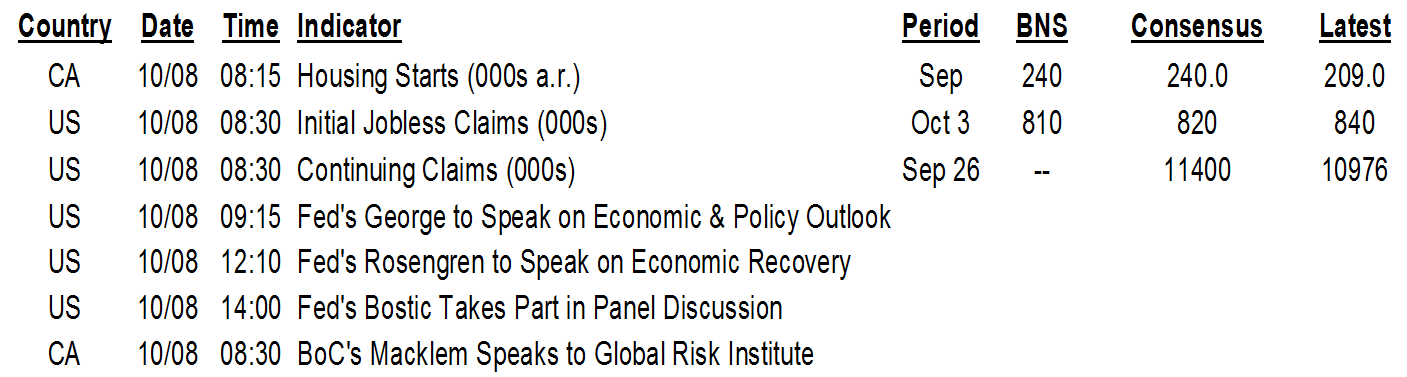

ON DECK FOR THURSDAY, OCTOBER 8

KEY POINTS:

- Stocks lose some ground as Pelosi rejects partial stimulus...

- …and continues to seek a ‘crush it’ larger bill

- Fed expectations may be setting a floor for equities while boosting bonds

- · BoC’s Macklem puts negative rates back on the table

- Don’t count out Trump…

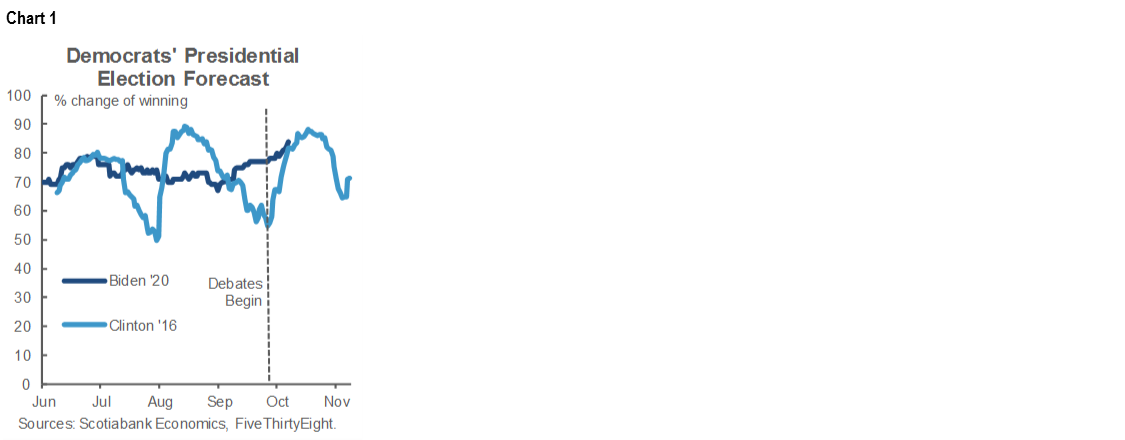

- …as Biden’s chances are tracking identically to Clinton’s in 2016

- German exports beat expectations

- Trump threatens more China tariffs if he wins

- Canadian housing starts fall from a 13 year high

INTERNATIONAL

Markets were rather volatile throughout the North American market morning as contradictory headlines surrounding prospects for US fiscal stimulus were to blame. Market participants focused upon the US and Canada spent much of their mornings watching speeches, interviews and press conferences. US President Trump started the day saying that broader US fiscal stimulus talks were back on after he himself pulled the plug the other day. Pelosi would have nothing to do with a limited approach (see below) which pulled stocks off their earlier highs. I think expectations for Fed stimulus helped to set a floor to how low equities would slip and added some heat to sovereign bonds. BoC Governor Macklem continued to further himself from his predecessor’s downplaying of negative rate prospects earlier this year.

- US equities started the day in the black but shed their gains after Pelosi spoke.

- Sovereign debt yields are marginally lower by about 2–3bps across N.A. (slightly more in Mexico) and Europe. Why are sovereigns richer alongside stocks? One possibility is speculation the Fed could alter stimulus plans as discussed in last evening’s Closing Points on the back of the FOMC minutes notwithstanding the how this view is debatable (here).

- Oil is up by almost 2%.

- The USD is little changed on balance as the yen, euro and Swiss franc are all pretty much dead flat but higher beta crosses and particularly commodity-driven ones are higher.

German exports grew faster than expected in August (+2.4% m/m, consensus 1.5%). They have recovered about two-thirds of the pandemic hit so far.

BoE Governor Bailey said nothing new on his panel this morning and just repeated that the BoE can apply more stimulus as needed in second or further covid-19 waves.

Mexican headline and core CPI for September were basically unchanged at 4% y/y as expected. This at least temporarily halts an upward climb after core CPI increased by a half point since April to 4% y/y. Inflation is running at the top end of Banxico’s 3% +/-1% target range.

CANADA``

Bank of Canada Governor Macklem intensified reference to how a negative policy rate is possible in Canada but not imminently. Today he said:

“We have a wide range of tools. Canadians have already seen that in purchase programs and rate cuts and forward guidance. Depending on what form new problems emerge, these programs can be scaled up, or scaled down if things go better. Other tools include funding for lending, negative rates. Never say never. It’s in the toolkit.”

This is a partial pivot compared to May 1st during Macklem’s introductory press conference when he threw it out there but reaffirmed that ¼% was the effective lower bound in the “current situation”:

“With respect to the effective lower bound at 0.25%, the Bank of Canada has elaborated a framework with unconventional monetary instruments, the possibility of using negative interest rates is included in that list. I think the reason it hasn’t been deployed is that, well, let me put it this way, there are some disruptive effects of going negative. It’s hard to explain to depositors why their deposits are shrinking in their account when they’re not taking any money out. And when you’ve already got a disrupted financial system, you may want to be hesitant about introducing a new source of disruption. So, when you look at the current situation, yes, I’m quite comfortable with the effective lower bound where it is.”

This contradicted his predecessor’s guidance in March that “We don’t like the idea” while downplaying what Poloz had said about negative rates in 2015. Recall that in December 2015 at the conclusion of the review of strategic options, Poloz said:

"The bank is now confident that Canadian financial markets could also function in a negative interest rate environment. Why would anyone ever accept a negative nominal return when they could always simply hold cash and earn a zero return? A big part of the answer is that there are costs to holding currency, particularly in large quantities, and these costs affect the lower bound. Because of the costs, which include storage, insurance and security, central banks can charge negative rates on commercial bank deposits without seeing a surge in demand for bank notes. Interest rates don't go below zero for savers. We would expect the same sort of behaviour here. We now believe that the effective lower bound for Canada's policy rate is around minus 0.5 per cent, but it could be a little higher or lower.”

Canadian housing starts fell back to 209k in September which was lower than the consensus guesstimate of 240k but not terribly surprising given the prior month’s 261.5k was a thirteen year record.

UNITED STATES

President Trump remarked in a long interview this morning that stimulus talks were back on. Treasury Secretary Mnuchin is reportedly seeking a standalone airline bill and is trying to see if Trump would support a larger effort.

House Speaker Pelosi doused such talk. She rejected a standalone bill with remarks such as the following:

- “Nothing is agreed to until everything is agreed to.”

- “Ain’t gonna be no standalone bill unless it is part of a bigger deal.”

- “There is no standalone bill without a bigger bill.”

Even within the GOP there is opposition to a standalone airline bill. Senators Toomey and Lee reject aid to the airline industry absent “adequate protections for taxpayers and the opportunity to offer related amendments” and how airline problems “will not be resolved in the near future and continuing gto force the entire payroll obligation onto the taxpayers is not sustainable.” There is opposition to cutting a blank cheque to an industry that may require permanent support if conditions never return to pre-pandemic levels and likely also a requirement to see other stakeholders share the burden.

US initial jobless claims were little changed last week at 840k (consensus 820k) while the prior week was revised up to 849k from 837k.

US President Trump promises trade wars will continue if he’s re-elected. Joy. He said in an interview this morning that “I’m going to use tariffs on China” and repeated the wrong argument that they work because the proceeds flow into the Treasury, without mentioning that US consumers and businesses pay for them.

Nevertheless, despite all of this, if you’ve counted out Trump into the election because of efforts to measure Biden’s chances of winning (like here) then keep in mind that notwithstanding methodological changes compared to 2016, Biden’s probability of winning the election is about bang on where it stood for Hillary Clinton at this point in the 2016 campaign (chart 1).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.