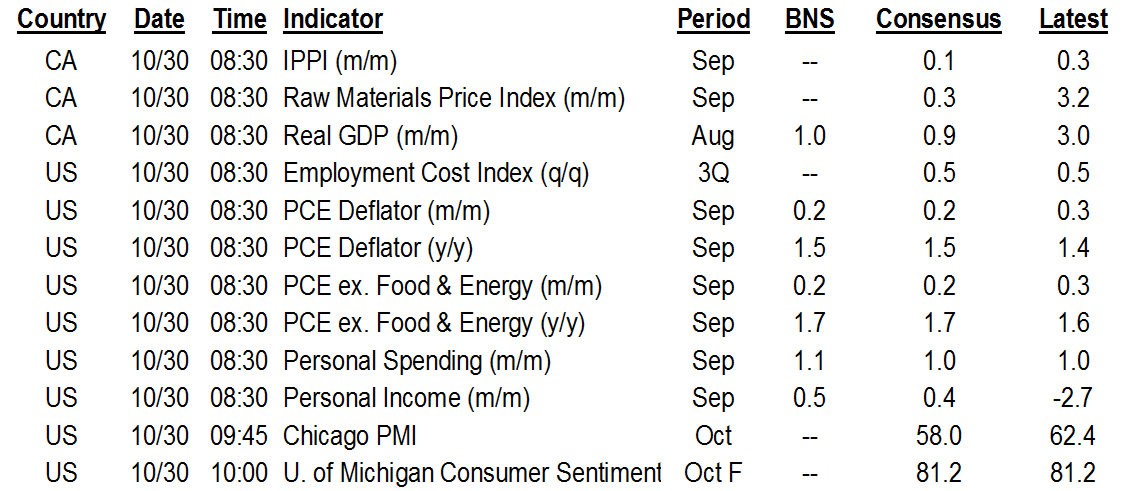

ON DECK FOR FRIDAY, OCTOBER 30

KEY POINTS:

- Equities spooked by US tech earnings

- Month-end, vaccines, earnings, and positioning into the election…

- …all downplay macro data risk

- Eurozone GDP beats expectations

- Eurozone inflation holds steady

- Canada’s economy expected to post solid growth

- US consumption, incomes should be strong…

- …but uncertainty surrounds core PCE inflation

- Mexico’s economy bounced back as expected in Q3

- BanRep expected to hold

INTERNATIONAL

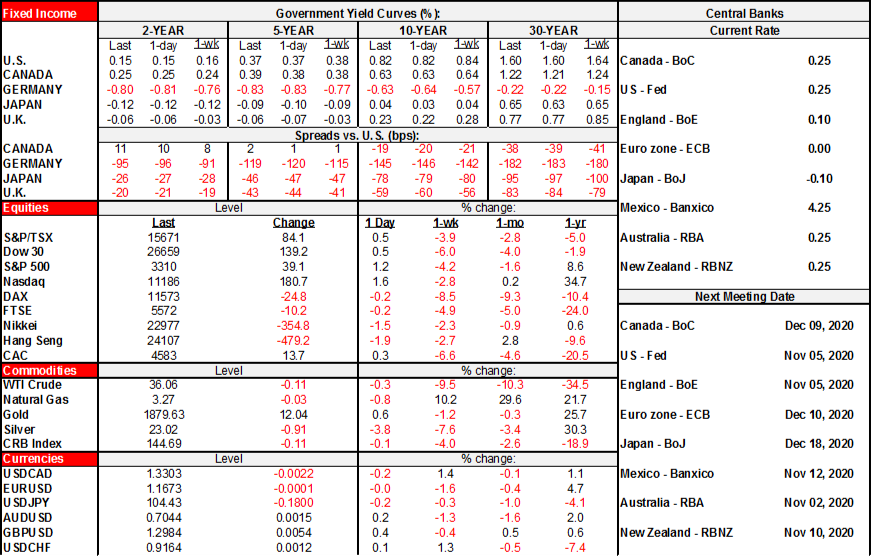

Good morning my favourite ghouls and goblins. Tech continues to spook US equity futures lower so far this morning. Examples include no bobbing for Apple(s) with the stock down -5% into the pre-market, Twitter down by about -15%, Facebook -1%, and Amazon -2%. The UK’s accelerated review of vaccines in development by Pfizer and Astra Zeneca reined in some earlier weakness. A wave of better than expected GDP releases and firmer than feared Eurozone inflation was largely ignored by markets as you’d have to be batty to invest on the basis of what’s already happened. Risk appetite through the day into Monday’s Asian market open may be vulnerable ahead of random covid-19 risk, US election uncertainty, month-end effects and tonight’s China data. Note the updated accompanying chart that shows Biden’s support hanging in better than Clinton’s in 2016 at an identical point in the campaigns.

- US equity futures are down by about ¾% to –1% with the Nasdaq leading the decline. TSX futures are off 0.3%. European equities are mixed but on average faring slightly better than the US.

- The USD is flat. The euro and related crosses are underperforming sterling, the yen and A$/NZ$ while CAD is little changed into data.

- Sovereign curves are looking rather lifeless and little changed apart from slight cheapening toward the European longer ends.

- Oil is flat. So is gold.

Eurozone GDP surpassed expectations at +12.7% q/q non-annualized (9.6% consensus) and thus exceeded the highest guesstimate within consensus. The ghost of yesterday’s growth will quickly be forgotten in the face of forward-looking risks. PMIs were signalling Q4 contraction even before recently announced lockdowns.

All major individual countries also exceeded expectations. That blood curdling scream you heard overnight was a chorus of economists who messed up somewhat. France grew by 18.2% (15% consensus). Germany advanced by 8.2% (7.3% consensus). Spain was up by 16.7% (13.5% consensus). Italy grew by 16.1% (11.1% consensus).

Eurozone CPI inflation creepily met expectations and was unchanged from the prior month’s reading at 0.2% y/y. Whereas yesterday’s German and Spanish readings decelerated, this morning’s French reading was unchanged at 0% y/y and Italy’s was very slightly firmer (-0.3%, -0.5% prior).

Hong Kong’s economy handily beat expectations with Q3 GDP up by 3% (0.7% consensus).

Mexico’s economy registered growth of 12% q/q at a non-annualized rate in Q3 which matched consensus expectations for 11.9%. Is the first positive growth after five contractions the start of a trend turning point for Mexico’s economy?

BanRep issues a policy decision (2pmET) and a zombie-like hold is expected at 1.75%.

China updates state PMIs tonight (9pmET). Little change is expected to the manufacturing PMI (prior 51.5) and the non-manufacturing PMI (prior 55.9) but is a tombstone being carved for its export markets like the Eurozone into Q4?

CANADA

Canadian GDP is on tap shortly (8:30amET). This will tell us what’s baked into Q4 growth before we get any Q4 information. Don’t expect anything macabre in this release. That’s because StatsCan will provide a preliminary estimate for September that should be solid based upon limited info so far, like hours worked, housing readings, and advance guidance on retail trade, manufacturing and wholesale. August GDP is supposed to be the main subject of the fully detailed release from StatsCan but they’ve already guided a preliminary estimate of +1.0% m/m so we’re only looking at tenths in either direction from that by way of risk.

UNITED STATES

US consumer spending, incomes and the Fed’s preferred inflation gauge are due for September updates (8:30amET). Consumption is expected to be strong (consensus 1% m/m) in the wake of the already known strong rise in retail sales during September. Incomes should bounce back off the 2.7% prior drop that was fed by the expiration of the CARES Act souped-up $2400/mth jobless benefits at the end of July. Core PCE inflation was expected to tick higher to 1.7% y/y before yesterday’s Q3 tally within the GDP figures that pointed to m/m drop against prior expectations for a rise, but the poltergeist that crept into it all yesterday was whether what is imputed from Q3 PCE for September may be offset by revisions to prior months today.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.