times higher. Once again, there was no explanation for the massive revision, but at least it wasn’t in the millions this time…. ADP’s payroll declines conflict with the reported 50.7k rise in payrolls during October in StatsCan’s Labour Force Survey and the prior month’s 403.4k rise. StatsCan’s companion payroll survey for September won’t be out until November 26th. In a nutshell, the country really only has one labour market report and that’s the household survey (LFS) that has a massive +/- 58k 95% confidence interval while StatsCan’s payroll survey is too untimely to matter and ADP is wonky. StatsCan’s LFS has suffered from a material decline in the response rate to around 70% this year compared to pre-pandemic response rates in the upper 80s. Overall, I’d say it’s a fine state of affairs, but the takeaway is to treat all of these reports with great caution.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.