- Chile: MPR confirms faster convergence of core inflation, in line with our scenario

- Colombia: Imports increased slightly m/m in October, but strung a twelfth straight y/y contraction

CHILE: MPR CONFIRMS FASTER CONVERGENCE OF CORE INFLATION, IN LINE WITH OUR SCENARIO

On December 20th, the Central Bank (BCCh) published its Monetary Policy Report (IPoM) for Q4-24. Regarding GDP, the BCCh reaffirms a zero growth projection for 2023, with no change in the outlook for the next two years, although closely linked to a rebound in mining sector activity. At Scotiabank, we project a 2% GDP growth in 2024, thanks to a recovery in investment and private consumption, which will benefit from lower short-term interest rates. At the same time, the BCCh again revised downward its estimate of trend non-mining GDP growth, which is reduced from 2.2% to 1.9% on average for the 2024–2033 period. As a result, the Central Bank estimates a less negative output gap than forecast in the previous IPoM.

We project that inflation will converge to 3% faster than estimated by the BCCh in its IPoM. Regarding the outlook for inflation, the Central Bank did not make significant changes to its projections, anticipating that the CPI will close 2024 with a year-on-year variation of 2.9%, which is not very different from what we project at Scotiabank for December. In this sense, the Board reiterates that its projection considers a convergence of inflation to the target in the second part of the year, unlike what we project in Scotiabank, where we continue to estimate that the target will be reached in the first part of 2024. In this line, the BCCh joined our view of faster convergence for core inflation (ex-volatiles), an important change with respect to the previous IPoM.

If our inflation projection materializes, the BCCh could cut the benchmark rate more aggressively than its central scenario. The corridor for the rate presented by the BCCh in its IPoM shows a rate ending at a level close to 5% in December 2024, with no major changes with respect to what was assumed in the previous IPoM and above our projection of 4.25%. The main difference with respect to our scenario is observed in the assumption for the first quarter of 2024, where the center of the corridor incorporates a cut between 25 and 50 bps, which we estimate could be higher given our projected path for inflation. In this sense, the benchmark rate used as a working assumption by the Central Bank for 2024 would continue to be positive and contractionary in real terms, even being almost 2 times above its neutral level, which was revised 25 bps upwards in the December IPoM, as we anticipated (see our Latam Daily).

—Aníbal Alarcón

COLOMBIA: IMPORTS INCREASED SLIGHTLY M/M IN OCTOBER, BUT STRUNG A TWELFTH STRAIGHT Y/Y CONTRACTION

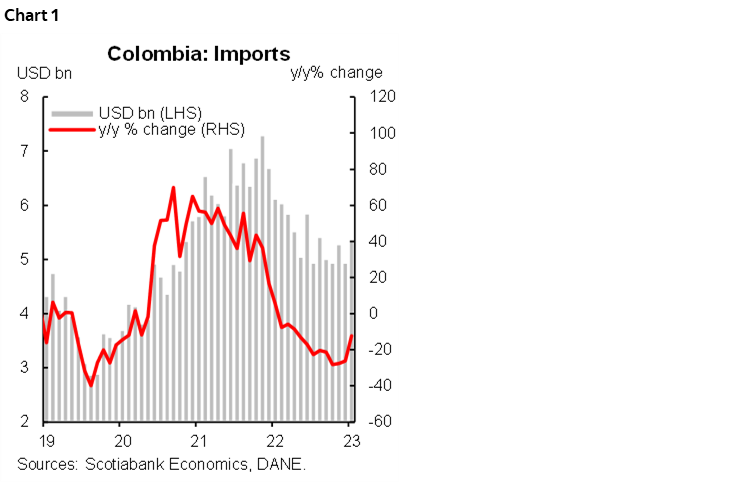

On Wednesday, December 20th, DANE (National Administration of Statistics) published the import data for October 2023, which amounted to USD 5.37 billion CIF (chart 1), with a decrease of 12.3% y/y, registering a slight recovery compared to the previous month (USD 4.94 billion CIF in Sep-23) and completing twelve consecutive months of negative annual variations. This behaviour is mainly due to the 14.9% y/y decline and the -11 pp contribution of the manufacturing group, as a result of lower imports of vehicles, iron, and steel, in addition to telecommunications equipment, which contributed -6.3 pp to the total y/y variation of imports. This dynamic continues to be explained by lower domestic demand, especially for durable and semi-durable consumer goods.

In October 2023, imports of manufactured goods represented 71.9% of the total CIF value of imports, followed by fuels and products of the extractive industries with 14.2%, agriculture, food, and beverages with 13.7%, and finally other sectors with 0.2%.

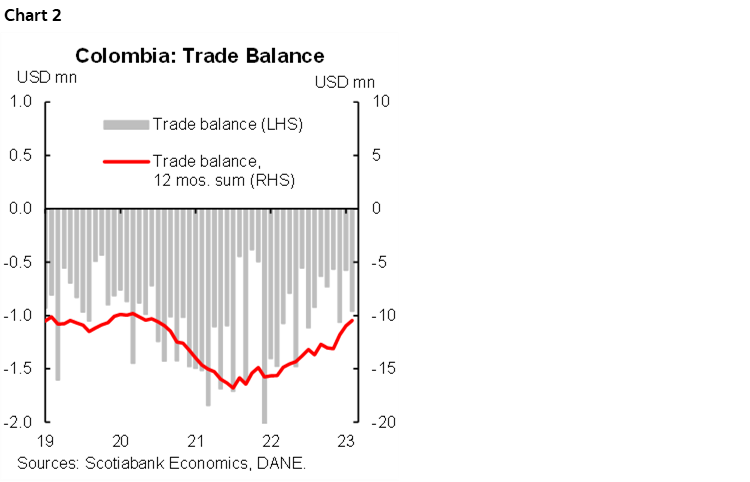

Regarding the trade balance, Colombia recorded an external deficit of USD 960.2 million FOB in October 2023 (chart 2), an increase compared to the previous month (USD 575 million in September) due to a slightly higher recovery of the imports than the exports during this month. Nevertheless, the external deficit continued its correction path in October compared to that recorded in October 2022, when it reached USD 1,47 billion FOB. Thus, domestic demand has contracted from the high levels observed a year ago, due to the decline in investment and consumption of durable and semi-durable goods. This behavior of domestic demand was reflected in a significant decline in imports, which, together with the growth in exports, continues to explain a reduction in the real external deficit. Consequently, we expect a weakening of external demand in the context of declining global demand from countries such as China and terms of trade lower than those of 2022.

On the domestic front, the recent adjustment of domestic demand to more sustainable levels, combined with the latest data on economic activity approaching its potential capacity and a cautious interpretation of inflation, which continued its downward trend favoured in November by the good behavior of food prices, led the Board of the Bank of the Republic to reduce interest rates by 25 basis points. In our view, the central bank will continue the easing cycle in the coming meetings. However, the pace will largely depend on the slowdown in inflation. Nevertheless, we estimate that the easing cycle could accelerate in the first half of 2024, as we expect inflation to show the strongest decline in this period, given the statistical base effects of indexed elements. Current surveys point to an official rate of between 8.25% and 9.0% at the end of 2024; at Scotiabank Colpatria Economics, we project that the policy rate will end in 2024 at 7%.

Highlights:

In terms of product groups, imports of manufactured goods reached USD 3.87 billion CIF in October 2023, down 14.9% from October 2022 and contributing -11 pp, mainly due to lower purchases of machinery and transport equipment (-16.6% y/y), which contributed -7.5 pp to the group's variation. The second most important import group was fuels and products of the extractive industries, which amounted to USD 763.2 million CIF, an increase of 24.1% y/y and a positive contribution of 2.2 pp to the total variation. Within this group, petroleum, its derivatives, and related products were the subgroup that contributed most to the growth, with a variation of 8.3% y/y and a contribution of 8.3 pp to the total variation of the group.

Thirdly, there are imports of agriculture, food, and beverages, valued at USD 735 million CIF, with a decrease of 20.9% compared to October 2022 and a contribution of -3.2 pp to the total variation, explained by lower imports of food and live animals (-17.8% y/y), which contributed -20.9 pp to the variation of the group.

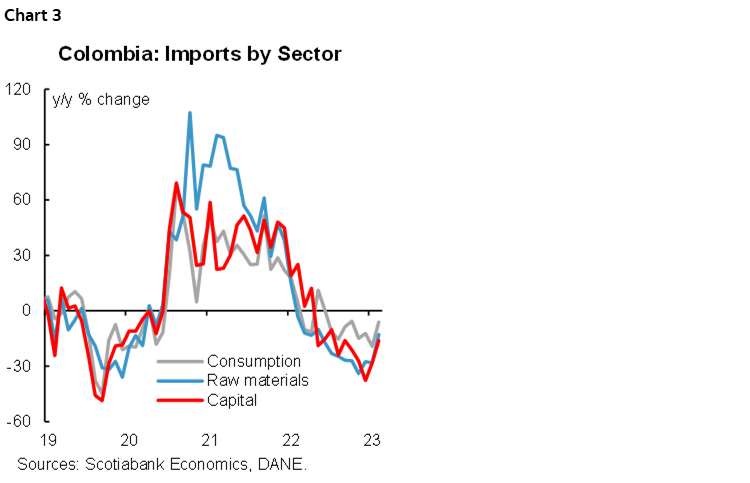

In terms of imports by economic use or destination, the three main groups remained in negative territory (chart 3):

- Consumer goods imports reached USD 1.30 billion CIF in October 2023, down -6.2% y/y, with a contribution of -1.4 pp to the total. Non-durable consumer goods fell by 0.8% y/y with a contribution of -0.1 pp, led by declines in apparel (-31.9% y/y), other consumer goods (-10.9% y/y) and food (-4.9% y/y) with negative contributions of -0.5, -0.2 and -0.2 pp respectively. These declines were offset by the positive contribution of pharmaceuticals and cleaning materials (+22.6% y/y), which added 0.9 pp.

- Durable consumer goods fell by 13.2% y/y in October and contributed up to -1.3ppl to the total variation in imports, mainly due to falls in vehicles (-10% y/y and -0.5ppl), arms and military equipment (-89.2% and -0.4ppl), domestic appliances (-20.6% y/y and -0.4ppl) and household goods (-19.4% y/y and -0.1ppl). These declines were offset by a slight recovery in furniture and other household goods (0.6% y/y) and personal care items (2.9% y/y).

- Imports of raw materials and intermediate goods amounted to USD 2.56 billion CIF in October 2023, a decrease of 12.8% y/y and a negative contribution of -6.1 pp to the total variation (the largest contributor). This was due to a decline of 23.3% y/y in imports of raw materials and intermediate goods for industry (excluding construction), with a negative contribution of -8.1 pp, followed by imports of raw materials and inputs for agriculture, which fell by 6.6% y/y in October and contributed -0.3 pp. On the other hand, fuels, lubricants, and related materials rose by 26.9% y/y in October, contributing 2.3 pp to the total.

- Capital goods imports amounted to USD 1.52 billion in October 2023, down 16.1% y/y and contributing -8.5 pp. This contraction continued to be driven mainly by a fall in imports of capital goods for industry, which fell -13.3% y/y in October and contributed -3.5 pp (the largest contributor). This was followed by transport equipment, which fell by 16% y/y and contributed -1.5 pp. This was followed by purchases of construction materials (-32.9 % y/y and a contribution of -0.9 pp) and finally by imports of capital goods for agriculture, which recorded a fall of 28.1% y/y and a negative contribution of -0.1 pp in October 2023.

—Sergio Olarte & Santiago Moreno

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.