- Chile: October GDP grew 0.3% y/y (-0.1% m/m), economic stagnation continues

- Peru: Inflation surprises due to faster reversal of supply shocks and lower core inflation

A busy week is starting out quietly in terms of overnight data, events, and headlines with markets merely in consolidation mode, cashing in on Friday’s rallies. In the early-Europe data round, Swiss inflation missed expectations by a wide margin and German international trade disappointed in both export and import terms showing monthly contractions. The G10 day ahead only has the ECB’s Lagarde at 9ET and final US durable goods orders (alongside new data for factory orders) at 10ET, awaiting a flood of US data that includes nonfarm figures on Friday. The BoC and RBA also announce policy this week.

USTs are bear flattening slightly in a broad selloff, with a 6/7bps increase in 2–10yr yields that correct about a third of the declines on Friday on the combination of dovish central bank speak, a 2.5% drop in crude oil, and an overreaction to ISM manufacturing, that was then not challenged by Powell at his last pre-blackout appearance. European bourses are down 0.2–0.5% in line with a 0.2/3% decline in SPX/Nasdaq futures. Oil is weaker again, by 0.8%, touching off intraday lows under $73/bbl in WTI which is a near-20% decline in Jan 24 contracts from the September peak. Iron ore and copper are down about 2% in a reversal of Friday’s moves.

The USD is firmer against all key currencies, with some decent gains against high-beta FX among which the MXN is down 0.5% but that only clears less than half of its strong 1.1% rally on Friday—when the COP and CLP both led in the region thanks to 1.7% gains. The PEN lagged its peers with only a 0.1/2% gain after inflation greatly missed estimates, raising odds of a possibly larger BCRP cut later this month. On Friday, Peru Fin Min Contreras said that the country wants to continue their push to replace USD debt with PEN issues, saying that when Fed cuts begin they will “feel more comfortable”; for reference, the first full 25bps in Fed cuts is seen at the May 1st meeting.

Mexican data is in the Latam spotlight today, with gross fixed investment the main release alongside domestic auto sales and private consumption data. We’ll watch fixed investment data for insights into the pace of public construction outlays in infrastructure and whether some nearshoring investments begin to show up more clearly in hard data—but ultimately today’s prints should have limited market impact. A new unknown has arisen in Mexican politics, after Samuel Garcia returned to the Nuevo Leon governorship over the weekend after the Supreme Court ruled the Orozco, from the opposition, should take over. It’s uncertain whether Garcia may return after he quit his position to run for president under the MC party next year, which he has now decided to not take part in, and if not who will replace him for the MC next June.

—Juan Manuel Herrera

CHILE: OCTOBER GDP GREW 0.3% Y/Y (-0.1% M/M)

- The economy remains stagnant for almost a year and a half, despite improved non-mining activity figures in October

On Friday, December 1st, the Central Bank (BCCh) published the October GDP, which grew by 0.3% y/y, in line with our expectations and still compatible with the 0.2% drop we expect for this year (chart 1). Industry partly explained the year-on-year growth, together with the positive effects delivered by electricity generation, which are still observed compared to last year. On the other hand, the fall in mining GDP offset part of the expansion of these sectors.

The seasonally adjusted GDP reveals that the economy remains stagnant, fluctuating around mid-2022 levels. Compared to the previous month, GDP contracted 0.1%, mainly due to a 3.5% m/m drop in mining GDP that was partially offset by an expansion in services (+0.6% m/m) and commerce (+1.6% m/m). The figure also ratifies that electricity generation stopped contributing positively to the monthly growth rate and also that the construction sector would remain in recession (chart 2).

To achieve positive GDP growth next year, the economic sectors need to regain dynamism, as the carry-over effect will not be sufficient. If we hold October’s GDP level constant over the next few months, GDP growth in 2024 would be only 0.2%. In other words, to achieve GDP growth rates between 1.5% and 2.5%, as estimated by the authorities, the sectors will need to return to dynamism around their historical average from the beginning of 2024. The longer the economic recovery is delayed, the more uphill these forecasts will be. To this end, it is imperative to accelerate the execution of public and private investments.

Public investment contracted 14.4% y/y in real terms, due to lower spending on housing subsidies and lower execution of public works. With this, capital expenditure accumulates an execution of only 57.5%, which could lead to a level of under-execution of public investment of between USD 1 and 2 bn this year, with the consequent lower job creation in sectors such as construction. Based on estimates by the Capital Goods Corporation, the peak employment required by projects in construction stages within the investment pipeline would have been reached in January 2023. After that, the lower labour requirements for existing projects would be affecting mainly the mining, real estate and public works sectors.

—Aníbal Alarcón

PERU: INFLATION SURPRISES DUE TO FASTER REVERSAL OF SUPPLY SHOCKS AND LOWER CORE INFLATION

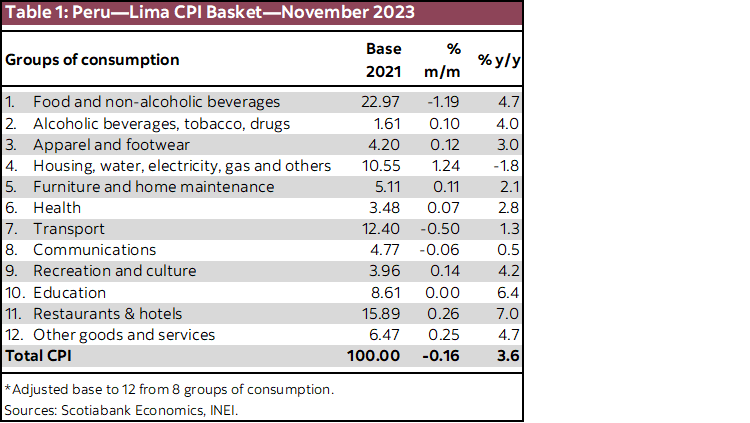

Inflation continues to surprise downwards. All price indices posted falls in November. Lima’s CPI fell -0.16% m/m, for the second consecutive month and below all forecasts, including market consensus (+0.11% according to Bloomberg survey), Scotiabank (+0.15% according to our latest update) and the historical average of the last 20 years (+0.10%). With this, year-on-year inflation continued to slow, going from 4.3% to 3.6%, reaching its lowest rate since June 2021.

The inflationary surprise in November came from the more accelerated reversal of supply shocks and lower prices in the core component of the basket. Two reasons could be explaining these results: A more moderate impact of the effects of El Niño, at least on prices, and the effects of the recession, reflected in consumption that during 3Q23 was in negative territory. The more accelerated reversal of supply shocks was reflected in a greater-than-expected drop in the prices of some perishable foods (mainly fruits -7% and vegetables) and poultry, which together contributed to a decrease of 0.32 percentage points. Although a moderate/strong El Niño event for the coming months remains the dominant scenario, the probability of occurrence has moderated, going from 83% to 77% in the most recent reading.

Core inflation also surprised, registering no variation (0%) in November, being below October (0.22%) and its historical average (0.14% in the last 20 years). In year-on-year terms, it went from 3.3% to 3.1%, slowing for the eighth consecutive month (chart 3). Inflationary pressures on costs (wholesale inflation) remained low, with negative year-on-year variations. The PEN appreciated in November, accumulating an appreciation of 3% in year-on-year terms. In November, of the 586 products that make up the consumption basket (2021 base), 304 increased (52%), 152 decreased (26%) and 130 remained unchanged (22%). As of November, there are 30 months in which inflation remains above the upper limit of 3% of the inflation target (table 1). Inflation at the national level (not just in Lima) went from 4.5% to 3.8%, exceeding Lima’s inflation for 27 consecutive months.

Looking ahead, we have revised our inflation forecast for 2023 from 4.6% to 3.6%, considering that inflation is lower than expected, the moderation of the effects of El Niño and more stable oil prices in a scenario of lower probability of escalation of international conflicts. The lower level of inflation with which we would begin 2024 leads us to revise our inflation forecast for next year from 4.0% to 3.5%. That is, in general terms we expect an inflation rate like this year’s for next year, slightly higher than the central bank’s target range (between 1% and 3%), since we maintain a moderate/strong El Niño scenario in our macro forecast.

Lower inflationary pressures create room for the BCRP to continue its interest rate cutting cycle. We anticipate a new cut of 25bps to 6.75% at its meeting on Thursday, December 14th. In our December 1st Latam Weekly, we have also revised our interest rate forecast for end-2024, from 5.00% to 4.75%, consistent with our review of a lower inflation rate.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.