- Colombia: Consumer confidence declines, while willingness to purchase vehicles and homes improves

- Mexico: Inflation slowed for the sixth consecutive month; pressure continues in core inflation

Overnight markets have a clear USD-negative, risk-on mood on little of note that may simply reflect some retracement of yesterday’s more risk-averse fee. Natural gas prices are about 5% lower in Europe after the surge yesterday on strikes at Aussie LNG plants, while remaining strong alongside flat crude oil prices, copper up 0.5%, and iron ore down 0.5%. USTs are holding in relatively narrow ranges, with 2s down 1bp versus 30s up 1bp. The MXN is flat, and by consequence lagging its major peers where the EUR’s 0.4% gain stands out.

Global markets await eagerly the release of US July CPI data at 8.30ET where Scotiabank Economics sees slightly lower y/y and m/m readings—but there’s a lot of data to go after this until the Fed’s September decision.

In Latam, we have a quiet session from a data standpoint with only Brazilian services volumes data for June due at 8ET (seen roughly halving from 0.9% to 0.5% m/m) and the results of the BCCh’s economists survey at 8.30ET that we’ll watch for expectations on how fast the bank will continue its rate-cuts cycle after it surprised most economists (but not us) with a 100bps cut to kick things off.

Two more Latam central banks announce policy today, Banxico at 15ET and the BCRP at 19ET. Neither is expected to change settings today, leaving their respective policy rates at 11.25% and 7.75%. In the case of the BCRP, there may be a bit more to look forward to as very disappointing economic data points to rising odds that the bank brings forward the start of the cutting cycle to September instead of October as is our baseline forecast (see more here)—there is even a small chance that the bank decides to act today (one economist surveyed by Bloomberg thinks as much).

As for Banxico, the focus will be on the bank’s perception of inflation trends, but with the fight not won against core inflation (see below) it is still much too early to tee up the start of rate cuts—which is an additionally risky proposition without being sure that the Fed is done.

Within the broader Latam space that is not part of our core coverage, we highlight that Ecuadorian presidential candidate Villavicencio was assassinated yesterday. His strong anti-corruption and hard on drug trafficking campaign set him on a trend towards a runoff vote after the first voting round scheduled for August 20 (runoff, if needed, would take place in mid-October).

—Juan Manuel Herrera

COLOMBIA: CONSUMER CONFIDENCE DECLINES, WHILE WILLINGNESS TO BUY VEHICLES AND HOMES IMPROVES

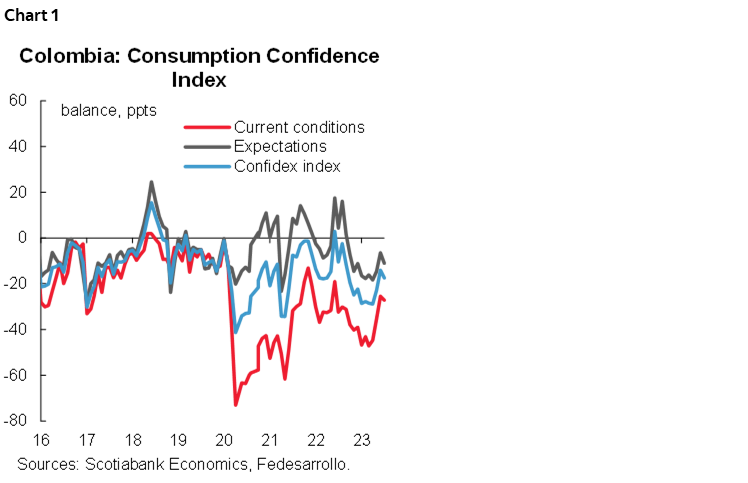

Colombia’s Consumer Confidence Index (CCI) in July stood at -17.4%, which represents a decrease of 3.3 p.p. compared to June (-14.1%). Both components of the indicator showed a deterioration compared to the previous record. The Consumer Expectations Index (CEI) went from -6.5% in June to -11% in July, which corresponds to a decrease of 4.5 p.p. while the Economic Conditions Index (ECI) had a decrease of 1.7p.p. from -25.4% in June to -27.1% in July (chart 1).

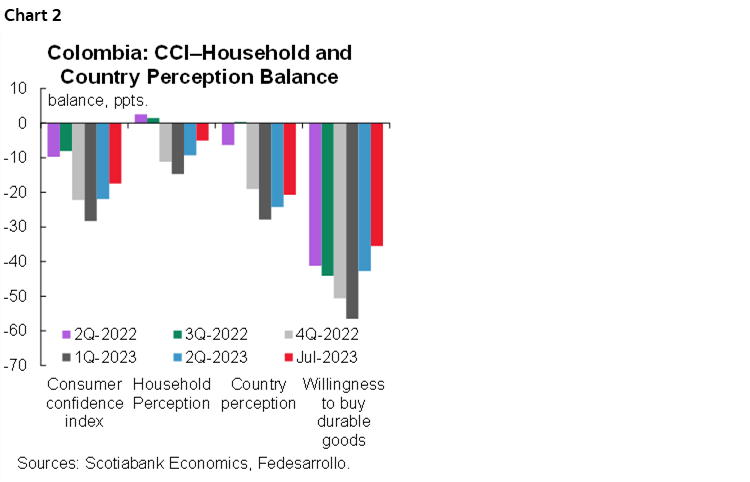

The Consumer Expectations Index (CEI) was the component that presented the largest drop, explained by a significant decrease in consumers’ perception of the economic conditions of their households and the country in general over 12 months. This represents a change of trend in the CEI, given that the previous month consumers’ perception had improved; however, a lower dynamism of the economy could be explaining the new drop in July. On the other hand, the willingness to buy durable goods also fell from -30.9% in June to -35.5% in July, while the willingness to buy houses and vehicles increased by 3.8 p.p. and 3.6 p.p. respectively. A drop in the prices of used vehicles could explain the increase in the willingness to buy vehicles, and on the side of the willingness to buy housing, the improvement could be related to the expectation that Banco de la República will start cutting the interest rate in the short term.

Looking at the June details:

- The Economic Conditions Index stood at -27.1%, a decrease of 1.7 p.p. concerning the previous month. The exchange rate has failed to stabilize and has fluctuated in a wide range, which is not conducive to price stabilization, hence consumers’ decreased willingness to purchase durable goods in the month of July.

- Consumers’ economic outlook deteriorated in July. The expectations index stood at -11%, which represents a decrease of 4.5 p.p. concerning the previous month. Consumers’ perception of the country’s economic conditions remains in negative territory, which could be explained by a decrease in economic activity and a more unfavourable image of the current government.

- The Consumer Confidence Index showed a greater drop in the city of Barranquilla. In the previous month, Barranquilla was the city that presented the best record, even so, in July the indicator deteriorated significantly, standing at -12.9% compared to 4.5% in June, which represents a drop of 8.4 p.p. As for the other cities, Cali was the second city that presented a significant drop from -7.9% in June to -17.1% in July; finally, Medellin continues to be the city with the lowest CCI with a record of -32.2%.

- Consumer confidence improved at the low socioeconomic level. In the high-income group, confidence stood at -48.3%, an increase of 13.3 p.p. versus the previous month. The middle-income group showed a decrease in confidence of 12.9 p.p. to -23.2%. Finally, the low-income group was the only one that presented an increase, standing at -8.6% compared to -15% in June.

Although consumer confidence deteriorated in July compared to the previous month, it improved compared to previous quarters (chart 2). This result, coupled with the release of the July inflation figure, suggests that there is still uncertainty about a possible rate cut in September.

—Sergio Olarte, Jackeline Piraján & Santiago Moreno

MEXICO: INFLATION SLOWED FOR THE SIXTH CONSECUTIVE MONTH; PRESSURE CONTINUES IN CORE INFLATION

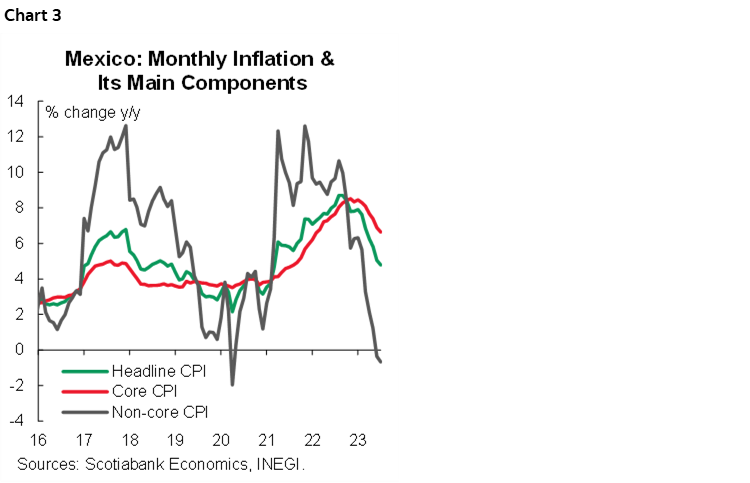

In July, inflation registered the lowest figure in 28 months, and decelerated for the sixth consecutive month to 4.79% y/y from 5.06% previous (4.79% consensus). Core inflation also moderated to 6.64% y/y from 6.89% previous (6.66% consensus), derived from a slowdown in merchandise to 7.82% (8.26% prior), and marginally in services to 5.24% (5.25% prior). Non-core fell -0.67% y/y from -0.36%, as energy fell -3.90% (-3.08% prior), although agriculture rose 3.16% (2.89% prior). In its monthly comparison, headline inflation increased 0.48% m/m (0.1% previous, 0.49% consensus), core inflation went to 0.39% m/m (0.30% previous, 0.42% consensus), with increases in merchandise and services. Finally, the non-core registered a strong rebound 0.77% m/m (-0.52% previous, see chart 3).

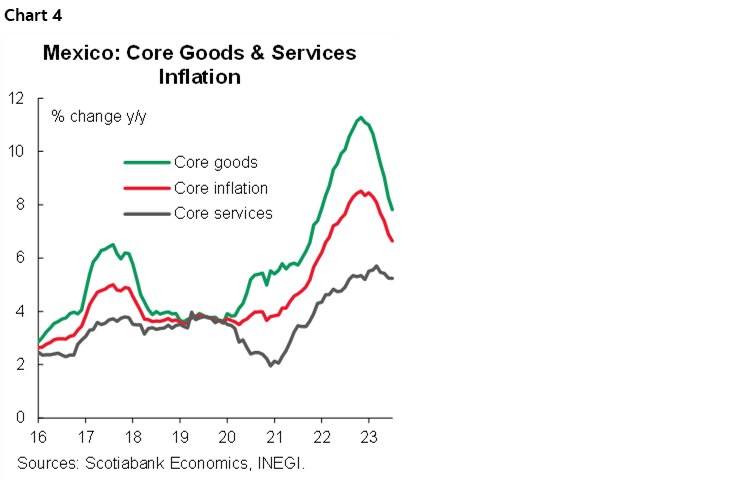

Given this reading, we anticipate that inflation will continue to slow down, although the core component could show some persistence that could lead to a slower pace of slowdown (in headline inflation). For twelve months, services have shown positive variations that exceed 5.0%, along with risks of a rebound in non-core inflation, which has so far contributed to the downward trend in inflation this year, supported by the drop in energy (chart 4). In the last Citibanamex survey, the inflation forecast was revised slightly downwards, at this time the average stands at 4.68% for 2023, and at 3.97% in 2024. After this indicator was released, the peso reacted by appreciating against the dollar, after seeing some volatile days. The market will have in its sights the monetary policy decision by Banxico, mainly due to its comments on the path of inflation and how long rates will remain at high levels.

—Brian Pérez

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.