- Peru: BCRP cuts rate for the fourth consecutive time, inflation under control

Treasurys, currencies, equity futures, and crude oil all moved in relatively narrow ranges in Asia hours, getting a break from the sharp moves seen over the week with the parade of central bank decisions and key data, until rates caught a bid with the release of weaker-than-expected Eurozone PMIs. The PBoC injected a net CNY800bn against expectations that it would reduce funds under the 1-yr MLF, but the broad market barely blinked. G10 markets await the US PMIs and industrial production, Canadian housing starts, and a parade of central bank speakers.

USTs are slightly bull steepening compared to bull flattening EGBs (after a weak open in front-end to catch up to US). The USD is mixed as the EUR underperforms down 0.3% after the weak PMIs while high-beta FX outperform (NOK and AUD leading) likely reflecting the PBoC’s move. However, the MXN is among the laggards, down 0.2% tou roughly trade only a touch better than pre-Banxico levels (see our report here on the hawkish hold). US equity futures are up 0.2/3%, ESX is up 0.8% while FTSE is down 0.3%. WTI/Brent and copper are 0.5% higher, but iron ore is flat.

In Latam, Colombia and Peru data at 10ET is the highlight. Banxico will also publish the results to its economists survey, but these will likely be stale as guidance or comments (and the November meeting minutes) ahead of the yesterday’s decision, and thus before the survey, suggested that Banxico was eyeing a Q1 rate cut—it’s now not as certain. AMLO will today inaugurate a leg of the Maya Train in Campeche, so there’s a risk of political rhetoric coming out of the event.

From Colombia, we get November data for manufacturing/industrial production and retail sales, and the results of BanRep’s economists survey, all this ahead of Monday’s monthly economic activity release, all to help us narrow our view of what BanRep may do on the 19th. Compared to October, economists expect smaller but still large declines in manufacturing and retail activity—which would be their ninth and eighth consecutive months of negative y/y growth, respectively. We’ll keep an eye on the reaction in markets to, or experts’ opinions to, yesterday’s submission of a bill to Congress by Petro’s government for the creation of a state mining company.

We estimate that October GDP data will show a 0.4% y/y contraction in output due to weakness in manufacturing and construction industries against a boost from the second fishing season of the year (the first one in May was cancelled). The median economist has a more negative view, expecting a 0.9% y/y drop. The (somewhat unreliable) unemployment rate is expected to hold at 6.6% for the capital region. No matter how you slice it, the Peruvian economy is in poor shape and more than supports the BCRP’s decision to continue rate cuts, more so because of the positive evolution of inflation in the past few months (see our take on yesterday’s decision below).

—Juan Manuel Herrera

PERU: BCRP CUTS RATE FOR THE FOURTH CONSECUTIVE TIME, INFLATION UNDER CONTROL

The board of Peru’s Central Bank of Peru (BCRP) cut its key interest rate on Thursday, December 14th by 25bps, to 6.75%, in line with what was expected by market consensus, according to a survey by Bloomberg, and Scotiabank. In its statement, the BCRP once again emphasized that the rate cut “would not necessarily imply a cycle of successive cuts in the key rate,” although the possibility of a pause on the horizon is increasingly less, due to more moderate signs of El Niño and because inflation is already under control according to the BCRP.

The BCRP statement confirmed the forecast that headline inflation will reach the target range within the next few months but added that core inflation will be within the target range starting this month. This message confirms what Governor Velarde previously stated regarding inflation being under control. Velarde went further by pointing out that he even sees it possible that the target range will be reached only in December, during the first quarter or towards April 2024. Velarde specified that “if there were an El Niño it would probably take us longer to reach the goal, but we would get there anyway”. Although the statement repeated that since June a more marked downward trend in inflation has been observed, as some of the transitory effects due to supply restrictions dissipate, 30 months have already accumulated outside the target range (between 1% and 3%). Likewise, 12-month inflation expectations fell only slightly, from 3.3% to 3.2% in its last reading.

We see it likely that the BCRP will reduce its inflation forecast of 3.8% for this year and maintain its forecast of 2.4% for next year in its next report, to be released on Friday, December 22nd.

Velarde pointed out that 2023 has not been a good year and that he hopes 2024 will be better. The BCRP warned that leading indicators and expectations about the economy showed mixed results in November, but the majority remained in the pessimistic range, and reiterated that “the shocks derived from social unrest and the El Niño event have had a greater impact on economic activity and domestic demand”. The macroeconomic expectations survey reflects a new drop in the GDP growth forecast for this year from 0.2% to -0.1% on average, in line with our -0.2% GDP forecast. Expectations for 2024 GDP were stuck at 2.3% in the survey, in line with our forecast for 2024. Climate experts are lowering the odds of a Strong El Niño. Today the respective authority (ENFEN) publishes a new statement, where there will be a clearer vision of this event. If there is not a strong El Niño during the next year, there will be a significant recovery, Velarde noted. The first readings for December inflation suggest that it could drop from 3.6% to a range between 3.1% and 3.2%, below our current forecast of 3.6%. This new forecast is in line with what the authorities expected now. Food prices have been reversing the supply shocks of previous months, to which is added a lower impact of El Niño, whose temperature metrics fade during the latest readings. Likewise, the weakness of the economy would put pressure on a new decrease in core inflation, which would go from 3.1% to 2.9%, with which we agree with the BCRP, regarding the possibility of it returning to the target range after 24 months.

Our forecast remains under a moderate/strong El Niño scenario, the dominant probability until now, although we will evaluate a change of scenario if the reduction in the temperature anomalies that we have been observing until now is confirmed. The BCRP pointed out that the data indicate that the probability of a strong or very strong El Niño has fallen, so a lower economic impact is expected for 2024.

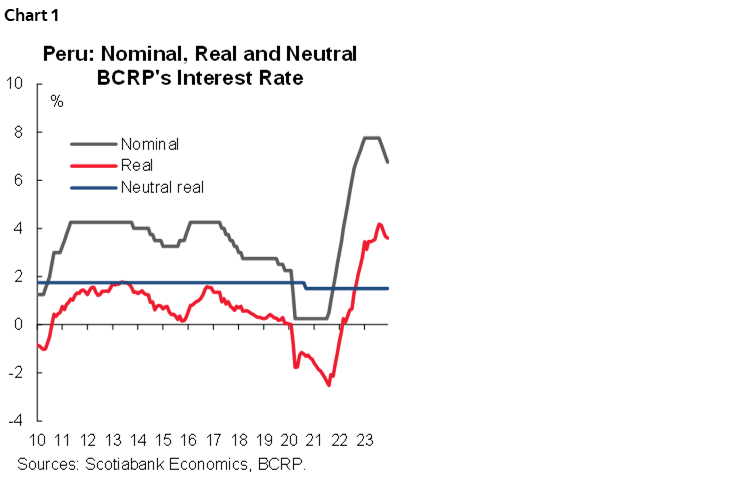

By cutting its policy rate to 6.75%, the real interest rate fell from 3.7% to 3.6% (chart 1), maintaining the restrictive stance of monetary policy, and still well above the neutral level (2.00%), accumulating 16 months in contractive territory. The monetary policy stance was maintained by reaffirming that, “if necessary, it will consider additional modifications to monetary policy”. Our forecast for 2024 is for a cut of 200bps, to 4.75%, with a bias that the cut could be greater, if a more moderate impact of El Niño on inflation materializes.

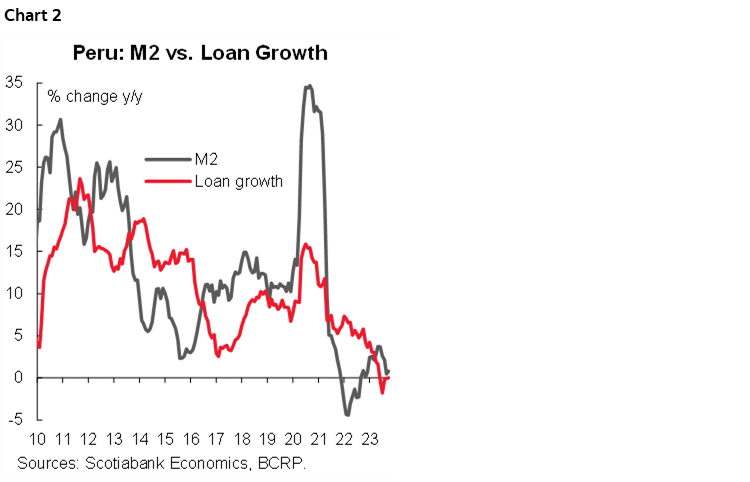

Even though the cycle of interest rate cuts has already accumulated four months, monetary conditions continued to tighten until October, with a greater contraction of the currency (-6.7% y/y, in negative territory for 17 consecutive months) and liquidity (-1.0% y/y, in negative territory for the fourth consecutive month). Loans recorded a null variation for the second consecutive month, in line with the weakness of the economy and the still contractionary stance of monetary policy (chart 2).

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.