- Colombia: Annual headline inflation decreased less than expected but core inflation went down for the first time since October 2021

- Peru: Focus on the BCRP statement, future rate cut would be on the horizon

COLOMBIA: ANNUAL HEADLINE INFLATION DECREASED LESS THAN EXPECTED BUT CORE INFLATION WENT DOWN FOR THE FIRST TIME SINCE OCTOBER 2021

Colombia’s pace of monthly CPI inflation was 0.50% m/m in July, according to DANE data released on Tuesday, August 8th. The result was well above analyst expectations in the BanRep survey (0.30% m/m) and above Scotiabank Economics’ projection of 0.37% m/m. The upside surprise came mainly from food inflation, which in July was positive by 0.22% m/m, probably reflecting the effect of the interruption in regular operation amid landslides in relevant roads. Lodging & utilities and transportation remain the main upside driver of inflation, especially due to increases in rent fees, which reflect indexation effects and gasoline prices.

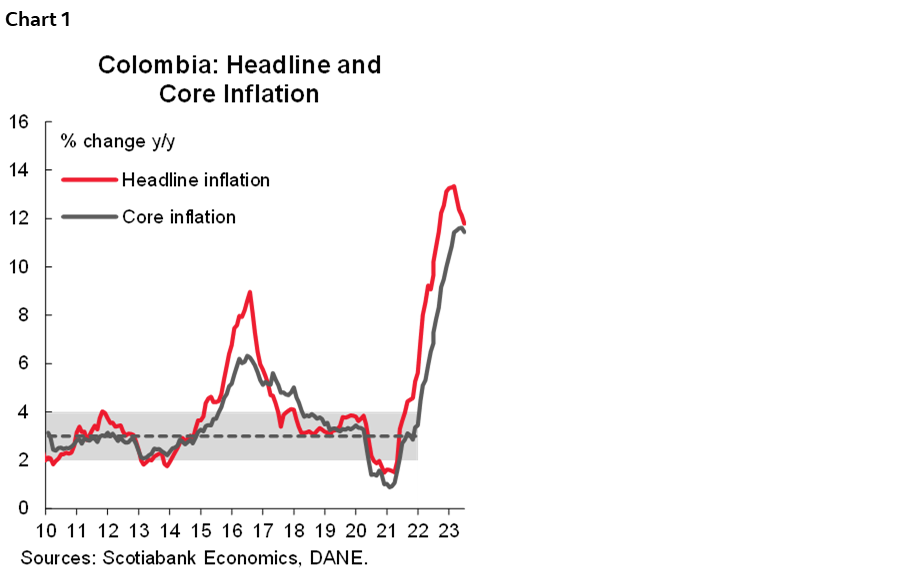

Year-on-year headline inflation decreased for the fourth month, from 12.13 % in June to 11.78% in July (chart 1), the lowest since September 2022. However, headline inflation decreased less than expected. Core inflation showed its first reduction since October 2021; ex-food inflation decreased from 11.62% to 11.44%, while ex-food and regulated inflation was 10.22% y/y, also decreasing from the previous register of 10.51% y/y, especially due to a moderation in tradable goods inflation. Either way, both headline and core inflation remain well above BanRep’s target (3%). The previous dynamic affirms our expectation that BanRep won’t consider rate cuts in September. Our official call is to start rate cuts in October; however, the start of the easing cycle could be delayed if inflation fails to show further improvement. Our current projection shows that Colombia could have single-digit inflation only by the end of the year (November), which is still a very high number versus the central bank target (3%) and represents a risk for inflation inertia due to indexation effects for 2024.

Regulated prices, especially gasoline and eventually diesel prices, El Niño weather phenomenon, and minimum wage negotiation remain the main risk factors that could prevent BanRep from starting the easing cycle. On the other side, the economic activity deceleration and FX appreciation could favour lower inflation. That said, the data-dependent approach that BanRep is taking is expected to continue, and only a scenario of further reduction of inflation and inflation expectations could trigger the easing cycle.

Today’s surprises demonstrate that inflation reduction is still fragile, and there is still a significant uncertainty ahead that moderates recent bets about a rate cut coming in September.

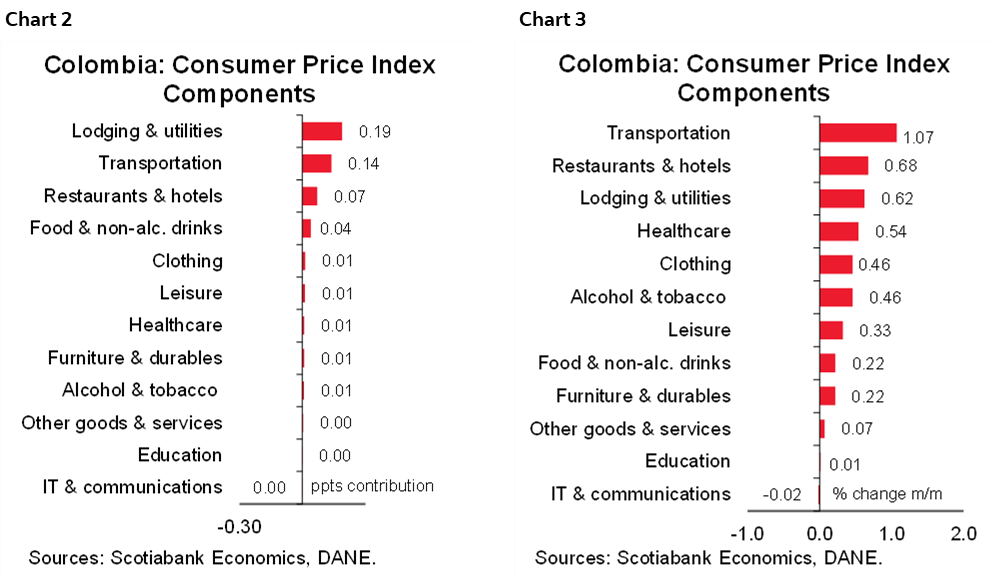

Looking at July’s numbers in detail, food inflation was the only group that showed monthly contractions (charts 2 and 3).

The highlights are:

- The lodging and utility group was the main contributor to the upside to monthly inflation. The group posted a +0.62% m/m and +19 bps contribution. Rent fees continued increasing, however, at a slower pace than last month (+0.53% m/m in July vs. 0.61% m/m in June), showing that indexation effects are moderating their impact as the year passes, although they are still present. Utility fees were increased by 0.91% m/m; gas fees decreased by 0.91% m/m. However, it was offset by increases in utility fees (+0.51% m/m) and water (+2.41% m/m).

- The second most significant contributor to headline inflation was the transportation group, showing a 1.07% m/m figure and a contribution of 0.14 ppts to overall inflation. Gasoline prices (+4.84% m/m) contributed 14 bps in the monthly inflation due to the 600 pesos increase. We expect the government to continue increasing gasoline prices at a 600 pesos pace until the end of the year; however, by this time, the big question is if the government will decide to increase diesel prices, which is a material risk to the upside due to the potential secondary effects on other key items in the CPI basket.

- The transportation group continued showing an interesting dynamic derived from the FX appreciation and weaker demand: vehicle inflation was -0.19% m/m, the first monthly contraction since January 2019. The vehicle sector is showing the effect of a lower demand since new car sales have contracted more than 40% y/y, and a trend of sellers trying to renew inventories at a lower FX level.

- Foodstuff inflation surprised to the upside, showing a 0.22% m/m inflation. Price reductions are leveling off in many items; in fact, in July, 25 out of the 59 references in the basket reported a m/m reduction, however this time, that reduction was offset by significant increases in fruits (+4.96% m/m), chicken (+0.47%) and meat (+0.50% m/m). It is relevant to note that inflation has eased, mostly explained by food inflation. However, today’s results prove that those prices are very volatile, and the cumulative progress observed in recent months could face sudden challenges. In the short/medium term, the main challenge is the El Niño weather phenomenon. However, we estimate that the potential upside impact on food prices could start to be reflected in H1-2024 if this phenomenon proves to be intense.

- Inflation by main groups: out of the 188 CPI items, 53 posted negative m/m inflation (~28% of the total basket). Goods inflation decreased from 14.26% m/m to 12.84% m/m, signaling that tradable goods are starting to contribute to lower inflation. Services inflation increased from 9.04% y/y to 9.19% y/y as a result of still material indexation effects in labour-intensive sectors.

—Sergio Olarte, Jackeline Piraján & Santiago Moreno

PERU: FOCUS ON THE BCRP STATEMENT, FUTURE RATE CUT WOULD BE ON THE HORIZON

We expect the BCRP to leave its key rate unchanged at 7.75% at its meeting this Thursday, August 10th, in line with the market consensus according to a Bloomberg survey. However, this time we are not so convinced of it. We see economic reasons for the BCRP to start the rate cut cycle, although the absence of signals makes it difficult to predict the timing, so a 25bp cut would not be entirely surprising.

Regardless of the decision to move interest rates, the focus will be on the signals issued by the statement, since forward guidance has so far not shed any light on the future trajectory expected. We hope that the BCRP’s statement contains explicit concern about economic weakness, considering that the MoF recently reduced its economic growth forecast for this year from 2.5% to 1.5%, and the market consensus from 1.8% to 1.3%, according to a BCRP survey. This could be interpreted as a sign that the BCRP would be open to a possible advance in the cycle of interest rate cuts. The BCRP’s growth forecast is 2.2% and would be revised in its September inflation report. That is probably the right time to start the rate cut cycle.

Based on the signals in the BCRP’s statement, we will evaluate changes to our baseline scenario. Our forecast assumes the start of the interest rate cut cycle during Q4-2023, but we see reasons for the BCRP to bring it forward, despite the risks posed by the proximity of the El Niño phenomenon and the recent increase in oil prices. We see that it has room to add cuts of 25bps, without altering the stance of monetary policy. Year-on-year inflation continued to decline in July, in line with official estimates, core inflation accumulated four months close to its historical average, and 12-month inflation expectations continued to decline. Although the direction of these metrics contributes to a scenario of the beginning of the rate cut cycle, the levels are still far from the target range (between 1% and 3%).

The decision does not seem so simple and the BCRP would evaluate it with caution. The Latam context favours it, after Chile and Brazil have already started their respective cut cycles, although this does not necessarily condition the BCRP. Although the economic weakness is a factor to consider, the BCRP will prioritize the performance of inflation—which so far in August would contribute to a further slowdown—as well as the future risks on prices derived from the increasing probabilities of an El Niño phenomenon.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.