- Chile: We do not anticipate a significant impact on assets after the plebiscite result

- Colombia: manufacturing and retail sales in October were lower than expected and remain in contraction; Citi Colombia Survey: expectations remain split between a 25bps rate cut and rate stability ahead of this week's monetary policy meeting

- Peru: October GDP, just like September

After central bankers scared markets a bit on Friday on the timing of rate cuts, we have USTs bull steepening to start the week in defiance as rates steadily rally since the Asia open. The mood in markets is somewhat optimistic, with the USD mostly weaker—where the MXN and JPY the only ones down a touch—while US equity futures hold little changed and in their range since Thursday, crude oil is flat, and iron ore and copper are 0.6/1% weaker. The G10 day ahead has little of note on the data front but the schedule is again full of central banker speeches. The rest of the G10 data/events week is very busy with Canada CPI and GDP, UK CPI and revised GDP, US PCE, and tomorrow’s BoJ decision on tap.

Today in Latam, aside from watching the political and financial markets response to Chile’s constitutional vote results, the highlight (and only notable release) will be Colombian October economic activity at 11ET. Today’s data follow Friday’s weaker than expected retail sales results (see below) that tees up a softer than expected gain in aggregate output. The median economist polled by Bloomberg estimates a 0.3% y/y print, but our team in Colombia has a more negative view eyeing a 0.3% y/y contraction. The weaker the print, the more likely it is that BanRep begins its rates cutting cycle tomorrow; we think a 25bps reduction will be delivered but it remains a close call (see Latam Weekly).

—Juan Manuel Herrera

CHILE: WE DO NOT ANTICIPATE A SIGNIFICANT IMPACT ON ASSETS AFTER THE PLEBISCITE RESULT

On Sunday, December 17th, the new constitutional text—drafted by the right-wing parties—was rejected by ~56% of the voters (6.9 mn people), compared to 44% who voted in favour. The result was similar across the country, with the rejection option prevailing in almost all regions, including the Metropolitan Region (59% versus 41%). For its part, the ’for’ option won in only 3 of the 16 regions. The plebiscite had a high turnout (85%; 13 mn voters), the same as in the previous plebiscite (September 2022) as the election was mandatory.

We do not expect a relevant market reaction, as the rejection was somewhat teed up by polls. Our view is that we would see a more political than financial impact, albeit moderate. On the one hand, most polls anticipated an ‘against’ victory, so this option should have been reflected in asset prices, and the market reaction should be minimal. On the other hand, the result will give some political breathing room to Boric’s ruling coalition given that there is an implicit agreement between the leftist parties and the government to not launch a new constituent process for the next two years—which was reaffirmed yesterday.

Finally, in our opinion, the broad triumph of the ‘against’ option renews the need to reach broad agreements in political terms, which will be put to the test as of March 2024 in order to move forward with the tax and pension reforms.

—Aníbal Alarcón

COLOMBIA: MANUFACTURING AND RETAIL SALES IN OCTOBER WERE LOWER THAN EXPECTED AND REMAIN IN CONTRACTION

On Friday, December 15th, the National Statistics Administration (DANE) released data on manufacturing and retail sales for October 2023. Real manufacturing production recorded a contraction of 5.9% y/y in October 2023, although still in the contractionary territory, at a smaller decline compared to the previous month (-7% y/y in September). As for real retail sales, they contracted by 11.0% y/y in October, the largest sales decline so far in 2023. Nevertheless, both indicators remained below market expectations and completed eight months in a row of annual contraction in the case of manufacturing and nine consecutive months in the case of retail sales. Moreover, at the margin, both indicators deteriorated, contracting by 0.9% m/m in the case of industry and -1.5% m/m in the case of retail sales.

These results continue to show that the Colombian economy is undergoing an orderly adjustment process from a high level of economic activity above its long-term path. That is, sectors such as manufacturing and trade are quickly closing the positive gap that had from the faster recovery in 2021 and 2022, while sectors related to services remain at maximum levels.

On the other hand, the decline in investment and the lower demand for durable and semi-durable goods have favoured the reduction in the closing of the current account deficit gap. On the contrary, demand for services remains resilient and defensive in sectors such as personal hygiene products and food and beverages.

Thus, the economy will maintain weak momentum in the coming quarters, with annual growth rates below 2% in 2023 and 2024, as domestic demand adjusts to more sustainable levels in a context of low consumer and business confidence, high household indebtedness, credit contraction, and a contractionary monetary policy stance. Considering these macroeconomic variables and adding last week’s inflation data, we still see the possibility of a first-rate cut at next week’s BanRep meeting. However, the definition of the minimum wage will also be an important piece of data, as it defines much of the 2024 indexation effects.

Highlights:

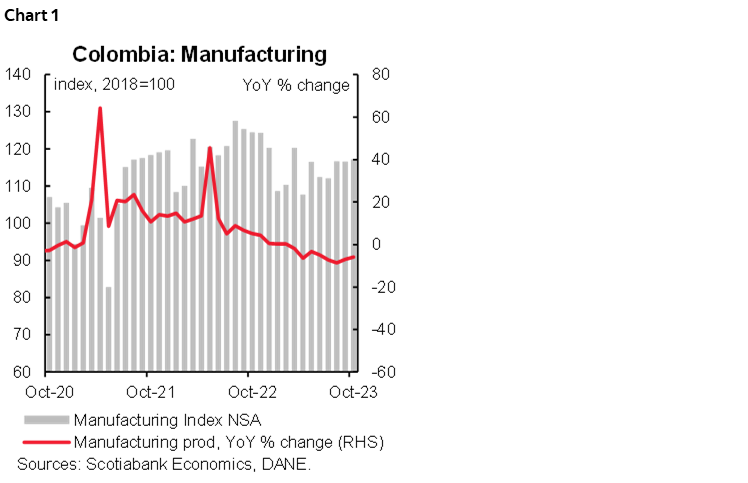

Manufacturing Production

Manufacturing production contracted by 5.9% y/y in October 2023 (chart 1), below market expectations (-5.7% y/y) and completed eight consecutive months of declines in 2023. In seasonally adjusted terms, manufacturing contracted by 0.9% m/m, reversing the positive data of the previous month (1.5% m/m in September).

Out of the 39 industrial activities included in the survey, a total of 32 recorded negative year-on-year changes in real output, subtracting 5.9 pp from the annual total, while 8 subsectors recorded positive changes, adding a total of 1.3 percentage points to the annual total.

On an annual basis, the sectors with the largest falls were transport equipment (-67.7% y/y and a contribution of -0.9 pp), clothing (-12.2% y/y and a contribution of -0.5 pp), chemicals (-15.5% y/y and -0.5 pp contribution), nonmetallic mineral products (-8% y/y and -0.5 pp contribution) and pulp, paper and paper products (-9.8% y/y and -0.4 pp contribution). These activities accounted for -2.8pp of the total annual variation in manufacturing production.

On the other hand, other important industries recorded annual decreases, in particular those related to durable and semi-durable consumer goods, such as textiles (-16.1% y/y and a contribution of -0.3 pp), the manufacture of furniture, mattresses and beds (-12.0% y/y and a contribution of -0.1 pp), and the manufacture of footwear (-13.8% y/y and a contribution of -0.1 pp).

In contrast, the sectors that performed better were beverages (+8% y/y and a contribution of 1.0 pp), coking, refining and blending of petroleum products (+4% y/y and a contribution of 0.2 pp), soap and detergents, cleaning and polishing preparations (+0.7% y/y and a contribution of 0.03 pp) and machinery and equipment (2.7% y/y and a contribution of 0.03 pp).

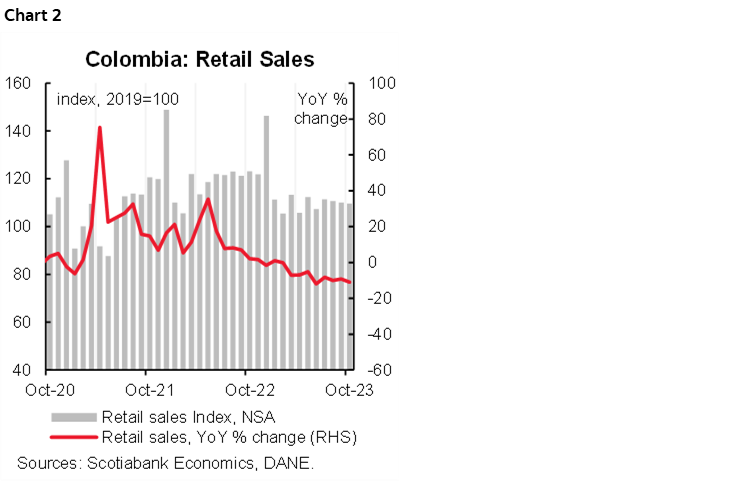

Retail sales

Retail sales fell by 11% y/y in October 2023 (chart 2), below market expectations (-8.0% y/y) and recording nine months in negative territory. In seasonally adjusted terms, retail sales excluding freight vehicles, public transport, and others fell by 1.5% m/m, reversing the positive data of the previous month (0.8% m/m), just like in manufacturing.

Out of the 19 product lines, 18 reported negative annual variations in real turnover, while only one product line reported an increase in its turnover.

On an annual basis, the behaviour of retail sales in October 2023 was influenced by a decline in sales of other motor vehicles and motorcycles (-34.6% m/m and -3.5 pp), domestic use vehicles and motorcycles (-28.3% m/m and -2.7 pp), and spare parts and auto parts (-9.7% m/m and -0.7 pp). In total, these three product groups contributed to a fall of -6.9 pp in total retail trade sales.

Conversely, the only positive contribution came from non-alcoholic beverages, with 0.04pp (+3.3% y/y). It is worth noting that in October the positive trend of the last three months was reversed by durable goods such as televisions, which fell by 9.1% y/y in October and made a negative contribution of 0.2 pp.

Services and hotels

In October, most of the activities related to services were moderated in real terms. The worst performing sub-sectors were storage and transport activities (-19.4% y/y), other recreational activities (-18.2% y/y), call centers (-17.4% y/y), administrative activities (-13.5% y/y), advertising (-9.3% y/y) and post and courier activities (-7.2% y/y). On the other hand, health services (+7% y/y) and real estate services (+6.5% y/y) showed positive dynamics.

In the hotel sector, revenues fell by 15.1% in real terms in October, ending seven months of contraction. Moreover, hotel occupancy stood at 50% in October, slightly above the pre-pandemic average of around 49%.

CITI COLOMBIA SURVEY: EXPECTATIONS REMAIN SPLIT BETWEEN A 25 BPS RATE CUT AND RATE STABILITY AHEAD OF THIS WEEK'S MONETARY POLICY MEETING

On Thursday afternoon, December 14th, the November Citi survey was released, which BanRep uses as one of its indicators for inflation expectations, the monetary policy rate, GDP, and COP.

Key points included:

- GDP forecasts deteriorated across the board. For 2023, the analysts’ consensus forecast is for GDP growth of 1.04% y/y, 4 bps lower than in the previous month’s survey. On the other hand, GDP growth expectations for 2024 fell by 10 bps and now stand at 1.37% y/y, compared to the last growth expectation of 1.47% y/y. It should be noted that the forecasts have deteriorated for three consecutive months for 2023 and for eleven consecutive months for 2024, in line with last quarter’s weak economic data.

- Inflation expectations have been revised to the downside. On average, headline inflation is expected to be 0.63% m/m in December, which would bring annual inflation to 9.48% y/y. While November’s inflation data was in line with market expectations (0.47% vs. 0.46%), expectations for the end of 2023 declined slightly by 3 bps from last month’s survey to 9.48% y/y, while expectations for 2024 increased by 22 bps to 5.43% y/y from 5.20% y/y in November. Higher inflation expectations for 2024 likely incorporate risks related to indexation effects, regulated price increases, and the El Niño weather phenomenon.

- Scotiabank Economics’ inflation forecast is lower than the analyst consensus. We estimate monthly inflation of 0.47% m/m and annual inflation of 9.30% y/y in December. This month, we expect the announced pause in gasoline prices and moderation in food prices to offset public service tariffs, which could create upward pressure. Prices of tradable goods are also expected to continue to provide a respite to headline inflation amid a lower exchange rate and retailers offering discounts to customers during the holiday season.

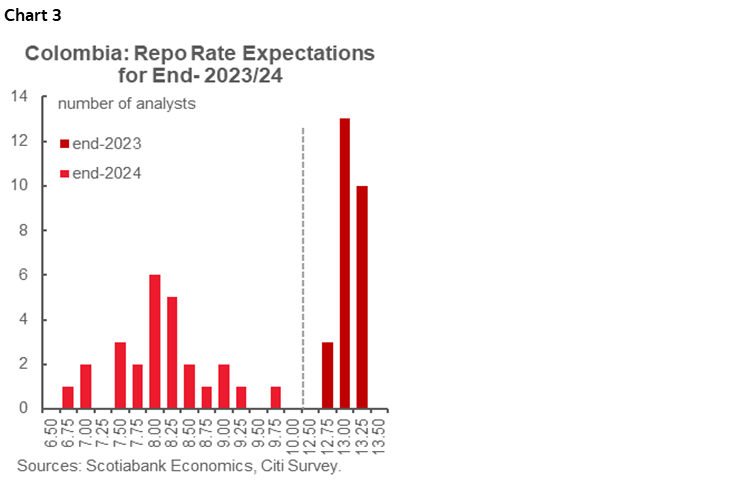

- Monetary policy: Opinions are mixed for the December meeting: 13 out of 26 analysts expect BanRep to start the easing cycle with a 25 bps rate cut; however, the second most popular expectation (10 out of 26 analysts) is for the rate to remain stable at 13.25%. Only 3 analysts expect a 50 bps rate cut and only one analyst expects a 75 bps cut to 12.5% (chart 3). Looking out to 2024, the rate path is less certain, with respondents expecting rates to end 2024 between 6.75% and 9.75%. At Scotiabank Economics, we still see the possibility of a first-rate cut in December, but this will largely depend on a further correction in inflation and further evidence of economic weakening.

- Finally, the exchange rate is expected to average 4.042 USDCOP at the end of 2023 (versus 4.113 USDCOP in November) and 4.116 USDCOP at the end of 2024 (versus 4.148 USDCOP in November). Scotiabank Economics' projections show an exchange rate of 4,000 pesos in December 2023 and 4,116 pesos in 2024.

—Sergio Olarte & Santiago Moreno

PERU: OCTOBER GDP, JUST LIKE SEPTEMBER

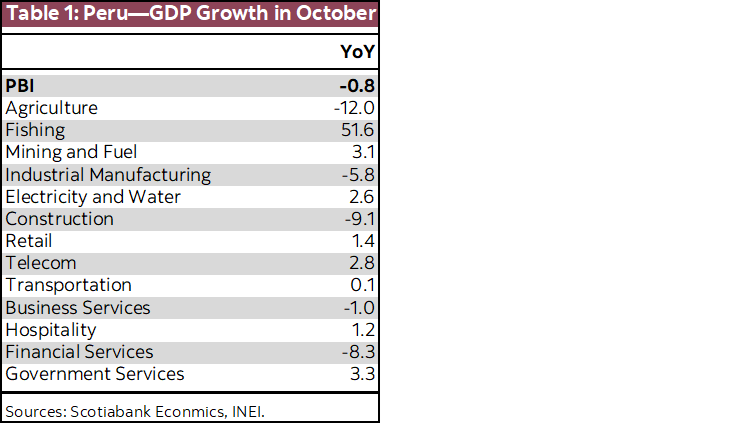

October GDP growth was -0.8% y/y. This was not much of an improvement over -1.3% y/y in September. The details were also similar, and largely reiterate trends that have been going on since GDP growth fell into negative territory six months ago. Agriculture plummeted 12% y/y. But, this was the only sector that continues to experience the (lagged) effect of El Niño severe weather. Meanwhile, October was a good month for fishing, up nearly 52%, albeit off a low base (table 1).

What continues to be a major source of concern is, rather, industrial manufacturing, -5.8% y/y, and construction, -9.1% y/y. Both are linked to domestic demand and have little to do with El Niño. Well, except to the extent that El Niño has been one of the drivers of inflation, which has whittled away at consumer purchasing power over the past couple of years. As we’ve said before, until industrial manufacturing and construction pick up, growth will be deficient.

Mining grew 3.1% y/y, a sign that the impact of the new Quellaveco mine on copper production growth has worn out (as expected).

As for the 8.3% decline in financial services, one is tempted to link this to low demand, and especially low investment, but that is not really the case. The main factor is that the special Covid-linked Reactiva loans have been coming due in October, as they have throughout the year.

All other sectors were within what one would expect considering an economy which is only limping along.

October’s figure puts YTD growth at -0.7%. This suggests that it won’t be easy to reach our full-year 2023 forecast of -0.2%, even though December, at least, should see a return to positive growth.

Meanwhile, the unemployment rate for the three months ending in November (which is how it is measured here) was 6.6% in Lima. The unemployment rate has not moved from this range throughout the second half of 2023. This does improve on a year ago, however, when the unemployment rate was 7.6%. During this period total employment rose 5.2%, y/y, while the workforce increased 4.0%, y/y.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.